US Market Open: Tepid tone emerged to the benefit of fixed and USD, earnings & Reeves ahead

29 Jul 2024, 11:18 by Newsquawk Desk

- A positive start for European bourses, following the APAC handover, quickly shifted into a more mixed picture as the broader risk tone became increasingly tepid

- USD now broadly firmer vs. peers after a sluggish start to the session, GBP and EUR underpressure while JPY pares initial strength

- Fixed benchmarks benefit from the more tepid tone, EGBs, Gilts & USTs all at/probing recent highs

- Crude came under pressure as the tone tilted and USD strengthened, XAU resilient to the USD and at a USD 2402/oz peak

- Geopols in focus after escalatory rhetoric from numerous officials including Netanyahu and Erdogan over the weekend

- Looking ahead, highlights include US Dallas Fed Manufacturing Business Index, Speech from UK Chancellor Reeves, & Earnings from McDonald's.

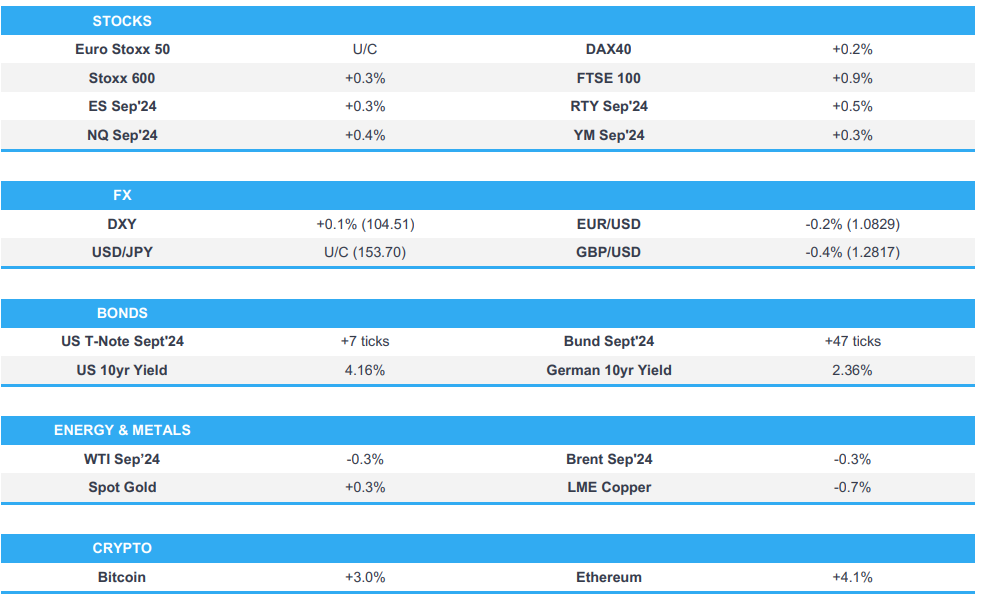

As of 10:40BST/05:40ET

EUROPEAN TRADE

EQUITIES

- A positive start for European bourses, following the APAC handover, quickly shifted into a more mixed picture as the broader risk tone became increasingly tepid; Euro Stoxx 50 U/C.

- The sectoral configuration remains the same as at the open, but with more dropping out of the green and the strength of those still firmer has also waned; Energy and Utilities outperform while Personal Care & Drug names lag.

- FTSE 100 outperforms given the weaker Pound, CAC 40 lags and has slipped under the 7.5k mark with the Luxury sector continuing to drift while the AEX remains firmer despite marked pressure in Heineken post-earnings as Phillips numbers offset.

- Stateside, futures are in the green but off best levels; ES +0.3% & NQ +0.4%. Directionally in-fitting with the above and the overall tone is a tentative one as we approach numerous megacap earnings this week including Amazon, Apple & Microsoft.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD now broadly firmer vs. peers after a sluggish start to the session; last week’s high of 104.55 has been tested but not surpassed thus far. Reminder, month-end flows are weak to neutral for USD demand.

- EUR and GBP pressured with the week packed for both markets. EUR/USD down to a 1.0828 base which is in a 1.4bln 1.0825-35 OpEx band while Cable nears 1.28 to the downside as pricing for a BoE cut intensifies but before that a speech from Chancellor Reeves.

- JPY gave back initial gains vs. the USD which saw the pair delve as low as 153.02. BoJ due on Wednesday, markets assigning a 41% chance of a 15bps hike.

- Antipodeans under pressure but to varying degrees with AUD faring slightly better after managing to halt its nine-session slump on Friday, Kiwi now lower for the 8th consecutive session and nearing the 0.5852 YTD base.

- PBoC set USD/CNY mid-point at 7.1316 vs exp. 7.2522 (prev. 7.1270).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A firmer start to the session with benchmarks benefitting from the tepid risk tone into a week packed with central bank activity outside of the bloc.

