US Market Open: Equities are lower, JPY gains & DXY holds flat ahead of US NFP

06 Sep 2024, 10:53 by Newsquawk Desk

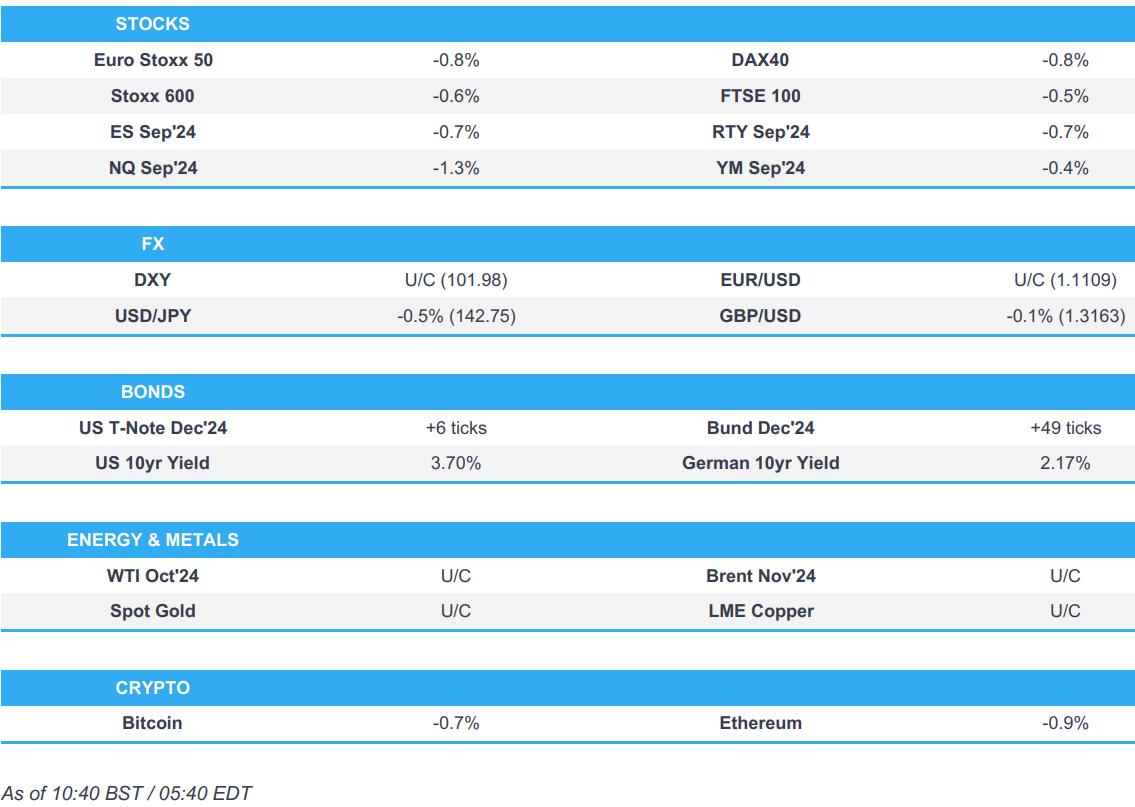

- Equities are lower across the board and now hold at lows ahead of the US NFP report

- Dollar is flat, JPY continues to advance amid the broader risk tone

- Bonds are bid, USTs less-so as attention remains firmly on US unemployment data

- Crude is flat in what has been a choppy session thus far, XAU is also little changed whilst base metals are mixed

- Looking ahead, US NFP, Canadian Employment; Fed’s Williams, Waller

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.3%) opened the session entirely in the red, and sentiment continued to sour as the morning progressed. Indices then found support and traversed worst levels, but with some choppy price action.

- European sectors hold a strong negative bias; Media takes the top spot, alongside Healthcare. Energy is towards the foot of the pile, hampered by the broader weakness in oil prices.

- US Equity Futures (ES -0.6%, NQ 1%, RTY -0.5%) are entirely in the red, as traders position themselves ahead of today’s key risk event, the US NFP report.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is flat ahead of the much-awaited August NFP report, where the headline figure is expected to print at 160k. Should the release come in soft, the YTD low from August 27th sits at 100.51.

- EUR/USD is sitting just above the 1.11 mark with not much follow-through from yet more soft German data and the appointment of Barnier as French PM. Upside sees the late-August peak at 1.1201, downside sees yesterday's low at 1.1074.

- Flat trade for GBP vs. the USD and EUR, with UK-specific newsflow quiet today. Cable did briefly take out yesterday's 1.3186 high but is ultimately struggling to move back onto a 1.32 handle

- JPY the best performer across the majors after gaining ground vs. the USD in early European trade. No clear fundamental driver behind the move, but comments from ex-BoJ Governor Kuroda that the short-term nominal rate may be less than 2%, could be a factor. USD/JPY has slipped from an overnight peak at 143.48 to a current session low at 142.07.

