US Market Open: NVDA -1.8% pre-market, USD gains & EUR hampered by German State CPIs

29 Aug 2024, 11:10 by Newsquawk Desk

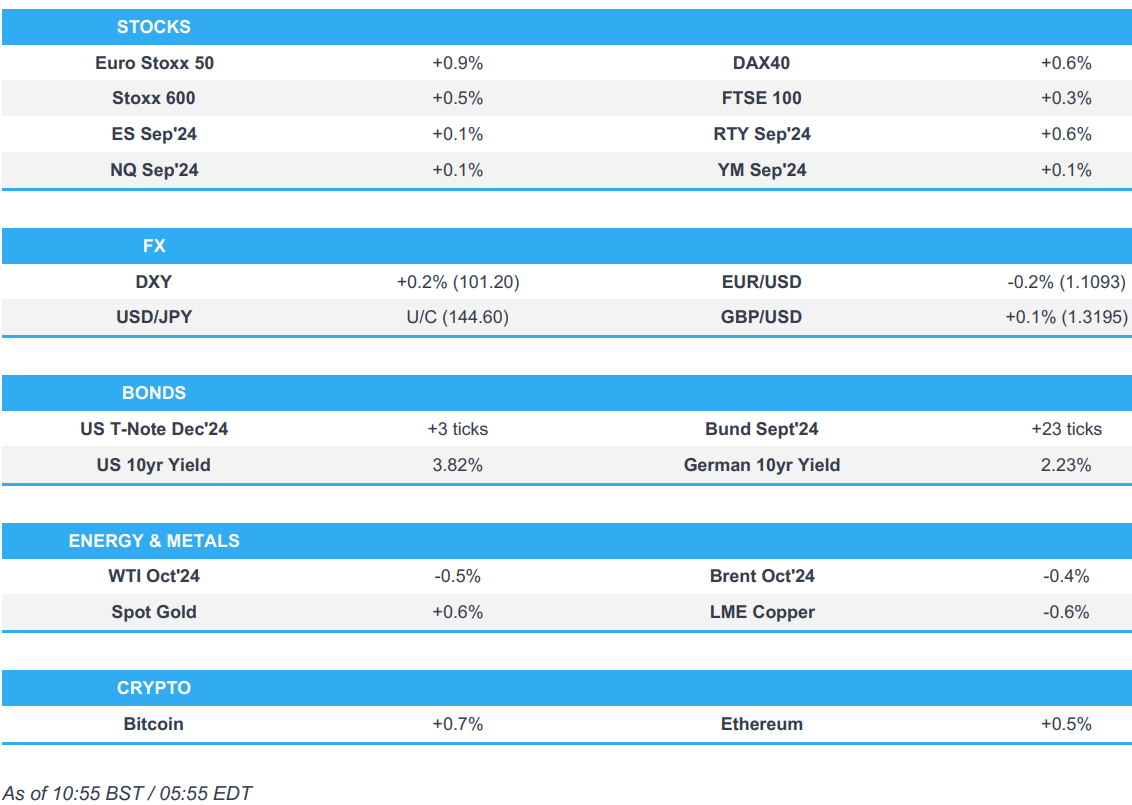

- European bourses edge higher with Tech leading; US futures are slightly higher, NVDA -1.5% pre-market vs -4.9% after-hours

- Dollar is firmer, Antipodeans outperform given the risk-tone whilst EUR is hampered post-German State CPIs

- Bonds have been lifted after the cool German State CPIs vs mainland expectations

- Crude is lower and near session lows, XAU gains whilst base metals are broadly lower

- Looking ahead, US PCE (Q2), GDP (Q2), IJC, Fed’s Bostic, Supply from the US, and Earnings from Lulelemon, Dollar General, Best Buy, Marvell

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.5%) began the session with a modest upward bias. As the session progressed, indices continued to edge higher, but most notably in the Euro Stoxx 50 (+0.9%) and AEX (+0.9%), with Tech leading, despite NVIDIA (-2.8% pre-market) slipping post-earnings (albeit. metrics were strong).

- European sectors hold a strong positive bias. Tech is the clear outperformer, propped up by gains in the ASM International (+2.4%) and ASML (+2%), benefiting from strong NVIDIA results, despite the Co. itself being down by around 2.8% in the pre-market.

- Alcohol names shot higher following an announcement that China's Commerce Ministry will not impose provisional anti-dumping subsidy on brandy imported from the EU; Pernod Ricard (+4.5%) / Remy Cointreau (+7.6%).

- US Equity Futures (ES +0.1%, NQ +0.1% RTY +0.6%) are flat/mixed, with very slight outperformance in the RTY, whilst the NQ fails to find a firm direction, following NVIDIA’s results on Wednesday.

