US Market Open: US equity futures are mixed, Dollar is firmer & AUD benefits post-RBA; US Retail Sales due

18 Jun 2024, 11:13 by Newsquawk Desk

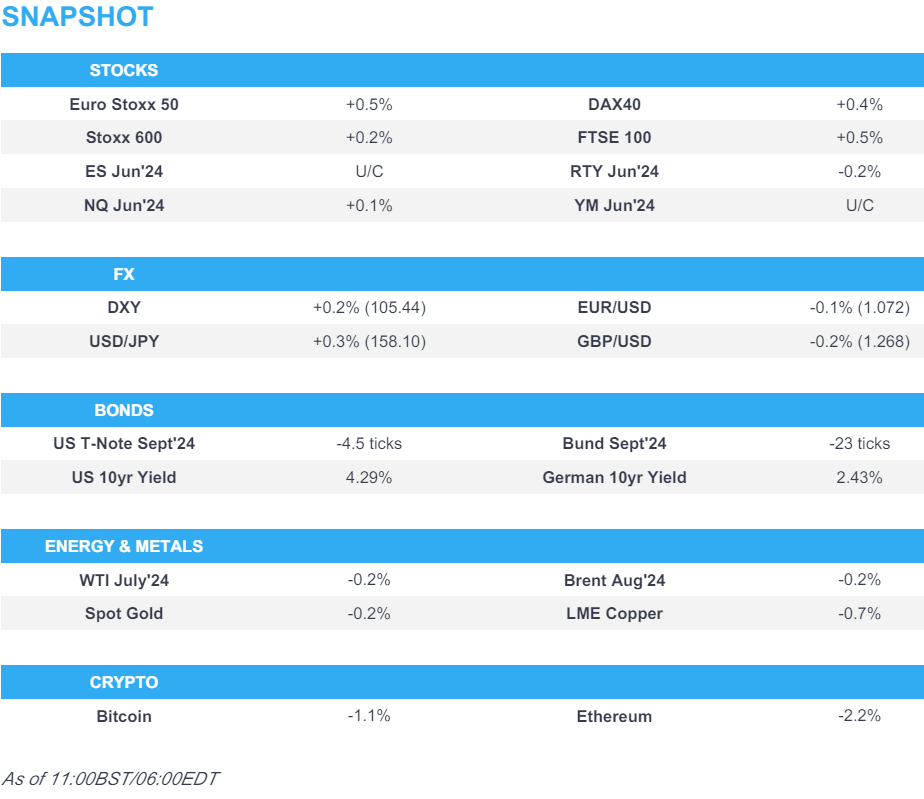

- European bourses are entirely in the green whilst US futures are mixed

- Dollar is firmer, AUD gains post-RBA and USD/JPY holds above 158.00

- Softer session for fixed thus far, Bunds initially boosted by ZEW but slipped on a poor German outing

- Crude is slightly softer, hampered by the softer Dollar; XAU contained

- Looking ahead, US Retail Sales & Industrial Production, NBH Policy Announcement, Comments from ECB’s Cipollone & de Guindos, Fed’s Barkin, Collins, Logan, Kugler, Musalem & Goolsbee & US supply

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.2%) began the session entirely in the green, taking impetus from a positive APAC session overnight, continuing the strength seen in the US on Monday. Since, stocks have slipped off best levels though remain modestly firmer.

- European sectors are mostly in the green, and hold a risk on bias, with Travel & Leisure topping the pile, whilst Consumer Products lags.

- US Equity Futures (ES U/C, NQ +0.1%, RTY -0.3% are mixed, taking a breather from the prior day’s strength which saw the S&P 500 and the Nasdaq notch record highs once again.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- Dollar is on a firmer footing today, benefiting from the slightly higher yield environment, and trading towards the upper end of today’s 105.25-47 range. Next up, US Retail Sales, with headline M/M expected at 0.3%.

- EUR is slightly softer vs the Dollar, with some of the political concerns out of France subsiding in recent trade. The Single-currency currently holds towards the bottom end of today’s 1.0715-41 range, and more resilient to the recent Dollar strength than other G10 peers.

