Europe Market Open: Softer trade in tight ranges ahead of NVDA, geopols remain in focus

28 Aug 2024, 06:25 by Newsquawk Desk

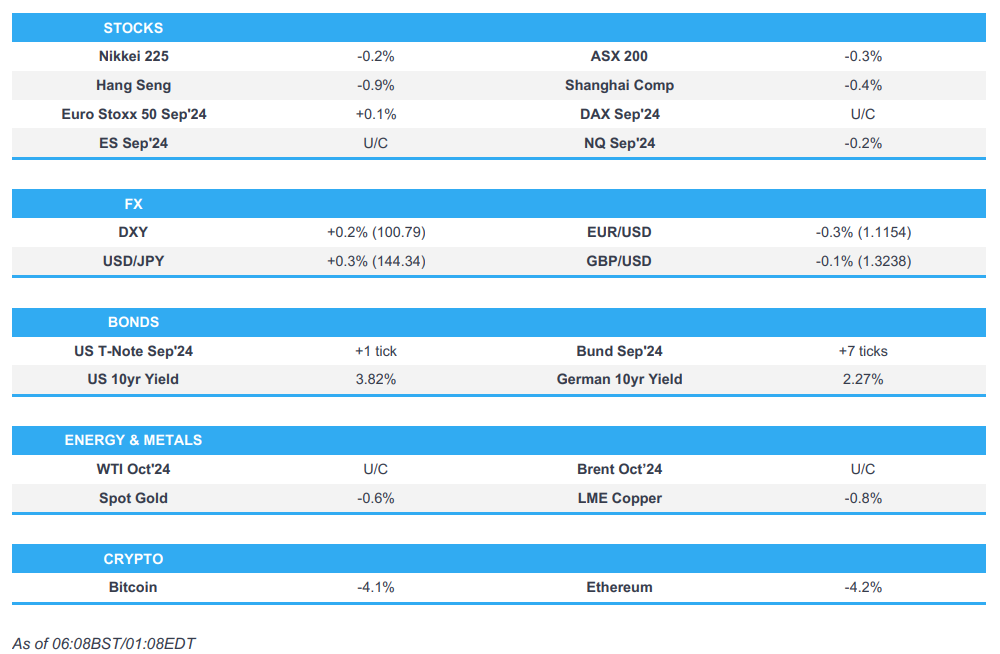

- APAC stocks traded subdued but mostly within tight ranges following a mixed lead on Wall Street ahead of NVIDIA earnings.

- DXY ticked higher during the back end of the APAC session, USD/JPY gradually rose, AUD/USD saw upside on hotter-than-expected Aussie CPI.

- The Israeli army launched a large-scale operation against militants in various parts of the northern West Bank; the operation is expected to last days.

- European equity futures are indicative of a flat open with the Euro Stoxx 50 future unchanged after the cash market closed unchanged on Tuesday.

- Looking ahead, highlights include DoEs, Fed's Bostic, Supply from the UK and US, and earnings from NVIDIA, Salesforce, and CrowdStrike.

US TRADE

EQUITIES

- US stocks were mixed on Tuesday with clear underperformance in the small-cap Russell 2000 in what was a day of thin newsflow as participants await tech behemoth NVIDIA's earnings on Wednesday after-hours.

- SPX +0.16% at 5,626, NDX +0.33% at 19,582, DJIA flat at 41,251, RUT -0.67% at 2,203

- Click here for a detailed summary.

NOTABLE HEADLINES

- US voters prefer Trump's approach to the economy over Harris' 43% to 40%, down from an 11-point July lead - Reuters/Ipsos poll.

- US Democratic Presidential Candidate Harris and her VP candidate Waltz will be interviewed on CNN this week Thursday, according to Reuters.

- Fed Discount Rate Meeting Minutes: Chicago and NY directors favoured a cut.

- Apple (AAPL) cuts about 100 services jobs as part of priority shift, according to Bloomberg.

