US Market Open: Bourses lower across the board, DXY above 103.00, fixed bid; US 30yr due

08 Aug 2024, 11:40 by Newsquawk Desk

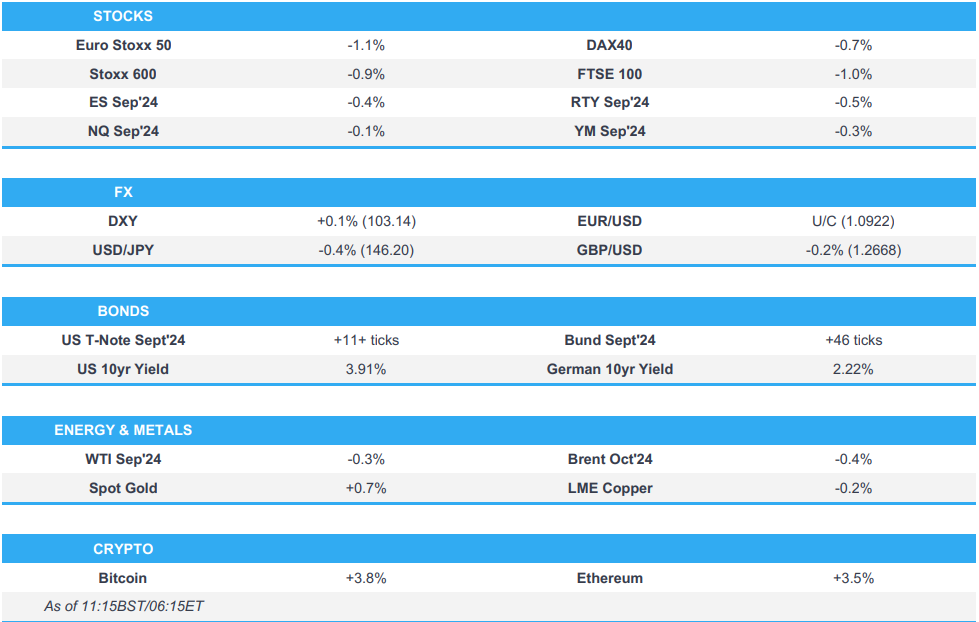

- European bourses are lower across the board, Euro Stoxx 50 -1.2%, as the downbeat sentiment from Wall St. reverberated into APAC trade and continued.

- DXY softer with catalysts light, G10s largely contained though the AUD outperforms after RBA commentary

- Fixed benchmarks bid, but largely rangebound, into data and supply

- Crude consolidates from recent gains while NatGas has pared initial Kursk-driven outperformance, metals mixed

- Looking ahead, highlights include US IJC, Banxico Policy Announcement, Comments from Fed’s Barkin, Supply US, Earnings from Eli Lilly.

- Click for the Newsquawk Week Ahead.

EUROPEAN TRADE

EQUITIES

- European bourses are lower across the board, Euro Stoxx 50 -1.2%, as the downbeat sentiment from Wall St. reverberated into APAC trade and continued.

- Macro newsflow light, earnings driving sectoral differences with Travel & Leisure underpinned by Entain numbers, Telecoms supported by Deutsche Telekom.

- Stateside, US futures are lower across the board but only modestly so with losses shallow than those seen in Europe, ES -0.4% & NQ -0.3%. Ahead, a handful of earnings due.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is softer intraday after mild gains on Wednesday, with a lack of specific catalysts thus far into US data and supply; holding just 103.00.

- JPY unreactive to a Japanese earthquake and tsunami; USD/JPY just above the 146.00 mark and softer on the session with overall action much more contained than that seen recently.

- EUR underpinned by the mentioned soft USD, but only modestly so with specifics light; similar story for Sterling, though Cable has slipped below the 1.2700 mark.

- Antipodeans are firmer, outperformance once again for the AUD after comments from the RBA Governor. Kiwi kept afloat despite softer inflation expectations which have increased the odds of an RBNZ cut next week.

- PBoC set USD/CNY mid-point at 7.1460 vs exp. 7.1821 (prev. 7.1386).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Fixed benchmarks bid, specific drivers light and the action overall well within recent parameters.

- Complex is essentially in a holding pattern ahead of US weekly data and then a 30yr auction which follows the soft 10yr on Wednesday.

- Bunds at the mid-point of c. 50 tick parameters with Gilts in-fitting but in even narrow ranges while USTs are inching toward Wednesday's 113-37 best having pared the late-doors auction-driven downside.

- Click for a detailed summary

COMMODITIES

- Crude is subdued but holds onto the bulk of yesterday's gains, complex is focussed on geopols as we await a Iran/Lebanon retaliatory strike against Israel with potential Hezbollah action also a point of focus.

- WTI Sep trades within a USD 74.78-75.70/bbl range while Brent Oct trades within a USD 77.80-78.70/bbl band.

- Nat Gas benchmarks began with marked gains, bolstered by reports of Ukrainian troops launching an attack on the Kursk, Russia region; however, the situation in Kursk has, according to somewhat mixed Russian reporting, seemingly stabilised a touch and has caused a pullback from best.

