Europe Market Open: ISM sparked a sell off which continued on AMZN -6.9% & INTC -18.9% results

02 Aug 2024, 06:45 by Newsquawk Desk

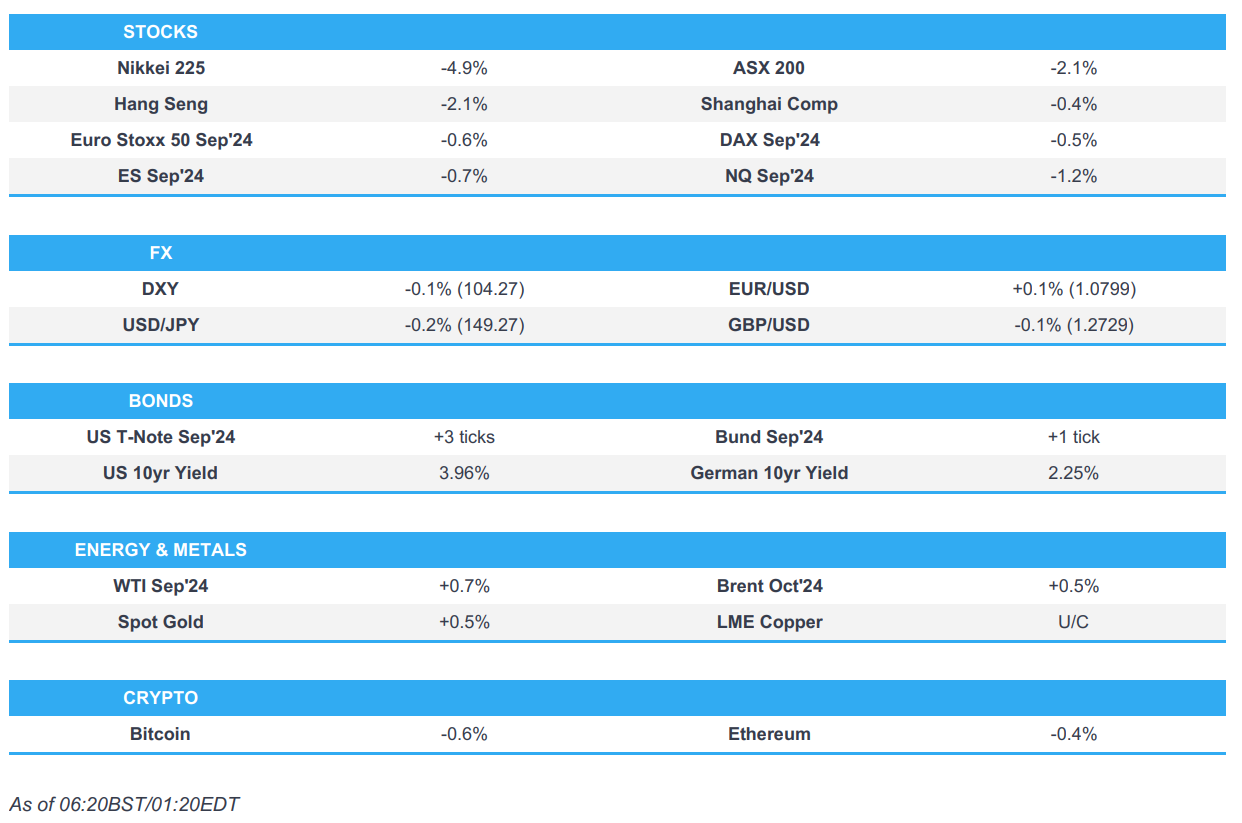

- US stocks sold off in the wake of the disappointing US ISM Manufacturing PMI data which sparked a flight to quality; APAC followed suit with hefty losses in the region.

- Post-earnings, Apple (AAPL) rose 0.6%, Amazon (AMZN) fell 6.9%, and Intel (INTC) tumbled 18.9%; US equity futures remained on the back foot.

- BoE Chief Economist Pill said there will be bumps in the road on inflation ahead and he is not committing to further interest rate cuts.

- European equity futures indicate a lower open with Euro Stoxx 50 futures down 0.6% after the cash market finished with losses of 2.2% on Thursday.

- Looking ahead, highlights include Swiss CPI, Italian Industrial Output, Italian Retail Sales, US NFP, Durable Goods (R), BoC Market Participants Survey, Comments from BoE’s Pill & Fed's Barkin, Earnings from AXA, Engie, IAG, IMCD, Volvo Car AB, Chevron & Exxon

US TRADE

EQUITIES

- US stocks sold off in the wake of the disappointing US ISM Manufacturing PMI data as the headline surprisingly declined which printed outside the bottom end of the forecast range and prices paid rose, while other data also showed a larger-than-expected rise in jobless claims. There was a distinct flight-to-quality throughout the session which benefitted the Dollar and Treasuries, while the key after-market earnings from the likes of Amazon, Apple and Intel were mixed.

- SPX -1.4% at 5,447, NDX -2.4% at 18,890, DJIA -1.2% at 40,348, RUT -3.0% at 2,186.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Apple Inc (AAPL) Q3 2024 (USD): EPS 1.40 (exp. 1.35), revenue 85.78bln (exp. 84.53bln), Products rev. USD 61.56bln (exp. 60.63bln), iPhone rev. USD 39.30bln (exp. 38.95bln), iPad revenue USD 7.16bln (exp. 6.63bln), Mac rev. USD 7.01bln (exp. 6.98bln), Wearables, home and accessories rev. USD 8.10bln (exp. 7.79bln), Service rev. USD 24.21bln (exp. 23.96bln), Greater China rev. USD 14.73bln (exp. 15.26bln). Shares rose 0.6% after-hours.