- Antipodeans are mildly diverging. AUD is a touch softer vs. the USD but with AUD/USD near the mid-point of the week's 0.6685-0.6794 range. Similar price action for NZD/USD with the pair contained within this week's 0.6169-0.6299 band.

- PBoC set USD/CNY mid-point at 7.0925 vs exp. 7.0927 (prev. 7.0989)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are bid but not to quite the same extent as European peers after the pronounced two-way action seen on Thursday’s data points and as participants await today’s NFP report. USTs are holding around 115-00+ which marks the December contract high and is just three ticks shy of the September contract peak from early August.

- Bunds are firmer and above Thursday’s ADP-driven 134.29 best to a fresh 134.61 WTD peak. If the upside continues, resistance features at 134.93 before the figure and then the contract high of 135.66.

- Gilts are also benefiting from the general risk tone. Gilts eclipsed the 100.00 mark with nothing of note now until the 100.30 contract high from the 14th of August.

- Click for a detailed summary

COMMODITIES

- Crude was initially firmer, benefiting from the weaker Dollar. Since, oil turned lower, in-fitting with the general risk tone and as markets await US NFP. Brent'Nov currently around USD 72.75/bbl.

- Spot gold is little changed and in a narrow range but one that is entirely above USD 2500/oz.

- Base metals are steady and unable to benefit from the softer USD which has been overshadowed by the risk tone deteriorating in the European morning.

- Kazakhstan expects a significant reduction in oil production during planned repair period at Kashagan oil field (400k BPD) in October.

- Citi sees the OPEC+ unwind delay and ongoing geopolitics and financial positioning providing price support at USD 70-72/bbl in Brent. Citi recommends selling on a bounce toward USD 80/bbl Brent, as it looks ahead to move down to the USD 60/bbl range in 2025 as a sizeable market surplus emerges.

- Goldman Sachs pushed back their end-2024 copper price target of USD 12,000/t to after 2025 and lowered the 2025 aluminium price forecast to USD 2,540/t (from USD 2,850/t).

- Citi maintains 0-3-month price forecasts for copper at USD 9,500/t, aluminium at USD 2,500/t, and zinc at USD 2,800/t; "We reiterate our cautious outlook for the base metals complex until after the US election when we expect more clarity on US and China policy and improving manufacturing sentiment as Fed rate cuts progress." (Newswires)

- Indian gov't is reportedly considering cutting diesel and petrol prices, via Reuters citing India Today sources.

- BofA says that fundamentals for Tin remain solid and sees prices rising to an average of USD 37k/ton by 2026 vs. prev. view of USD 32.5k/ton.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Trade Balance, EUR, SA (Jul) 16.8B vs. Exp. 21.0B (Prev. 20.4B); Exports MM 1.7% vs. Exp. 1.2% (Prev. -3.4%); Imports MM 5.4% vs. Exp. 0.3% (Prev. 0.3%)

- German Industrial Output MM (Jul) -2.4% vs. Exp. -0.3% (Prev. 1.4%)

- UK Halifax House Prices MM (Aug) 0.3% vs. Exp. 0.2% (Prev. 0.8%, Rev. 0.9%)

- UK BBA Mortgage Rate (Aug) 7.83% (Prev. 7.98%, Rev. 8.03%)

- French Trade Balance, EUR, SA (Jul) -5.884B (Prev. -6.088B, Rev. -5.980B); Imports, EUR (Jul) 55.682B (Prev. 57.746B, Rev. 57.479B); Exports, EUR (Jul) 49.798B (Prev. 51.659B, Rev. 51.498B)

- Italian Retail Sales NSA YY* (Jul) 1.0% (Prev. -1.0%); Retail Sales SA MM (Jul) 0.5% (Prev. -0.2%)

- EU Employment Final YY (Q2) 0.8% vs. Exp. 0.8% (Prev. 0.8%); Employment Final QQ (Q2) 0.2% vs. Exp. 0.2% (Prev. 0.2%); GDP Revised YY (Q2) 0.6% vs. Exp. 0.6% (Prev. 0.6%); GDP Revised QQ (Q2) 0.2% vs. Exp. 0.3% (Prev. 0.3%)

NOTABLE EUROPEAN HEADLINES

- ECB's Elderson speaks on "Nature-related risk: legal implications for central banks, supervisors and financial institutions"; not pertinent to monetary policy.

GEOPOLITICS

- US Secretary of State Blinken said 90% of the Gaza ceasefire agreement is agreed upon, but critical issues remain where there are gaps; Incumbent on both parties to get to yes on remaining issues.

