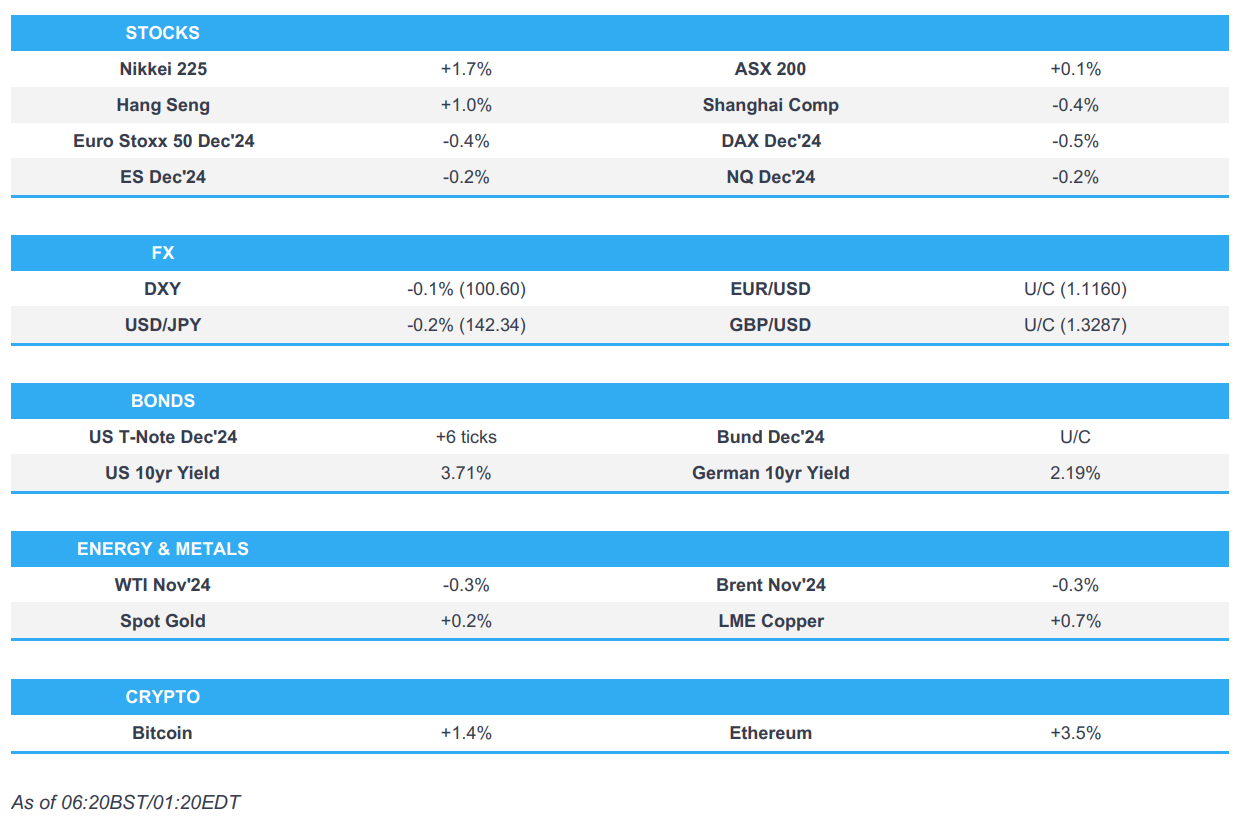

European Market Open: S&P & Dow hit record highs; BoJ holds rates and European futures point to a softer open

20 Sep 2024, 06:55 by Newsquawk Desk

- APAC stocks mostly gained following the rally stateside where the S&P 500 and the Dow surged to fresh record highs as the dust settled after the Fed over-delivered in its first rate cut in four years and US data topped forecasts.

- BoJ kept its short-term policy rate unchanged at 0.25%, as expected with the decision made by unanimous vote, with no fireworks; USD/JPY was choppy before heading marginally lower, and 10-year JGBs were eventually subdued.

- PBoC maintained LPRs at their current levels as expected; Hang Seng and Shanghai Comp were mixed whilst the Yuan was firmer overnight despite reports of Chinese major state-owned banks seen buying dollars.

