Europe Market Open: APAC stocks positive as China rallies following stimulus boost

25 Sep 2024, 06:47 by Newsquawk Desk

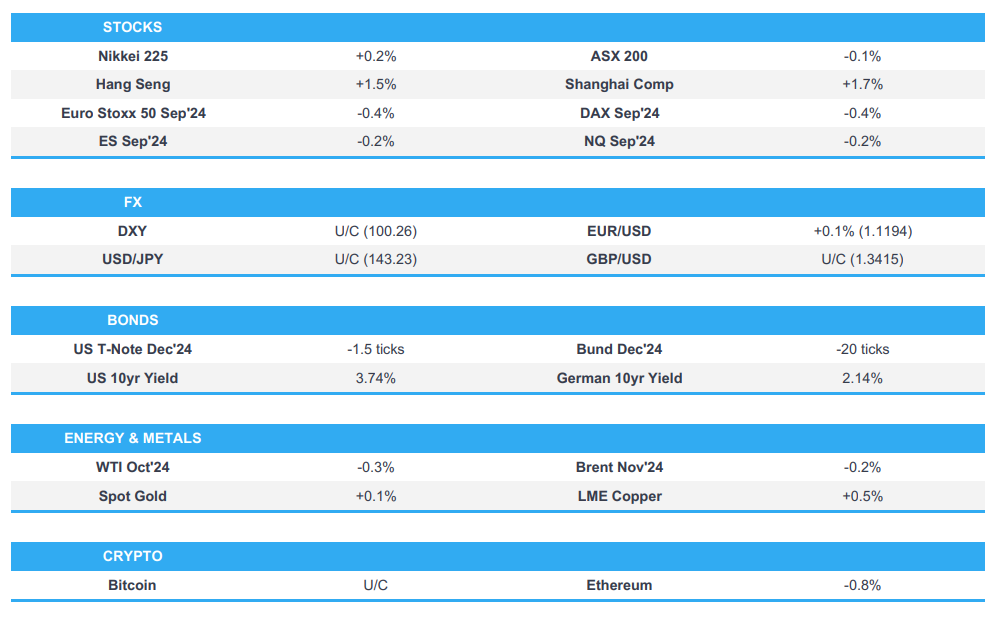

- APAC stocks were mostly positive as Chinese markets continued to rally following the stimulus boost.

- Australian monthly CPI matched estimates and slowed to a 3-year low, although core inflation remained above the 2%-3% target.

- European equity futures are indicative of a lower cash open with the Euro Stoxx 50 future -0.3% after the cash market closed up by 1.1% on Tuesday.

- USD is broadly flat vs. peers, EUR/USD is eyeing 1.12 to the upside, Cable has pulled back onto a 1.34 handle.

- Israeli Defence Minister Gallant said they have more strikes ready against Hezbollah; added they must continue until they achieve their goal.

- Looking ahead, highlights include US Building Permits, Riksbank & CNB Policy Announcements, Speakers including BoE’s Greene, Riksbank's Thedeen & Fed's Kugler, Supply from UK, Italy, Germany & US.

SNAPSHOT

US TRADE

EQUITIES

- US stocks ultimately finished with mild gains after reversing the early downside that was spurred by disappointing US Consumer Confidence data, while the sectors were mixed with outperformance in materials following China's recent stimulus efforts and financials lagged with Visa pressured as it faces a DoJ antitrust suit. The data release also saw Treasuries reverse their initial risk-on losses and triggered selling in the dollar.

- SPX +0.25% at 5,733, NDX +0.47% at 19,945, DJIA +0.20% at 42,208, RUT +0.17% at 2,224

- Click here for a detailed summary.

NOTABLE HEADLINES

- US House Foreign Affairs Committee recommended contempt of Congress charges against Secretary of State Blinken, for failing to appear at a hearing regarding the Biden administration’s handling of the 2021 withdrawal from Afghanistan.

APAC TRADE

EQUITIES

- APAC stocks were mostly positive as Chinese markets continued to rally following the stimulus boost.