- GBP began the session on a 1.27 handle, before succumbing to Dollar-led pressure, dragging the Pound down to lows of 1.2676. UK-specifics have been light today, though the docket picks up tomorrow in the form of UK CPI, ahead of the BoE a day later.

- A stronger session for the USD/JPY, breaching 158.00 to the upside, finding slight resistance at 158.10, before taking another leg higher towards the session’s best at 158.22; a level just shy of the 14th June high at 158.25.

- Differing performances for the Antipodeans today, on RBA day. The Bank kept rates unchanged though some upside was seen after Governor Bullock said that rate hikes were discussed at the meeting. The Kiwi is the G10 underperformer, which has been dragged lower by the AUD/NZD cross, which is currently at 1.0830.

- Click for a detailed summary

FIXED INCOME

- USTs are softer by only a handful of ticks and resides just off today's lows, ahead of US Retail Sales and a slew of Fed speakers. USTs in a narrow 110-08+ to 110-16 band, which has edged to a new WTD base by a tick.

- Bunds are also slightly subdued, in-fitting with the initial bias on Monday. Specifics light aside from ZEW, which came in softer than expected with the Current Conditions surprisingly falling and printing below the forecast range. Data lifted Bunds back to the unchanged mark, but markedly shy of their 132.68 overnight peak. Thereafter, a poor German auction prompted some modest EGB pressure.

- Gilts are flat awaiting impetus from Wednesday's CPI and then Thursday's BoE. Supply this morning came via a 2029 DMO tap which was well received and spurred a very modest move higher for Gilts, though the move proved shortlived.

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 3.59x (prev. 3.2x), average yield 4.083% (prev. 4.199%), tail 0.3bps (prev. 0.6bps)

- Germany sells EUR 3.36bln vs exp. EUR 4bln 2.10% 2029 Bobl: b/c 2.1x (prev. 2.8x), average yield 2.45% (prev. 2.56%) & retention 16.00% (prev. 16.75%)

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are just underwater with specifics light, largely at the whim of the firmer Dollar, with the complex taking a breather from yesterday's geopolitics driven gains. Brent currently just shy of USD 84/bbl.

- Precious metals are contained with specifics light and the mentioned USD strength weighing on the space. At the low end of thin USD 2313-2325/oz parameters, a low which holds just above Monday's USD 2310/oz.

- Base metals are weighed on by the USD which is overshadowing any support for the complex from the PBoC's latest liquidity measures.

- Click for a detailed summary

NOTABLE DATA RECAP

- German ZEW Economic Sentiment (Jun) 47.5 vs. Exp. 50.0 (Prev. 47.1); both the sentiment and the situation indicators stagnate; Current Conditions (Jun) -73.8 vs. Exp. -65.0 (Prev. -72.3)

- EU ZEW Survey Expectations (Jun) 51.3 (Prev. 47.0)

- EU HICP Final YY (May) 2.6% vs. Exp. 2.6% (Prev. 2.6%)

NOTABLE EUROPEAN HEADLINES

- EU leaders concluded their summit with no agreement on key political positions, while EU's Michel said EU leaders will continue to work in the coming days for a deal on top jobs and that they need to agree on a program for the next five years at EU summit next week.

NOTABLE US HEADLINES

- Tesla (TSLA) has commenced deliveries of Model 3 performance at a beginning price of CNY 335.9k.

GEOPOLITICS

MIDDLE EAST

- Israeli negotiator said tens of Gaza hostages are alive with certainty, according to AFP News Agency.

- US National Security Adviser Sullivan said they need to give and take in negotiations, as well as bridge the differences between Hamas and Israel, while he added that the current proposal represents a roadmap for a ceasefire in Gaza.

- Top US Democrats approve massive arms sales to Israel including 50 F-15 fighter jets, according to Washington Post.

- "US President Biden's senior adviser Amos Hochstein's paper seeks a truce agreement with Israel after removing Hezbollah forces from the border", via Al Hadath citing Lebanese press

OTHER

- US National Security Adviser Sullivan said their approval of Kyiv's use of US weapons inside Russia extends to any place used by Russian forces to strike Ukraine, according to Al Jazeera.

