US Market Open: US equity futures trade tentatively & DXY below 102.50 ahead of US CPI, Kiwi underperforms post-RBNZ

14 Aug 2024, 11:22 by Newsquawk Desk

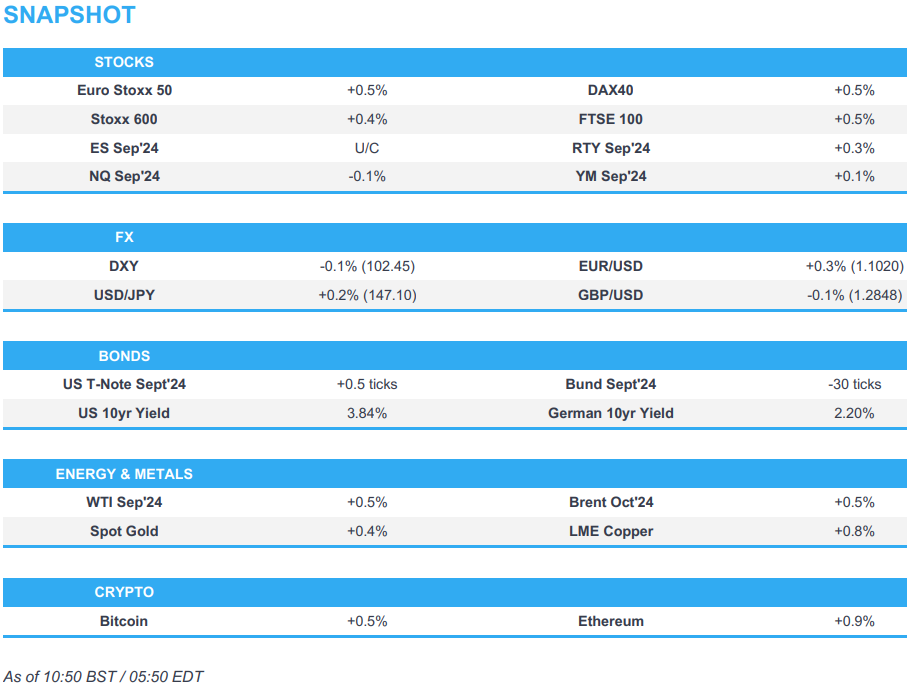

- European equities are entirely in the green, US futures are mixed with price action tentative ahead of today’s US inflation report

- DXY is mixed, EUR climbs above 1.10, Kiwi is the clear underperformer after the RBNZ cut by 25bps, with projections pointing towards further easing

- USTs are essentially unchanged, Gilts benefit from softer-than-expected inflation metrics, with particular focus on the Services component

- Crude is incrementally firmer, XAU gains and base metals are mixed

- Looking ahead, US CPI and Earnings from Cisco

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.4%) are entirely in the green, continuing the optimism seen on Wall St in the prior session.

- European sectors hold a strong positive bias; Travel & Leisure takes the top spot, propped up by significant post-earning gains in Flutter. Financial Services is also towards the top of the pile, after UBS reported strong Q2 earnings. Basic Resources lags given the weakness in the metals complex.

- Futures are mixed, and price action has been rangebound ahead of today’s key risk event, US CPI.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is mixed vs peers with the DXY slipping below 102.50 in the run up to US CPI data. Fed pricing currently prices in circa 37bps of loosening for next month's meeting with a total of 106bps of cuts priced by year-end.

- EUR/USD is back on a 1.10 handle and eclipsing the 1.1008 peak printed on 5th August. In terms of levels to the upside, the YTD peak from Jan 2nd kicks in at 1.1038.

- GBP is on the backfoot following softer-than-expected inflation metrics. The decline in services inflation will be welcomed by the MPC. Pricing for the September BoE meeting has moved in a dovish direction with a cut now seen at 42% vs. circa 36% pre-release. Cable maintains the 1.28 handle.

- JPY is losing ground to the USD with the main macro update coming via PM Kishida's decision to step down. Overall, the pair is tucked within yesterday's 145.43-147.94 range with today's CPI release likely to offer the next inflection point.

- NZD is the laggard across the majors as the RBNZ delivered a 25bps cut (Governor Orr even suggested that 50bps was discussed), with market expectations mixed between a cut and a hold heading into the event. AUD/USD also pressured but to a lesser extent alongside downside in iron ore prices.

