US Market Open: Sell off continues, circuit breakers triggered in APAC trade; odds of Fed cuts soar

05 Aug 2024, 11:30 by Newsquawk Desk

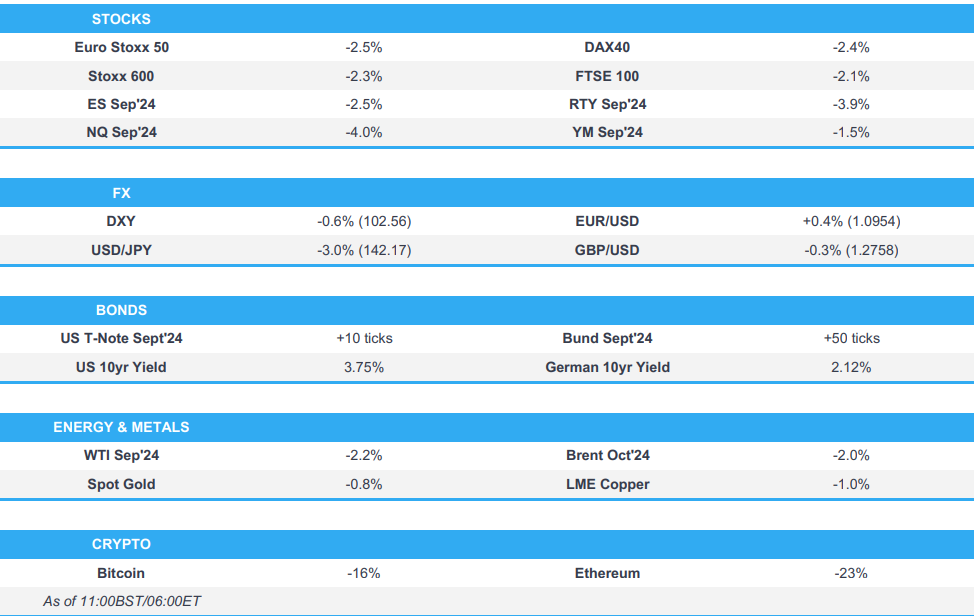

- European bourses opened with marked downside, following the APAC pressure post-NFP with sentiment hit further by updates concerning Apple and Nvidia; US futures slump, ES -2.5% & NQ -4.0%

- APAC pressure was pronounced with circuit breakers triggered in Japan and South Korea; Nikkei 225, -12%, closed with a record daily points fall

- Hefty losses for the DXY with JPY the main beneficiary and USD/JPY down to a 141.70 base, EUR benefitting modestly from the USD downside

- Fixed benchmarks bid with the odds of Central Bank easing ramping up; implied odds of a 25bp Fed cut this week as high as 60%

- Crude conforms to the broader tone despite ongoing geopolitical tensions with metals pressured as JPY and Fixed are favoured over XAU currently

- Looking ahead, highlights include US Final Composite/Services Final PMIs, ISM Services PMI, Comments from Fed’s Daly & Goolsbee.

EUROPEAN TRADE

EQUITIES

- European bourses opened with marked downside, following the APAC pressure post-NFP with sentiment hit further by updates concerning Apple and Nvidia; since, benchmarks have lifted slightly off worst but remain under marked pressure, Euro Stoxx 50 -2.3%.

- In brief, APAC pressure was pronounced with circuit breakers triggered in Japan and South Korea while the Nikkei 225 closed with a record daily points fall.

- Sectors in the red, Energy lags as crude benchmarks come under renewed pressure with Tech hit on sentiment and AAPL/NVDA while Banks slump as yields fall and pricing for central bank easing lifts.

- Infineon opened as the DAX 40 laggard after missing forecasts, narrowing guidance and announcing layoffs.

- Stateside, futures in the red given the above but have begun to consolidate just off worst levels with newsflow light and as we await ISM Services & Fed speak for direction; ES -2.4%, NQ -3.9%.

- Bloomberg headlines this morning suggested that traders are pricing a 60% chance that the Fed will cut rates by 25bps in the next week.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- Hefty losses to begin the week for the USD with the DXY down to a 102.41 base as pricing for Fed easing ramps up considerably and as JPY strengthens significantly.

- USD/JPY down to a 141.70 base vs. a brief high-point of 146.56, action which comes as yields globally slump and differentials become more favourable following the BoJ's hike in addition to its typical haven status amid the broad sell off.

