Europe Market Open: APAC saw a rebound, RBA kept rates unchanged with a hawkish tone

06 Aug 2024, 06:50 by Newsquawk Desk

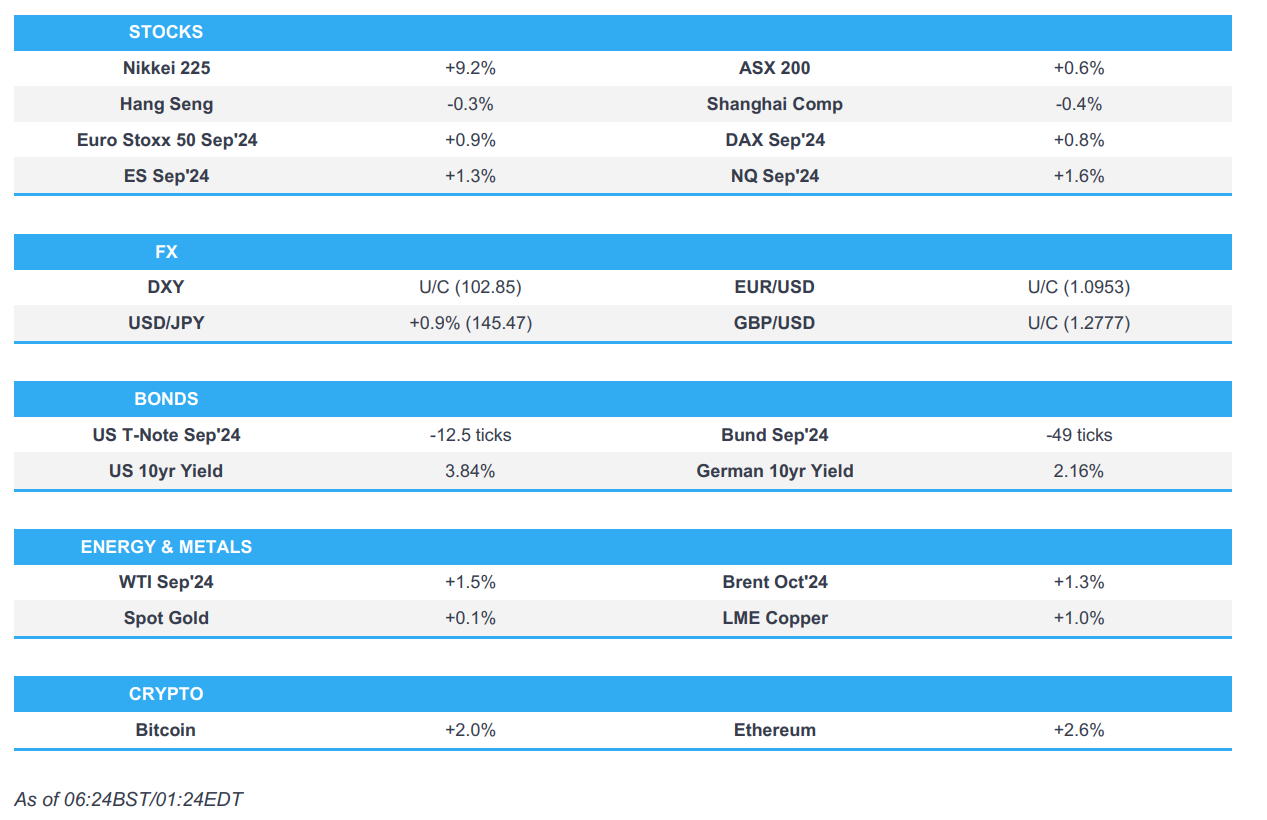

- APAC stocks were mostly positive as the region rebounded from the recent market turmoil.

- Nikkei futures saw an upside circuit breaker triggered, while the Korea Exchange activated sidecars for the Kospi and Kosdaq after early surges.

- The RBA policy announcement provided no major surprises as it kept rates unchanged and maintained its hawkish tone.

- Fed’s Daly (voter) said none of the labour market indicators she looks at are flashing red right now but she is monitoring them carefully and said the Fed is prepared to act as it gets more information.

- European equity futures indicate a firmer open with Euro Stoxx 50 futures up 0.9% after the cash market finished with losses of 1.5% on Monday.

