Europe Market Open: Mixed trade with drivers limited as traders await Israel's response; earnings ahead

23 Oct 2024, 07:00 by Newsquawk Desk

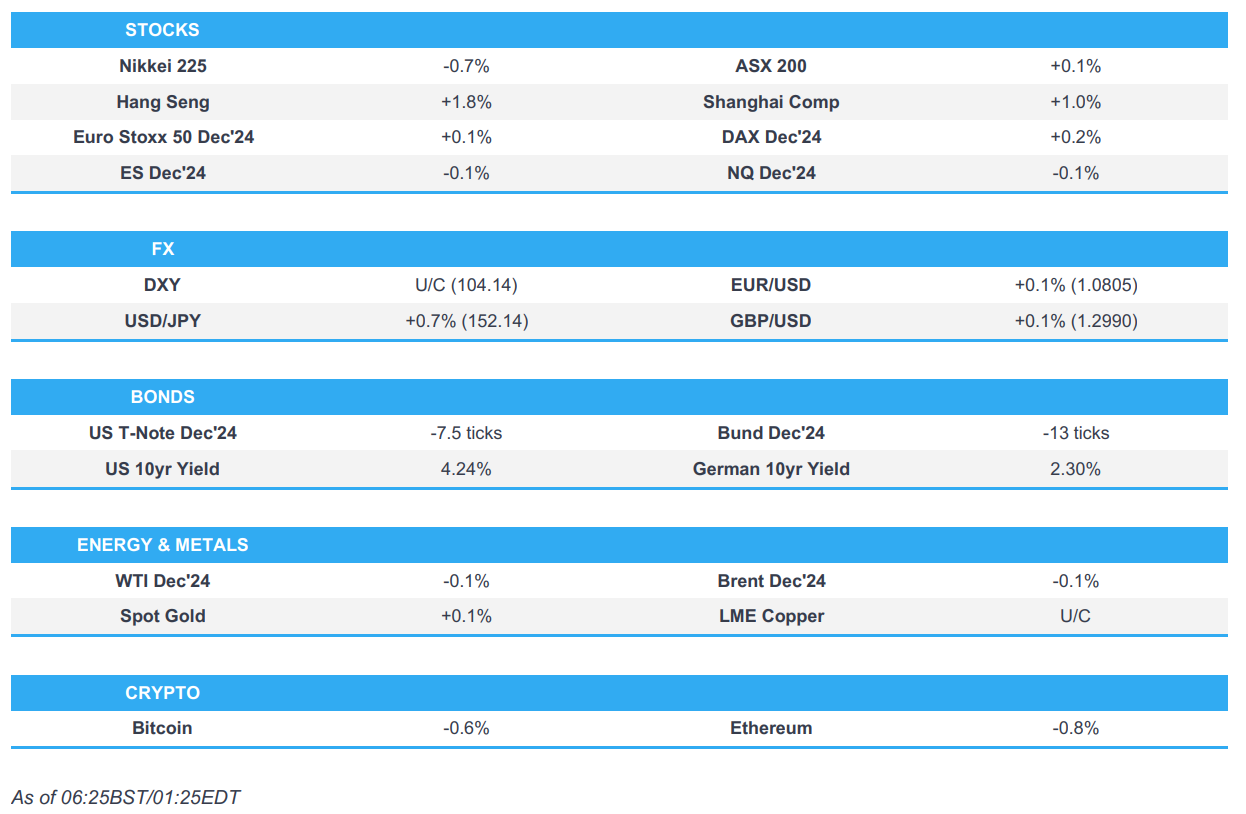

- APAC stocks were ultimately mixed with the upside capped following the inconclusive performance on Wall St amid a lack of fresh macro drivers, recent upside in yields and ongoing geopolitical tensions.

- ECB policymakers are beginning to debate whether rates will have to go below neutral level in the current easing cycle, according to sources cited by Reuters.

- Israel’s army completed its preparations to attack Iran, and it seems that it will be within days, according to Israel's Channel 12 citing two sources.

- European equity futures are indicative of a flat/firmer cash open with the Euro Stoxx 50 future +0.1% after the cash market closed flat on Tuesday.