- EUR benefitting from the USD's pressure but with upside for the single currency capped/hampered by strength in the JPY and CHF; EUR/USD holding around 1.0950 just shy of the 1.0975 peak.

- Cable more contained and somewhat torn between USD pressure and EUR strength with yields not providing as much direction for GBP given the extent of last week's moves around the BoE.

- Antipodeans lag on the risk tone, AUD and NZD down to lows of 0.6350 and 0.5851 respectively.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Fixed benchmarks bid as the post-NFP sell-off reverberated into and was exacerbated during APAC trade. The odds of Fed easing have ramped up even more with a 50bp cut almost entirely priced for September and implied pricing for a 25bp cut in the next week at 60%.

- USTs at highs, yields lower across the curve with just the 20yr & 30yr remaining above 4.0% at lows of 4.08% and 4.01% respectively.

- EGBs and Gilts in-fitting, Bunds up to a 136.28 peak and on track for a 10th consecutive session of gains while Gilts are also at highs but slightly more modest after last week's action.

- No real move to the session's Final PMIs and EZ Sentix, though both PMIs and Sentix remain downbeat on Germany with the latter noting that “recession bells are ringing again in Germany”.

- Click for a detailed summary

COMMODITIES

- Crude is conforming to the broader risk aversion after the US jobs data on Friday stoked fears of a recession against the backdrop of sluggish Chinese demand; though, downside has at times been cushioned by ongoing geopolitical tensions.

- WTI and Brent at the low-points of session parameters, below USD 72.00/bbl and nearing USD 76.00/bbl respectively.

- Precious metals lower across the board as the USD managed to pick up slightly from worst levels and with XAU being outshone by marked JPY and Fixed bids; holding around USD 2430/oz after being as high as USD 2458/oz overnight.

- Base metals are lower across the board given the mentioned risk tone and despite better-than-expected Chinese Caixin Services PMI.

- Saudi Arabia raised its official selling price for Asia in September by 20 cents to USD 2.00/bbl above the Oman/Dubai average, while it set the OSP to NW Europe to + USD 1.25/bbl vs ICE Brent and to the US at + USD 4.10/bbl vs ASCI.

- NHC said Tropical Storm Debby is strengthening over the southeastern Gulf of Mexico, while it later stated Debby has strengthened to a hurricane and is expected to make landfall in the Florida Big Bend area on Monday which will bring a major flood threat to the southeastern United States.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HCOB Composite Final PMI (Jul) 50.2 vs. Exp. 50.1 (Prev. 50.1); Services Final PMI 51.9 vs. Exp. 51.9 (Prev. 51.9)

- EU Sentix Index (Aug) -13.9 vs. Exp. -8.0 (Prev. -7.3)

- EU Producer Prices MM (Jun) 0.5% vs. Exp. 0.4% (Prev. -0.2%); YY -3.2% vs. Exp. -3.3% (Prev. -4.2%, Rev. -4.1%)

- UK S&P Global PMI Composite (Jul) 52.8 vs. Exp. 52.7 (Prev. 52.7); Service PMI 52.5 vs. Exp. 52.4 (Prev. 52.4)

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer vowed that those responsible for the disorder and chaos that’s spreading across UK towns and cities will be punished for what he described as “far-right thuggery”, according to Bloomberg.

- Infineon (IFX GY) - Q3 (EUR): Revenue 3.7bln (exp. 3.8bln), Net 403mln (exp. 447mln), adj. Gross Margin 42.2% (exp. 40.3%), adj. EPS 0.43 (exp. 0.42). Further improvement to revenue and earnings seen in Q4, FY forecasts are well within the prior guided range. It is anticipated that revenue will increase in all four segments Q/Q. Q4 Guidance: Revenue 4bln (exp. 3.9bln). CEO says they are to cut around 1.4k jobs globally and will move an additional 1.4k. 3.6% weighting in the DAX 40

NOTABLE US HEADLINES

- Bloomberg headlines suggest that traders are pricing a 60% chance that the Fed will cut rates by 25bps in the next week.

- Fed's Goolsbee (2025 voter) said on Friday that jobs data follows the trend of a cooling labour market and noted they had multiple good months of inflation and was broad-based. Furthermore, he said if inflation and the job market continue to cool, the Fed should cut.

