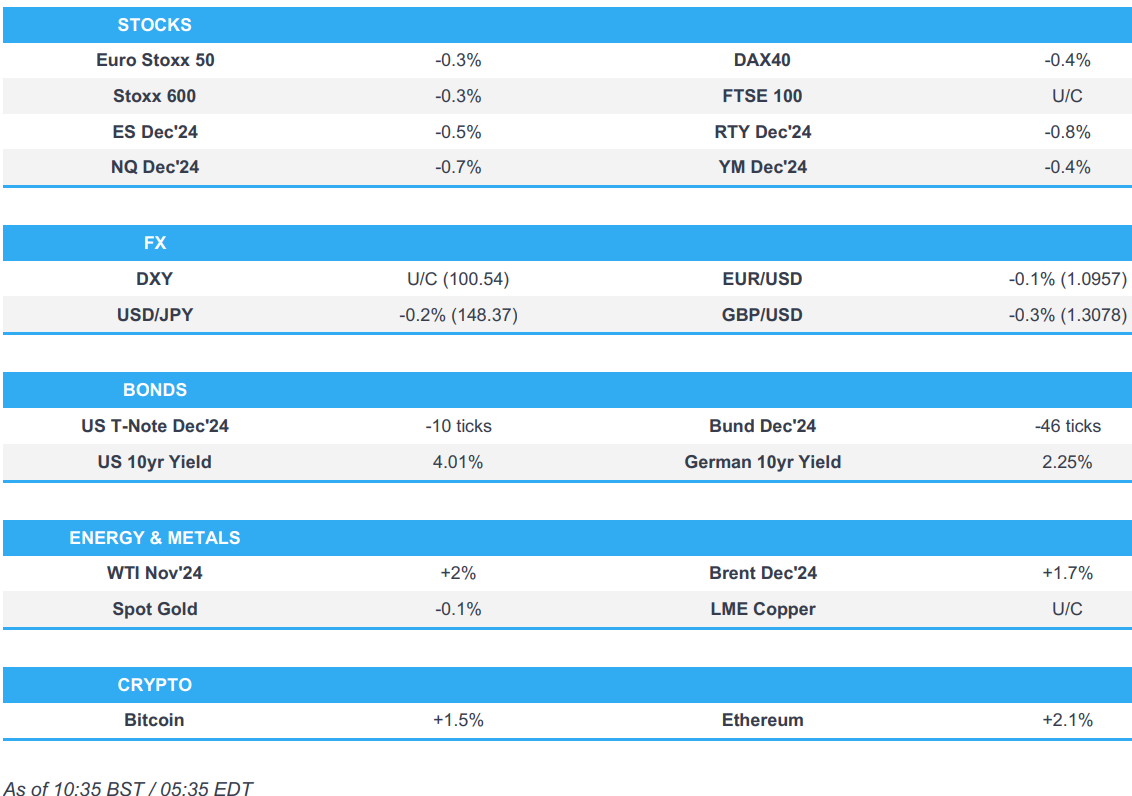

US Market Open: Equities modestly lower, US 10-year yield climbs to highest since August 8th.

- Equities are modestly lower across the board and unable to continue the post-NFP gains seen on Friday.

- Dollar is flat and attempting hold onto its recent gains, JPY firmer vs Dollar whilst the GBP narrowly underperforms.

- Bonds continue to extend on the post-NFP losses with the US 10yr yield now incrementally above 4%; highest since Aug 8.

- Crude is firmer given the geopolitical backdrop, XAU is flat whilst base metals are flat/mixed.

- Looking ahead, US Employment Trends & Consumer Credit, Speakers including ECB’s Escriva, Fed’s Kashkari, Bostic & Musalem.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.4%) began the session on a modestly firmer footing, but soon after the cash-open, sentiment soured. Indices are now mostly in negative territory and reside near session lows.

- European sectors initially opened with a modest firm bias which turned into a mixed picture within the first 15 minutes of cash trade and then mostly negative within the first half hour of trade, although no theme can be seen. Energy leads whilst Real Estate lags, given the relateively higher yield environment.

- US equity futures (ES -0.5%, NQ -0.7%, RTY -0.8%) are entirely in the red, continuing similar price action seen in Europe. US data docket ahead is light, but focus will be on Fed speak from Kashkari, Bostic & Musalem.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is net flat vs. peers following last week's surge which saw DXY pick up from a 100.17 low to a 102.68 peak post-NFP. The next upside target for DXY comes via the 103 mark; not breached since 16th August. Docket today is light, but Fed’s Kashkari, Bostic & Musalem are due to speak.

