US Market Open: JPY hit and fixed bid after Ueda, XAU at highs; Fed speak due

20 Sep 2024, 11:23 by Newsquawk Desk

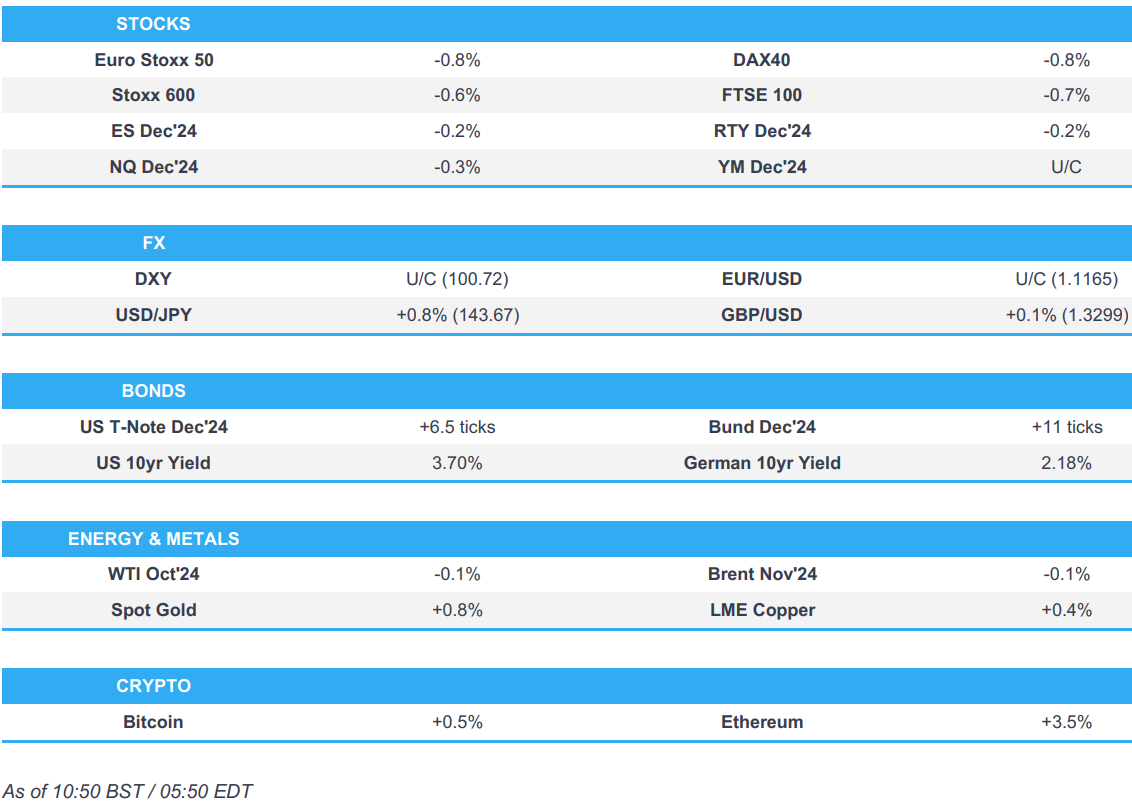

- European bourses are entirely in the red, with the DAX 40 slightly underperforming as Mercedes Benz cuts guidance; US futures are modestly lower

- Dollar is flat, JPY underperforms after the BoJ kept rates unchanged (as expected), but with Ueda striking a dovish tone at his press conference

- Bonds are slightly bid, taking impetus from the BoJ announcement; Gilts initially underperformed vs peers after hotter-than-expected UK Retail Sales

- Crude is slightly subdued, XAU prints record highs again and base metals are generally stronger

- Looking ahead, Canadian Producer Prices, Retail Sales, EZ Consumer Confidence, Quad Witching, Comments from BoC’s Macklem, ECB’s Lagarde, Fed’s Harker & Bowman

BoJ

Decision

- BoJ kept its short-term policy rate unchanged at 0.25%, as expected with the decision made by unanimous vote, while it said Japan's economy is recovering moderately albeit with some weaknesses and inflation expectations are heightening moderately. BoJ also stated that inflation is likely to be at a level generally consistent with the BoJ's price target in the second half of its 3-year projection period through fiscal 2026 and it sees medium and long-term inflation expectations increasing. Furthermore, it sees exchange rate trends as having a greater influence on prices and said Japan's economy is likely to achieve growth above potential but also stated that they must be vigilant to the impact of financial and FX market moves on Japan's economy and prices.

Ueda

- Outlook for overseas economies, incl. the US and markets, remains unstable. When asked about remarks from Uchida, says markets remain unstable. Remarks which sparked USD/JPY upside.

- Upside price risks have decreased given recent FX moves; risks of an inflation overshoot have somewhat diminished.

- No change to the thinking that they will continue to lift rates if the economy develops as expected; will take the next policy step when there is enough evidence.

- Aware that more efforts are needed to change market expectations as policy rates have shifted in earnest to positive territory from zero or negative over long period.