APAC TRADE

EQUITIES

- APAC stocks traded subdued but mostly within tight ranges following a mixed lead on Wall Street, whilst volume in APAC remained low amid thin summer trade.

- ASX 200 was pressured by Telecoms and Energy, whilst the hotter-than-expected Aussie CPI sent the index lower, albeit briefly.

- Nikkei 225 was hindered by the recent upside in the JPY, although price action was contained to tight ranges. Losses lead by Banks and Miners. No notable reaction was seen to BoJ Deputy Governor Himino who noted financial and capital markets remain unstable and the BoJ needs to monitor their developments with the utmost vigilance.

- Hang Seng and Shanghai Comp initially traded in tight ranges but the Hang Seng later extended on losses with Hong Kong seeing its earnings pick up in pace - Meituan and BYD traded lower ahead of earnings.

- US equity futures saw sideways trade around the flat mark following yesterday's mixed performance and with the tone tentative ahead of NVIDIA numbers.

- European equity futures are indicative of a contained open with the Euro Stoxx 50 future +0.1% after cash closed unchanged on Tuesday.

FX

- DXY gradually ticked higher during the back end of the APAC session in an attempt to nurse some of the prior day's losses, but remained within a narrow 100.59-77 range (vs yesterday's 100.51-93 parameter).

- EUR/USD waned in tandem with the upticks in the Dollar index, with EUR/USD within 1.1159-85 confines. In terms of notable levels, 1.1150 marks the lows on Monday and Tuesday and could provide some support, whilst the weekly peak currently stands at 1.1201.

- GBP/USD saw uneventful trade and meandered around within 1.3250-60 for most of the session before dipping under the half-round figure, but the pair held onto a bulk of the prior day's gains in which it printed a 1.3177-1.3266 range and closed at 1.3255.

- USD/JPY inched higher as the JPY gradually pared back some of the prior day’s strength, whilst little notable reaction was seen to BoJ Deputy Governor Himino who suggested financial and capital markets remain unstable and urged utmost vigilance.

- Antipodeans saw a divergence after Aussie inflation failed to cool as much as expected, sparking modest upside in the Aussie currency and in turn taking AUD/NZD back above 1.0900 briefly (from a 1.0865 low).

- PBoC set USD/CNY mid-point at 7.1216 vs exp. 7.1210 (prev. 7.1249)

FIXED INCOME

- 10yr UST futures saw uneventful APAC trade following a mixed Wall Street session whilst the 2-year auction was strong, but not as strong as the July offering - with little reaction seen in response. Traders look ahead to the 2-year FRN and 5-year Note auctions later.

- Bund futures saw a choppy session but within narrow ranges with macro newsflow light, although some downticks were seen at the time the hotter-than-expected Aussie CPI was released.

- 10yr JGB futures experienced little action amid the summer lull with JGBs unfazed by commentary from BoJ Deputy Governor Himino.

- US sells USD 69bln of 2yr notes; stop-through 0.6bps. High Yield: 3.874% (prev. 4.434%, six-auction average 4.707%). WI: 3.880%. Tail: -0.6bps (prev. -2.3bps, six-auction avg. -0.2bps). Bid-to-Cover: 2.86x (prev. 2.81x, six-auction avg. 2.62x). Dealers: 11.9% (prev. 9.0%, six-auction avg. 13.7%). Directs: 19.1% (prev. 14.4%, six-auction avg. 20.1%). Indirects: 69% (prev. 76.6%, six-auction avg. 66.2%).

COMMODITIES

- Crude futures consolidated after the prior day's losses. Little reaction was seen on reports of a large-scale Israeli operation in the West Bank, which is likely to keep tensions high in the Middle East. Before that, modest upticks were seen on the larger-than-expected draw in Private Inventories.

- Spot gold waned throughout the session in tandem with the gains in the Dollar, but the yellow metal remained within yesterday's range.

- Copper futures were subdued and reflective of the APAC tone, with the upside also capped by the firmer Dollar.

