US Market Open: US equity futures lower & DXY subdued following the US Presidential Debate ahead of US CPI

11 Sep 2024, 11:17 by Newsquawk Desk

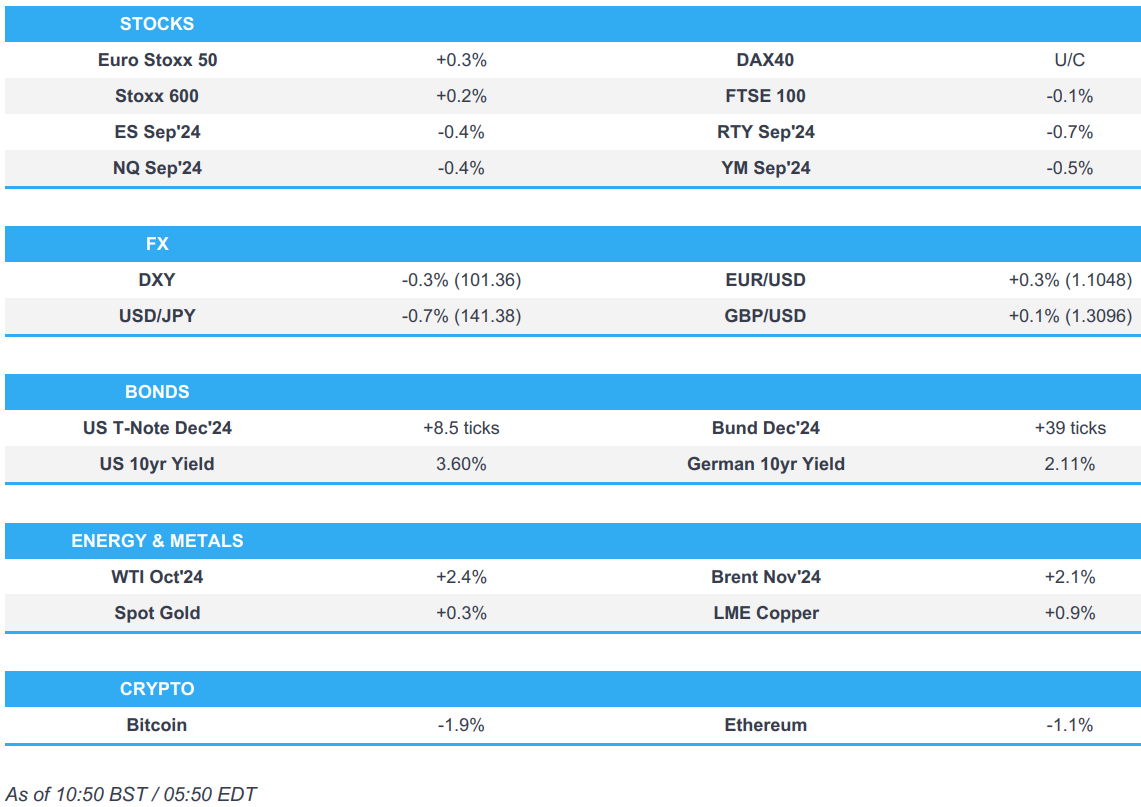

- European bourses are mixed having initially opened with a clear positive bias; US equity futures are entirely in the red ahead of CPI.

- Dollar is softer as markets digest the Presidential Debate; CNN opinion polls suggest that 63% of voters thought candidate Harris won the debate; gains in JPY overnight also weighed on the index

- Bonds are entirely in the green continuing the price action seen in the prior session; Gilts outperform after softer-than-expected UK GDP metrics

- Crude gains as it attempts to pare the prior day's losses; XAU and base metals benefit from the softer Dollar

- Looking ahead, highlights include US CPI. Supply from the US, NVIDIA CEO Huang.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.2%) began the session modestly in the green and generally traded near session highs throughout the European morning; in recent trade sentiment in the complex has slipped slightly, with indices displaying more of a mixed picture.

- European sectors hold a strong positive bias; Retail takes the top spot, propped up by post-earning gains in Inditex (+4%). Healthcare is found at the foot of the pile, continuing the losses seen in the prior session. In terms of individual movers, Commerzbank (+17%) soars after UniCredit (+1.9%) bought shares in the Co. from the German Government.

