Europe Market Open: Equity strength capped into month-end, data and earnings; mixed Chinese PMIs

30 Apr 2024, 06:35 by Newsquawk Desk

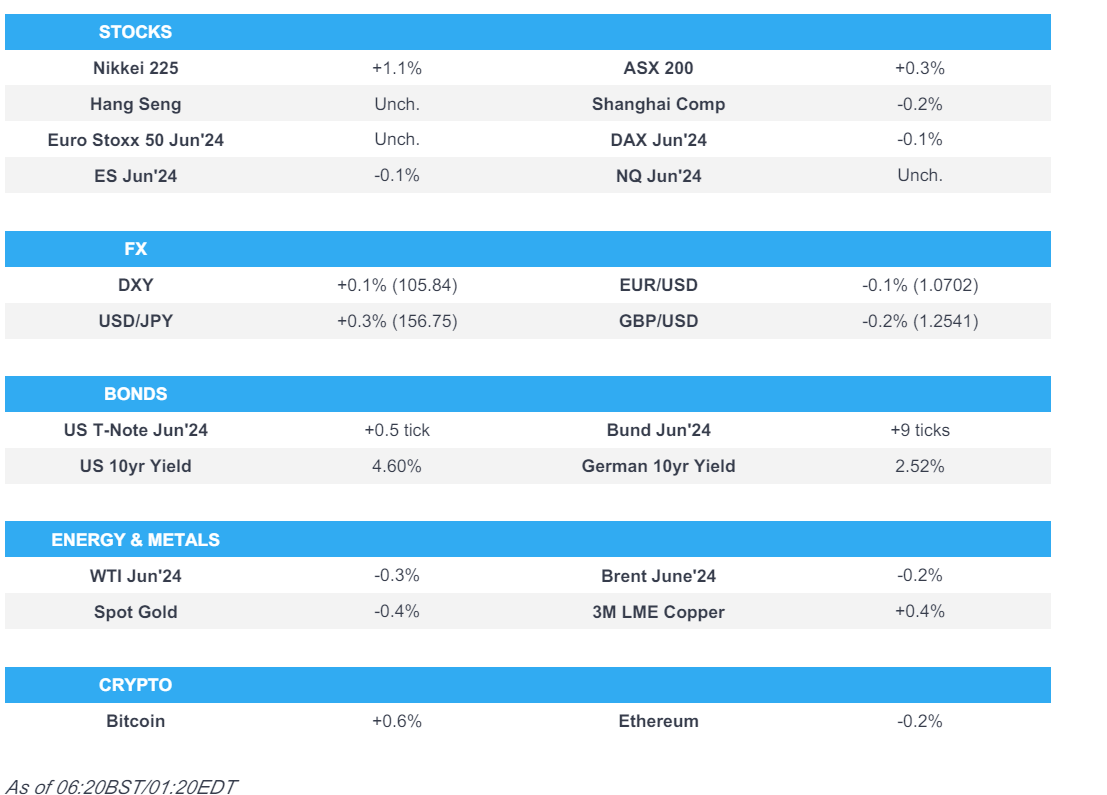

- APAC stocks were mostly higher but with gains capped heading into month-end alongside a slew of data and earnings.

- Official Chinese NBS Manufacturing and Caixin Manufacturing PMIs topped forecasts but Non-Manufacturing PMI disappointed.

- European equity futures indicate a flat open with the Euro Stoxx 50 future unchanged after the cash market closed down 0.5% on Monday.

- DXY is a touch firmer in an attempt to unwind recent losses, USD/JPY tested 157 to the upside, EUR/USD is holding above 1.07.

- Looking ahead, highlights include French CPI, GDP, German Unemployment Rate, Import Prices, Retail Sales, Spanish GDP, Italian GDP, CPI, EZ CPI, GDP, US Employment Cost Index, Chicago PMI, Consumer Confidence, RBNZ FSR, Supply from UK, Germany & Netherlands.

- Earnings from Logitech, Lufthansa, Adidas, Mercedes, Volkswagen, Stellantis, UniCredit, Amazon, McDonald's, Advanced Micro Devices, Eli Lilly, Mondelez, Air Products and Chemicals, Coca-Cola, 3M, PayPal, Marathon & Starbucks.

US TRADE

EQUITIES

- US stocks finished with mild gains with price action choppy amid a lack of major macro catalysts except for the reported yen intervention, while there were no tier 1 data releases although the US quarterly financing estimates came in above estimates ahead of the quarterly refunding announcement on Wednesday, which led to some downside in stocks and bonds in late trade before fading the moves into the close. Nonetheless, TSLA (+15%) and AAPL (+2.4%) were the notable gainers, with the former seeing a further short squeeze on reports it received approval for FSD in China, while AAPL benefitted from an upgrade at Bernstein ahead of its earnings on Thursday.

- SPX +0.32% at 5,147, NDX +0.36% at 17,878, DJIA +0.38% at 38,596, RUT +0.66% at 2,053.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Treasury Quarterly Funding Estimates sees borrowing of USD 243bln in April-June (+41bln vs estimate in Jan), while it expects to borrow USD 847bln in July-September and assumes end-September cash balance of USD 850bln.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher but with gains capped heading into month-end amid a slew of data and earnings.

- ASX 200 was led by strength in the mining sector but with upside limited after a surprise contraction in Retail Sales.

- Nikkei 225 outperformed on return from the long weekend and as participants digested a slew of earnings releases.