- US Republican Presidential Candidate Trump said he agreed with Fox News to debate Kamala Harris on September 4th and said he agreed to conduct a major town hall event that evening if Harris is unwilling or unable to debate on that date.

- Goldman Sachs raised its odds of a US recession by 10ppts to 25% for the next 12 months.

- Apple (AAPL) - Warren Buffett's Berkshire Hathaway (BRK.B) has reduced its stake in Apple to USD 84.2bln (vs 135.4bln last quarter)

- Berkshire Hathaway (BRK) - Q2 EPS 21,122 (vs 24,775 Y/Y), Q2 operating income USD 11.59bln (+15.5% Y/Y), Quarterly net income -15% to USD 30.34bln (vs 35.91bln Y/Y), Q2 revenue USD 93.65bln (exp. 94.5bln). Nearly half of BRK's profit came from its insurance businesses, including Geico car insurance, where underwriting profit more than tripled as premiums rose and claims fell. Insurance underwriting income +81% Y/Y, and insurance investment income +40% Y/Y. Berkshire's cash stake grew to USD 276.9bln (vs 189bln Q/Q) as it sold a net USD 75.5bln of stocks in Q2, the seventh straight quarter that Berkshire sold more stocks than it bought, Reuters notes. Berkshire repurchased USD 345mln of its own stock in the quarter (vs USD 2.57bln in Q1).

- Nvidia (NVDA) - Nvidia's upcoming AI chips, part of the Blackwell series, will be delayed by over three months due to design flaws, The Information reports. This delay affects major customers like Meta Platforms (META), Alphabet (GOOG), and Microsoft (MSFT), which have collectively ordered tens of billions of dollars worth of the chips. Goldman Sachs said if the report is true, it could drive some volatility in Nvidia’s near-term fundamentals, but it expects there to be little to no impact on CY2025 earnings and, most importantly, the company’s long-term competitive position; GS maintained its Buy rating on NVDA (also on its Americas Conviction List) and its 12-month PT of USD 135 (26% potential upside).

GEOPOLITICS

MIDDLE EAST

- Israel conducted strikes targeting two schools sheltering the displaced near Gaza City which killed at least 25 Palestinians, while the Israeli military said the strikes on Gaza schools targeted militants operating there. Israel also conducted a strike in the West Bank which killed a Hamas commander.

- Israeli PM Netanyahu on Sunday warned "Iran's axis of evil" against attacking Israel amid expectations that Tehran and the militant groups it supports are readying retaliatory strikes, according to dpa.

- Iran-led retaliatory assaults are “expected imminently” and will likely be simultaneous, coming from Hezbollah in Lebanon, the Houthis in Yemen and Iran itself, according to Israeli officials cited by Bloomberg and Iran International.

- Iran’s Revolutionary Guards said the terrorist act of killing Hamas chief Haniyeh was designed and executed by Israel with the support of the criminal US government, while it added that the adventurous and terrorist Zionist regime will decisively receive the response to this crime. Furthermore, the IRGC said Tehran’s revenge will be severe and at the appropriate time, place and manner, according to Reuters.

- US Secretary of State Blinken told his G7 counterparts on a conference call on Sunday that an attack by Iran and Hezbollah against Israel could begin within 24 to 48 hours, according to Walla News.

- IRGC sources told iNews Britain that Iran's response to Israel could come no later than Tuesday or Wednesday.

- Egypt’s Foreign Minister held a call with Iran’s Foreign Minister and stressed that recent developments are unprecedented, very dangerous and threatening to the region’s stability.

- US President Biden will speak to Jordan's King on Monday and will convene the national security team on Monday in the situation room to discuss Middle East developments, according to the White House.

- US Secretary of State Blinken spoke with Iraqi PM Al-Sudani and emphasised the importance of all parties taking steps to calm regional tensions and avoid escalation, while Iraq’s PM told Blinken in the phone call that preventing regional tensions is tied to stopping Israeli aggression on Gaza. It was separately reported that Blinken told G7 ministers that Iran and Hezbollah may attack Israel within the next 24 hours, according to Axios

- White House’s Finer said the US is trying to prepare for any scenario in the Middle East by warning citizens to leave Lebanon and the US is moving an aircraft carrier to the Middle East purely for defensive reasons, while Finer said the overall goal is to turn the temperature down in the region, according to a CBS interview.