- EUR is slightly lower vs. the USD in comparison to last week's hefty losses, slipping from a 1.12 handle to a low of 1.0951 on account of the hawkish repricing at the Fed and endorsement of an October cut at the ECB. EUR/USD currently 1.0963.

- Cable is found at the foot of the G10 chart, despite the lack of fresh UK-specific drivers. GBP/USD currently trades towards the bottom end of today's 1.3072-1.3134 range.

- JPY is a touch firmer vs. the USD but gains pale into insignificance compared to the losses seen last week which drove USD/JPY from a 141.64 low to a 149.12 high overnight.

- AUD/USD is slightly lower after a bruising end to the week last week which saw the pair dragged lower onto a 0.67 handle. NZD/USD has slipped below Friday's 0.6145 low to a session trough of 0.6136. Focus for NZD is on this week's RBNZ rate decision.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are extending the downside seen in the wake of last week's unambiguously hot NFP print which saw the odds of a 25bps rate cut rise from around 65% to current levels of 93%. US data docket today is light, so focus will be on US CPI/PPI later in the week. The US 10yr yield has climbed above 4% for the first time since Aug 8.

- Bunds are on the backfoot in an extension of the price action seen late last week. As it stands, market pricing currently has a 25bps cut next week at 98% with another 25bps cut in December fully priced. The German 10yr yield has climbed as high as 2.252%; highest since 4th September.

- Gilts are extending their downside with the Dec'24 contract at its lowest level since July. In terms of fresh UK drivers, there hasn't been a great deal to go off over the weekend and that could remain the case throughout the week with Friday's GDP print the main highlight. The UK 10yr yield has been as high as 4.189%; highest since July 4th.

- Click for a detailed summary

COMMODITIES

- Crude is firmer across the board and extending on gains amid the backdrop of heightened geopolitics on the first anniversary of the Israel-Hamas conflict, which has broadened to include Lebanon (with a new "focused and specific" ground operation in Southern Lebanon announced today), whilst an Israeli retaliation on Iran also looms. Brent Dec resides in a USD 77.23-78.85/bbl parameter.

- Mixed trade across precious metals with the complex failing to gain on geopolitics this morning, but likely taking a breather after the NFP-induced volatility on Friday. Spot gold resides in a current USD 2,639-2,656.44/oz range

- Flat/mixed base metals complex with copper futures rangebound on either side of USD 10k following a similar overnight session despite the mostly positive risk tone in APAC which later faded in Europe. 3M LME copper resides currently in a USD 9,928.00-10,023.00/t parameter.

- Saudi Arabia set the November Arab Light Crude Official Selling Price to Asia at a premium of USD 2.20 vs Oman/Dubai and to NW Europe at minus USD 0.45/bbl vs ICE Brent, while it set the OSP to the US at plus USD 3.90/bbl vs ASCI.

- Qatar set the November Marine Crude Official Selling Price at a premium of USD 1.00/bbl vs Oman/Dubai and Land Crude OSP at a premium of USD 0.85/bbl vs Oman/Dubai.

- Iraq’s Kerala refinery is undergoing extensive maintenance which started on September 25th and is currently non-operational with the maintenance expected to last for around a month, according to a source with direct knowledge cited by Reuters.

- Goldman Sachs sees Brent to trade in the USD 70-85/bbl range and forecasts an average price of USD 77/bbl in Q4 2024 and USD 76/bbl for 2025. Goldman Sachs added that assuming a 2mln bpd 6-month disruption to Iranian supply, it estimates that Brent could temporarily rise to a peak of USD 90/bbl if OPEC rapidly offsets the shortfall.

- NHC said Milton is strengthening over the Southern Gulf of Mexico, storm surge and and hurricane watches issued for portions of Florida

- NHC said tropical storm Milton is about 845 miles west-southwest of Tampa Florida and that the risk of life-threatening impacts is increasing for portions of Florida's west coast, while NHC said Milton is expected to become a major hurricane in the next day or so.

- BP (BP/ LN) abandons 2030 oil and gas output reduction targets, via Reuters citing sources; BP eyes investments in Iraq, Kuwait and Gulf of Mexico to boost oil output in the coming years.

- Shell (SHEL LN) Q3 update note: The Chemicals sub-segment adjusted earnings are expected to reflect a marginal loss in Q3 2024.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Industrial Orders MM (Aug) -5.8% vs. Exp. -2.0% (Prev. 2.9%)

- UK Halifax House Prices MM (Sep) 0.3% vs. Exp. 0.4% (Prev. 0.3%)

- EU Sentix Index (Oct) -13.8 vs. Exp. -15.9 (Prev. -15.4)

- UK BBA Mortgage Rate (Sep) 7.69% (Prev. 7.83%)

- EU Retail Sales MM (Aug) 0.2% vs. Exp. 0.2% (Prev. 0.1%); Retail Sales YY (Aug) 0.8% vs. Exp. 1.0% (Prev. -0.1%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves seeks to reassure investors that guardrails will be placed around extra borrowing for investment and confirmed she was looking to revise her fiscal debt rule to take account of the benefits of investment and not just the costs, according to FT. It was also reported that Chancellor Reeves is to spare private equity bosses from the top 45p tax rate in the upcoming Budget as she looks for a compromise agreement to close tax loopholes that won't drive investors out of Britain.