- PBoC set USD/CNY mid-point at 7.1415 vs exp. 7.1493 (prev. 7.1479).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are unchanged ahead of US CPI. The 113-22 peak printed alongside the release of UK CPI before the benchmark then eased a touch, alongside EGBs, to the 113-19 mark where it remains.

- Gilts are the relative outperformer, though off 100.57 best by around 20 ticks as fixed benchmarks generally ease a touch. Outperformance which was driven by the latest UK inflation data, which saw the headline pick-up by less than forecast and crucially the Services metric come in markedly cooler than expected.

- Bunds drift lower. In the morning it experienced two-way action on UK CPI, but ultimately dipped below the 135.00 mark and then slipped further on a modest upward revision to French Final CPI.

- France sells EUR 9bln vs exp. EUR 7.5-9bln 0.00% 2027, 2.75% 2029, 2.75% 2030, 0.00% 2031 OAT.

- Germany sell EUR 0.803bln vs exp. EUR 1bln 2.50% 2054 Bund & EUR 0.798mln vs exp. 1bln 0.00% 2050 Bund.

- Click for a detailed summary

COMMODITIES

- Crude gains thus far following yesterday’s lower settlement, following reports Iran's attack may be limited and potentially delayed contingent on the Gaza ceasefire talks slated for tomorrow. Brent Oct sits in a 80.89-81.40/bbl range after dipping back under USD 82/bbl.

- Firmer trade in the precious metals space despite a relatively steady Dollar, but amidst heightened geopolitics after Russia said issues regarding Ukrainian peace talks have been put on a long pause, meanwhile, sources suggested Hamas will not attend tomorrow's ceasefire discussions in Doha.

- Mixed trade across base metals awaiting US inflation data, with a performance contract seen between Western and Eastern futures. Dalian and SGX iron ore overnight fell to the lowest in over a year.

- US Private Inventory data (bbls): Crude -5.2mln (exp. -2.2mln), Distillate +0.6mln (exp. -0.6mln), Gasoline -3.7mln (exp. -1.4mln), Cushing -2.3mln.

- Union at BHP (BHP AT) Escondida mine said management is illegally replacing workers during the strike and said it is willing to hold talks with management to end the strike, while BHP said the union at the Escondida mine declined to restart talks after a new invitation.

- Russia extends ban on gasoline exports until end of 2024, via Interfax.

- India's July Gold imports at USD 3.13bln (prev. 3.06bln M/M)

- Click for a detailed summary

RBNZ

- RBNZ cut the OCR by 25bps to 5.25% (vs. mixed views between a cut and a hold), while its projections point to a further reduction this year. RBNZ said inflation is declining and is returning to the target band, while it noted that the pace of further easing will depend on the committee's confidence that pricing behaviour remains consistent with a low inflation environment. Members noted that monetary policy will need to remain restrictive for some time to ensure that domestic inflationary pressures continue to dissipate and the pace of further easing will thus be conditional on the committee’s confidence that pricing behaviour is continuing to adapt to a low-inflation environment. Furthermore, the committee agreed there was scope to temper the extent of monetary policy restraint, while it sees the OCR at 4.92% in December 2024 (previously 5.65%), 4.1% in September 2025 (previously 5.4%) and at 3.85% in December 2025 (previously 5.14%).

- RBNZ Governor Orr noted confidence inflation back in its target band can commence re-normalising rates and said they considered a range of moves including 50bps but consensus was for 25bps, while he added that a 25bps rate cut is a relatively low-risk start and it is a reasonable first step for monetary easing with the central bank in a strong position to move calmly.

NOTABLE DATA RECAP

- UK CPI YY (Jul) 2.2% vs. Exp. 2.3% (Prev. 2.0%); Services YY 5.2% vs. Exp. 5.5% (Prev. 5.7%); Core YY 3.3% vs. Exp. 3.4% (Prev. 3.5%)

- UK CPI MM (Jul) -0.2% vs. Exp. -0.1% (Prev. 0.1%); Services MM 0.5% vs. Exp. 0.8% (Prev. 0.6%); Core MM 0.1% vs. Exp. 0.2% (Prev. 0.2%)

- Swedish CPIF YY (Jul) 1.7% vs. Exp. 1.6% (Prev. 1.3%); Ex Energy YY (Jul) 2.2% vs. Exp. 2.0% (Prev. 2.3%)