- Bunds at a 133.25 peak, surpassing the 133.21 high from June and bringing a virtual double-top at 133.70/71 from April into view.

- Gilts bid as pricing for a BoE cut on Thursday continues to creep higher, up to a c. 60% chance at the time of writing; reside at the top end of 98.34-98.78 bounds and is beginning to work through a cluster of recent highs between 98.66-98.93 from 16th-19th July.

- USTs are bid and approaching the July high of 111-15, within half a tick of the mark at best thus far. Session’s highlight is the Treasury Financing Estimate, ahead of Wednesday’s refunding which is expected to see coupon sizes maintained for a second consecutive quarter

- Click for a detailed summary

COMMODITIES

- Crude benchmarks under modest pressure after trimming APAC gains in the European morning in conjunction with a negative tilt in risk which also saw the Dollar index rise to session highs.

- WTI Sep resides in a USD 76.85-77.69/bbl range at the time of writing, with its Brent counterpart within USD 80.87-74/bbl parameters.

- Macro focus for the complex remains on geopols, after the escalation in rhetoric from Netanyahu and Erdogan. Reminder, this week also features the JMMC but no policy recommendation is expected to be put forward.

- A slightly mixed picture for metals with spot gold firmer despite the mentioned USD strength and at highs of USD 2403/oz while base metals have come under pressure from the tone & USD, causing 3M LME Copper to test USD 9k/T to the downside.

- Venezuelan President Maduro won a third term, according to the electoral authority. US Secretary of State Blinken said the US applauds the Venezuelan people for their participation in the election despite significant challenges and deep concerns about the process, while he added it is vitally important that every vote is counted fairly and transparently. Furthermore, he said the US calls for electoral authorities in Venezuela to publish detailed tabulation of votes to ensure transparency and accountability.

- Iraq’s June oil exports averaged 3.4mln bpd, according to the Oil Ministry.

- Ukraine said it struck an oil depot in Russia’s Kursk region.

- JP Morgan expects silver to average USD 36/oz in 2025.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Mortgage Approvals (Jun) 59.976k vs. Exp. 60.4k (Prev. 59.991k, Rev. 60.134k); Lending (Jun) 2.653B GB vs. Exp. 1.2B GB (Prev. 1.212B GB, Rev. 1.26B GB)

- UK M4 Money Supply (Jun) 0.5% (Prev. -0.1%)

- Swedish GDP YY Prelim (Q2) 0.0% vs. Exp. 0.3% (Prev. 0.7%); QQ -0.8% vs. Exp. -0.4% (Prev. 0.7%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is to accuse the former Conservative government on Monday of committing to billions of pounds of spending that has not been properly budgeted for, according to Reuters. The Telegraph reports that Reeves will attempt to fill the "black hole" by selling off land and building sites, whilst also banning the use of non-essential consultants. CityAM notes that the Treasury has refused to deny rumours it is planning to hike capital gains tax today.

- UK ports are to demand compensation if post-Brexit trade barriers with the EU are reduced after they were forced to spend millions of pounds building border-control facilities, according to FT.

- Trade between the UK and Germany is starting to recover from the post-Brexit decline, according to FT citing official figures which showed that the UK was Germany's ninth-largest trading partner during most of H1.

NOTABLE US HEADLINES

- US President Biden plans to unveil a proposal on Monday for dramatically reforming the Supreme Court and is expected to push for a constitutional amendment limiting immunity for presidents and other officeholders, according to Politico.

- Apple and IAM CORE union of retail workers reached a tentative labour agreement, while it was also reported that Apple Intelligence will miss the initial launch of the upcoming iOS 18 overhaul.

GEOPOLITICS

MIDDLE EAST

- A dozen were killed including children and more were injured by a rocket that hit a football pitch in Golan, according to Israeli Channel 13.

- Israeli PM Netanyahu said Hezbollah will pay heavily for the rocket attack that killed children, while the PM’s office later announced that the cabinet authorised the PM and Defence Minister to determine the type and response to the Hezbollah attack. It was also reported that Israel’s Foreign Minister said they are approaching the moment of an all-out war against Hezbollah and Lebanon.

- Israeli military spokesperson said they are preparing a response against Hezbollah, while the Israeli military later said it struck Hezbollah targets deep inside Lebanese territory and in southern Lebanon.

- Hezbollah announced it was on high alert and cleared some key sites in east and south Lebanon in case of possible Israeli escalation, according to two securities sources cited by Reuters.

- US Secretary of State Blinken said every indication is that the rocket that hit Golan Heights was from Hezbollah and the US stands with Israel’s right to defend its citizens from terrorist attacks, while he added that a ceasefire in Gaza would be an opportunity to bring lasting calm to the blue line between Israel and Lebanon.