- US Private Inventory Data (bbls): Crude -3.4mln (exp. -2.3mln), Distillate -1.4mln (exp. -1.1mln), Gasoline -1.9mln (exp. -1.6mln), Cushing -0.5mln.

- One global aluminium producer reportedly seeks USD 185/t premium in talks, +8% from current quarter, according to Reuters sources.

CRYPTO

- Bitcoin was pressured amid the broader downbeat sentiment across crypto, with prices falling to levels just above USD 58k from around USD 62k at the start of the session before partially recovering.

NOTABLE ASIA-PAC HEADLINES

- BoJ Deputy Governor Himino said financial and capital markets remain unstable, and BoJ needs to monitor their developments with the utmost vigilance. He added the BoJ will adjust the degree of monetary accommodation if it has growing confidence that its outlook for economic activity and prices will be realized, and the central bank needs to closely monitor developments in recent market volatilities including weaker stocks and stronger JPY.

- Alibaba (BABA/ 9988 HK) converted its secondary listing on the Hong Kong Exchange into a primary listing; says the Co. is now a dual primary listed firm on the NYSE and HKEX.

- PBoC injected CNY 277.3bln via 7-day Reverse Repo at a maintained rate of 1.70%

DATA RECAP

- Australian Weighted CPI YY (Jul) 3.5% vs. Exp. 3.4% (Prev. 3.8%)

- Australian CPI SA YY (Jul) 3.60% (Prev. 3.90%, Rev. 3.80%)

- Australian CPI SA MM (Jul) 0.00% (Prev. 0.40%, Rev. 0.30%)

- Australian Construction Work Done (Q2) 0.1% vs. Exp. 0.7% (Prev. -2.9%)

GEOPOLITICS

MIDDLE EAST

- The Israeli army launched a large-scale operation against militants in various parts of the northern West Bank, according to Al Jazeera citing Israel Channel 14.

- "Hundreds of Israeli soldiers take part in the operation in the northern West Bank with full air cover", according to Sky News Arabia.

- Israeli operation in the West Bank is expected to last for days, according to Israel Channel 14. Sky News Arabia suggested "Israeli operation in Tulkarm and Jenin [in West Bank] is expected to last for a long time, up to weeks", according to Sky News Arabia.

- "Israel's Channel 14: The army mobilized thousands of soldiers from special units in preparation for the large-scale operation in the northern West Bank", according to Al Jazeera.

- "Israeli army storms Aida camp in the southern West Bank", according to Al Arabiya.

- An Israeli delegation from the Mossad, the IDF and the Shin Bet will travel to Doha on Wednesday to continue talks with US, Qatari and Egyptian officials to close the remaining gaps in the Gaza hostage and ceasefire deal, via Axios' Ravid.

- White House's Kirby said he believes Iran is "postured and poised" to launch an attack on Israel. Messaging to Iran has been "Don't do it. There is no reason to potentially start some of the regional war". The US will defend Israel in the event of an Iranian attack. Still hopeful on Gaza ceasefire talks since all parties remain engaged.

RUSSIA-UKRAINE

- Several oil tanks reportedly on fire at Glubokinskaya oil depot after Ukraine's drone attack in Russia's Rostov region, according to Reuters citing Telegram reports.

EU/UK

NOTABLE HEADLINES

- Italian premier Meloni is reportedly looking to fill a EUR 12bln budget hole with measures such as cost cuts and delayed retirement, according to Bloomberg citing sources. Finance Minister Giorgetti has until Sept. 20 to deliver a fiscal plan to Brussels.

- Italy is to approve its updated fiscal plan by mid-September, according to The Treasury.

DATA RECAP

LATAM

- Brazil's Finance Minister Haddad said the 2025 budget proposal to be sent to Congress will include suggestions from the private sector. Haddad also said a new central bank head to be picked by September, according to Reuters.

GLOBAL

- IDC sees worldwide smartphone shipments growing 5.8% Y/Y in 2024 to 1.23bln units. "The 12% growth in the first quarter, followed by 9% growth last quarter, has brought improved optimism about how 2024 will play out in the second half of the year."