US Market Open: Modest positive bias into US data and numerous large-cap earnings

30 Jul 2024, 11:20 by Newsquawk Desk

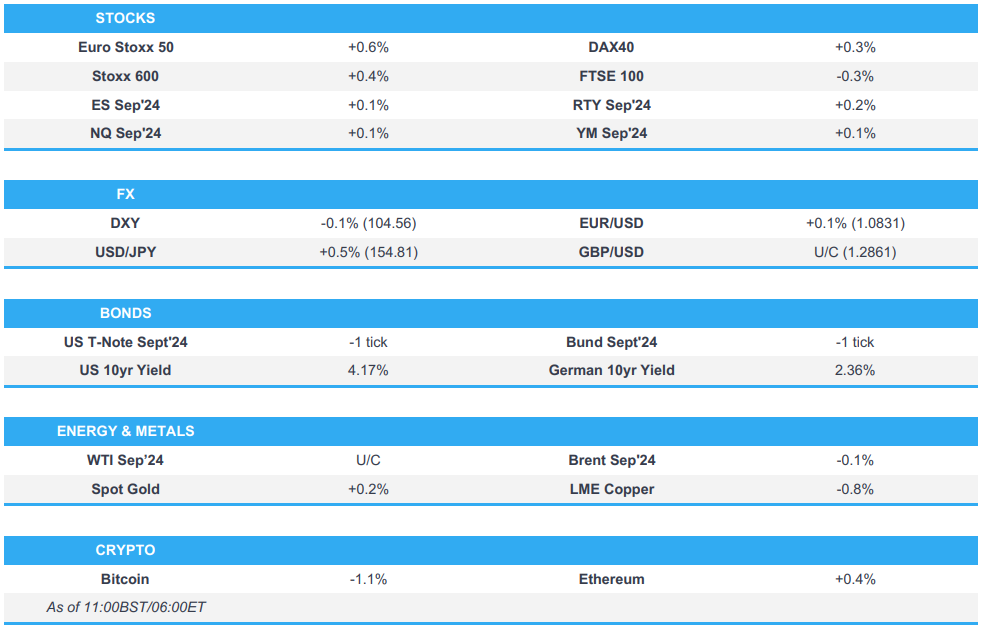

- A mostly firmer start to the session, Euro Stoxx 50 +0.5%, with sentiment on a better footing than APAC counterparts as earnings take the spotlight ahead of this week's risk events.

- Stateside, a modest positive bias remains in play into JOLTS and then earnings which include MSFT, AMD, MRK, PFE & PG.

- DXY largely contained vs. peers, JPY on the backfoot while NZD outperforms. EUR marginally firmer after a data deluge

- Fixed benchmarks flat/softer, initial Spanish inflation/German GDP induced gains gave way to a slight bearish bias after hawkish regional CPI and robust EZ GDP

- Crude benchmarks are flat/choppy, NatGas slightly firmer while metals are mixed with XAU within Monday's range

- Looking ahead, highlights include US JOLTS. Earnings from Merck, Paypal, Pfizer, Procter & Gamble, AMD, Microsoft, Mondelez & Starbucks.

EUROPEAN TRADE

EQUITIES

- A mostly firmer start to the session, Euro Stoxx 50 +0.5%, with sentiment on a better footing than APAC counterparts as earnings take the spotlight ahead of this week's risk events.

- Sectors have no overarching theme/bias with Autos strong and rebounding from recent pressure, Tech supported by ASML while Basic Resources have been dented by benchmark action.

- Breakdown dictated by earnings/data; DAX 40 +0.4% firmer but stalling after a soft Flash German GDP print and amid growing pressure in Heidelberg Materials post-earnings. FTSE 100 lags given pressure in mining and most banking names, though BP +2.2% and Standard Chartered +5.5% are strong post-earnings while Diageo -9.0% slips after warning of persisting challenges.

- Stateside, a modest positive bias remains in play into JOLTS and then earnings; ES +0.2% & NQ +0.2%. Stateside earnings docket has MSFT, AMD, MRK, PFE & PG.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is largely contained vs. peers with specifics light into the week’s risk events; DXY is currently within yesterday's 104.13-75 range. Upside sees the 50DMA @ 104.88 and 100DMA @ 104.89. Downside sees 10 and 200DMA both @ 104.32.