- Metals are mixed, precious peers supported by the geopolitical landscape but in narrow ranges while base metals are near-unchanged, though LME Copper attempting to pare some of Wednesday's hefty pressure.

- Russia's Gazprom is continuing shipping gas to Europe via Ukraine, Thursday's volume at 37.3MCM (prev. 39.4MCM on Wednesday and 42.3MCM on Tuesday).

- China's NDRC to cut the retail gasoline and diesel price by CNY 305/T and CNY 290/T respectively as of 8th August.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK RICS House Price Balance (Jul) -19 vs. Exp. -10 (Prev. -17)

GEOPOLITICS

MIDDLE EAST

- Iran’s UN envoy said Tehran’s “priority is to punish the aggressors” responsible for Haniyeh's assassination in Tehran and preventing the repetition of terrorist attacks by Israel. This follows a report that US officials said Iran may be rethinking launching a multi-pronged attack on Israel, while they do anticipate an Iranian response to the Haniyeh killing but think Tehran seems to have recalibrated and the US does not expect an imminent attack.

- Hezbollah reportedly looks increasingly like it may strike Israel independent of whatever Iran may intend to do, according to two sources familiar with the intelligence cited by CNN.

- Israeli officials think the target for Hezbollah's response could be the IDF headquarters in the centre of Tel Aviv or the Mossad headquarters and other key intelligence bases in northern Tel Aviv, according to Axios's Ravid.

- Israel told the US if Hezbollah harms Israeli civilians as part of its retaliation for the assassination of its top military commander, the Israel Defense Force's response would be disproportionate, according to two officials cited by Axios.

- Saudi Deputy Foreign Minister said Haniyeh's assassination is considered a 'blatant violation' of Iran's sovereignty.

OTHER

- Russia's Medvedev said Russia must press on to Odesa, Kharkiv, Dnipro, Mykolaiv, Kyiv, and further, while he added that Russia will stop only when it finds it acceptable and beneficial.

- Russia's Defence Ministry says Russia is thwarting Ukraine attempts to break through deeper into Russia's Kursk region, according to agencies.

CRYPTO

- Bitcoin is firmer on the session and has managed to just about get above the USD 57k handle.

APAC TRADE

- APAC stocks traded mixed after the weak handover from Wall St where the major indices fumbled early gains and finished in the red amid soft earnings and geopolitical risks.

- ASX 200 was dragged lower amid underperformance in the commodity-related stocks including BHP which is reportedly planning to sell Brazilian copper and gold assets it acquired in the takeover of Oz Minerals.

- Nikkei 225 slumped in early trade with losses of as much as 2.5% before briefly staging a full recovery.

- Hang Seng and Shanghai Comp. pared opening losses with the former making its way back towards the psychological 17,000 level, while the mainland also pared early losses but kept within a narrow range amid light catalysts.

NOTABLE ASIA-PAC HEADLINES

- BoJ Summary of Opinions from the July 30th-31st meeting stated one member said they must be mindful of upside risks to inflation and a member said a tight labour market and rise in import prices from a weak yen will likely keep inflation under upward pressure. There was also the opinion that it is appropriate to raise the interest rate given that the economy and prices are moving in line with forecasts and there is a need for vigilance to upside inflation risk. Furthermore, a member said there is no change to the fact that the BoJ is supporting the economy even upon raising rates as a nominal rate of 0.25% is very accommodative, while one member said given the environment surrounding inflation, it is good time to consider small rate hike and a member also said the BoJ should eventually raise rates to levels deemed neutral to economy, which is likely at least around 1%.

- RBA Governor Bullock said they are vigilant to inflation risks and will not hesitate to hike if needed, while she added the board considered a hike on Tuesday and current rates are still deemed to meet the inflation mandate. Bullock said core inflation is not expected to return to the 2–3% target range until the end of 2025 and based on current information, the RBA does not anticipate rates coming down quickly. Furthermore, she said the RBA does not react to individual economic numbers and if the economy declines faster than expected, the RBA would consider cutting rates but sees the need for more evidence to alternate the rate stance.

- RBI kept the Repurchase Rate unchanged at 6.50%, as expected, while it maintained the stance of remaining focused on the withdrawal of accommodation in which 4 out of 6 members voted in favour of the rate decision and policy stance. RBI Governor Das said India's growth remains strong and inflation is broadly on a declining trajectory. Furthermore, Das said they want inflation to progressively align with the target and noted the food component of inflation remains stubborn but added that going forward, the base effect on inflation will wear out.

- Earthquake in Japan's southern region, prelim. magnitude of 6.9 (rev. to 7.1 at 08:57BST), via NHK; Tsunami warning has been issued for Miyazaki and Kochi, then broadened to Kagoshima and Ehime

DATA RECAP

- New Zealand 2yr Inflation Expectations (Q3) 2.0% (Prev. 2.3%); 1yr Inflation Expectations (Q3) Q1 2.4% (Prev. 2.73%)