Europe Market Open: APAC stocks were mixed, JPY firmer and Bonds continue to edge higher

05 Sep 2024, 06:45 by Newsquawk Desk

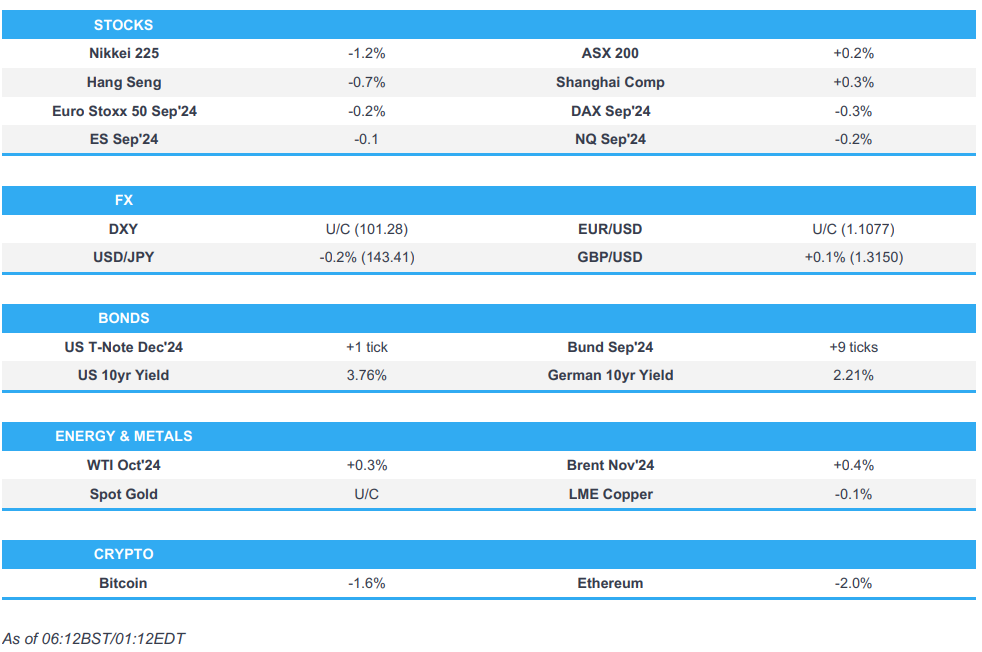

- APAC stocks eventually traded mixed following the earlier mild regional gains, with the overall market tone tentative ahead of a slew of US data ahead of NFP on Friday.

- USD/JPY initially fell amid higher-than-expected Labour Cash Earnings; Yuan strengthened on the PBOC fixing; G10s were largely uneventful.

- 10-year UST futures held an upward bias in continuation of Wednesday's Wall Street session, after the bull steepening seen following the dovish July JOLTS data.

- European equity futures are indicative of a flat/softer open with Euro Stoxx 50 futures -0.1% after cash closed -1.3% on Wednesday

- Looking ahead, highlights include German Industrial Orders, EZ Construction PMIs, EZ Retail Sales, US Challenger Layoffs, ADP National Employment, IJC, ISM Services, BoE Decision Maker Panel; Fed’s Beige Book, supply from Spain, France, UK, US, and Earnings

- Click here for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks were ultimately lower on Wednesday, albeit not to the same extent as Tuesday's session. Losses were widespread, with Energy, Materials and Tech underperforming.

- SPX -0.16% AT 5,520, NDX -0.20% at 18,921, DJIA +0.09% at 40,974, RUT -0.34% at 2,141

- Click here for a detailed summary.

NOTABLE HEADLINES

- US VP Harris is to reportedly pare back Biden's capital-gains tax proposal, according to WSJ; Democratic Presidential candidate Harris said if you earn USD 1mln or more your capital gains tax rate will be 28%.

- US President Biden is due to speak on economic policy on Thursday 5th September at 16:00 ET/ 21:00 BST.

- Atlanta Fed GDPNow (Q3 24): 2.1% (prev. 2.0%).

- Leader of Canada's opposition New Democrats is tearing up a deal that is helping keep Trudeau's liberal government in power; announcement by new Democrats means if Trudeau is to continue governing, he will need to find support from other opposition legislators.