- European equity futures are indicative of a softer cash open with the Euro Stoxx 50 future -0.4% after the cash market closed higher by 2.2% on Thursday.

- Looking ahead, highlights include UK Retail Sales, Canadian Producer Prices, Retail Sales, EZ Consumer Confidence, Quad Witching, Comments from Norges Bank's Longva & Bache, BoE’s Mann, BoC’s Macklem, ECB’s Lagarde, Fed’s Harker & Bowman.

SNAPSHOT

US TRADE

EQUITIES

- US stocks rallied which saw both the S&P 500 and Dow surge to record highs as the dust settled after the Fed over-delivered in its first rate cut in four years with the advances led by notable outperformance in tech although defensives lagged, while participants also digested better-than-expected data releases including the Philly Fed Index and Initial Jobless Claims which pressured Treasuries.

- SPX +1.70% at 5,714, NDX +2.56% at 19,840, DJIA +1.26% at 42,025, RUT +2.10% at 2,253.

- Click here for a detailed summary.

BOJ POLICY DECISION

- BoJ kept its short-term policy rate unchanged at 0.25%, as expected with the decision made by unanimous vote, while it said Japan's economy is recovering moderately albeit with some weaknesses and inflation expectations are heightening moderately. BoJ also stated that inflation is likely to be at a level generally consistent with the BoJ's price target in the second half of its 3-year projection period through fiscal 2026 and it sees medium and long-term inflation expectations increasing. Furthermore, it sees exchange rate trends as having a greater influence on prices and said Japan's economy is likely to achieve growth above potential but also stated that they must be vigilant to the impact of financial and FX market moves on Japan's economy and prices.

NOTABLE US HEADLINES

- Port of New York/New Jersey executives tell CNBC they have begun preparations for a potential complete work stoppage by the International Longshoreman’s Association which is the largest union in North America.

APAC TRADE

EQUITIES

- APAC stocks mostly gained following the rally stateside where the S&P 500 and the Dow surged to fresh record highs as the dust settled after the Fed over-delivered in its first rate cut in four years and US data topped forecasts.

- ASX 200 followed suit to its US counterparts as tech led the advances and the index printed a new all-time high.

- Nikkei 225 outperformed again and approached closer to the 38,000 level, while the BoJ policy announcement provided no major fireworks in which the central bank kept its short-term rates unchanged at 0.25%, as unanimously forecast.

- Hang Seng and Shanghai Comp were mixed with the former joining in on the optimism in the region owing to the recent central bank activity and with EV makers finding some encouragement from recent China-EU EV tariff talks. Conversely, the mainland lagged despite the recent pledge by the NDRC to roll out a batch of incremental measures and reports that China is mulling removing major homebuying curbs, while the PBoC also announced China's latest Loan Prime Rates which were unsurprisingly maintained at their current levels.

- US equity futures took a breather after recent advances and as the witching hour approaches.

- European equity futures are indicative of a softer cash open with the Euro Stoxx 50 future -0.4% after the cash market closed higher by 2.2% on Thursday.

FX

- DXY languished beneath the 101.00 level after weakening following the Fed's recent 50bps rate cut and the risk-on environment, while the various data releases stateside were better than expected but failed to inspire a sustained recovery in the greenback.

- EUR/USD took a breather at around the 1.1150 level after recently benefitting from the softer greenback albeit in a choppy fashion.

- GBP/USD was uneventful and held on to most of the spoils from the BoE's hawkish hold, but was slightly off its two-year highs.

- USD/JPY traded indecisively following the lack of surprises from the BoJ which kept policy settings unchanged although the pair eventually trickled lower as the central bank had noted that it sees medium and long-term inflation expectations increasing.

- Antipodeans eked mild gains amid the positive risk sentiment and a firmer CNY although the upside was capped amid the lack of pertinent data releases, while there were also no surprises in the announcement of the latest Chinese Loan Prime Rates which were kept unchanged.

- PBoC set USD/CNY mid-point at 7.0644 vs exp. 7.0637 (prev. 7.0983).

- Chinese major state-owned banks are seen buying dollars in the onshore currency market to prevent the yuan from strengthening too fast, according to sources cited by Reuters.

FIXED INCOME

- 10-year UST futures clawed back some lost ground after recent selling pressure from the firmer US data releases.

