Europe Market Open: APAC followed gains on Wall Street, Chinese stimulus the main driver

27 Sep 2024, 07:03 by Newsquawk Desk

- APAC stocks followed suit to the gains on Wall St; Chinese stimulus remained the main driving force overnight.

- Nikkei 225 and USD/JPY upside were seen as dovish LPD candidate Takaichi is said to face Ishiba in Japan's LDP runoff.

- Fed's Cook (voter) said upside risks to inflation have diminished and downside risks to employment have increased.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.3% after the cash market closed higher by 2.4% on Thursday.

- Looking ahead, highlights include French & Spanish CPI, German Unemployment Rate, EZ Sentiment, UoM Sentiment (Final), Speakers including ECB’s Lane & Cipollone, Fed’s Collins, Kugler & Bowman, and Supply from Italy.

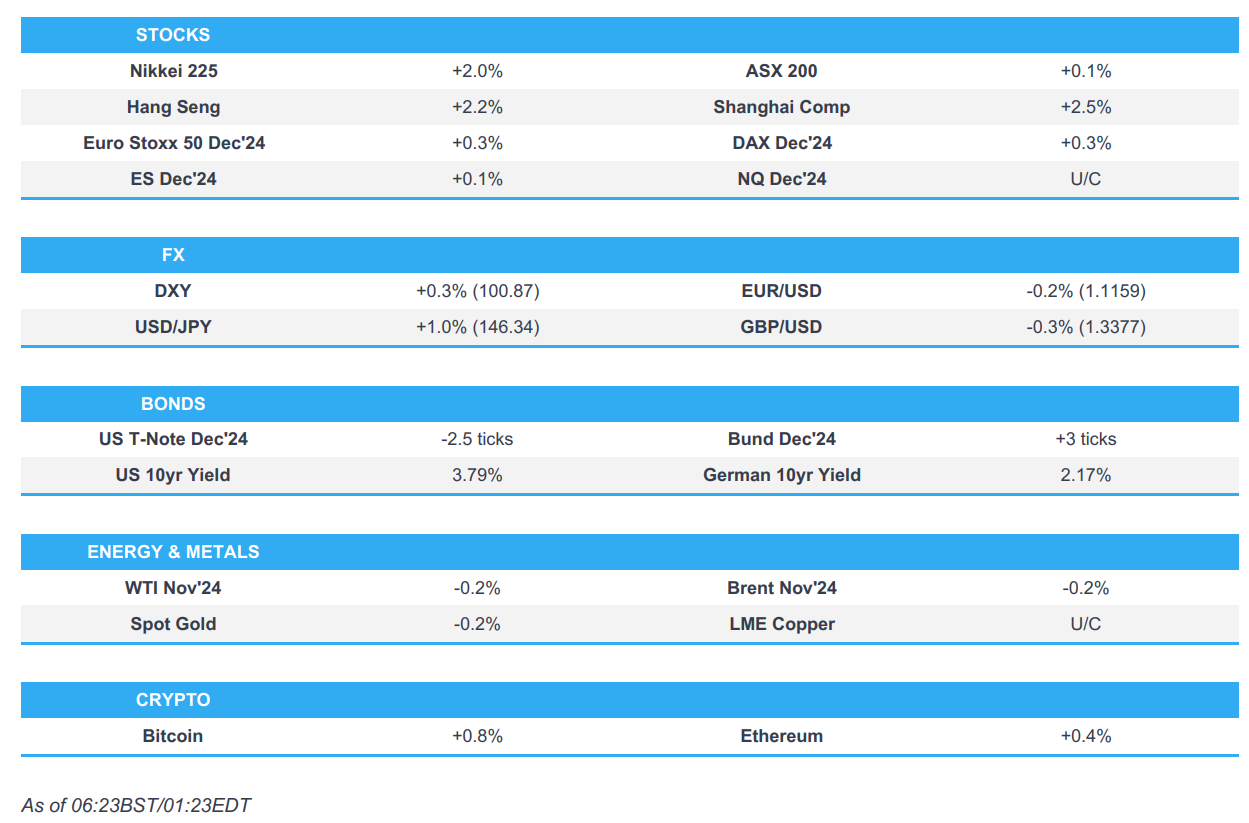

SNAPSHOT

US TRADE

EQUITIES

- US stocks finished higher in which the S&P 500 notched another record close with early momentum seen following China's continued stimulus efforts and with tailwinds from recent encouraging data releases, although the major indices were off their intraday highs amid lingering geopolitical concerns after Israel rejected the 21-day ceasefire proposal and continued its strikes on Lebanon.