- UK PM Starmer's Chief of Staff Sue Gray resigned on Sunday citing concerns about increasing news reports regarding her salary and role risk becoming a distraction to the government, according to AP.

- UK ministers were warned that power market reforms pose a danger to the industry and investment with trade groups warning proposals for regional pricing could risk deindustrialisation and higher costs, according to FT.

- UK's job market continued to show more cooling in September as a survey by REC and KPMG showed growth in starting pay for people hired in permanent roles was at the slowest since February 2021.

- ECB's Villeroy said the ECB will quite probably cut rates in October due to the rising risk of inflation undershooting the 2% target, according to a La Repubblica interview.

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- "Israeli media: Raising the state of high alert as more rockets expected from Gaza", according to Al Jazeera.

- Israel opposition leader Lapid calls to attack Iran’s oil facilities, via Walla News's Elster.

- Hamas claims the latest strike on Tel Aviv and Rishon Lezion, via Al Jazeera. These rockets were reportedly fired from Gaza. Five rockets fired at the Tel Aviv area and Iron Dome were detected, some of which were intercepted. Israel media report "A number of people injured as a result"

- "Palestinian resistance factions: There is still a lot of strategic consequences for the enemy in the coming days", according to Al Jazeera.

- "IDF announces the start of a focused and specific ground operation in southern Lebanon", according to Al Arabiya

MIDDLE EAST

- Israel conducted a strike on a mosque in Deir Al-Balah in the central Gaza Strip over the weekend which killed at least five people and wounded 20, according to Reuters.

- Israel continued its wave of airstrikes on Lebanon in what was the heaviest 24 hours of bombing since it stepped up its campaign against Hezbollah, according to a report on Sunday by FT.

- Lebanese media reported rocket barrages fired from Lebanon towards the Galilee and the Haifa area in Israel, according to Asharq News. Furthermore, sources reported a direct hit on a restaurant in Haifa, Israel after rockets were fired by Hezbollah from southern Lebanon and Israel's ambulance service separately announced 10 were wounded after Hezbollah fired rockets at Haifa, including one in serious condition.

- Israel’s military issued new evacuation alerts on Sunday for areas in southern Lebanon, while it separately announced that areas of Manara, Yiftah and Malkia in northern Israel declared a closed military zone, according to Reuters.

- Israel’s military announced changes to the Home Front defensive guidelines which apply to several areas including communities near the Gaza Strip in which gatherings of up to 2,000 participants will be permitted and the activity scale will be changed to partial activity in a number of central Galilee communities, while the rest of the country’s guidelines remain unchanged, according to Reuters.

- Israeli military spokesperson said their response to Iran’s missile attack will come at the timing that Israel decides is best, while the spokesperson confirmed that two Israeli airbases were hit in Iran’s attack on Tuesday but noted its air force and the bases remain fully operational, according to Reuters.

- Israel’s military said Hamas official Muhammad Hussein Ali Al-Mahmoud who served as Hamas’s executive authority in Lebanon and Hamas military wing in Lebanon member Said Alaa Naif Ali were killed by an Israeli air strike and operation on Saturday. It was also reported that a Lebanese security source said Hezbollah leader Hashem Safieddine was ‘unreachable’ since Israeli air strikes on Friday.

- Hamas official said Israel is blocking a ceasefire agreement despite Hamas’s flexibility and urged world countries to stop the double-standards policy over Gaza and Lebanon, according to Reuters.

- Hezbollah political official Qmati said Hezbollah is now being jointly led internally and picking a new Secretary-General will take some time, while he responded that Israel is not allowing a search to progress when asked about the fate of Hezbollah’s senior official Hashem Safieddine.

- Iranian security officials said Quds Force commander Esmail Qaani, who travelled to Lebanon, has not been heard from since Israeli strikes on Beirut last week, according to Reuters.

- Iran’s Oil Minister said he was not worried about the crisis amid reports of Israeli threats to strike Iran’s oil facilities, according to Reuters.

- Iran’s Mehr news agency cited an official who stated all flights were cancelled in Iran’s airports from Sunday at 21:00 (18:30BST/13:30EDT) to Monday at 06:00 (03:30BST/22:30EDT). However, it was later reported that all flight restrictions were lifted after ensuring favourable and safe conditions.