- Need to watch to see if the US economy attains a soft landing, making a judgement on the US is difficult.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.6%) are entirely in the red, but to varying degrees; price action today has been fairly lacklustre, with indices generally slowly drifting lower as the morning progressed.

- European sectors hold a strong negative bias; Utilities takes the top spot alongside Telecoms. Autos is by far the clear underperformer, dragged down by Mercedes-Benz (-7.1%) after it cut guidance citing China weakness. Consumer Products and Tech also lag, with the latter hampered by ASML (-2%) after it was downgraded at Morgan Stanley.

- US Equity Futures (ES -0.1%, NQ -0.1%, RTY -0.1%) are very modestly softer across the board, taking a breather following the significant gains seen in the prior session.

- Nike (NKE) CEO John Donahoe will retire on October 13th, with company veteran Elliott Hill returning to replace him.

- FedEx Corp (FDX) Shares tumbled by 13% pre-market following misses on profits and revenue, downward revisisions to the top-end of its guidance range, and warned on macro trends.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is steady vs. peers (ex-JPY) in what has been an eventful week for the USD after the Fed delivered an outsized 50bps rate cut and sent DXY to a fresh YTD trough at 100.21.

- EUR is flat vs. the USD but in close proximity to recent highs. EUR/USD is sitting just below the WTD peak set on Wednesday at 1.1189 with focus on a test of 1.12.

- GBP is the marginal outperformer across the majors on account of better-than-expected UK retail sales and yesterday's "hawkish hold" by the BoE which led markets to no longer fully price a 25bps reduction at the November meeting. Cable is off best levels, however, printed another multi-year high earlier in the session at 1.3340.

- JPY is the laggard across the majors, initially unreactive to the BoJ policy announcement, which kept rates unchanged. However, follow-up remarks from BoJ Governor Ueda gave the impression that the Bank was not in a rush to hike rates further as policymakers assess the impact of prior tightening. Accordingly, USD/JPY rose from a 141.75 base to a 143.75 peak but is yet to eclipse yesterday's 143.94 peak.

- AUD/USD's recent run of gains since Monday has paused for breath with the USD a touch firmer vs. AUD. NZD/USD is seeing uneventful trade with the pair contained within yesterday's 0.6181-0.6268 band.

- PBoC set USD/CNY mid-point at 7.0644 vs exp. 7.0637 (prev. 7.0983).

- Chinese major state-owned banks are seen buying dollars in the onshore currency market to prevent the yuan from strengthening too fast, according to sources cited by Reuters.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are slightly firmer with specifics light thus far for the US but with action coming from the BoJ; while the decision itself was largely uneventful the presser saw a particularly dovish Ueda. Thus far, USTs have probed but failed to breach 115-00 or, by extension, test yesterday’s 115-02+ top. Fed's Bowman (who dissented at the most recent meeting) is set speak about her decision later.

- JGBs climbed by almost 30 ticks during Ueda's speech and potentially driving the broader modest move higher in USTs/EGBs/Gilts across the morning.

- Gilts gapped lower by nine ticks as the benchmark reaction to UK data points from earlier in the morning with strong Retail Sales (buoyed by good weather) sparking a hawkish reaction in GBP at the time a modest but fleeting move in market pricing. The move ultimately proved fleeting, broadly a factor of the JGB upside.

- Bunds are towards the top end of a sub-30 tick range with European specifics relatively light aside from a handful of ECB speakers, though commentary was in-fitting with the data-dependent tone and as such did not merit any reaction. At a 134.53 peak, someway shy of Wednesday’s 134.86 best.

- Click for a detailed summary

COMMODITIES

- Crude complex is slightly softer largely a factor of today's subdued market sentiment. Brent'Nov sits near the lower end of a USD 74.40-74.87/bbl parameter.

- Precious metals are firmer but to varying degrees with spot silver the outperformer, spot gold printing fresh record highs, and spot palladium relatively flat. XAU rose from a USD 2,584.87/oz APAC low to a high of USD 2,612.60/oz in early European hours.

- Overall a mixed session for base metals amid the cautious tone elsewhere, but industrials are seemingly still supported by the Fed's 50bps rate cut alongside reports that China weighs removing major homebuying curbs to boost demand, according to Bloomberg.

- Operator of Kazakhstan's Karachaganak field says it cut oil output on Sept 9-5 due to maintenance; says it will run another round of maintenance on Sept 23-28.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Retail Sales MM (Aug) 1.0% vs. Exp. 0.4% (Prev. 0.5%, Rev. 0.7%); YY 2.5% vs. Exp. 1.4% (Prev. 1.4%, Rev. 1.5%)

- UK Retail Sales Ex-Fuel MM (Aug) 1.1% vs. Exp. 0.5% (Prev. 0.7%, Rev. 1.0%); YY 2.3% vs. Exp. 1.1% (Prev. 1.4%)

- UK GfK Consumer Confidence (Sep) -20.0 vs. Exp. -13.0 (Prev. -13.0)

NOTABLE EUROPEAN HEADLINES

- ECB's Rehn says they have progressed well towards the inflation target, easing pace is data-dependent.