- Looking ahead, highlights include US Existing Home Sales, BoC Policy Announcement, Comments from BoE's Breeden & Bailey, Fed's Bowman, ECB's Lagarde, Lane & Cipollone, RBNZ's Governor Orr, BoJ Governor Ueda, BoC's Macklem & Rogers. Supply from UK, Germany & US.

- Earnings from Michelin, Carrefour, Heineken, Akzo Nobel, Deutsche Bank, Volvo Car, Iberdrola, Barratt, Redrow, WPP, Reckitt Benckiser, Roche, AT&T, Boston Scientific, GE Vernova, Coca-Cola, Roper Technologies, General Dynamics, Boeing, T-Mobile US, Tesla, IBM & ServiceNow.

SNAPSHOT

US TRADE

EQUITIES

- US stocks were choppy and the major indices ultimately finished little changed on the day amid a lack of any fresh major macro catalysts and with participants tentative as they continued to await Israel's response to Iran. Sectors were mixed following a deluge of earnings with Industrials and Materials the laggards as the former was weighed on by disappointing GE Aerospace and Lockheed Martin earnings, while Consumer Staples was the notable outperformer. Furthermore, geopolitics remained in the spotlight with sources noting the Israeli army has completed its preparations to attack Iran and it seems that it will be within days.

- SPX -0.05% at 5,851, NDX +0.11% at 20,384, DJIA -0.02% at 42,925, RUT -0.37% at 2,232

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Daly (voter) commented on X that the economy is in a better place, inflation has fallen substantially and the labour market has returned to a more sustainable path, while she added that risks to goals are now balanced which is a significant improvement from two years ago. Furthermore, she stated that work to achieve a soft landing is not fully done and they are resolute to finish that job, but noted it cannot be all they are after and ultimately must strive for a world where people aren’t worried about inflation or the economy.

- Former President Trump said he would make car interest payments fully tax deductible if they are domestically built.

- Bill Gates privately said he has backed VP Harris with a USD 50mln donation, according to NYT.

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed with the upside capped following the inconclusive performance on Wall St amid a lack of fresh macro drivers, recent upside in yields and ongoing geopolitical tensions.

- ASX 200 traded rangebound with strength in consumer stocks offsetting the underperformance in tech and energy.

- Nikkei 225 was the laggard as it failed to benefit from a weaker currency and a surge in Tokyo Metro shares on its debut.

- Hang Seng and Shanghai Comp advanced with risk appetite supported as participants digested earnings releases and after the PBoC upped its liquidity effort, while a Chinese policy think tank called for the issuance of CNY 2tln in special treasury bonds to establish a stock market stabilisation fund.

- US equity futures remained subdued following the prior day's choppy mood with some late headwinds after Starbucks reported weak sales and McDonald's was linked to an E. coli outbreak.

- European equity futures are indicative of a flat/firmer cash open with the Euro Stoxx 50 future +0.1% after the cash market closed flat on Tuesday.

FX

- DXY held on to yesterday's mild gains after it recently reclaimed the 104.00 level which was facilitated by the slight upside in yields but with price action quiet amid a lack of fresh catalysts and a sparse calendar.

- EUR/USD attempted to nurse some of its losses after briefly dipping beneath the 1.0800 level alongside a plethora of ECB rhetoric which continued to point to more cuts ahead, while more comments are scheduled later including from Lagarde and Lane.

- GBP/USD struggled for direction and remained beneath the 1.3000 level in the absence of significant drivers.

- USD/JPY extended on gains and breached 152.00 for the first time since July with the help of a firmer dollar and US yields

- Antipodeans conformed to the mostly uneventful mood across the FX amid a quiet calendar and somewhat mixed sentiment.

FIXED INCOME

- 10yr UST futures remained subdued after the prior day's choppy performance and mild upside in yields with demand constrained amid a lack of fresh fundamental catalysts and heading into the latest US 20yr auction.

- Bund futures languished beneath the 133.00 level following the recent slide to multi-month lows, with bund supply ahead.

- 10yr JGB futures were restrained by recent selling in global peers and after the 40yr JGB yield reached its highest since 2008.