- Looking ahead, highlights include German Industrial Orders, EZ Retail Sales, Canadian Trade Balance Supply from Germany & US, and Earnings from Bayer, Caterpillar, Uber & SuperMicro.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks suffered firm losses on Monday in a continuation of the selling in the aftermath of last Friday's disappointing jobs data amid economic growth and recession fears, while the weakness also followed on from the market turmoil seen in Asia-Pac bourses which rolled over to their global counterparts. However, the major indices on Wall St finished off their worst levels after finding some slight solace from the stronger-than-expected ISM Services report.

- SPX -3.0% at 5,186, NDX -3.0% at 17,895, DJIA -2.6% at 38,703, RUT -3.3% at 2,039

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Daly (voter) said risks to Fed mandates are getting in more balance and minds are open to cutting the rate in coming meetings, while she noted concern is that they will deteriorate from the current place of balance in the jobs report but added that they don't see that right now. Daly said the July jobs report reflected a lot of temporary layoffs and hurricane effect although she noted that if they react to one data point, they would almost always be wrong. Furthermore, Daly said none of the labour market indicators she looks at are flashing red right now but she is monitoring them carefully and said the Fed is prepared to act as it gets more information.

- Fed's SLOOS found a net 7.9% of large and medium banks tightened standards for commercial and industrial loans in Q2 (prev. 15.6% in Q1) and net 0% of large and medium banks reported weaker C&I loan demand in Q2 (prev. 26.6% in Q2).

- Federal Reserve finalised the resolution plan guidance for large, non-globally systemic banks, while the Fed action follows joint guidance approved by the FDIC at the July 30th meeting.

- US Vice President Harris officially won the Democrat presidential nomination.

APAC TRADE

EQUITIES

- APAC stocks were mostly positive as the region rebounded from the recent market turmoil - Nikkei futures saw an upside circuit breaker triggered, while the Korea Exchange activated sidecars for the Kospi and Kosdaq after early surges.

- ASX 200 traded higher albeit within a confined range as participants awaited the latest RBA policy announcement, while the central bank provided no major surprises as it kept rates unchanged and maintained its hawkish tone.

- Nikkei 225 bounced back aggressively following its largest-ever daily point drop and reclaimed the 34,000 status.

- Hang Seng and Shanghai Comp. were somewhat lacklustre with the Hong Kong benchmark gave up initial gains, while the mainland lagged after a substantial daily net liquidity drain.

- US equity futures continued to nurse recent losses as Asian stocks snapped back from the panic selling.

- European equity futures indicate a firmer open with Euro Stoxx 50 futures up 0.9% after the cash market finished with losses of 1.5% on Monday.

FX

- DXY languished beneath the 103.00 level after extending on post-NFP losses yesterday owing to recent economic growth concerns and recession fears, while there were comments from Fed's Daly who stated it is too early to tell if the job market is slowing, or if there's real weakness and that she is more confident they are on a sustainable path to 2%.

- EUR/USD traded sideways after pulling back from a prior attempt to reclaim the 1.1000 status.

- GBP/USD eked mild gains but with upside capped by resistance around the 1.2800 level.

- USD/JPY regained composure following yesterday's market turmoil and briefly reclaimed the 146.00 handle.

- Antipodeans were mixed despite the improvement in risk sentiment although AUD/USD was mildly underpinned following the RBA policy decision where the central bank unsurprisingly kept rates unchanged and maintained a hawkish tone, while it upped its forecast for GDP, CPI and the Unemployment Rate.

- PBoC set USD/CNY mid-point at 7.1318 vs exp. 7.1454 (prev. 7.1345).

FIXED INCOME

- 10-year UST futures retreated after yesterday's choppy performance and firmer-than-expected ISM Services data.

- Bund futures gapped beneath the 135.00 level amid a turnaround in risk sentiment and looming supply.

- 10-year JGB futures continued to fade recent advances as risk sentiment got a shot in the arm after a strong ISM Services report, while the data from Japan was mixed as Household Spending disappointed but Labour Cash Earnings topped forecasts with its fastest pace of increase since 1997. There was also further selling pressure after the 10-year auction which resulted in a lower bid to cover and a significant widening of the tail in price with the lowest tail demand measure since 2003.

COMMODITIES

- Crude futures were underpinned as risk appetite recovered and as geopolitical concerns linger amid fears of an imminent retaliation by Iran on Israel.

- Venezuela's Attorney General is to open a criminal investigation against opposition leaders Machado and Gonzalez.

- Spot gold traded rangebound after recently whipsawing through the USD 2,400/oz level.

- Copper futures were indecisive despite the brightened mood in Asia as its largest buyer China lagged.