- "The Israeli army withdraws from Jenin and its camp after 10 days of military operations", according to Sky News

NOTABLE US HEADLINES

- Broadcom Inc (AVGO) Q3 2024 (USD): Adj. EPS 1.24 (exp. 1.20), Revenue 13.07bln (exp. 12.96bln). Adj. EBITDA 8.22bln (exp. 7.89bln); Sees Q4 revenue about 14bln (exp. 14.13bln). Semiconductor solutions revenue 7.27bln (exp. 7.41bln). Infrastructure software revenue 5.80bln (exp. 5.5bln). Adj. operating income 7.95bln (exp. 7.73bln) Adj. R&D expense 1.47bln (exp 1.47bln). Capital expenditure 172mln (exp 140.5mln). Exec said the Co. is raising FY24 revenue forecasts to USD 51.5bln (prev. USD 51bln; exp. 51.46bln). Shares fell ~6.7% after earnings.

- Intel (INTC) is said to be exploring the sale of part of its stake in Mobileye (MBLY), according to Bloomberg sources; said to be a large stake. Intel also weighing options for its network and edge business.

- Qualcomm (QCOM) has reportedly explored buying pieces of Intel’s (INTC) design business, Reuters sources said.

- Berkshire Hathaway (BRK.B) sold about 18.8mln Bank of America (BAC) common shares for approximately USD 760mln between Sept 3 and Sept 5, according to an SEC filing

APAC

- APAC stocks traded without a firm direction following a similar lead from Wall Street, with the tone tentative heading into the much-awaited US jobs report, which could be the determining factor between a 25bps or 50bps cut by the Fed after the central bank shifted its emphasis to the labour market. As a reminder, Fed Vice Chair Williams and Governor Waller will be speaking after the jobs numbers ahead of the Fed's blackout period set to begin this weekend for the September 18th announcement.

- ASX 200 just about held onto gains at one point, with Utilities, Financials, Real Estate and Gold names countering the underperformance in Energy and Tech.

- Nikkei 225 was subdued under the 37k mark (and briefly dipped under 36.5k) with mining and industrial names among the worst performers, whilst Nippon Steel shares fell around 3% amid the ongoing spat with the Biden admin after the US intervened in the Nippon Steel takeover of US Steel amid national security risks.

- Hang Seng saw its Friday trade scrapped amid a typhoon signal.

- Shanghai Comp saw subdued trade amid the broader tentative mood across the market and lack of Stock Connect flows. In terms of newsflow, former PBoC Governor Yi Gang offered a bleak prognosis of the Chinese economy, whilst the PBoC drained a net CNY 1.1916tln for the week via open market operations, marking the biggest weekly net cash withdrawal in eight months, according to Reuters calculations.

NOTABLE ASIA-PAC HEADLINES

- Former PBoC Governor Yi Gang, speaking at the Bund Summit, stated that China currently faces weak domestic demand, particularly in consumption and investment. He expressed hope that in the near future, China’s GDP deflator will turn slightly positive. Additionally, Yi hopes that the producer price industry will improve to about zero by the end of this year. He suggests that China should return to a proactive fiscal policy and an accommodative monetary policy.

- PBoC injected CNY 141.5bln via 7-day Reverse Repo at a maintained rate of 1.70%.

- PBoC drained a net CNY 1.1916tln for the week via open market operations, marking the biggest weekly net cash withdrawal in eight months, according to Reuters calculations.

- HKEX confirmed no trading on Friday in securities and derivatives markets due to the issuance of Typhoon Signal No. 8. Stock Connect trading is also suspended for the day. No securities clearing and settlement services will be provided for the day.

- Japan Finance Minister Suzuki said there is a need to examine the impact of potential investment tax hikes on the economy and stock prices when asked about the preproposal, according to Reuters.

- Toyota (7203 JT) to cut 2026 global EV production to around 1mln units, down 30% from previously announced 1.5mln, via Nikkei.

- Former BoJ Governor Kuroda said overnight “A nominal neutral rate, which the Bank of Japan is trying to gradually approach, could be less than 2%,” and “A short-term nominal rate may be less than 2%, maybe around 1.5% or maybe less than that.”

- S&P Global Ratings says China Vanke (2202 HK) is downgraded to "BB-" amid weakening sales and margins; outlook Negative

APAC DATA RECAP

- Japanese All Household Spending YY (Jul) 0.1% vs. Exp. 1.2% (Prev. -1.4%); MM -1.7% vs. Exp. -0.2% (Prev. 0.1%)

- Japanese Foreign Reserves (Aug) 1.236T (Prev. 1.219T)