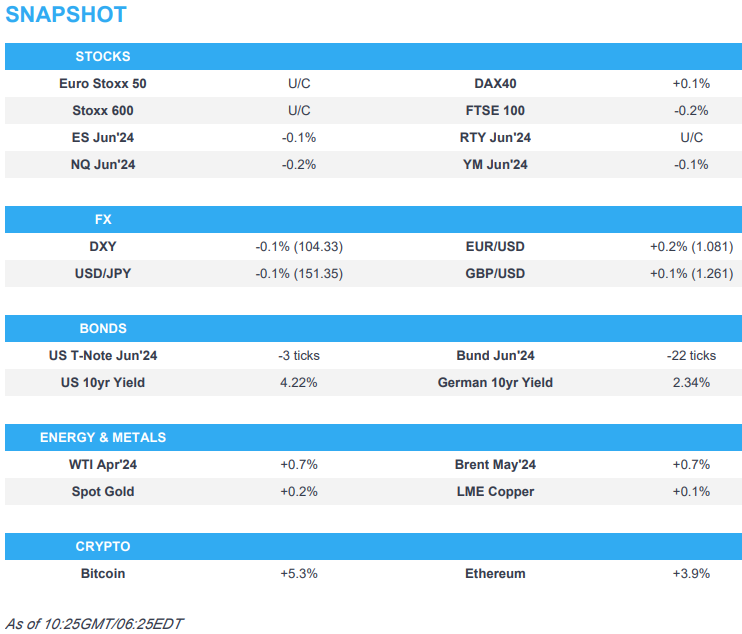

US Market Open: Equities modestly softer, Antipodeans benefit from a stronger CNH, Crude bid; Central bank speak due

25 Mar 2024, 10:42 by Newsquawk Desk

- Equities mostly and modestly lower, following on from a downbeat session in China/Japan overnight

- Dollar is flat, Antipodeans modestly firmer benefitting from a stronger Yuan

- Bonds are incrementally softer ahead of a 2yr US auction

- Crude is firmer, whilst base metals are entirely in the red hampered by poor Chinese price action overnight

- Looking ahead, Comments from ECB’s Lagarde, Fed’s Bostic, Goolsbee, Cook & BoE’s Mann, Supply from the US

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (-0.2%) initially struggled to find direction, though succumbed to slight selling pressure as the session progressed.

- European sectors are mostly lower; Energy benefits from broader strength in the crude sector, whilst Kingfisher (-2.5%) weighs on Retail.

- US equity futures (ES -0.2%, NQ -0.3%, RTY U/C) are mostly but modestly lower, in-fitting with price action seen in Europe; AMD (-2.1%)/ Intel (-2.5%) suffer in the pre-market after China blocked the use of AMD/INTC chips in government computers.

- Modest pressure in Apple (AAPL), Alphabet (GOOG), and Meta (META) following the EU Commission announcing a digital-market probe into the names.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- USD is a touch softer vs. peers but with price action in the FX space broadly contained as newsflow has proved to be non-incremental. Current high of 104.47 is just below Friday's 104.49 peak.

- EUR is contained with catalysts currently lacking to inspire price action. EUR/USD holding above Friday's 1.0801 low. June 25bps ECB cut price at ~87%.

- Jawboning from Kanda failed to see the JPY regain much ground vs. the USD with the pair not far off the 2023 high at 151.91 and 2022 high at 151.94.

- Antipodeans are both a touch firmer vs. the USD with not much in the way of pertinent newsflow. AUD/USD briefly pierced Friday's low at 0.65101 but has stopped shy of testing last week's low at 0.6503 which lies just ahead of the 0.65 mark.

- Yuan regaining some ground vs. USD with Chinese banks said to be selling dollars and a firmer fix from the PBoC. USD/CNH down as low as 7.2327 but yet to test Friday's 7.2175 low.

- PBoC set USD/CNY mid-point at 7.0996 vs exp. 7.2267 (prev. 7.1004).

- Chinese major state-owned banks were seen selling dollars for yuan in the onshore FX market to stabilise the Chinese currency, according to sources cited by Reuters.

- Click here for more details.

- Click here for FX Option Expiries.

FIXED INCOME

- USTs are slightly softer ahead of a handful of speakers, New Home sales and then a 2yr sale which is potentially incrementally weighing on the fixed space; currently near lows around 110-22.

- A relatively contained start to the week for Bunds with the docket thin on the data front, though action could stem from a handful of ECB speakers later today. The calendar doesn't pick up within Europe until Wednesday's Flash HICP before the EZ number post-Easter; modest downside has been seen in Bunds, to a low of 132.84 thus far.

- Gilt price action mirrors EGBs, awaiting fresh fundamentals following the "dovish" shift by the BoE. BoE's Mann (Hawk) will be closely watched to see if she has entirely abandoned her long-held call for further tightening; currently around 99.80.

- Click here for more details.

COMMODITIES

- Crude is firmer despite a lack of fresh fundamental headlines, albeit remains within overnight ranges; Brent May is back around USD 86.00/bbl.