- ASX 200 was rangebound with strength in mining and materials offsetting the underperformance in financials and tech, while the latest monthly CPI data from Australia matched estimates and slowed to a 3-year low although core inflation remained above the 2%-3% target.

- Nikkei 225 swung between gains and losses and traded both sides of the 38,000 level with little fresh catalysts, while Services PPI data was firmer than expected but slowed from the prior month's revised print.

- Hang Seng and Shanghai Comp rallied amid ongoing optimism following the stimulus announcements, while the PBoC also conducted an MLF operation with the rate cut by 30bps to 2.00% which it had flagged during Tuesday's press briefing.

- US equity futures (ES -0.1%) marginally softened after the prior day's choppy mood and with little in the way of key risk events scheduled today.

- European equity futures are indicative of a lower cash open with the Euro Stoxx 50 future -0.3% after the cash market closed up by 1.1% on Tuesday.

FX

- DXY saw some respite from the prior day's selling pressure that was triggered by weak US Consumer Confidence.

- EUR/USD held on to recent spoils and edged closer towards the 1.1200 territory following the dollar's recent demise.

- GBP/USD sat near its best levels in around two and a half years after returning to 1.3400 territory.

- USD/JPY marginally rebounded after yesterday's whipsawing and brief dip beneath the 143.00 level.

- Antipodeans took a breather after climbing yesterday alongside commodity gains and Chinese stimulus.

- BoC Governor Macklem said with the continued progress they have seen on inflation, it is reasonable to expect further rate cuts.

FIXED INCOME

- 10yr UST futures traded rangebound near the prior day's best levels after rebounding due to weak US Consumer Confidence data.

- Bund futures were contained after recently hitting resistance around the 135.00 level and with a Bund issuance scheduled later.

- 10yr JGB futures were indecisive and tested support near 145.00 following somewhat ambiguous Services PPI data.

COMMODITIES

- Crude futures were lacklustre after yesterday's fluctuations and failed to benefit from the draws in private sector inventory data.

- US Private Energy Inventory (bbls): Crude -4.3mln (exp. -1.4mln), Distillate -1.1mln (exp. -1.6mln), Gasoline -3.4mln (exp. -0.02mln), Cushing -0.0mln.

- BSEE reported that 16% of oil production and 11% of gas production in the US Gulf of Mexico is shut in response to tropical storm Helene. It was separately reported that theNHC said a storm surge and hurricane warnings were issued for the Gulf Coast of Florida, while it added that Helene's large size will likely cause an extensive area to be affected by the storm's hazards.

- Shell (SHEL LN) is monitoring tropical storm Helene for potential impacts to its assets and operations in the Gulf of Mexico and noted with a shift in the forecast track of the storm, they are beginning the process of restoring production at their Stones platform. Co. added that production at Appomattox continues to be curtailed and a completed removal of non-essential personnel from Appomattox as well as assets in the Mars corridor, have safely paused some of their drilling operations, while there are currently no other impacts on their production across the Gulf of Mexico.

- OPEC's 2024 World Oil Outlook stated that global primary energy demand is to increase by 24% to 2050, driven by the non-OECD, with the numbers suggesting it will lift from 301 mboe/d in 2023 to 374 mboe/d in 2050.

- Spot gold mildly extended on fresh record levels again in the aftermath of the recent dollar weakness.

- Copper futures remained underpinned amid the continued China stimulus euphoria.

CRYPTO

- Bitcoin was indecisive and eked mild gains around the USD 64,500 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC conducted a CNY 300bln 1-year MLF operation with the rate lowered to 2.00% from 2.30%.

- US hopes to discuss fentanyl with China at the APEC Summit in November.