- EUR marginally firmer after a slew of data prints which have been headlined by slightly hawkish German regional CPI and a better-than-expected GDP print for the bloc. EUR/USD at the top-end of 1.0815-34 parameters.

- GBP is essentially unchanged with little follow-through from Reeves’ statement, focus remains firmly on Thursday’s BoE. Cable is currently well within yesterday's 1.2807-1.2888 range.

- JPY on the backfoot vs. USD, though has managed to pull away marginally from the USD/JPY 155.21 high for the session. Attention firmly on Wednesday’s BoJ which could potentially be hawkish and is then followed by the FOMC’s gathering.

- NZD outperforms with nothing by way of fresh fundamental catalyst, NZD/USD is in the process of snapping an eight session losing streak; AUD essentially unchanged vs. USD.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A relatively contained start before a packed morning of data points. EGBs are under modest pressure after a slightly hawkish set of German regional CPI numbers and a stronger-than-expected EZ Flash Prelim. GDP outing.

- As such, Bunds at the low-end of a 133.09-43 range, the high printed early doors on a cooler Spanish Flash CPI release; Monday’s base at 132.72.

- Gilts steady at the low-end of yesterday’s 98.34-98.93 parameters. Supply saw the first auction for the 4.25% 2034 line post strong results after a record setting syndication in June.

- USTs are essentially flat. Holding a handful of ticks below Monday’s 111-16+ best. Docket headlined by JOLTS.

- UK sells GBP 3.75bln 4.25% 2034 Gilt: b/c 2.93x, average yield 4.082%, tail 0.5bps

- Italy sells EUR 7.75bln vs exp. EUR 6.5-7.75bln 4.10% 2029, 3.35% 2029 & 3.85% 2035 BTP and EUR 1.5bln vs exp. EUR 1.0-1.5bln 2032 CCTeu

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are flat/choppy following APAC losses which were largely a continuation of the weakness that has plagued the complex recently.

- WTI & Brent in narrow circa. USD 0.50/bbl parameters and are currently around the mid-point of such bands.

- Nat Gas is flat but with a mild upward tilt following another session of gains for Dutch TTF which settled higher by over 4% yesterday amid hotter weather forecasts for Asia.

- Metals are mixed; precious metals are slightly firmer with gold at the top-end of a USD 20/oz band that is entirely contained by Monday’s USD 2369-2403/oz parameter; base metals pressured, but off worst.

- Adnoc announces that the Satah Al Razboot field has attained a 25% increase in production capacity due to advanced technologies, taking it to 140k BPD.

- Japan's Eneos has restarted its 129k BPD Chiba CDU on July 28th following system issues, according to a spokesperson cited by Reuters.

- BP (BP/ LN) CEO says European refining margins are struggling due to weak gasoline and diesel demand, BP expects global fuel inventories to fall during summer driving seasons and lift refining margins.

- Ukraine is ready to resolve oil transit issues with Slovakia if Slovakia activates relevant mechanism in EU association agreement, according to the Ukrainian deputy energy minister.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU GDP Flash Prelim QQ (Q2) 0.3% vs. Exp. 0.2% (Prev. 0.3%); YY 0.6% vs. Exp. 0.5% (Prev. 0.4%)

- EU Consumer Confidence Final (Jul) -13.0 vs. Exp. -13.0 (Prev. -13.0)

- EU Selling Price Expectations (Jul) 6.8 (Prev. 6.1, Rev. 6.2); Consumer Inflation Expectations 11.2 (Prev. 13.1)

- German Data Summary/Reaction (Regional CPI & Q2 GDP): A weak set of Q2 GDP data saw Bunds revisit the earlier 133.43 peak (printed on the Spanish Flash CPI numbers), thereafter a net slightly hawkish (vs. mainland exp.) set of German regional CPIs saw Bunds reverse and fall to 133.20. From the Regional CPI, expectations for the mainland M/M are perhaps subject to a modest upward skew vs. 0.2% (prev. 0.1%) consensus set before the regional release while the Y/Y view is broadly in-fitting at 2.2% (prev. 2.2%) as the regional numbers were somewhat mixed.