- US equity futures (ES -0.4%, NQ -0.4%, RTY -0.7%) are lower across the board, with slight underperformance in the economy-linked RTY as traders digest the Presidential Debate; CNN opinion polls suggest that 63% of voters thought candidate Harris won the debate.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer vs. most peers with the DXY dragged lower by a notable pick-up in the JPY and in the backdrop of the Presidential Debate, where CNN polls suggest Harris won vs Trump. Her candidacy is broadly seen as USD-negative given expectations of easier Fed policy (compared to Trump). US CPI will be the next inflection point for the index.

- EUR is firmer vs. the USD with the broadly softer USD providing EUR/USD some reprieve after three sessions of losses which dragged the pair to a 1.1015 low yesterday.

- GBP is unable to materially capitalise on the broadly softer USD as soft UK data acts as a drag. The UK registered 0 growth in July (vs. Exp. 0.2%) with output data also soft across the board. Cable has returned to a 1.30 handle after topping out at 1.3111.

- JPY is the clear outperformer vs. the USD across the majors with the move being attributed to some of the risk-aversion seen in stocks overnight and comments from BoJ's Nakagawa. As the European morning progressed, USD/JPY has bounced off worst levels and has attempted to pare some of the overnight losses.

- Contained trade for the antipodes with AUD slightly edging out its NZD counterpart. AUD/USD remains sandwiched within its 100 and 200DMAs at 0.6648 and 0.6668 respectively.

- PBoC set USD/CNY mid-point at 7.1182 vs exp. 7.1198 (prev. 7.1136).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs have extended on their recent upside amid a slew of factors, including yesterday's strong 3yr auction, anticipation of Fed easing ahead of CPI, recent downside in oil prices and Harris' performance in the debate last night. The 2yr yield is at its lowest level since September 2022.

- EGB price action is similar to peers; Bunds have continued their recent bullish run. It remains to be seen how much legs this move has as focus tomorrow will shift to Eurozone-specific developments with the ECB policy announcement. From a yield perspective, with the 10yr moving as low as 2.112%. The German 10yr auction had little impact on Bunds.

- Gilts are outpacing peers as a combination of catch-up trade with other peers and soft UK data. On the latter, the M/M GDP print for July came in at 0% vs. Exp. 0.2%, whilst production, industrial and construction output all came in lower than expected. The 10yr has been as low as 3.771%. The 10yr auction was slightly softer than prior, and led to some pressure in Gilts.

- UK sells GBP 3.75bln 4.25% 2034 Gilt: b/c 2.84x (prev. 2.93x), average yield 3.757% (prev. 4.082%), tail 1.3bps (prev. 0.5bps)

- Germany sells EUR 3.688bln vs exp. EUR 4.5bln 2.60% 2034 Bund: b/c 2.1x (prev. 2.0x), average yield 2.11% (prev. 2.22%), retention 18.04% (prev. 18.44%)

- Click for a detailed summary

COMMODITIES

- Crude is firmer on the session thus far, and has been gradually edging higher in the European morning, in a paring to some of the hefty losses seen in the prior session. Brent'Nov sits in a USD 69.31-70.81/bbl range.

- Spot gold is on the front foot, initially benefiting from the softer Dollar; price action today has been contained within a USD 2,515-529/oz range.

- Base metals trade higher across the board in what is seemingly a broader Dollar-induced recovery across industrial commodities.

- US Private Inventory Data (bbls): Crude -2.8mln (exp. +1.0mln), Distillate +0.2mln (exp. +0.3mln), Gasoline -0.5mln (exp. -0.1mln), Cushing -2.6mln.

- NHC said Francine is moving towards the Louisiana coast, with a life-threatening storm surge and hurricane-force winds expected to begin in Louisiana on Wednesday, but noted Francine is expected to weaken quickly after it moves inland.