NOTABLE EQUITY-SPECIFIC NEWS

- NVIDIA (NVDA) said they have not been subpoenaed by DoJ, according to Bloomberg.

- Verizon (VZ) reportedly in advanced talks to acquire Frontier Communications (FYBR) in a deal that would bolster the company’s fibre network to compete with rivals including AT&T (T), according to WSJ citing sources.

- US President Biden reportedly prepares to block the Nippon Steel (5401 JT) acquisition of US Steel (X), according to WaPo citing sources. Biden administration reportedly told Nippon Steel (5401 JT) on Saturday that Nippon's acquisition of US Steel (X) would pose a national security risk by harming the American steel industry, according to Reuters sources

APAC TRADE

EQUITIES

- APAC stocks eventually traded mixed following the earlier mild regional gains, with the overall market tone tentative ahead of a slew of US data ahead of NFP on Friday.

- ASX 200 was kept afloat by its Tech and Real Estate sectors whilst Energy resided at the bottom.

- Nikkei 225 was choppy on either side of 37k as it saw initial pressure amid the stronger JPY, with the index later entirely trimming losses, only to falter once again.

- Hang Seng and Shanghai Comp were mixed for most of the session, Hang Seng initially saw modest gains with Banks and Real Estate initially supported following reports China mulls cutting mortgage rates in two steps to shield banks, via Bloomberg sources. That being said, the mood later waned despite a lack of catalysts, although pre-market reports suggested JPMorgan cut China stocks to Neutral from Overweight.

- US equity futures traded between modest gains and losses with futures overall indecisive ahead of more US data.

- European equity futures are indicative of a flat/softer open with Euro Stoxx 50 futures -0.1% after cash closed -1.3% on Wednesday.

FX

- DXY was unchanged within a narrow 101.23-34 range and yesterday's 101.24-74 parameter with price action minimal amid a lack of catalysts. DXY saw no major move on commentary from Fed's Daly.

- EUR/USD saw sideways trade in tandem with an uneventful USD with the pair towards the top end of yesterday's 1.1037-94 parameter.

- GBP/USD was trading on either side of 1.3150 in a 1.3142-56 parameter and inside Tuesday's 1.3097-1.3175 range.

- USD/JPY initially fell as participants reacted to the JPY strength seen in Western sessions alongside higher-than-expected Labour Cash Earnings, with USD/JPY reaching a low of 143.17 before coming off worst levels vs yesterday's 143.70-145.56 range. JPY saw no move to commentary from BoJ Board Member Takata.

- Antipodeans were both flat and trading sideways amid the lukewarm tone across the summer markets in the run-up to the next catalysts. AUD saw no move on reiterations from RBA Governor Bullock.

- Yuan saw gains after the PBoC's stronger-than-expected CNY fix, which was at the strongest level since mid-April.

- PBoC set USD/CNY mid-point at 7.0989 vs exp. 7.1010 (prev. 7.1148); strongest level since Apr 15th

FIXED INCOME

- 10-year UST futures held an upward bias in continuation of Wednesday's Wall Street session, after the bull steepening seen following the dovish July JOLTS data.

- Bund futures were relatively flat and hovering above 134.50 throughout the APAC session in a 134.57-69 range.

- 10yr JGB futures conforming to the tone set by Western counterparts in the Wednesday sessions but with price action rather horizontal in recent trade, with little reaction to BoJ's Takata. A tepid 30-year JGB auction prompted very little action.

- Japan sold JPY 0.9tln 30-yr JGB; b/c 3.40x (prev. 3.47x), and average yield 2.043% (prev. 2.229%).

COMMODITIES

- Crude futures saw mild gains for most of the session, albeit later warning off highs, as prices consolidated from the prior day's slump, whilst the delayed weekly Private Inventory release showed a much larger-than-expected draw in crude and subsequently led to upticks at the time.

- Spot gold traded flat in a narrow range under USD 2,500/oz with the yellow metal finding some overnight resistance at the level awaiting the next catalyst.

- Copper futures traded on either side of USD 9,000/t (3M LME) and in a tight range against the backdrop of a tentative market.

- US Private Inventory (bbls): Crude -7.4mln (exp. -1.0mln), Distillate -0.4mln (exp. +0.5mln), Gasoline -0.3mln (exp. -0.7mln), Cushing -0.8mln (prev. -0.49mln).