- Bund futures just about kept afloat following the prior day's dovish ECB rhetoric and rebound off support at the 134.00 level.

- 10-year JGB futures lacked demand amid an unsurprising BoJ policy decision and after Japanese CPI data mostly matched estimates.

COMMODITIES

- Crude futures marginally pulled back overnight although held on to most of yesterday's spoils after rallying alongside the broad risk-on sentiment and the escalation of geopolitical tensions in the Middle East.

- Spot gold traded rangebound with price action uneventful and contained within post-FOMC ranges.

- Copper futures remained underpinned following the recent risk-fuelled momentum.

CRYPTO

- Bitcoin gradually advanced overnight and attempted to reclaim the USD 63,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese 1-Year Loan Prime Rate (Sep) 3.35% vs. Exp. 3.35% (Prev. 3.35%).

- Chinese 5-Year Loan Prime Rate (Sep) 3.85% vs. Exp. 3.85% (Prev. 3.85%).

- China weighs removing major homebuying curbs to boost demand and may end distinctions between first and second home purchases, while it may also ease restrictions on non-local homebuyers in Beijing and Shanghai, according to Bloomberg. People familiar with the matter also said authorities are mulling measures to shore up the sluggish stock market but didn't provide specifics.

- China and EU both aim to resolve differences via consultations over the EU investigation into Chinese EVs, while China's Commerce Minister and EU's Trade Commissioner are to continue pushing forward negotiations on price commitments and the sides are to spare no effort to reach a mutually acceptable solution through dialogue, according to Xinhua. This followed a previous report that no deal was reached in EU-China talks on EV tariffs and EU's Dombrovskis said both sides agreed to intensify efforts to find an effective, enforceable and WTO-compatible solution.

- USTR office said it will accept public comments from Monday on plans for steep tariff increases on Chinese polysilicon, silicon wafers and tungsten products, according to Reuters.

- Republican Senator Rubio is introducing a bill to prevent Chinese companies from benefiting from favourable US trade rules by operating in other countries.

DATA RECAP

- Japanese National CPI YY (Aug) 3.0% vs. Exp. 3.1% (Prev. 2.8%)

- Japanese National CPI Ex. Fresh Food YY (Aug) 2.8% vs. Exp. 2.8% (Prev. 2.7%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Aug) 2.0% vs. Exp. 2.0% (Prev. 1.9%)

GEOPOLITICS

MIDDLE EAST

- Israel conducted dozens of strikes in south Lebanon in a major intensification of bombing, according to Reuters citing security sources, while Israeli military later said that their fighter jets struck hundreds of rocket launcher barrels in southern Lebanon that were ready to be used immediately to fire toward Israeli territory, according to Reuters.

- Israel was reportedly to determine on Thursday night the course of its action on the northern front, according to Sky News Arabia citing Israel Broadcasting Corporation.

- Israeli Defence Minister Gallant said Hezbollah feels hounded and will pay an increasing price, while military actions will continue.

- Lebanese ministers warned of a dangerous next 48 hours after pager and device attacks, according to CNBC.

- Hamas source told Al-Arabiya that they are keen to reach an agreement in Gaza.

- US Secretary of Defense Austin has postponed his visit to Israel planned for early next week due to the escalation on the Israeli-Lebanese border, according to Axios citing two Israeli officials briefed on the matter.

- White House said they are afraid and concerned about a potential escalation in the Middle East. It was also separately reported that the US doesn't expect an Israel-Hamas deal before the end of US President Biden's term, according to WSJ

OTHER

- Ukrainian President Zelenskiy said Ukrainian forces have reduced Russian potential for attacks in the eastern Donetsk region and the Ukrainian operation in Russia's Kursk region has obliged to redirect 40k troops to that area.

- Russian Foreign Minister Lavrov said they see how NATO is increasing its manoeuvres near the North Pole and that Russia is ready to defend its interests militarily, according to Asharq News.

- China Defence Ministry spokesperson said US arms sales to Taiwan seriously violated the One-China principle and provisions of China-US joint communiques.

EU/UK

DATA RECAP

- UK GfK Consumer Confidence (Sep) -20.0 vs. Exp. -13.0 (Prev. -13.0)