US Market Open: US futures mixed ahead of Fed speakers; dollar firmer and bonds pressured

21 Oct 2024, 11:11 by Newsquawk Desk

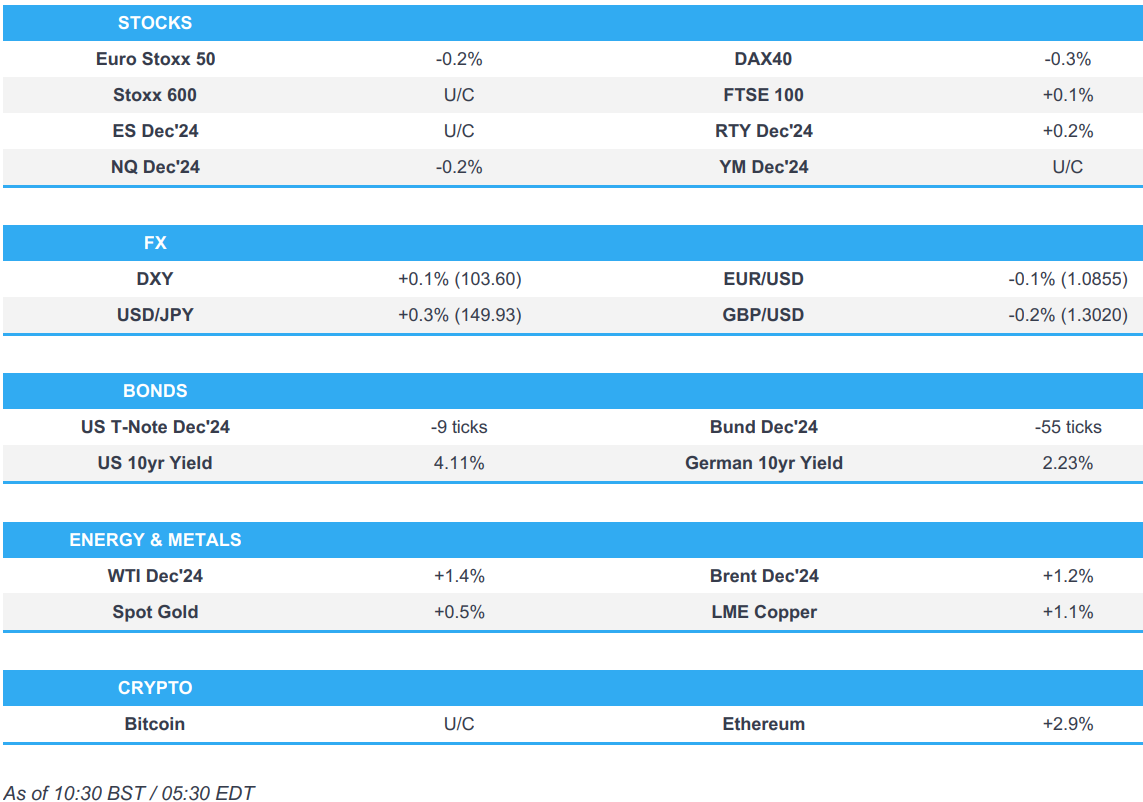

- European bourses are generally trading in negative territory, but the FTSE 100 remains afloat owning to gains in Energy/Mining names; US futures are mixed.

- Dollar is firmer, JPY underperforms with USD/JPY attempting to test 150 to the upside.

- Bonds are entirely in the red, Bunds were initially lifted by soft German producer prices, but ultimately succumbed to selling pressure.

- Crude climbs higher attempting to recoup some of the prior week’s losses, XAU & base metals continue to advance.

- Looking ahead, Fed's Logan, Kashkari & Schmid, Earnings from SAP.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (U/C) began the session with a slight negative bias, and generally opened just below the unchanged mark. Stocks attempted to tilt higher soon after the cash open, but have since dipped off best levels to display a generally negative picture in Europe.

- European sectors are mixed and with the breadth of the market fairly narrow. Energy takes the top spot, alongside Basic Resources. Insurance is found at the foot of the pile.

- US Equity Futures (ES U/C, NQ -0.2%, RTY +0.2%) are mixed, with very slight underperformance in the NQ. Catalysts today have been light and the docket ahead remains thin.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is broadly stronger vs. peers; for now, the index is below Friday's 103.80 peak which coincides with the 200DMA.

- EUR a touch softer vs. the USD after what has been a bruising run for the pair as of late, given a dovish ECB repricing, more hawkish Fed pricing and markets leaning towards a potential Trump presidency. EUR/USD hit resistance at its 200DMA at 1.0871 and has since drifted to a low at 1.0847.

- GBP is softer against the USD and to a lesser extent the EUR. Docket ahead is quiet, but a slew of BoE speakers are due throughout the week. For now, Cable is tucked within Friday's 1.3008-71 range.