CRYPTO

- Bitcoin was firmer and climbed back above the USD 55,000 level amid the improved risk sentiment.

NOTABLE ASIA-PAC HEADLINES

- Japan's Ministry of Finance, FSA and BoJ will hold a meeting today at 07:00BST/02:00EDT to discuss international financial markets, while an official will provide a press briefing after the meeting.

- RBA kept the Cash Rate Target unchanged at 4.35%, as expected, while it reiterated that the Board remains resolute in its determination to return inflation to the target, is not ruling anything in or out, and inflation remains above target which is proving persistent. RBA added that returning inflation to the target is the priority and policy will need to be sufficiently restrictive until the board is confident that inflation is moving sustainably towards the target range. Furthermore, it upped forecasts for GDP, CPI and the Unemployment Rate with forecasts assuming the Cash Rate will be at 4.3% in December 2024, 3.6% in December 2025, and 3.3% in December 2026.

DATA RECAP

- Japanese All Household Spending MM (Jun) 0.1% vs. Exp. 0.2% (Prev. -0.3%)

- Japanese All Household Spending YY (Jun) -1.4% vs. Exp. -0.9% (Prev. -1.8%)

- Japanese Labour Cash Earnings YY (Jun) 4.5% vs Exp. 2.4% (Prev. 2.0%)

GEOPOLITICAL

MIDDLE EAST

- IDF said it killed Jamal al-Din Jawad who is a leader of the Radwan unit of Hezbollah.

- US President Biden's administration informed US lawmakers that Iran’s retaliatory strikes may happen as early as Monday or Tuesday, according to The Washington Post citing sources.

- US President Biden and VP Harris were told by the national security team it is unclear when Iran and Hezbollah are likely to launch an attack against Israel and the specifics of such an attack, according to a US official.

- "Chairman of Iran's National Security and Foreign Policy Committee Describes Haniyeh's Assassination in Tehran as a Declaration of War", according to Sky News Arabia.

- US officials said US President Biden was informed of the expectation of a scenario for two waves of attacks, one of which is from Iran and another from Hezbollah. However, it is unclear to US intelligence who will attack first or the nature of the attack, while intelligence indicates that Iran and Hezbollah have not yet decided what exactly they want to do, according to Axios.

- US Secretary of State Blinken said the Middle East is at a critical moment and all parties must refrain from escalation, while it is critical that they break this cycle by reaching a Gaza ceasefire and parties should not look for a reason to delay or say no.

- US Secretary of State Blinken spoke to his Egyptian counterpart and Qatar’s PM on Middle East tensions, while Blinken delivered a consistent message to refrain from escalation and calm tensions in the Middle East. Furthermore, Egypt's Foreign Minister called on his Blinken to pressure Israel to seriously engage in ceasefire talks in the Gaza Strip.

- White House said the US is working to prevent Iran from attacking Israel.

- Palestinian President Abbas said the killing of Hamas leader Haniyeh intended to prolong the conflict in Gaza, while it was also reported that Abbas is to visit Russia on August 12th-14th, according to RIA.

- Russia has started delivering advanced radars and air-defence equipment to Iran as the country prepares for a possible war with Israel, according to two Iranian officials familiar with the planning cited by NYT.

- Hungarian Foreign Minister called the Israeli Foreign Minister and told him that Iran informed Hungary it is going to attack Israel in response to the assassination of Hamas's political bureau chief, according to Barak Ravid.

- Several US personnel were injured in a rocket attack on a base housing US troops in Iraq, according to three officials cited by Reuters. It was later reported that US Defence Secretary Austin spoke with Israeli Defence Minister Gallant on Monday and they agreed that the Iran-aligned militia attack on US forces stationed in Iraq marked a dangerous escalation.

OTHER

- Explosions were heard in the Ukrainian capital of Kyiv after air raid sirens sounded, according to Reuters.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves said she wants to strengthen and deepen trade ties with the US and noted that the tax burden in the UK is too high, according to an interview with Bloomberg.

- UK Chancellor Reeves left the door open to higher borrowing to tackle the UK ‘fiscal hole’, according to FT.

DATA RECAP

- UK BRC Retail Sales YY (Jul) 0.3% (Prev. -0.5%)

- UK BRC Total Sales YY (Jul) 0.5% (Prev. -0.2%)

- Barclaycard UK Consumer Spending YY (Jul) -0.3% Y/Y (Prev. -0.6%)