DATA RECAP

- Japanese Services PPI (Aug) 2.70% vs. Exp. 2.60% (Prev. 2.80%)

- Australian Weighted CPI YY (Aug) 2.7% vs. Exp. 2.7% (Prev. 3.5%)

- Australian Trimmed Mean CPI YY (Aug) 3.40% (Prev. 3.80%)

GEOPOLITICS

MIDDLE EAST

- Israeli Defence Minister Gallant said they have more strikes ready against Hezbollah, while he added that they must continue until they achieve their goal and ensure the safe return of Israel's northern residents to their homes.

- Israel conducted a strike on Jiyyeh which is south of Lebanon's capital Beirut, according to security sources cited by Reuters.

- Sirens sounded in Tel Aviv and its surrounding area, as well as in central Israel, while explosions were heard in the sky of Tel Aviv caused by the interception of rockets, according to Sky News Arabia. Furthermore, Israel's military said after Tel Aviv sirens were activated a missile was detected crossing from Lebanon and was intercepted.

- Iran-backed Iraqi militia claimed responsibility for overnight drone attacks on Golan, according to Times of Israel.

- Hezbollah confirmed its senior commander Ibrahim Qubaisi was killed in an Israeli strike on Beirut, while it was separately reported that Hezbollah said it targeted Israel's Atlit navy base south of Haifa with drones.

- Hezbollah urged Iran in recent days to launch an attack against Israel as fighting between the Lebanese militant group and the Israeli military dramatically escalated, but Iran has so far refrained, according to Axios.

- Lebanon's Foreign Minister said US President Biden's UN speech was not strong and not promising, while the official added that the US is the only country that can really make a difference in the Middle East, as well as noted that Lebanon itself cannot end the fighting and needs US help despite disappointments of the past.

- Syrian air defences confronted suspected Israeli missiles that were launched towards targets in the port city of Tartous, according to Reuters sources citing the Syrian Army.

- Iran's President Pezeshkian said the international community must immediately stop the violence and work to reach a permanent ceasefire in Gaza, while he added Tehran is ready to work with parties to the 2015 Nuclear Act pact to resolve the standoff and is ready to improve ties with the world.

- Iran's President Pezeshkian met with French President Macron in what is described as a good meeting in which they discussed Gaza and a nuclear deal. Iran's President said he expects a group of countries to meet on the nuclear deal, while Macron warned Iran's President about Tehran's continued support for Russia's war in Ukraine.

- IAEA chief Grossi said he sees a willingness from Iranian officials to re-engage in a more meaningful way, while he will visit Tehran in the coming weeks and is aiming for October. Grossi said Iran is continuing the development of its nuclear programme at a regular pace and any future nuclear talks will be different from the 2015 nuclear deal with a bigger role for the IAEA expected. Furthermore, he noted the need to start preparing now for possible future negotiations between the West and Iran.

- Iran is brokering secret talks to send Russian anti-ship missiles to Yemen's Houthis, according to Reuters citing sources. The report noted that experts said this would increase the Houthis to strike Red Sea commercial shipping and raise the threat to US and allied warships, while experts also stated that Houthis could use the missiles on land to threaten Saudi Arabia.

OTHER

- China's PLA rocket force successfully launched an intercontinental ballistic missile with a simulated warhead in international waters in the Pacific Ocean with the launch said to be routine and part of the rocket force's annual training, according to Xinhua. China notified relevant countries ahead of the missile launch, while China's Defence Ministry said the launch was not directed at any country or target and was in line with international laws and practices.

- Former US President Trump was briefed by US intelligence officials regarding threats from Iran to assassinate him, according to his campaign.

EU/UK

NOTABLE HEADLINES

- ECB's Knot said the ECB is likely to continue to gradually reduce interest rates at least through the first half of 2025 but noted that rates are unlikely to return to extremely low levels and will likely end up between 2-3%.

- ECB's Nagel said they assume the German economy will slowly pick up some momentum again and what is certain is that some of these factors holding it back such as weakening growth in Germany, are only temporary. Nagel stated that the main factors behind Germany's weak growth in recent years were the energy crisis, weak foreign demand and high inflation, while he added that tight monetary policy is dampening the economy.