- UK Foreign Office said Britain temporarily withdrew the families of officials working at the British embassy in Beirut due to a highly volatile security situation in Lebanon.

- US Central Command forces said they successfully destroyed an Iranian-backed Houthi missile and launcher in the Houthi-controlled area of Yemen. It was separately reported that Yemen’s Houthis said they targeted MV Groton in the Gulf of Aden with ballistic missiles.

- Israel could reportedly pre-emptively strike Iran in the scenario that intelligence was to show that an attack was imminent, via Times of Israel.

- US is reportedly willing to guarantee to Israel that it will be able to renew fighting against Hamas in Gaza after the first phase of a potential ceasefire and hostage deal, via Times of Israel.

OTHER

- Ukrainian President Zelensky announced the arrival of F-16 fighter jets and said they are already in use in Ukraine’s skies, while he said Ukraine does not have enough F-16 pilots or jets and hopes training will be expanded. Furthermore, he plans to discuss at the Ukraine-NATO council the use of neighbouring countries’ aviation for air defence work.- Ukrainian military said it struck a Russian submarine and anti-aircraft system in Crimea, while it also struck Russia’s Morovosk airfield, as well as oil fields and fuel facilities in three Russian regions.

- Russian Defence Ministry said Russian forces captured a settlement in the Donetsk region.

- North Korean leader Kim said they will have a more improved level of nuclear readiness in the near future to respond to any challenges, while he added that stockpiling and improving nuclear weapons is the best way to counter the US, according to KCNA.

- Philippines and German Defence Ministers committed to concluding a broader defence agreement, while the Philippines Defence Minister said they invited German ships to participate in exercises.

CRYPTO

- Bitcoin under marked pressure and briefly losing the USD 50k handle with downside in excess of 15% thus far.

APAC TRADE

- APAC stocks mostly slumped following last Friday's continued sell-off on Wall St owing to disappointing jobs data which sparked recession concerns, while heightened tensions in the Middle East linger as markets await Iran's retaliation.

- ASX 200 declined with tech, financials and real estate leading the broad retreat seen across all sectors.

- Nikkei 225 continued its aggressive slide and dipped beneath the 33,000 level for the first time since early January, while the index entered into a bear market along with the Topix.

- Hang Seng and Shanghai Comp. showed early resilience with the mainland initially kept afloat after Caixin Services PMI topped forecasts, while China recently laid out its priorities to spur consumer spending and the State Council designated 20 key steps to expand basic consumption. However, the bourses later conformed to global losses.

- Nikkei 225 unofficially closes at 31458, -12.4%; closes with a record daily points fall, exceeding the drop on Black Monday in October 1987

NOTABLE ASIA-PAC HEADLINES

- China issued guidelines to promote high-quality development of service consumption, according to Bloomberg. China’s government on Saturday laid out its priorities to spur consumer spending as weak domestic demand continues to weigh on growth in which the State Council designated 20 key steps including exploring the potential to expand basic consumption in areas such as catering, home services and elderly care, according to a statement posted on the central government’s website.

- EU capitals are set to back tariffs on Chinese electric cars with member states likely to support the imposition of proposed tariffs on Chinese EVs in November, according to FT citing the bloc's trade commissioner Dombrovskis.

- BoJ Minutes from the June 13th-14th meeting stated that a few members said import prices are rising due to the recent yen fall, creating upside inflation risk, while a member said cost-push inflation could heighten underlying inflation if it leads to higher inflation expectations and wage increases. Furthermore, one member said the BoJ must raise rates at appropriate timing without delay although another member said a rate hike must be done only after inflation makes a clear rebound and data confirms heightening in inflation expectations, while members agreed recent weak yen pushes up inflation and warrants vigilance in guiding monetary policy.

- Japanese Finance Minister Suzuki says stock price is determined by the market; expects economy to gradually recover; Cooperating with BoJ and FSA and closely monitoring markets with a sense of urgency. Highly interested in the current stock market situation.

- Japan's Chief Cabinet Secretary Hayashi says they are monitoring financial situations both abroad and domestic with a sense of urgency, says it is important for the gov't to make a judgement on the market calmly.

- Thai Finance Minister says the stock market fall is being driven by external factors, should be supported by gov't measures

DATA RECAP

- Chinese Caixin Services PMI (Jul) 52.1 vs. Exp. 51.4 (Prev. 51.2); Composite PMI (Jul) 51.2 (Prev. 52.8)