- JPY is softer vs. the USD. However, USD/JPY remains sub-150 after venturing as high as 150.31 last week.

- Antipodeans are both softer vs. the broadly firmer USD in quiet newsflow. AUD/USD has failed to sustain a move above the 0.67 mark and has since slipped below its 100DMA at 0.6695 and Friday's 0.6692 trough.

- PBoC set USD/CNY mid-point at 7.0982 vs exp. 7.0990 (prev. 7.1274).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are modestly lower but holding at a 112-00 trough which equals last Thursday’s base with support at 111-31 and 111-29+ below that.

- Bunds are softer despite experiencing a modest tick higher to a 134.18 session peak on cool German producer price metrics for September. The upside ultimately proved fleeting, with Bunds slipping to a current trough of 133.61. ECB speak today has had little impact on prices.

- Gilts gapped lower at the open and continued to extend losses, in tandem with weakness seen across the complex. Gilts are currently trading at a session trough of 97.61.

- Click for a detailed summary

COMMODITIES

- Crude oil is modestly firmer with geopolitical tensions remaining in full focus as we await a response from Israel following Iran's attacks; elsewhere, over the weekend, tensions have been exacerbated by a reported drone attack on the (empty) residence of Israel PM Netanyahu. Brent'Dec currently towards the upper end of a USD 72.80-73.99/bbl range.

- Gold is in the green, gleaning support from the above geopolitical tensions. At a USD 2733/oz peak, which marks yet another ATH for the yellow metal.

- Base metals are firmer owing to the move higher seen in mainland China on the back of the (widely expected) PBoC LPR cut with the metals also seeing strength in APAC hours owing to the tone from Friday.

- Saudi Aramco's CEO said the world must accelerate the development of new energy sources and lower carbon technologies that can compete on price and performance, while he added that they are fairly bullish on China and oil demand, as well as see some more demand for jet fuel and NAPTHA, especially for crude to chemical projects.

- IEA's Birol said more than 25% of global energy demand growth is to come from SE Asia in the next 10 years.

- Shell (SHEL LN) said there was an oil leak from a pipeline at Shell Energy and Chemicals Park in Singapore and it activated emergency response specialists to help manage the situation.

- Turkmenistan signed a deal with Iraq to supply 20mln cubic metres of gas daily.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Rightmove House Price Index MM (Oct) 0.3% (Prev. 0.8%); YY 1.0% (Prev. 1.2%)

- German Producer Prices MM (Sep) -0.5% vs. Exp. -0.2% (Prev. 0.2%); YY -1.4% vs. Exp. -1.0% (Prev. -0.8%)

NOTABLE EUROPEAN HEADLINES

- ECB’s Holzmann said on Friday they are on track to getting inflation under control and that the rate decision in December will depend on the data.

- ECB’s Villeroy said they are on a good way to defeating inflation which is good news and there may be some temporary rebounds in the coming months although this would be due to technical effects, while he added that there will probably be more rate cuts and they will decide depending on the data.

- ECB's Vasle said that back-to-back rate cuts are no indication of future ECB action, according to the FT.

- ECB's Simkus says if disinflation becomes entrenched, rates could go below the natural level.

- ECB's Kazaks says inflation is continuing to decline whilst the economy is weak; rates will continue to decline as inflation declines. ECB rate cuts cannot bring sustainable growth. Rates are still inhibiting economic growth.

- S&P affirmed the UK’s rating at AA; Outlook Stable, while Fitch affirmed Sweden at AAA: Outlook Stable, affirmed Sweden at AAA; Outlook Stable and affirmed Italy at BBB: Outlook revised to Positive from Stable.

NOTABLE US HEADLINES

- IAM union said regarding negotiations with Boeing (BA) that the latest proposal includes a 35% general wage increase spread over 4 years and that Boeing workers will receive a one-time ratification bonus of USD 7,000, according to Reuters. It was also reported that Boeing is exploring asset sales that could bring in much-needed cash while shedding non-core underperforming units and reached a deal to offload a small defence subsidiary that makes surveillance equipment for the US military, according to WSJ.

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said a drone attack which targeted his home in northern Israel was a "grave mistake", while he and his family were not at their house when the drone attack struck on Saturday and there were no casualties.

- Israeli PM Netanyahu spoke with former US President Trump and told him that Israel considers the issues the US administration raises but will make decisions based on its national interests.

- Israel’s military said it attacked Hezbollah’s intelligence HQ and weapons storage facilities in the southern suburbs of Beirut on Saturday. It was also reported that Israel conducted a fresh raid on the southern suburbs of Beirut on Sunday, as well as targeted the city of Tyre and the towns of Bir al-Salasil and Homine al-Fawqa in southern Lebanon.