- EU Employment Flash YY (Q2) 0.8% vs. Exp. 1.0% (Prev. 1.0%); Employment Flash QQ (Q2) 0.2% vs. Exp. 0.2% (Prev. 0.3%)

- EU GDP Flash Estimate YY (Q2) 0.6% vs. Exp. 0.6% (Prev. 0.6%); Flash Estimate QQ (Q2) 0.3% vs. Exp. 0.3% (Prev. 0.3%)

- French CPI (EU Norm) Final MM (Jul) 0.2% vs. Exp. 0.2% (Prev. 0.2%)

GEOPOLITICS

MIDDLE EAST

- "Hamas will not participate in Doha's ceasefire talks tomorrow, according to a senior official in the Palestinian factions, who was cited by Al-Mayadeen", according to Walla's Elster

- Israeli media reported a rocket attack from southern Lebanon on Meron in the Upper Galilee with 40 rockets fired from southern Lebanon towards Jabal al-Jarmaq, according to Al Arabiya. Furthermore, Hezbollah announced the targeting of the base of Mount Neria in northern Israel in response to the raid on the town of Barashit in southern Lebanon, according to Sky News Arabia.

- Support is reportedly increasing in Israel for an offensive against Hezbollah, according to WSJ.

- Sources reported an Iran proxy attack on US troops at the Conoco base in eastern Syria with impacts outside its perimeter, while a US official said projectiles aimed in the direction of the US base in Syria did not impact the base and the attack was unsuccessful.

- Iran is reportedly planning to resume testing nuclear bomb detonators and is actively working on the development of its clandestine nuclear weapons program, getting closer than ever to building a nuclear bomb, according to Iran International.

OTHER

- Russia's border region of Belgorod declares regional emergency because of attacks by Ukrainian forces, according to the regional governor.

- Ukraine plans to hold its first follow-up international conference after the peace summit online in August in which the conference is to focus on energy security, according to the presidential office.

- It was separately reported that a US official said the objective of Ukraine's Kursk invasion appears to be to force Russia to pull troops out of Ukraine to defend Russian territory against this invasion.

- IAEA said evidence continues to indicate that the fire at the Russia-controlled Zaporizhzhia nuclear plant in Ukraine did not start at the base of the cooling tower and no foreign objects were visible in the tower, while it added the impact of the fire on the structural integrity of the cooling tower needs to be assessed and there may be a need to dismantle it.

CRYPTO

- Bitcoin continues to edge higher and now back above USD 60k.

APAC TRADE

- APAC stocks only partially sustained the momentum from Wall St where risk sentiment was underpinned by softer-than-expected PPI data, while the region digested the RBNZ rate cut and PM Kishida's decision to not join the LDP leadership race.

- ASX 200 advanced amid a slew of earnings including from index heavyweight and largest bank CBA.

- Nikkei 225 wiped out initial gains with trade driven by currency moves and after PM Kishida announced to step down.

- Hang Seng and Shanghai Comp. were subdued ahead of key earnings from Alibaba and Tencent, while participants also digested weaker-than-expected Chinese new loans and aggregate financing data.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Kishida said it is important to show a new face of the LDP in the leadership race and the first step to do so is for him to step down, while he confirmed he won't run for re-election as LDP leader and will fully support the new leader.

- Hon Hai/Foxconn (2317 TT) Q2 (TWD) Net Income 35bln (exp. 34.5bln). EPS 2.53 (exp. 2.56). Operating Profit 44.6bln (exp. 41.06bln); expects Q3 and 2024 revenue to grow significantly Y/Y.

- Foxconn (2317 TT) says visibility in FY business is better than in May; strong demand for AI server will continue. Business is to grow in Q4 Y/Y. Wil start delivery for Nvidia's (NVDA) GB200 in Q4 in small volumes and further increase deliveries in Q1. AI server business will grow Q/Q this year and could beat Co's own expectations. Co.'s leading position in AI servers will not be challenged easily due to production capacity and technology. Talks with potential EV customers in Japan are on track.

- Tencent (700 HK): Q2 (CNY) Revenue 161.12bln (exp. 161.35bln), Adj. Net 57.31bln (exp. 48.67bln), Domestic Games Revenue 34.6bln (exp. 33.6bln), International Games Revenue 13.9bln (exp. 14.14bln). As of June 30th, combined MAU of Weixin and WeChat at 1.371bln. Did not declare dividend for 6-month period. Will continue to invest in AI.