COMMODITIES

- Crude futures slightly softened after gaining yesterday on the back of geopolitical updates including reports that Israel’s army completed preparations to attack Iran which seemingly could be within days, while the latest private inventory data showed a larger-than-expected build in headline crude stockpiles.

- Private inventory data (bbls): Crude +1.6mln (exp. +0.3mln), Distillate -1.5mln (exp. -1.7mln), Gasoline -2mln (exp. -1.2mln), Cushing -0.2mln.

- Spot gold swung between gains and losses in which it gradually pulled back after stalling just shy of the USD 2,750/oz level, before rebounding late in the session to breach the key aforementioned level and print a new record high.

- Copper futures were on the back foot in tandem with the mild retreat across the commodities complex but with the downside cushioned amid the constructive mood in China.

CRYPTO

- Bitcoin was subdued and trickled lower to test the USD 67,000 level to the downside.

NOTABLE ASIA-PAC HEADLINES

- Chinese policy think tank CASS called for Beijing to issue CNY 2tln of special treasury bonds to set up a stock market stabilisation fund, according to 21st Century Business Herald.

GEOPOLITICS

MIDDLE EAST

- Israel’s army completed its preparations to attack Iran and it seems that it will be within days, according to Israel's Channel 12 citing two sources.

- Israeli PM Netanyahu said in a meeting with US Secretary of State Blinken that there is a need to lead to a security and political change in the north, which would allow Israel to return its residents safely to their homes. Netanyahu added that the killing of Hamas leader Sinwar may have a positive effect on the return of Israeli hostages, the achievement of all the goals of the war, and the day after.

- US Secretary of State Blinken, in meeting with Israeli PM Netanyahu, underscored the need to capitalise on Israel's action to bring Sinwar to justice by securing a hostage release and ending the conflict in Gaza. Furthermore, Blinken sought during his meeting with Israeli PM Netanyahu to soften the response to Iran, according to Al Jazeera citing Israel's Channel 13.

- US Secretary of State Blinken and Israeli PM Netanyahu discussed the concrete steps to capitalise on the death of Hamas leader Sinwar, a senior US official told Reuters. Blinken made it clear that Israel's humanitarian aid steps so far have not been sufficient and Israeli leaders committed to act upon US requests laid out in Blinken's letter on the need for more humanitarian aid. Furthermore, Blinken will no longer go to Jordan on Wednesday but he will be traveling to Saudi Arabia.

- White House said Israel must respond to the Iranian attack and it will not review what they will do, according to Al Jazeera.

- Pentagon said it cannot provide information regarding the Israeli attack on Iran and it is consulting with partners in the region in order to de-escalate, according to Al Jazeera.

- Israel's army confirmed the killing of late Hezbollah leader Nasrallah's presumed successor Hashem Safieddine.

- Israel will continue to attack Hezbollah even after the end of the operation in Lebanon until it withdraws behind the Litani, according to Sky News Arabia citing comments by Galant to Blinken.

- IDF spokesman said the Israeli Air Force intercepted a drone in Syrian airspace launched from the east. It was also reported that Israeli military said it intercepted two UAVs that crossed into Israel's waters in the area of Eilat, while Islamic Resistance in Iraq announced it targeted Israel's Eilat with drones.

- Palestinian media reported continuous aerial and artillery shelling on different areas in the northern Gaza Strip, as well as heavy Israeli shelling on Rafah in the southern Gaza Strip, according to Asharq News.

OTHER

- North Korean leader Kim inspected strategic missile bases, according to KCNA.

EU/UK

NOTABLE HEADLINES

- ECB policymakers are beginning to debate whether rates will have to go below neutral level in the current easing cycle, according to sources cited by Reuters.

- UK Chancellor Reeves is expected to impose national insurance on employer's pension contribution in the Budget, according to The Times. It was separately reported that the UK Treasury is to slash overseas aid in the Budget as asylum seeker costs rise, according to FT.

- ECB's Rehn said the growth outlook has weakened and this could increase disinflationary pressures. Rehn added that rate cuts are coming with the speed and scope to be decided later.

- ECB's Villeroy said there is a risk that inflation undershoots the 2% target, especially if growth is weak and inflation could be at target in early 2025, while the economy is still on course for a soft landing but no take off is in sight.