- Amazon.com Inc (AMZN) Q2 2024 (USD): EPS 1.26 (exp. 1.03), rev. 148bln (exp. 148.56bln). Shares fell 6.9% after-market.

- Intel Corp (INTC) Q2 2024 (USD): Adj. EPS 0.02 (exp. 0.10), rev. 12.83bln (exp. 12.94bln). Shares tumbled 18.9% after-hours.

APAC TRADE

EQUITIES

- APAC stocks suffered firm losses following the bloodbath and flight-to-quality stateside which was triggered by weak ISM Manufacturing data, while geopolitical concerns and mixed earnings added to the downbeat sentiment.

- ASX 200 declined amid the broad weakness and with firm losses seen across all sectors.

- Nikkei 225 fell beneath 37,000 for the first time since April, while the Topix index followed the benchmark into correction territory.

- Hang Seng and Shanghai Comp. were pressured which saw the former give up the 17,000 status and the mainland index also retreated, while there were bearish comments on trade from a Mofcom official who stressed the seriousness of difficulties and challenges in foreign trade.

- US equity futures remained on the back foot amid the ongoing sell-off and the recent bout of mostly underwhelming quarterly earnings results and guidance.

- European equity futures indicate a lower open with Euro Stoxx 50 futures down 0.6% after the cash market finished with losses of 2.2% on Thursday.

FX

- DXY was steady and held on to the prior day's gains amid the broad risk-off mood following the weak US ISM data which supported haven currencies, while the attention turns to the incoming jobs data.

- EUR/USD traded rangebound after falling beneath the 1.0800 handle with the single currency not helped by the recent rise in EU unemployment.

- GBP/USD remained subdued in the aftermath of the BoE's first rate cut in four years.

- USD/JPY price action was choppy after the recent central bank frenzy but with support seen at 149.00.

- Antipodeans gradually rebounded off yesterday's lows but with upside limited amid the downbeat risk sentiment.

FIXED INCOME

- 10-year UST futures extended on this week's gains with upside fuelled by haven demand following weak ISM data and as the US 10yr yield fell to a 6-month low, while money markets are fully pricing three Fed rate cuts this year and around a 30% chance of a 50bps move in September.

- Bund futures took a breather after climbing to multi-month highs above the 134.00 level.

- 10-year JGB futures rallied from the open as the flight-to-quality rolled over into Asia and with declining yields in Japan including the 10-year yield which fell beneath 1.00%.

COMMODITIES

- Crude futures nursed some of their recent losses after slumping alongside the broad risk-off mood and flight-to-quality trade, while the OPEC+ JMMC did not make any recommendations, as expected.

- Spot gold edged higher amid the flight-to-quality but with gains capped as the NFP report looms.

- Copper futures were lacklustre following the recent slide as weak US ISM data spooked risk assets.

- BHP's Escondida copper mine workers rejected the contract offer paving the way for a strike, while BHP will request a 5-day government mediation to negotiate with the Escondida union.

CRYPTO

- Bitcoin declined alongside the selling across risk assets and briefly dipped beneath USD 64,000.

NOTABLE ASIA-PAC HEADLINES

- China MOFCOM official said the complexity of the foreign trade environment is rising and we should take into full account the seriousness of the difficulties and challenges in foreign trade, as well as noted that they will use many bilateral mechanisms to help enterprises actively respond to unreasonable trade restrictions.

- Japanese Finance Minister Suzuki said they will analyse the impact of forex volatility on the economy and respond appropriately. Suzuki added that stock prices are determined in the market based on various factors such as economic conditions and he is closely watching stock moves with a sense of urgency.

- Japanese Industry Minister Saito said economic fundamentals aren't bad when asked about the sharp fall in the stock market, while he added that a strong movement is seen in investment and wage hikes are continuing.

DATA RECAP

- South Korean CPI MM (Jul) 0.3% vs. Exp. 0.25% (Prev. -0.2%)

- South Korean CPI YY (Jul) 2.6% vs. Exp. 2.5% (Prev. 2.4%)

- Australian PPI QQ (Q2) 1.0% (Prev. 0.9%)

- Australian PPI YY (Q2) 4.8% (Prev. 4.3%)

GEOPOLITICAL

MIDDLE EAST

- Israeli military said warning sirens sounded in northern Israel.

- US President Biden and Israeli PM Netanyahu discussed new defensive military deployments, according to the White House.

- US officials said they are preparing to counter an Iranian attack on Israel within days, according to Axios.

- Turkish President Erdogan told US President Biden that Israel does not want a ceasefire, while he added the killing of the Hamas chief harmed ceasefire efforts and that Israel is trying to spread conflict to the wider region.

OTHER

- US announced the release of detainees including Evan Gershkovich and Paul Whelan from Russia in a multi-country swap with the swap effort the result of intense diplomacy involving multiple countries, while the Biden administration will not change policy related to Russian aggression.

EU/UK

NOTABLE HEADLINES

- BoE Chief Economist Pill said there will be bumps in the road on inflation ahead and he is not committing to further interest rate cuts.