- NHC said Hurricane Francine a little stronger, life threatening storm surge and hurricane force winds expected to begin in Louisiana today

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Services MM (Jul) 0.1% vs. Exp. 0.2% (Prev. -0.1%); YY (Jul) 1.7% vs. Exp. 1.8% (Prev. 1.2%)

- UK GDP Estimate 3M/3M (Jul) 0.5% vs. Exp. 0.6% (Prev. 0.6%); Estimate MM (Jul) 0.0% vs. Exp. 0.2% (Prev. 0.0%); Estimate YY (Jul) 1.2% vs. Exp. 1.4% (Prev. 0.7%)

- UK Construction O/P Vol YY (Jul) -1.6% vs. Exp. -0.8% (Prev. -1.7%); Construction O/P Vol MM (Jul) -0.4% vs. Exp. 0.4% (Prev. 0.5%)

- UK Goods Trade Balance GBP (Jul) -20.003B GB vs. Exp. -18.1B GB (Prev. -18.894B GB, Rev. -18.894B GB); Goods Trade Bal. Non-EU (Jul) -7.5B GB (Prev. -7.455B GB, Rev. -7.455B GB)

- UK Manufacturing Output YY (Jul) -1.3% vs. Exp. -0.1% (Prev. -1.5%); Manufacturing Output MM (Jul) -1.0% vs. Exp. 0.2% (Prev. 1.1%)

- UK Industrial Output YY (Jul) -1.2% vs. Exp. -0.2% (Prev. -1.4%);Industrial Output MM (Jul) -0.8% vs. Exp. 0.3% (Prev. 0.8%)

PRESIDENTIAL DEBATE

- US Vice President Harris said she supports small businesses and will offer a tax cut for these businesses, while she added that Trump left them with the worst unemployment rate, an economic recession and the worst attack on democracy since the Civil War. Harris stated that Trump got them into economic wars and that he thanked the Chinese President but is attacking him today. Furthermore, she said Trump favours campaigning on issues instead of solving them and that 81mln Americans fired Trump which is hard for him to realise.

- Former President Trump reiterated that millions of migrants are pouring into the country illegally and "taking our jobs before our eyes", while he added the economy is terrible economy because of inflation which is devastating to the middle American class. Trump also commented that the Biden administration only gained "bounce back" jobs, as well as stated that Harris doesn't have an economic plan and copied Biden's plan.

GEOPOLITICS

MIDDLE EAST

- Israeli army radio said the Israeli army attacked Hezbollah positions in southern Lebanon during the night and destroyed about 25 rocket launchers, according to Sky News Arabia.

- US Defence Secretary Austin spoke with his Israeli counterpart Gallant to express grave concern for the IDF’s responsibility for the "unprovoked and unjustified death" of an American in the West Bank, while he urged Gallant to reexamine the IDF’s rules of engagement while operating in the West Bank.

OTHER

- Ukraine Foreign Ministry spokesman said Kyiv will consider its options and could even cut ties with Tehran if Russia uses Iranian missiles in the Ukraine war.

- US President Biden said they are working that out now when asked about potentially lifting the Ukraine long-range weapons ban, according to Reuters.

- A cargo train derailed in Russia's Belgorod region due to outside 'interference', according to Russian agencies.

- Russia's Chairman of the State Duma, on the potential supplies of western long-range weapons to Ukraine, said Russia will have to respond by using more powerful and destructive weapons.

CRYPTO

- Bitcoin slips and sits below USD 56k with Ethereum also on the backfoot and just above USD 2.3k.

APAC TRADE

- APAC stocks traded cautiously after the two-way price action stateside and as participants await US CPI data.

- ASX 200 trickled lower as weakness in tech and financials overshadowed the gains in commodity-related stocks.

- Nikkei 225 was pressured amid currency strength and after BoJ's Nakagawa kept the door open for further hikes.

- Hang Seng and Shanghai Comp conformed to the downbeat mood with the former dragged beneath the 17,000 level amid heavy losses in energy stocks, while there was very little to spur a turnaround.

NOTABLE ASIA-PAC HEADLINES

- BoJ Board Member Nakagawa said one-sided yen falls subsided somewhat but rising import prices could affect consumer inflation with a lag and stated that prolonged inflation overseas could put upward pressure on Japan's import prices. Nakagawa said even after the July rate hike, real interest rates remain deeply negative and accommodative monetary conditions are maintained. Furthermore, she said if long-term rates spike, the BoJ could review its taper plan at its policy meeting as needed and that the BoJ is likely to adjust the degree of monetary easing if the economy and prices move in line with its projection.

- RBA's Hunter said the labour market is still tight relative to full employment and has moved towards better balance since late 2022, while she added that the easing in the labour market similar to past mild downturns. Hunter also stated that Australia's economy is moving through a turning point and that turning points are innately challenging and tough.