- Weakness across precious metals as the stronger Dollar exerted pressure while Friday newsflow remains quiet; XAU dipped under yesterday's low (2,166.45/oz) and trades within a current USD 2,162.64-2,186.13/oz range.

- Base metals are softer across the board following the risk aversion from Chinese markets overnight coupled with the recovery in the Greenback.

- Iraq Oil Ministry blamed foreign companies operating in Iraqi Kurdistan for a delay in the restart of crude exports from the region, while it added that OPEC and secondary sources reports show crude production between 200k-225k bpd in the region without the knowledge or approval of the ministry, according to Reuters.

- Russia's Kuibyshev oil refinery halts primary unit CDU-5 (70k bpd) after weekend drone attack, via Reuters citing sources.

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Hunt said the Conservative Party will keep the triple lock for pension increases in its election manifesto, according to Reuters.

- BoE announced Q2 QT schedule on Friday in which it will sell short-dated Gilts across four auctions of GBP 800mln and will sell medium-dated Gilts across four auctions of GBP 750mln, while it will sell long-dated Gilts across three auctions of GBP 600mln with its total sales at GBP 8bln in Q2.

NOTABLE US HEADLINES

- Fed’s Bostic (voter) said on Friday that there is no silver bullet answer on why the economy is doing so well but immigration and productivity are likely playing a role, while he added that data so far indicates inflation will fall slower and he adjusted his projection to one rate cut this year and at a later start vs. previous view of two cuts. Furthermore, he stated that the base case remains for no more hikes and noted they should begin tapering relatively soon but do not have a time in mind yet, according to Reuters.

- US Senate passed a USD 1.2tln government funding bill which President Biden signed to avert a government shutdown, according to the White House.

- Morgan Stanley's US equity strategy upgrades Energy sector to Overweight.

- China blocked the use of Intel (INTC) and AMD (AMD) chips in government computers. Intel -2.5% / AMD -2.2% in pre-market trade.

- Apple (AAPL), Google (GOOG), and Meta (META) are probed by EU under the new digital law, according to EU's Competition Commissioner; EU to seek information on Amazon (AMZN) ranking practices in its marketplace.

GEOPOLITICS

MIDDLE-EAST

- A leading Hamas source said Israeli media leaks about concessions and compromises offered to Hamas are miserable propaganda aiming to cover up its intransigence and evade responsibility for obstructing the agreement in front of the families of its prisoners, according to Al Jazeera.

- US Vice President Harris said an Israeli assault on Rafah ‘would be a huge mistake’ and she did not rule out 'consequences' if Israel invades Rafah, according to an interview with ABC News.

- UN Secretary-General Guterres visited Rafah and said it is time for an immediate humanitarian ceasefire, while he added there is a clear international consensus that any ground intervention in Rafah will cause a humanitarian catastrophe.

- UKMTO said a vessel was struck by an unidentified projectile 23NM west of Yemen’s Mukha and the resulting fire was extinguished by the crew, while the crew were reported safe.

- "Israel Broadcasting Corporation: Truce negotiations have reached an impasse due to Hamas' demands", according to Al Arabiya.

MOSCOW TERROR ATTACK

- The death toll from the Moscow concert hall attack on Friday was at least 137, while Russian President Putin declared a day of mourning on Sunday and said all attackers have been found and detained, according to Reuters.

- Russia’s FSB said the perpetrators of the Moscow attack were heading towards the Russia-Ukraine border and had contacts on the - Ukrainian side, according to IFAX. There were also comments from Russian lawmaker Kartapolov who said there should be a clear answer on the battlefield if Ukraine is found to be behind the Moscow attack, according to RIA.

- Ukrainian President Zelensky said Russian President Putin and others seek to divert blame for the Moscow concert massacre and that Putin could use the terrorists he sent to their deaths in Ukraine to stop terrorism in Russia.

- US National Security Council spokesperson said the US government shared information with Russia earlier this month about a planned attack on Moscow, while the spokesperson added that Ukraine has no involvement in the attack on Russia and Islamic State bears sole responsibility for the attack. It was also reported that Islamic State released footage of the attack on the concert hall.

- France raised its security alert after the attack on Moscow, according to reports citing the French PM.

OTHER

- Ukraine’s military said it hit two Russian large landing ships, as well as a communications centre and infrastructure used by Russia’s Black Sea fleet during strikes on Crimea.

- Russia violated Poland’s airspace with a cruise missile attack on western Ukraine, while it was later reported that Russia’s air strike hit a Ukrainian facility in the western Lviv region and took control of the village of Krasnoye in the Donetsk region, according to IFAX.

- Russia scrambled a MiG-31 jet after US bombers approached near the Russian border over the Barents Sea, according to RIA.

- Gunmen reportedly stormed a police station in the Armenian capital of Yerevan, according to TASS.

- China's coastguard used water cannons against Philippine ships in the South China Sea, while China’s Defence Ministry warned the Philippines against provocative actions and to stop infringing and making any remarks that may lead to the intensification of conflicts and escalation of the situation. Furthermore, the Defence Ministry said China will continue to take decisive measures to firmly safeguard its territorial sovereignty and maritime rights and interests if the Philippines repeatedly challenges China’s bottom lines.

