Europe Market Open: NZD lags after the RBNZ cut, JPY unaffected by Kishida, US CPI ahead

14 Aug 2024, 06:35 by Newsquawk Desk

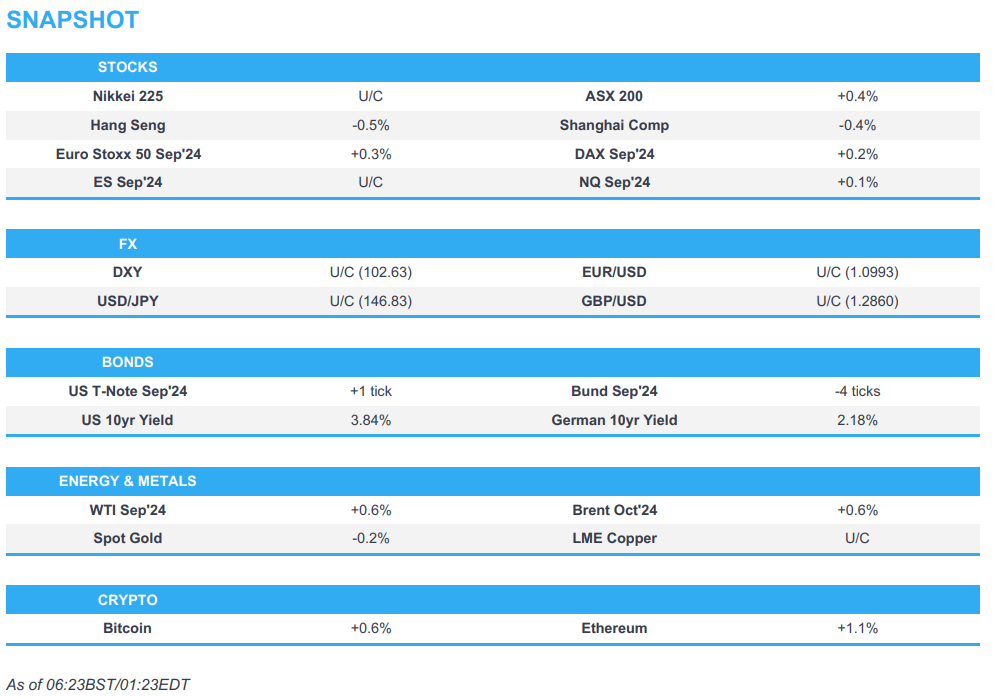

- APAC stocks only partially sustained the momentum from Wall St where risk sentiment was underpinned by softer-than-expected PPI data.

- RBNZ cut the OCR by 25bps to 5.25% (vs. mixed views between a cut and a hold); projections point to a further reduction this year.

- Japanese PM Kishida confirmed he won't run for re-election as LDP leader.

- European equity futures indicate a mildly positive open with the Euro Stoxx 50 future up 0.3% after the cash market finished with gains of 0.5% on Tuesday.

- DXY is steady above 102.50, NZD is the clear laggard post-RBNZ, JPY unfazed by Kishida stepping down.

- Looking ahead, highlights include UK & US CPI, Supply from Germany & France, Earnings from Aviva & Cisco.

US TRADE

EQUITIES

- US stocks were underpinned with broad-based gains seen in the major indices following the cooler-than-expected US PPI data which pressured yields and the dollar, while the tech-heavy Nasdaq 100 (+2.5%) outperformed amid notable strength in Nvidia (+6.5%) and Tesla (+5.3%). As such, Technology and Consumer Discretionary sectors spearheaded the advances although energy lagged and closed in the red after oil prices pulled back as reports suggested Iran's response may be limited.

- SPX +1.7% at 5,434, NDX +2.5% at 19,006, DJIA +1.0% at 39,766, RUT +1.6% at 2,095

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Bostic (voter) said the balance of risks in the economy is getting back to level and he is willing to wait for the first rate cut but it is coming. Bostic said recent inflation data gives him more confidence they can get back to 2% and he wants to see 'a little more' data, while he stated that if the economy evolves as he expects, there would be a rate cut by the end of the year.

APAC TRADE

RBNZ

- RBNZ cut the OCR by 25bps to 5.25% (vs. mixed views between a cut and a hold), while its projections point to a further reduction this year. RBNZ said inflation is declining and is returning to the target band, while it noted that the pace of further easing will depend on the committee's confidence that pricing behaviour remains consistent with a low inflation environment. Members noted that monetary policy will need to remain restrictive for some time to ensure that domestic inflationary pressures continue to dissipate and the pace of further easing will thus be conditional on the committee’s confidence that pricing behaviour is continuing to adapt to a low-inflation environment. Furthermore, the committee agreed there was scope to temper the extent of monetary policy restraint, while it sees the OCR at 4.92% in December 2024 (previously 5.65%), 4.1% in September 2025 (previously 5.4%) and at 3.85% in December 2025 (previously 5.14%).

- RBNZ Governor Orr noted confidence inflation back in its target band can commence re-normalising rates and said they considered a range of moves including 50bps but consensus was for 25bps, while he added that a 25bps rate cut is a relatively low-risk start and it is a reasonable first step for monetary easing with the central bank in a strong position to move calmly.

EQUITIES

- APAC stocks only partially sustained the momentum from Wall St where risk sentiment was underpinned by softer-than-expected PPI data, while the region digested the RBNZ rate cut and PM Kishida's decision to not join the LDP leadership race.

- ASX 200 advanced amid a slew of earnings including from index heavyweight and largest bank CBA.

- Nikkei 225 wiped out initial gains with trade driven by currency moves and after PM Kishida announced to step down.