- SPX +0.4% at 5,745, NDX +0.7% at 20,115, DJIA +0.6% at 42,175, RUT +0.6% at 2,210.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Cook (voter) said she wholeheartedly supported the 50bps rate cut and on the path of policy, will look carefully at the data, outlook and balance of risks. Cook said normalisation of the economy, particularly of inflation, is quite welcome and the labour market is solid but has cooled noticeably and it may become more difficult for some to find employment. Furthermore, she sees significant easing in inflationary pressure, as well as noted that upside risks to inflation have diminished and downside risks to employment have increased.

- NY Fed's Perli said there is plenty of room to further reduce the Fed's balance sheet and noted the pressures in the repo market do not currently appear to be close to the point of affecting the federal funds rate, according to Reuters.

- US President Biden signed the three-month government funding bill on Thursday to avert an imminent shutdown.

APAC TRADE

EQUITIES

- APAC stocks followed suit to the gains on Wall St where sentiment was underpinned and the S&P 500 extended on record highs owing to China's policy support and strong US data, while Chinese stimulus remained the main driving force overnight.

- ASX 200 was rangebound with strength in mining, materials and resources was counterbalanced by losses in defensives, while consumer stocks were also pressured with Star Entertainment shares down by more than 40% after its recent substantial FY loss.

- Nikkei 225 rallied at the open and climbed above the 39,000 level owing to a weaker currency. The index then pared the majority of its early gains as the JPY nursed some of its losses and with participants awaiting the LDP leadership vote, but then caught a second wind in late trade as dovish LPD candidate Takaichi is said to face Ishiba in Japan's LDP runoff.

- Hang Seng and Shanghai Comp rallied again owing to China's stimulus drive with China to issue USD 284bln of sovereign debt as part of fresh fiscal stimulus, while the securities regulator also issued guidance to promote long-term capital entering the market. Furthermore, the PBoC announced its 50bps RRR cut took effect today and set the 7-day reverse repo rate at 1.50% vs prev. 1.70%, as previously guided earlier this week.

- US equity futures were uninspired amid a lack of fresh pertinent drivers and as markets braced for the looming PCE data.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.3% after the cash market closed higher by 2.4% on Thursday.

FX

- DXY attempted to claw back some lost ground after suffering yesterday against its major peers despite recent encouraging data releases from the US. Furthermore, the recent slew of scheduled Fed speakers proved to be a damp squib as many refrained from commenting on monetary policy or the economy, while the focus for the dollar now shifts to the Fed's preferred inflation metric.

- EUR/USD marginally eased back overnight but retains a firm footing at the 1.1100 territory.

- GBP/USD partially faded some of yesterday's advances and trickled beneath the 1.3400 level.

- USD/JPY continued its upward momentum but then hit resistance around 145.50 which it later revisited and breached. Further upside in the pair was seen after dovish LPD candidate Takaichi is said to face Ishiba in Japan's LDP runoff.

- Antipodeans softened overnight after the prior day's rally with headwinds from a weaker CNH post-China rate cuts.

- Mexican Central Bank cut its interest rate by 25bps to 10.50% vs. Exp. 10.50% (Prev. 10.75%) through a 4-1 vote in favour of the 25bps cut (prev. 3-2), while it stated that looking ahead, the Board expects the inflationary environment will allow further reference rate adjustments (prev. said may allow).

FIXED INCOME

- 10yr UST futures traded lacklustre after slipping yesterday owing to firm US data releases.

- Bund futures were uneventful as trade calmed down following the recent whipsawing.

- 10yr JGB futures kept afloat but lacked conviction after Tokyo CPI data matched estimates and ahead of the LDP leadership election result, but rose in late trade as dovish LPD candidate Takaichi is said to face Ishiba in Japan's LDP runoff.