- Hang Seng and Shanghai Comp. were varied in which the former made another brief foray into bull market territory, while the mainland lagged ahead of the Labour Day holidays and as participants reflected on mixed Chinese PMI data in which the official NBS Manufacturing and Caixin Manufacturing PMIs topped forecasts but Non-Manufacturing PMI disappointed despite remaining in expansion territory.

- US equity futures traded rangebound after the prior day's choppy performance and as risk events loom.

- European equity futures indicate a flat open with the Euro Stoxx 50 future unchanged after the cash market closed down 0.5% on Monday.

FX

- DXY marginally strengthened and got some respite after suffering yesterday alongside the drop in the USD/JPY.

- EUR/USD was slightly pressured and looked to test the 1.0700 level to the downside as the dollar regained composure.

- GBP/USD traded rangebound amid a lack of pertinent drivers and just about failed to hold above its 200DMA.

- USD/JPY retested the 157.00 level to the upside as it picked itself up from the recent touted intervention.

- Antipodeans retreated with headwinds following mixed Chinese PMIs and a surprise contraction in Australian Retail Sales.

FIXED INCOME

- 10-year UST futures remained afloat after the prior day's gains and shrugged off the higher Treasury Quarterly Funding Estimates.

- Bund futures sat around yesterday's high after recent inflation data kicked the bid into month-end, while EZ CPI data is due later.

- 10-year JGB futures took impetus from recent gains in global peers and resumed last week's post-BoJ advances.

COMMODITIES

- Crude futures were lacklustre as hopes surrounding Gaza peace talks took some of the geopolitical risk premium out of the market.

- Iraq's crude oil exports were at 106.1mln bbls in March, averaging 3.42mln BPD (prev. 3.34mln BPD in January), according to the Oil Ministry.

- Spot gold slightly retreated with demand subdued ahead of the looming key risk events.

- Copper futures continued their upward momentum but with the gains capped amid mixed Chinese PMIs.

CRYPTO

- Bitcoin was ultimately lower after a choppy performance in which prices whipsawed through the USD 64,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 440bln via 7-day reverse repos with the rate at 1.80%.

- PBoC reportedly wants to halt the bond-buying spree and not join in on it, with the central bank concerned about bond market bubbles and economic gloom, according to Bloomberg.

- Japan's top currency diplomat Kanda said no comment on FX intervention and noted that a weak yen has positive and negative impacts, while he added the currency has a bigger impact on import prices now and that excessive FX moves could impact daily lives. Kanda said they need to take appropriate actions on FX and reiterated they are ready to take action 24 hours a day and will continue taking appropriate actions when needed.

DATA RECAP

- Chinese NBS Manufacturing PMI (Apr) 50.4 vs. Exp. 50.3 (Prev. 50.8)

- Chinese NBS Non-Manufacturing PMI (Apr) 51.2 vs. Exp. 52.3 (Prev. 53.0)

- Chinese Composite PMI (Apr) 51.7 (Prev. 52.7)

- Chinese Caixin Manufacturing PMI Final (Apr) 51.4 vs. Exp. 51.0 (Prev. 51.1)

- Japanese Industrial Production MM (Mar P) 3.8% vs. Exp. 3.5% (Prev. -0.6%)

- Japanese Retail Sales YY (Mar) 1.2% vs. Exp. 2.2% (Prev. 4.6%, Rev. 4.7%)

- Australian Retail Sales MM Final (Mar) -0.4% vs. Exp. 0.2% (Prev. 0.3%)

GEOPOLITICS

MIDDLE EAST

- Hamas delegation left Cairo and will return with a written response to the ceasefire proposal, according to Egypt's Al Qahera News.

- An Israeli delegation plans to travel to Cairo to resume ceasefire talks if Hamas agrees to attend, according to NYT.

- Israeli PM Netanyahu asked US President Biden to help prevent the ICC from issuing arrest warrants against Israeli officials, according to Axios.

- Yemen's Houthis said they targeted the 'Cyclades' vessel and two US destroyers in the Red Sea, while it also targeted 'Israeli ship MSC Orion' in the Indian Ocean, according to Reuters. US CENTCOM later confirmed that Iranian-backed Houthis fired three anti-ship ballistic missiles and three UAVs from Yemen into the Red Sea towards MV Cyclades but added there were no injuries or damages reported by US, coalition or merchant vessels.

- UKMTO reported a vessel 54 nautical miles northwest of Yemen's Mokha sustained damage although the vessel and crew were reported safe and are proceeding to the next port of call.

OTHER

- US extended the general license authorising transactions related to energy with certain Russian financial firms through to Nov. 1st.

- UN sanctions monitor told a Security Council committee that debris from a missile that landed in the Ukrainian city of Kharkiv on January 2nd was from a North Korean Hwasong-11 series ballistic missile, according to a report cited by Reuters. according to a report cited by Reuters.

- Chinese Coast Guard expelled a Philippines Coast Guard ship and vessels from waters adjacent to the Scarborough Shoal.

- Shanghai Maritime Safety Administration said military activities will be carried out in a part of the East China Sea from 07:00 AM on May 1st to 09:00 AM on May 9th local time and vessels unrelated to the activity are prohibited from entering the area.

EU/UK

NOTABLE HEADLINES

- ECB Vice President de Guindos said they are heading in the right direction on inflation and he is not pre-committing to any particular rate path, while he added the services inflation slowdown has stalled and there is still work to be done on inflation.

- ECB's Knot said he is increasingly confident inflation is falling towards the 2% target but the ECB must be cautious beyond a June rate cut.

DATA RECAP

- UK BRC Shop Price Index YY (Apr) 0.8% (Prev. 1.3%)

- UK Lloyds Business Barometer (Apr) 42 (Prev. 42)