- Russian President Putin said Russia and North Korea will develop trade and mutual settlements mechanism uncontrolled by the West and will jointly resist sanctions, while he added that Russia highly appreciates North Korea's support in Moscow's special operation in Ukraine and that the West is pushing Ukraine to strike Russia's territory, according to TASS.

- South Korea's military fired warning shots after North Korean soldiers crossed the military demarcation line, while the North Korean military suffered multiple casualties due to the explosion of land mines within the demilitarized zone, according to Yonhap.

- Chinese spokesperson criticised the Philippines' submission on its undersea shelf in the South China Sea, claiming it infringes on China's sovereign rights, violates international law and contradicts the Declaration on Conduct of Parties in the South China Sea.

CRYPTO

- Bitcoin is slightly softer on the session thus far, holding just shy of USD 66k, whilst Ethereum slips below USD 3.5k.

APAC TRADE

- APAC stocks took impetus from the gains in the US where the S&P 500 and the Nasdaq notched record highs once again despite the lack of any major fresh macros drivers and as a deluge of Fed rhetoric looms.

- ASX 200 was underpinned with financials and defensives front-running the broad advances seen across sectors, while attention turned to the RBA decision where the central bank provided no surprises and kept the Cash Rate target unchanged at 4.35%.

- Nikkei 225 recovered some of the prior day's notable losses amid the rising tide across global equity markets and was unfazed by the latest comments from BoJ Governor Ueda who suggested the potential for a July rate hike depending on the data.

- Hang Seng and Shanghai Comp. were ultimately mixed as the Hong Kong benchmark later deteriorated after failing to sustain the 18,000 level, while the mainland conformed to the positive mood after the PBoC upped its liquidity efforts.

NOTABLE ASIA-PAC HEADLINES

- Hong Kong will start to permit trading through typhoons from September 25th.

- BoJ Governor Ueda said underlying inflation is to gradually accelerate and they must be vigilant to financial market moves and the impact on the economy, while he added that they need to scrutinise data a bit more to judge whether underlying inflation will heighten on a firm note and if they become more convinced that underlying inflation will accelerate towards the price target, they will adjust the degree of monetary easing by raising the short-term policy rate. Furthermore, Ueda said they cannot say now how much the BoJ will trim bond buying and they will not send a strong policy message by cutting JGB purchases, while he added that depending on economic, price and financial data and information available at the time, there is a chance we could raise interest rates at July meeting.

- China's latest property support measures have boosted transactions in the largest cities, but activity in smaller localities struggles get off the ground which suggests more pain ahead for most of the country's real estate market, according to Reuters.

- China Output (May) Gasoline 13.8mln/MT, +2.9% Y/Y; Diesel 17.35mln/MT, -6.4%; Crude Iron Ore 88.48mln/MT, +9.0%; Refiner Copper +0.6%.

- China's Securities Regulator says they will enrich policy tools to manage market fluctuations, will resolutely prevent abnormal stock market volatility. To strengthen strategic reserves and market stabilisation mechanism

RBA

- Cash Rate Target unchanged at 4.35%, as expected, while it reiterated that the Board remains resolute in its determination to return inflation to the target and inflation remains high and is above target which is proving persistent. RBA said inflation is easing but has been doing so more slowly than previously expected and the Board expects that it will be some time yet before inflation is sustainably in the target range, while it added the path of interest rates that will best ensure that inflation returns to the target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out.

- Bullock: need to a lot to go our way too bring inflation back to range; board discussed whether to hike rates at this meeting, board decided to stay the course on policy. Wanted to make the point that they are alert to upside risks on inflation. Need to look across the economy, not just at Q2 CPI. Difficult to get a read on CPI with only quarterly data. Would not say the case for a rate hike is increasing, board did not consider the case for a rate cut at the gathering

DATA RECAP

- Singapore Non-Oil Exports MM (May) -0.1% vs. Exp. 1.7% (Prev. 7.6%, Rev. 7.3%); YY (May) -0.1% vs. Exp. -1.0% (Prev. -9.3%, Rev. -9.6%)