- Philippines' Foreign Ministry summoned the Chinese Embassy's Charge D’Affaires and protested against aggressive actions by China's Coast Guard and maritime militia against rotation and resupply mission over the weekend, while it added that China has no right to be in Second Thomas Shoal and demanded that Chinese vessels leave the vicinity of Second Thomas Shoal and the Philippine Exclusive Economic Zone immediately.

- US State Department said the US stands with the Philippines and condemns dangerous actions by China in the South China Sea. This was after China said it took control measures on Philippine vessels that ‘intruded’ into the Second Thomas Shoal waters on March 23rd.

- US and Japan plan the biggest upgrade to security pact in more than 60 years, according to FT. It was also separately reported that the US military command in Japan will be revamped, while Japan's Chief Cabinet Secretary Hayashi said they are discussing ways to strengthen military cooperation with the US amid a move to a joint command structure in Japan but nothing decided yet.

- North Korean leader Kim visited a tank unit and called for airtight combat readiness. It was also reported that North Korean leader Kim's sister said bilateral relations depend on Japan's political decision and that Japanese PM Kishida showed intention to meet with North Korea's leader recently, according to KCNA.

CRYPTO

- Bitcoin climbs higher and back on a USD 67k handle, whilst Ethereum sits just shy of USD 3.5k.

APAC TRADE

- APAC stocks traded mixed amid a lack of major macro drivers heading into month-end and a slew of data releases.

- ASX 200 finished higher with early outperformance in property and tech owing to softer yields.

- Nikkei 225 pulled back from record highs as investors booked profits amid some mild yen strength.

- Hang Seng and Shanghai Comp. were initially indecisive as participants digested recent earnings releases, although eventually strengthened after the slew of rhetoric from Chinese officials including Premier Li who noted relatively big room for macro policy.

NOTABLE ASIA-PAC HEADLINES

- Chinese Premier Li said China’s economic rebound momentum continues to consolidate and strengthen with economic development off to a good start judging by the first two months and though the economy sees some fluctuations, the long-term trend of the economy turning for the better won’t be changed. Premier Li said they will carefully study the issues of market access, match of supply and demand, as well as cross-border data flows, while there will be some regulations in some of these areas soon. Furthermore, Li said China will strive to boost domestic demand and that there is relatively big room for macro policy, according to Reuters.

- China’s Finance Minister said the government is confident and capable of achieving full-year economic and development goals, while China will prioritise support for sci-tech innovation and manufacturing development and allocate more fiscal resources to ensure employment, according to Reuters.

- China's Industry Minister said they will accelerate new industrialisation, promote continuous optimisation and upgrading of industrial supply chains, while they will accelerate the modernisation of the industrial system, fully abolish restrictions on foreign investment access in the manufacturing sector, and deepen in-depth cooperation with enterprises from all countries.

- China NDRC head said the state planner will implement a batch of major sci-tech projects based on the development of new productive forces, while it will crack down on monopolies and unfair competition activity, as well as publish a new version of a negative list for market access, according to Reuters.

- China's Vice Commerce Minister said they will further expand high-level opening up to the outside world and create more market opportunities by opening up for development, while China will continue to tap and unleash the potential of domestic demand, providing more trade and investment opportunities.

- China’s Commerce Minister met with Micron’s (MU) president and said that they welcome the Co. to expand its footprint in the Chinese market and ramp up investment projects while firmly obeying China’s laws and regulations, while China’s Commerce Minister also met with the chairmen of AMD (AMD), Exxon (XOM) and Medtronic (MDT), according to Reuters.

- China blocked the use of Intel (INTC) and AMD (AMD) chips in government computers.

- US Treasury Secretary Yellen will travel to China in April, according to POLITICO.

- US Secretary of State Blinken said the US expresses deep concern over Hong Kong’s security law.

- BoJ January meeting minutes noted that members said the likelihood of reaching the price goal was gradually rising and members discussed the positive and side effects of the Bank's unconventional monetary policy. Members also agreed that Japan's economy had recovered moderately and shared the recognition that, although exports and production had been affected by the slowdown in the pace of recovery in overseas economies, they had been more or less flat.

- Japan's top currency diplomat Kanda said they have been closely watching FX moves with a high sense of urgency and will take appropriate steps to respond to an excessive weakening of the yen without excluding any measures, while he added the current yen weakness does not reflect fundamentals and is due to speculation.

- China's STCN reports that "there are market rumours that real estate-related documents will be issued soon, which will focus on two directions" (cont)

- Nissan (7201 JT) targets an additional 1mln units in sales by end-FY2026 vs FY2023; 30 new Models to be launched by FY26, of which 16 will be electrified; dividend and buyback to target total shareholder return of over 30%. Executive says the global EV market is not stopping but starting to plateau to more normal cadence of growth

DATA RECAP

- Japanese Coincident Index (Jan F) 112.1 (Prev. 110.2); Coincident Indicator Revised (Jan) -3.8% (Prev. -5.8%); Leading Indicator Revised (Jan) -0.4 (Prev. -0.6); Leading Index (Jan F) 109.5 vs Exp. 109.9 (Prev. 110.2)