- Israeli military spokesperson had warned on Sunday that they would conduct targeted strikes on sites belonging to Hezbollah’s financial arm across Lebanon and urged Lebanese residents to evacuate areas near those facilities, while it was later reported that Israeli strikes hit branches of Hezbollah-linked bank in Beirut and Beqaa Valley, according to Times of Israel.

- Hezbollah announced it conducted a rocket barrage at Beit Hillel base, while it was separately reported that Iraqi armed factions announced the targeting of an Israeli military site in the Golan with drones.

- Israel gave the White House its demands for ending the war in Lebanon, while US President Biden's envoy Amos Hochstein will visit Beirut on Monday to discuss a possible diplomatic solution with Lebanese officials, according to Axios. The report noted one Israeli demand is that IDF be allowed to engage in "active enforcement" to ensure Hezbollah doesn't rearm and Israel also demands its air force have freedom of operation in Lebanese airspace, although a US official said it is highly unlikely Lebanon and the international community would agree to Israel's conditions.

- Iran's Supreme Leader said Hamas leader Sinwar’s death will not halt the axis of resistance and Hamas will live on.

- Iranian Foreign Minister Araghchi alluded to the US and warned that anyone who knows how and when Israel will attack Iran will be held accountable, according to Reuters.

- US House Speaker Johnson said on Sunday that there would be a classified briefing related to leaked US intelligence on Israel-Iran, according to Reuters.

- US Defence Secretary Austin said he would like to see Israel scale back on some of its strikes in and around Beirut, while he raised the issue about UNIFIL security with Israel’s Defence Minister Gallant. Furthermore, Austin reviewed the US defence posture and said he is relieved that PM Netanyahu is safe, while he said he couldn’t confirm reports that North Korean troops are in Russia and readying for combat in the Ukraine war, according to Reuters.

- UN peacekeeping force UNIFIL said an Israeli army bulldozer demolished a watchtower and fence surrounding the UN site in southern Lebanon on Sunday, according to Reuters.

- G7 defence ministers reaffirmed the importance of supporting UNIFIL and the Lebanese armed forces in their role of ensuring the stability and security of Lebanon, while they called on Iran to refrain from providing support to Hamas, Hezbollah, Houthis and other non-state actors. Furthermore, they called on Houthis to immediately cease their escalatory measures that increase regional instability and immediately release the vessel Galaxy Leader and its crew.

OTHER

- Russia's Kremlin say informal meeting between Putin and UAE president went on until midnight. "North Korea is our close neighbour, our partner and we are developing relations in all areas". Kremlin do not comment on claims that North Korea is sending troops to Russia. "Ties with North Korea are not directed against other countries".

- Ukrainian President Zelensky thanked countries that 'do not close their eyes' to North Korean involvement in Ukraine's war with Russia and seeks a normal, honest and strong reaction from them, according to Reuters.

- Russian Foreign Minister Lavrov said recent statements by US President Biden on being ready for nuclear talks with Russia without preconditions are deception and he does not see signs at this moment that Moscow and Washington will return to talks on equal terms after the US presidential election, according to RIA.

- G7 defence ministers expressed deep concern at China’s support to Russia which is enabling Russia to maintain its illegal war in Ukraine, while the defence ministers said they support Ukraine on its irreversible path to full Euro-Atlantic integration including NATO membership.

- North Korean Foreign Minister said the new US-led sanctions monitoring team is unlawful, according to KCNA.

CRYPTO

- Bitcoin is flat and resides around USD 68.4k, taking a breather from the recent strength seen over the past few days.

APAC TRADE

- APAC stocks began the week mixed, mostly positive although gains were capped by the lack of fresh macro catalysts from over the weekend and after China lowered its benchmark Loan Prime Rates as widely expected.

- ASX 200 was led by outperformance in the mining, resources and materials sectors.

- Nikkei 225 edged mild gains on a reclaim of the 39,000 level although the upside was limited by currency strength.

- Hang Seng and Shanghai Comp were mixed with the Hong Kong benchmark subdued and weakness in tech and casino stocks, while the mainland index edged higher after the PBoC announced a 25bps cut to China's benchmark LPRs.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (Oct) 3.10% vs. Exp. 3.10-3.15% (Prev. 3.35%)

- Chinese Loan Prime Rate 5Y (Oct) 3.60% vs. Exp. 3.60-3.65% (Prev. 3.85%)

- China-based DJI sues the US government for adding the drone manufacturer to the list of companies allegedly working with the Chinese military.

- US Republican Presidential Candidate Trump said he would impose tariffs on China if China went into Taiwan, according to a WSJ interview.

- Key US lawmakers urged Japan to strengthen restrictions on sales of chipmaking equipment to China and warned that if Tokyo fails to act, Washington could impose its own curbs on Japanese companies or bar toolmakers that sell to China from receiving US semiconductor subsidies.