CRYPTO

- Bitcoin was softer for most of the APAC session and briefly dipped under USD 57k.

NOTABLE ASIA-PAC HEADLINES

- JPMorgan cut China stocks to Neutral from Overweight.

- PBoC injected CNY 63.3bln via 7-day Reverse Repo at maintained rate of 1.70%0

DATA RECAP

- Japanese Labour Cash Earnings YY (Jul) 3.6% vs Exp. 3.0% (Prev. 4.5%)

- Japanese Overtime Pay (Jul) -0.1% (Prev. 1.3%, Rev. 0.9%)

- Japanese Foreign Invest JP Stock w/e -824.4B (Prev. -438.3B, Rev. -442.6B)

- Japanese Foreign Bond Investment w/e 1.6405T (Prev. 1.543T, Rev. 1.556T)

- South Korea GDP Growth QQ Revised (Q2) -0.2% (Prev. -0.2%)

- South Korea GDP Growth YY Revised (Q2) 2.3% (Prev. 2.3%)

CENTRAL BANKS

- Fed's Daly (2024 voter) said the Fed needs to cut the policy rate due to falling inflation and a slowing economy. Daly stated the size of the September rate cut is still unknown and that more data, including Friday’s job market report and CPI, is needed. She highlighted that the labour market has softened but remains healthy, and any overly tight policy could lead to further labour market slowing. Daly also noted that price stability has not been fully restored, with inflation still a major concern, and businesses are being frugal with hiring but not yet laying off employees. She added that the current economic outlook is uncertain and data will be volatile.

- Fed Beige Book: Employment levels were generally flat to up slightly in recent weeks.

- BoJ Board Member Takata said Japan's economy is recovering moderately, though some weak signs are evident; notes significant volatility in stock and FX markets but maintains that achieving the inflation target remains within reach, and BoJ must be vigilant to the chance of renewed wave of price hikes, while taking into account impact of yen rise in early August, according to Reuters. He noted it is hard to debate at this stage to what degree BoJ can shrink its balance sheet, and hard to pin down the precise level of Japan's natural rate of interest. He said Japan's current real interest rate is below the estimated natural rate of interest, which means monetary conditions remain accommodative and the fallout from market turbulence in early August remains, "so we must scrutinize the impact for the time being". He noted the BoJ must adjust monetary conditions by 'another gear' if we can confirm that firms will continue to increase capex, wages and prices, and won't hike policy rates with a pre-set level of neutral interest rate in mind. BoJ's decision to reduce bond buying won't hugely affect the impact of monetary easing, but marks a big turning point from when the central bank had YCC in place, and markets stabilizing after some turbulence, but must watch market developments with a very strong sense of urgency.

- BoJ to hold meeting on market operations on October 16th from 17:30 local time, according to Reuters.

- RBA Governor Bullock repeated that it is premature to be thinking about rate cuts; as of now, the board does not expect to be in a position to cut rates in the near term. She noted the RBA's highest priority has been and remains to bring inflation down, and the Board remains vigilant to upside risks to inflation, whilst the RBA's full employment goal is not served by letting inflation stay above target indefinitely. She noted substantial uncertainty around the central outlook, with risks on both sides and if circumstances change, the board will respond accordingly. Bullock said the labour market remains relatively tight, expected to ease gradually, and labour cost growth is strong reflecting wage increases, and weak productivity. She warned key drivers of elevated inflation are housing costs, market services, and CPI rents inflation is likely to be high for some time. Bullock said need to see results on inflation before lowering rates; board is not going to focus on one inflation number, and slightly elevated AUD is positive for inflation fight.

GEOPOLITICS

- White House reportedly scrambling to put forward a new Israel-Hamas proposal; draft accord could come next week or sooner; there is a strong perception that a ceasefire is slipping away, according to Reuters sources.

- Senior officials from the US and Israel reportedly held a low-profile virtual meeting on Tuesday to discuss how to ease tensions with Lebanon and prevent an all-out war between Israel and Hezbollah, according to Axios citing officials.

EU/UK

NOTABLE HEADLINES

- ASML (ASML NA) CEO repeated 2024 and 2025 guidance and said the chip market recovery is uneven.