- ECB's de Guindos says they have left the door totally open and in December they will have more information than in October.

- BoE's Mann says she agrees with investors who think inflation could stay above target for an extended period of time. It is better, under inflation uncertainty, to remain restrictive for longer, until right tail risks to the inflation process dissipate, and then to cut more aggressively. Has a guarded view on initiating a cutting cycle despite agreeing with the majority for a hold at the meeting just concluded. Policy needs to remain restrictive to purge inflationary behaviours. Risk of inflation expectations de-anchoring have subsdided. Did consider voting to cut rates in August but wanted to avoid a "boogie-dance" with policy rates.

NOTABLE US HEADLINES

- Port of New York/New Jersey executives tell CNBC they have begun preparations for a potential complete work stoppage by the International Longshoreman’s Association which is the largest union in North America.

GEOPOLITICS

MIDDLE EAST

- Israel conducted dozens of strikes in south Lebanon in a major intensification of bombing, according to Reuters citing security sources, while Israeli military later said that their fighter jets struck hundreds of rocket launcher barrels in southern Lebanon that were ready to be used immediately to fire toward Israeli territory, according to Reuters.

- "Senior adviser to (Israeli PM) Netanyahu presented the Biden administration with a new proposal for a ceasefire and the liberation of hostages", via Al Jazeera citing CNN

- Hamas source told Al-Arabiya that they are keen to reach an agreement in Gaza.

- The US doesn't expect an Israel-Hamas deal before the end of US President Biden's term, according to WSJ

- "Russia warns of 'dire consequences' if Israel launches large-scale military operation in Lebanon", according to Al Arabiya.

OTHER

- Russia says it is concerned by increasingly "provocative" NATO activity on the border with Belarus. Russia notes that it has tactical nuclear weapons in Belarus, says Kyiv and the West risk "disastrous consequences" if they pursue provocative scenarios.

- Russian Foreign Minister Lavrov said they see how NATO is increasing its manoeuvres near the North Pole and that Russia is ready to defend its interests militarily, according to Asharq News.

- China Defence Ministry spokesperson said US arms sales to Taiwan seriously violated the One-China principle and provisions of China-US joint communiques.

CRYPTO

- Bitcoin is incrementally firmer, building on the prior day's gains and currently reside just above USD 63k.

APAC TRADE

- APAC stocks mostly gained following the rally stateside where the S&P 500 and the Dow surged to fresh record highs as the dust settled after the Fed over-delivered in its first rate cut in four years and US data topped forecasts.

- ASX 200 followed suit to its US counterparts as tech led the advances and the index printed a new all-time high.

- Nikkei 225 outperformed again and approached closer to the 38,000 level, while the BoJ policy announcement provided no major fireworks in which the central bank kept its short-term rates unchanged at 0.25%, as unanimously forecast.

- Hang Seng and Shanghai Comp were mixed with the former joining in on the optimism in the region owing to the recent central bank activity and with EV makers finding some encouragement from recent China-EU EV tariff talks. Conversely, the mainland lagged despite the recent pledge by the NDRC to roll out a batch of incremental measures and reports that China is mulling removing major homebuying curbs, while the PBoC also announced China's latest Loan Prime Rates which were unsurprisingly maintained at their current levels.

NOTABLE ASIA-PAC HEADLINES

- Chinese 1-Year Loan Prime Rate (Sep) 3.35% vs. Exp. 3.35% (Prev. 3.35%).

- Chinese 5-Year Loan Prime Rate (Sep) 3.85% vs. Exp. 3.85% (Prev. 3.85%).

- China weighs removing major homebuying curbs to boost demand and may end distinctions between first and second home purchases, while it may also ease restrictions on non-local homebuyers in Beijing and Shanghai, according to Bloomberg. People familiar with the matter also said authorities are mulling measures to shore up the sluggish stock market but didn't provide specifics.

- China and EU both aim to resolve differences via consultations over the EU investigation into Chinese EVs, while China's Commerce Minister and EU's Trade Commissioner are to continue pushing forward negotiations on price commitments and the sides are to spare no effort to reach a mutually acceptable solution through dialogue, according to Xinhua. This followed a previous report that no deal was reached in EU-China talks on EV tariffs and EU's Dombrovskis said both sides agreed to intensify efforts to find an effective, enforceable and WTO-compatible solution.

- USTR office said it will accept public comments from Monday on plans for steep tariff increases on Chinese polysilicon, silicon wafers and tungsten products, according to Reuters.

- Republican Senator Rubio is introducing a bill to prevent Chinese companies from benefiting from favourable US trade rules by operating in other countries.

- China's NDRC will cut retail gasoline and diesel prices by CNH 365/ton and CNH 350/ton respectively, starting September 21, via Bloomberg

DATA RECAP

- Japanese National CPI YY (Aug) 3.0% vs. Exp. 3.1% (Prev. 2.8%)

- Japanese National CPI Ex. Fresh Food YY (Aug) 2.8% vs. Exp. 2.8% (Prev. 2.7%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Aug) 2.0% vs. Exp. 2.0% (Prev. 1.9%)