- Syria confronted hostile targets in the central region, according to state TV.

- US Defense Secretary Austin spoke with Israel's Defence Minister Gallant on Sunday to discuss Iran's destabilising actions in the Middle East and the current situation with Lebanon and Gaza, while they reiterated commitment to deterring Iran and Iranian-backed partners and proxies from taking advantage of the situation, according to the Pentagon.

- US Secretary of Defense Austin will host Israeli Defence Minister Gallant at the Pentagon on October 9th to discuss the ongoing Middle East security developments.

- US State Department commented regarding the latest Israeli bombing of Lebanon in which it stated that military pressure at times can enable diplomacy but could also lead to miscalculation and that Israel has a right to pursue extremist targets but civilian infrastructure should not be targeted. Furthermore, it stated that the US is continuing discussions with Israel and that the US goal is to reach a ceasefire to provide space for diplomacy, according to Reuters.

OTHER

- Ukraine’s air forces said on Sunday morning that Russia launched 87 drones and 3 missiles at Ukraine.

- Russia took control of the settlement of Zhelanne Druhe in Ukraine, according to IFX.

- Netherlands’s Defence Minister pledged EUR 400mln for a drone action plan with Ukraine.

- Chinese hackers reportedly breached US court wiretap systems, according to WSJ.

- Philippine President Marcos said the Philippines and South Korea elevated relations to strategic partnership and he exchanged views with South Korea's President on regional and international issues including the South China Sea and the Korean Peninsula. Furthermore, South Korean President Yoon said South Korea concurred with the Philippines a strategic partnership on the security front and will actively take part in Philippine military modernisation.

- China is reportedly likely to launch military drills this week near Taiwan, according to Reuters citing Taiwanese officials, coinciding with Taiwanese President Lai's speech on October 10th

CRYPTO

- Bitcoin gains and climbs above USD 63k, with Ethereum just shy of the USD 2.5k mark.

APAC TRADE

- APAC stocks began the week on the front foot following last Friday's gains on Wall St owing to the blockbuster jobs report, while Japanese stocks led the advances on the back of recent currency weakness.

- ASX 200 shrugged off early indecision as strength in tech, financials and miners picked up the slack from weakness in defensives.

- Nikkei 225 gapped above the 39,000 level with the rally facilitated by recent JPY weakness, while a Reuters analysis report suggested that a preference by Japan's new leadership for loose monetary policy raises the hurdle for rate hikes.

- Hang Seng climbed at the open ahead of tomorrow's resumption of trade in the mainland and the NDRC's news conference to discuss implementing a package of policies to promote economic growth, although the gains were initially capped by weakness in some property stocks and China-EU tariff frictions.

NOTABLE ASIA-PAC HEADLINES

- Chinese officials will brief on economic policy implementation with the state planner to conduct a news conference on Tuesday at 10:00 local time (03:00BST/22:00EDT).

- Chief China correspondent at the WSJ posted on X "Source in Beijing told me there are lots of 'misunderstandings in the market' about what China will do next to support growth. Yes, some fiscal measures “in the pipeline” but nothing as big as some had speculated".

- Japanese Finance Minister Kato said a weak yen has both merits and demerits, while he added that they will need to monitor how excessive forex moves will affect corporate activities and households.

- UMC (2303 TW) Sept (TWD) Sales 18.94bln, -0.58% Y/Y.

- BoJ Osaka Branch Manager said firms in Kansai region all share the view that FX moves should be moderate; expects more firms to strive towards raising wages next year.

- BYD (002594 CH) said new energy vehicle sales volume for September was 419,426 units (prev. 287,454 Y/Y).

- Samsung Electronics (005930 KS) CEO says he is not interested in spinning off foundry or system LSI business; adds new chip factory project in Texas is tough due to changing situation.

DATA RECAP

- Chinese FX Reserves (USD)(Sep) 3.316tln vs. Exp. 3.304tln (Prev. 3.288tln)

- China Gold Reserves (Oz)(Sep) 72.8mln (prev. 72.8mln)

IDF said on Monday that it is targeting Hamas sites and rocket launchers throughout the Gaza Strip and it attacked a Hamas command and control post at the Al-Aqsa Martyrs Hospital. It was also reported that four projectiles were fired from Gaza as Israel began October 7 commemorations, according to AFP. Furthermore, Israeli media reported sirens sounded in Tel Aviv for fear of infiltration of drones and the Israeli military also announced that sirens sounded in Rishon Letsiyon in central Israel.

MIDDLE EAST

"IRGC commander: We are committed to the Supreme Leader's strategy of not being complacent and not rushing to respond to enemy movements", according to Al Jazeera