COMMODITIES

- Crude futures remained constrained after this week's selling despite the positive risk tone and Israel's rejection of a ceasefire proposal.

- BSEE reported that 25% (prev. 29%) of oil production and 20% (prev. 17%) of natgas production in the Gulf of Mexico is shut (prev. 17%) in response to Hurricane Helene.

- Spot gold was rangebound after the recent roster of Fed speakers proved to be anticlimactic, while the focus turns to PCE data.

- Copper futures were little changed and took a breather after the recent stimulus-spurred advances.

CRYPTO

- Bitcoin traded indecisively and briefly dipped beneath the USD 65,000 level before staging a mild recovery.

NOTABLE ASIA-PAC HEADLINES

- Japan Economic Security Minister Takaichi gets 181 votes in ruling party leadership race and will face off Ishiba in Japan LDP runoff. Ex-Defence Minister Ishiba gets 154 votes in LDP leadership race, both short of a majority, according to Reuters. Run-off results expected around 07:00BST. Note: Takaichi is an advocate for BoJ easing, and she had previously noted that the BoJ hiked rates too soon.

- PBoC announced its 50bps RRR cut took effect from today and said the weighted average RRR for financial institutions was now at 6.6% after the new cut, while it set the 7-day reverse repo rate at 1.50% vs prev. 1.70%, as previously guided earlier this week and injected CNY 278bln via 14-day reverse repos with the rate lowered to 1.65% from 1.85%.

DATA RECAP

- Chinese Industrial Profit YTD YY (Aug) 0.5% (Prev. 3.6%)

- Chinese Industrial Profits YY (Aug) -17.8% Y/Y (prev. 4.1%)

- Tokyo CPI YY (Sep) 2.2% vs. Exp. 2.2% (Prev. 2.6%)

- Tokyo CPI Ex. Fresh Food YY (Sep) 2.0% vs. Exp. 2.0% (Prev. 2.4%)

- Tokyo CPI Ex. Fresh Food & Energy YY (Sep) 1.6% vs. Exp. 1.6% (Prev. 1.6%)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said he had a meeting on Thursday to discuss the US ceasefire initiative and that they will continue these discussions in the coming days, according to Reuters.

- Lebanese Parliament Speaker Nabih Berri told L'Orient Le Jour newspaper that Israeli PM Netanyahu lies to everyone and retracted his approval of the initiative, while Berri said that they adhere to the revival of the demand for a ceasefire in Gaza as in Lebanon.

- US and Israeli officials held talks on Lebanon in New York on Thursday and discussions continued for a 21-day ceasefire, according to the White House. It was later reported that Secretary of State Blinken and Israeli Minister of Strategic Affairs Dermer emphasised the need for a ceasefire and Blinken underscored that further escalation of the conflict will only make that objective more difficult.

- French President Macron said the US has to increase pressure on Israeli PM Netanyahu to agree to the 21-day ceasefire, while he added Israel cannot invade Lebanon today and it would be a huge mistake, according to an interview with CBC

- Former US President Trump responded that he would do that when asked if he would make a deal with Iran if he is elected, while he also commented that the war in the Middle East has to end.

- Israeli Walla website stated the Israeli army attacked 1,600 targets in Lebanon during the past day, according to Al Jazeera.

- Israeli Air Force Chief said they will stop any arms transfer by Iran to Hezbollah and are preparing to assist troops in ground operations against Hezbollah.

- Israeli army said missiles were fired from Yemen and the interceptor was launched, while it added that the 'Arrow' aerial defence system made a successful interception.

OTHER

- US President Biden said he will strengthen Ukraine's position in future negotiations by expediting funding during his term and will deal with Ukraine's future defence needs.

- US VP Harris said her support for Ukraine is unwavering and must stand for international order and norms, while she added if they allow aggressors to take land with impunity, Russian President Putin could set his sights on Poland, the Baltic states and NATO allies.

- Former US President Trump said he will meet with Ukrainian President Zelensky on Friday and that he has some disagreements with Zelensky, while he responded "We'll see what happens" when asked if Ukraine should hand over some land to Russia to end the war.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves is prepared to water down the planned Budget tax raid on 'non-doms' amid fears it may fail to raise any money, according to people familiar with the matter cited by FT.