- US asked Lebanon’s government to restrain Hezbollah, while Hezbollah asked the US to urge restraint from Israel, according to Lebanon’s Foreign Minister who warned a significant attack by Israel would lead to a regional war.

- US is highly concerned that the Golan Heights attack could lead to an all-out war between Israel and Hezbollah, according to Axios. It was also reported that the White House said it has been in continuous contact with Israeli and Lebanese counterparts since the attack that killed a number of children playing football and it is working on a diplomatic solution that would end attacks on the Israeli-Lebanon border.

- UN officials urged maximum restraint on the Lebanon-Israel front and warned exchanges of fire on the Lebanon-Israel border could engulf the region in catastrophe beyond belief.

- Iran’s Foreign Ministry spokesperson warned Israel about any new ‘adventure’ in Lebanon regarding the Golan Heights incident. In other news, Iran's Supreme Leader endorsed reformist Pezeshkianas president, according to FT.

OTHER

- Russian President Putin said Russia took note of US and German plans to deploy long-range missiles in Germany and noted that important Russian facilities will be in range of those US systems, while he warned that Russia will take similar actions to deploy and will no longer adhere to its unilateral INF moratorium if the US goes ahead with such plans.

- Russia’s Defence Ministry said its forces have taken two villages in Ukraine’s Donetsk region.

- US State Department senior official said Secretary of State Blinken and Chinese Foreign Minister Wang Yi had an extended conversation about Taiwan and Blinken raised concerns over China’s recent provocative actions regarding Taiwan including the simulated blockade around Taiwanese President Lai’s inauguration. Blinken raised human rights issues including Tibet, Hong Kong and Taiwan, while they agreed to keep making progress on military-to-military ties.

- US and Japan expressed concern Russia will undermine regional stability by giving North Korea WMD and missile technology, while they are concerned about the rapid expansion of China’s nuclear arsenal and will advance talks on a high-priority effort to expand co-production of defence equipment including air-to-air missiles and enhanced patriot air defence interceptors. Furthermore, the US reiterated its commitment to defend Japan with conventional and nuclear forces, while they condemned Russia’s procurement of North Korean weapons.

- South Korean Foreign Minister Cho stressed the importance of freedom of navigation and flight in the South China Sea at the ASEAN meeting, while he added peace and stability in the Taiwan Strait are just as important as the South China Sea.

- ASEAN communiqué said they strongly condemn violence against civilians in Myanmar and call for an immediate cessation, while they underlined the importance of a serious engagement and cessation of hostilities in Ukraine, as well as expressed concern over the dire humanitarian situation and alarming casualties in Gaza. Furthermore, they said North Korean missile tests are worrisome developments and urged UNSC resolution compliance, while they also affirmed the need to cease actions in the South China Sea that can complicate and escalate disputes.

- Russian Foreign Minister Lavrov expressed concern over the US-South Korean nuclear operations plan, according to Yonhap.

CRYPTO

- Bitcoin is firmer and probing the USD 70k mark after the pro-crypto remarks from US Republican nominee Trump at a Bitcoin Conference event on Saturday (see below).

- US Republican presidential candidate Trump said he wants crypto to be mined and made in America, while he will create a strategic national Bitcoin stockpile if elected and it will be his policy to keep 100% of all Bitcoin the US holds in the future if he is elected.

APAC TRADE

- APAC stocks traded mostly higher as the region resumed the momentum following last Friday's gains on Wall St heading into a pivotal week of risk events, while markets also shrugged off the rising Israel-Hezbollah tensions.

- ASX 200 was led higher by early outperformance in tech and telecoms, while all sectors traded in the green.

- Nikkei 225 outperformed and gapped above 38,000 at the open as markets second-guessed whether the BoJ will hike rates.

- Hang Seng and Shanghai Comp. were somewhat varied as the former conformed to the improved global risk sentiment, while the mainland index lagged after stalling just shy of the 2,900 level and failed to benefit from improved industrial profits.

NOTABLE ASIA-PAC HEADLINES

- Italian Premier Meloni said Italy is to sign a three-year action plan with China to experiment with new forms of cooperation, according to ANSA.

- China Evergrande. New Energy Vehicle said some creditors of two subsidiaries applied to the court for their bankruptcy reorganisation, while it said the matter has a major impact on the Co. and its units’ production and operating activities.

- Japan's Top Economic Council says the government and BoJ needs to guide policy with a "close eye" on recent JPY weakness. Adding, that the impact of a weak JPY and rising prices cannot be overlooked on household purchasing power.

- BoJ sources suggest some policymakers believe rate increases would have positive effects on consumption as the major cause of weak spending is the JPY depreciation; other policymakers doubt how much a small rate hike could help the JPY recovery, via WSJ.

DATA RECAP

- Chinese Industrial Profits YY (Jun) 3.6% (Prev. 0.7%)

- Chinese Industrial Profits YTD YY (Jun) 3.5% (Prev. 3.4%)