- Hang Seng and Shanghai Comp. were subdued ahead of key earnings from Alibaba and Tencent, while participants also digested weaker-than-expected Chinese new loans and aggregate financing data.

- US equity futures took a breather after yesterday's PPI-induced advances.

- European equity futures indicate a mildly positive open with the Euro Stoxx 50 future up 0.3% after the cash market finished with gains of 0.5% on Tuesday.

FX

- DXY found some slight reprieve after weakening yesterday on softer PPI data and as participants now await the latest CPI report, while there were comments from Fed's Bostic that the balance of risks in the economy are getting back to level and he is willing to wait for the first rate cut but it is coming.

- EUR/USD held on to the prior day's spoils although further is upside capped by resistance at the 1.1000 level

- GBP/USD plateaued after recent advances and with participants also awaiting the latest UK inflation data.

- USD/JPY swung between gains and losses and traded on both sides of the 147.00 level with pressure seen amid post-RBNZ NZD/JPY selling and news that Japanese PM Kishida will not run for re-election as LDP leader next month.

- Antipodeans wiped out early gains with NZD/USD heavily pressured after the RBNZ cut rates by 25bps and lowered the OCR projections which suggest another cut this year and for rates to decline to 4.10% by September 2025.

- PBoC set USD/CNY mid-point at 7.1415 vs exp. 7.1493 (prev. 7.1479).

FIXED INCOME

- 10-year UST futures took a breather after climbing on the back of softer-than-expected PPI data and with CPI scheduled later.

- Bund futures mildly pulled back beneath the 135.00 level after the prior day's rally and with German supply ahead.

- 10-year JGB futures saw two-way price action and ultimately shrugged off a weaker 5-year JGB auction.

COMMODITIES

- Crude futures nursed some of yesterday's losses amid geopolitical uncertainty and bullish private sector crude inventory data.

- US Private Inventory data (bbls): Crude -5.2mln (exp. -2.2mln), Distillate +0.6mln (exp. -0.6mln), Gasoline -3.7mln (exp. -1.4mln), Cushing -2.3mln.

- Spot gold traded rangebound as participants looked ahead to the incoming US inflation data.

- Copper futures were indecisive with initial support amid the mostly positive risk tone but then faltered as sentiment waned.

- Union at BHP (BHP AT) Escondida mine said management is illegally replacing workers during the strike and said it is willing to hold talks with management to end the strike, while BHP said the union at the Escondida mine declined to restart talks after a new invitation.

CRYPTO

- Bitcoin gradually edged higher and briefly climbed above the USD 61,000 level.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Kishida said it is important to show a new face of the LDP in the leadership race and the first step to do so is for him to step down, while he confirmed he won't run for re-election as LDP leader and will fully support the new leader.

GEOPOLITICAL

MIDDLE EAST

- Israeli media reported a rocket attack from southern Lebanon on Meron in the Upper Galilee with 40 rockets fired from southern Lebanon towards Jabal al-Jarmaq, according to Al Arabiya. Furthermore, Hezbollah announced the targeting of the base of Mount Neria in northern Israel in response to the raid on the town of Barashit in southern Lebanon, according to Sky News Arabia.

- Support is reportedly increasing in Israel for an offensive against Hezbollah, according to WSJ.

- Sources reported an Iran proxy attack on US troops at the Conoco base in eastern Syria with impacts outside its perimeter, while a US official said projectiles aimed in the direction of the US base in Syria did not impact the base and the attack was unsuccessful.

- Iranian officials said only a Gaza ceasefire could delay Iran's response towards Israel, according to Reuters citing sources.

- Iran is reportedly planning to resume testing nuclear bomb detonators and is actively working on the development of its clandestine nuclear weapons program, getting closer than ever to building a nuclear bomb, according to Iran International.

- US President Biden responded "that's my expectation" when asked if he expected Iran to skip a retaliatory strike if a Gaza ceasefire deal was reached.

- US Secretary of State Blinken has postponed his trip to the Middle East and won't travel to the region on Tuesday due to the uncertainty about the situation, according to Axios citing sources. Furthermore, US officials also told Axios they did not expect an Iranian attack on Tuesday.

- White House official said national security officials McGurk and Hochstein will travel to the Middle East to work on a ceasefire deal and to de-escalate tensions.

- Pentagon said it continues to focus on securing a ceasefire in Gaza as part of the hostage deal, while it was noted that it has increased military capabilities to defend Israel but is working to reduce tension.

- Pentagon said the US State Department approved a possible foreign military sale to Israel of F-15IA and F-15I+ aircraft for USD 18.82bln, while it approved the potential sale of the advanced medium-range air-to-air missiles to Israel for an estimated USD 102.5mln.

OTHER

- Russia's border region of Belgorod declares regional emergency because of attacks by Ukrainian forces, according to the regional governor.

- Ukrainian President Zelenskiy said Ukraine controls 74 settlements in Russia's Kursk region and Kyiv's forces advanced 1-3kms inside Russia in the last 24 hours, while it was noted that forces took over 40 square kilometres of new Russian territory.

- Ukraine plans to hold its first follow-up international conference after the peace summit online in August in which the conference is to focus on energy security, according to the presidential office.

- US State Department said the US is not engaged in any aspect, planning or preparation of Ukraine's incursion into Russia. It was separately reported that a US official said the objective of Ukraine's Kursk invasion appears to be to force Russia to pull troops out of Ukraine to defend Russian territory against this invasion.

- IAEA said evidence continues to indicate that the fire at the Russia-controlled Zaporizhzhia nuclear plant in Ukraine did not start at the base of the cooling tower and no foreign objects were visible in the tower, while it added the impact of the fire on the structural integrity of the cooling tower needs to be assessed and there may be a need to dismantle it.