- NVIDIA Corp (NVDA) Q2 2025 (USD): Adj. EPS 0.68 (exp. 0.64), Revenue 30.04bln (exp. 28.68bln); approved an additional USD 50bln in share buyback and maintained quarterly dividend at 0.01/shr. Some analysts cited expected increases in shipments of the current Hopper gen of chips over the next couple of quarters, while others remain unimpressed by the company’s expected growth rate, which is cooling from lofty levels; some noted that the growth projections did not exceed the most optimistic views of the street, while others noted that its margins were up Y/Y, but cooled vs Q1.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is extending the upside seen on Wednesday's session after basing out at 100.51 on Tuesday. DXY has printed a 101.36 peak with the pre-Powell high at 101.55 coming into view.

- EUR/USD is pressured and back on a 1.10 handle after regional German CPI metrics came in softer than suggested by expectations for the mainland data. German CPI due at 13:00BST ahead of the EZ-wide data on Friday.

- GBP is flat vs. the USD with UK-specific updates once again on the light side. Cable has returned to a 1.31 handle after printing a fresh YTD peak earlier in the week at 1.3266.

- USD/JPY is flat in quiet newsflow and opting to consolidate on a 144.00 handle and within yesterday's 143.69-145.04 range.

- NZD is the best performer across the majors after ANZ data showed NZ business confidence soaring. AUD is also firmer vs. the USD but to a lesser extent due to pressure in the AUD/NZD cross, though AUD/USD is within reach of the YTD peak.

- PBoC set USD/CNY mid-point at 7.1299 vs exp. 7.1297 (prev. 7.1216)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Bunds was initially subdued going into the German State CPI; thereafter, a marked rally was seen following the particularly cool release. Metrics which skew the mainland expectations to the downside and have resulted in a few additional bps of easing being priced for the ECB by end-2024. The data caused Bunds to pare downside of c. 15 ticks, climb back above the 134.00 mark.

- USTs are benefitting from the EGB move but to a much lesser extent as the region awaits Friday's key monthly PCE metrics (Q2 figures, 2nd GDP read and 7yr supply due today). USTs at the top-end of 114-00+ to 114-07 parameters and just shy of Wednesday's 114-09 best.

- Gilts rallied in tandem with EGBs, no UK specific drivers thus far with commentary continuing to focus on/look ahead to the October fiscal statement. Gilts incrementally topped 99.00, but have since fallen below that level.

- Italy sells EUR 7.75bln vs exp. EUR 6.75-7.75bln 3.00% 2029, 3.85% 2035 BTP & EUR 1.5bln vs exp. 1-1.5bln 2032 CCTeu.

- Click for a detailed summary

COMMODITIES

- Crude is slightly softer, but with specifics light and the complex essentially in a holding pattern until there is an update to the geopolitical and/or Libya front. Brent'Oct currently near session lows at around USD 78.30/bbl, weighed on by EUR-driven USD strength.

- Spot gold is firmer and relatively unreactive to the referenced uptick in the USD as pressure in yields globally are serving as a countering impulse for the yellow metal. At the top-end of a relatively wide USD 2503-2521/oz band.

- Base metals are broadly on the backfoot, largely in continuation of the broader negative sentiment seen in APAC trade overnight.

- South32 (S32 AT) expects to see improvement in aluminium prices on USD weakness and China buying, according to Reuters.

- Russian gov't has announced that fuel and oil production numbers are to be a state secret, via KyivPost.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Bavaria State CPI MM (Aug) -0.1% (Prev. 0.3%); CPI YY (Aug) 2.1% (Prev. 2.5%); the regional metrics were generally cooler than prior/mainland implied set of data, pressuring EUR & rallying EGBs. Mainland figures due at 13:00 BST / 08:00 EDT.

- German North Rhine-Westphalia State CPI YY (Aug) 1.7% (Prev. 2.3%); Core 2.5% (prev. 2.8%); MM (Aug) -0.1% (Prev. 0.3%)

- EU Business Climate (Aug) -0.62 (Prev. -0.61); Cons Infl Expec (Aug) 11.3 (Prev. 11.2); Selling Price Expec (Aug) 6.1 (Prev. 6.8); Services Sentiment (Aug) 6.3 vs. Exp. 5.2 (Prev. 4.8); Economic Sentiment (Aug) 96.6 vs. Exp. 95.8 (Prev. 95.8); Industrial Sentiment (Aug) -9.7 vs. Exp. -10.6 (Prev. -10.5); Consumer Confid. Final (Aug) -13.5 vs. Exp. -13.4 (Prev. -13.4)

- Spanish CPI YY Flash NSA (Aug) 2.2% vs. Exp. 2.40% (Prev. 2.80%); Core 2.7% vs Exp. 2.6% (prev. 2.8%)

- Swedish GDP Final QQ (Q2) -0.3% vs. Exp. -0.8% (Prev. -0.8%); GDP Final YY (Q2) 0.5% vs Exp. 0.0% (prev. 0.0%)

- Swedish Overall Sentiment (Aug) 94.7 (Prev. 95.0)

NOTABLE EUROPEAN HEADLINES

- Riksbank's Bunge foresees two or three further rate cuts this year, monetary policy should still be characterised by a gradual adjustment.