- Spanish CPI YY Flash NSA (Jul) 2.8% vs. Exp. 3.1% (Prev. 3.4%); Core 2.8% (prev. 3.0%)

- Spanish HICP Flash YY (Jul) 2.9% vs. Exp. 3.2% (Prev. 3.6%)

- French GDP Preliminary QQ (Q2) 0.3% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.3%); Consumer Spending MM (Jun) -0.5% vs. Exp. 0.2% (Prev. 1.5%, Rev. 0.8%)

- UK BRC Retail Shop Price Index YY (Jul) 0.2% (Prev. 0.2%)

NOTABLE US HEADLINES

- WSJ’s Timiraos wrote “The NY Fed's measure of inflation persistence (the "multivariate core trend" rate) fell again in June, to 2.1%”, while he added "With meaningful shelter disinflation arriving in June, the declines in inflation are broadening".

- Former US President Trump said he would probably end up debating VP Harris but added that he could also make a case for not debating.

- Nvidia (NVDA) is accelerating humanoid robotics development by offering new services, including NVIDIA NIM for robot simulation and learning, the OSMO orchestration service for robotics workloads, and a teleoperation workflow for training robots with minimal human demonstration data.

GEOPOLITICS

MIDDLE EAST

- US is leading a diplomatic push to deter Israel from targeting Beirut and southern suburbs in response to the Golan strike, according to Reuters citing sources.

- Syrian Observatory said the Israeli army targeted with missiles a military site west of the city of Nawa in the western countryside of Daraa province, according to Sky News Arabia.

OTHER

- Russia's Navy started drills involving 20,000 personnel and 300 ships, while drills involve Russia's Northern, Pacific and Baltic fleets and Caspian Sea flotilla, according to Interfax

- Venezuelan opposition leader Machado said the opposition has the ability to prove truth of election results, while a US senior official accused Venezuela's Maduro government of "electoral manipulation". It was also reported that Uruguay's Foreign Minister said the country will never recognise Maduro's win due to a clear victory of the opposition and Peru's Foreign Ministry ordered Venezuelan diplomats to leave the country within 72 hours.

CRYPTO

- Crypto is a touch mixed with Bitcoin under modest pressure after the weekend’s gains continued on Monday following on from Trump’s bullish commentary. Though, the downside thus far is somewhat limited with BTC currently between USD 66-67k.

- US SEC may be dropping it's charges against so-called third-party tokens, such as Solana (SOL) and Polygon (MATIC), which have been part of its case against Binance, according to a court filing early Tuesday morning cited by CoinDesk.

APAC TRADE

- APAC stocks were mostly pressured following the mixed performance stateside and with markets cautious as this week's major risk events drew closer.

- ASX 200 was dragged lower amid underperformance in mining stocks after several quarterly production updates and with heavy losses in Fortescue after an investor sought to offload as much as AUD 1.9bln of shares, while a much wider-than-expected contraction in building approvals added to the glum mood.

- Nikkei 225 retreated amid cautiousness as the BoJ kick-started its two-day policy meeting where it will decide on taper plans and is expected to mull lifting its policy rate by 15bps to around 0.25%.

- Hang Seng and Shanghai Comp. conformed to the broad negative mood in which the former tested the 17,000 level to the downside with notable weakness seen in consumer, energy and tech stocks, while the mainland was subdued with Chinese official PMI data also due tomorrow.

NOTABLE ASIA-PAC HEADLINES

- China customs official said China faces an increasingly uncertain trade environment and challenges to grow trade in H2.

- Japan reportedly taps brokerages to market JGBs abroad as the BoJ steps back, according to Nikkei.

- China's Politburo has held a meeting to study the current economic situation, according to state media; has set out economic priorities for H2 2024. Domestic effective demand remains insufficient.

DATA RECAP

- Japanese Unemployment Rate (Jun) 2.5% vs. Exp. 2.6% (Prev. 2.6%); Jobs/Applicants Ratio 1.23 vs. Exp. 1.24 (Prev. 1.24)

- Australian Building Approvals (Jun) -6.5% vs. Exp. -1.5% (Prev. 5.5%, Rev. 5.7%)