- China's Commerce Ministry says it will not impose provisional anti-dumping subsidy on brandy imported from the EU.

NOTABLE US HEADLINES

- NVIDIA Corp (NVDA) Q2 2025 (USD): Adj. EPS 0.68 (exp. 0.64), Revenue 30.04bln (exp. 28.68bln); approved an additional USD 50bln in share buyback and maintained quarterly dividend at 0.01/shr. Revenue Breakdown: Data centre 26.3bln (exp. 25.08bln). Professional Visualization 454mln (exp. 451.1mln). Automotive 346mln (exp. 347.9mln). Gaming 2.9bln (exp. 2.79bln). Full earnings available here. EARNINGS CALL: Q2 gross margins negatively impacted by inventory provisions for low-yielding Blackwell material and may continue to be impacted in future. Notable commentary available here. Shares fell 6.9% after-hours; desks suggest disappointment amid a lack of a "mega-beat".

- Salesforce Inc (CRM) Q2 2024 (USD): Adj. EPS 2.56 (exp. 2.36), Revenue 9.33bln (exp. 9.23bln); President and CFO Amy Weaver to step down. Shares rose 4.1% after-market.

- Apple (AAPL) reportedly orders over 10% more of its first AI-equipped iPhones vs last year, according to Nikkei sources; told suppliers to prepare for 88-90mln iPhones (vs initial order for ~80mln iPhones).

- Fed's Bostic (2024 voter) said there is still a distance to go on inflation, while the labour market is quite strong by historical standards, according to Reuters. He repeated that he is still awaiting data to be sure it's time to cut rates. He noted inflation has come down faster than expected, unemployment has risen further than he thought. He noted the Fed can not wait till inflation is at 2% to move away from a restrictive stance - "This means we should pull forward rate cut to 3rd quarter". He warned it would not be good to cut rates only to have to raise them again.

- Alphabet's (GOOG) Google is reportedly considering constructing a hyperscale data centre within southern, Vietnam, via Reuters citing sources.

- US official anticipates holding another round of talks on AI with China at some point.

GEOPOLITICS

- No notable geopolitical updates.

CRYPTO

- Bitcoin is slightly firmer and rests above USD 59k, whilst Ethereum climbs above USD 2.5k.

APAC TRADE

- APAC stocks traded mostly with modest losses following the weak lead from Wall Street and in the aftermath of NVIDIA's ill-received earnings. The tech sector was among the laggards in the region with Samsung Electronics (005930 KS), Tokyo Electron (8035 JT), and TSMC (2330 TT) all opening lower by 2-3%.

- ASX 200 was subdued amid the broader market mood and with Australia's earnings season picking up in pace. Materials, Energy and Tech resided as some of the lagging sectors.

- Nikkei 225 briefly dipped under USD 38k in early trade, with Japanese activity also affected by the approaching Typhoon Shanshan, although the index eventually eked mild gains amid gains in Industrial names.

- Hang Seng and Shanghai Comp both conformed to the APAC mood and later extended their losses, whilst earnings season in Hong Kong saw Meituan jump almost 10% while Li Autos slid 10.6%.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 150.9bln via 7-day Reverse Repo at a maintained rate of 1.70%.

- South Korean President Yoon said the government will introduce an automatic stabilization tool for the long-term sustainability of pension fund and is to raise the basic monthly pension by KRW 400k within his term, according to Reuters.

- PBoC will step up counter-cyclical adjustments; will strengthen financial support to the real economy

DATA RECAP

- New Zealand ANZ Business Outlook (Aug) 50.6% (Prev. 27.1%)

- New Zealand ANZ Own Activity (Aug) 37.1% (Prev. 16.3%)

- Australian Capital Expenditure (Q2) -2.2% vs. Exp. 1.0% (Prev. 1.0%)

- Australian Plant/Machinery Capex (Q2) -0.5% (Prev. 3.3%)

- Australian Building Capex (Q2) -3.8% (Prev. -0.9%)