Europe Market Open: APAC stocks bolstered by the Wall St. handover, earnings ahead

25 Oct 2024, 06:48 by Newsquawk Desk

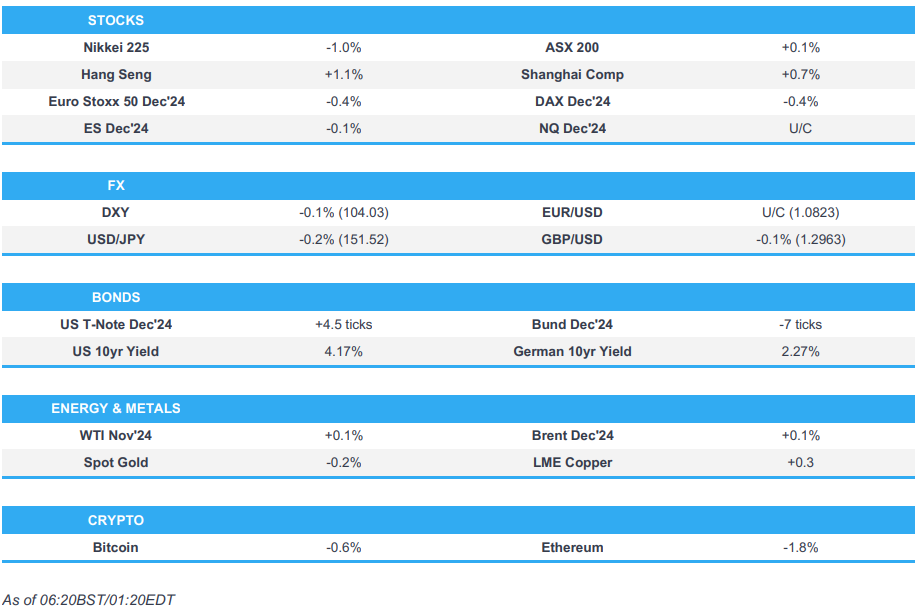

- APAC stocks bolstered by the the Wall St. handover though with upside capped given ongoing geopolitical uncertainty

- FX relatively contained with specifics light in overnight trade

- Fixed benchmarks remained afloat, JGBs edged mild gains after mixed Tokyo CPI

- Crude benchmarks attempted to nurse Thursday's losses, metals rangebound echoing FX

- Looking ahead, highlights include EZ M3, German Ifo, US Durable Goods, UoM (Final), Moody's on France, Comments from Fed's Collins, Earnings from NatWest, Porsche, Mercedes-Benz & Colgate-Palmolive

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks were predominantly higher after the recent selling pressure this week and with participants digesting earnings and several better-than-expected data releases. The advances in most major indices were led by outperformance in the Nasdaq as Tesla shares surged by around 22% post-earnings, while the Dow was the laggard which closed in the red after disappointing earnings results from IBM and Honeywell. Furthermore, the dollar pared its recent gains and T-notes were choppy with initial pressure seen in the aftermath of the fall in jobless claims and PMI beats, although the move in treasuries was ultimately reversed.

- SPX +0.21% at 5,910, NDX +0.83% at 20,233, DJIA -0.33% at 42,374, RUT +0.23% at 2,219.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Big Village public opinion poll showed Harris at 52% vs Trump at 45% which was conducted on October 23rd and involved around 1,600 respondents.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher following a similar handover from Wall St albeit with upside capped in a somewhat cautious session amid ongoing geopolitical concerns and heading into next month's key events.

- ASX 200 marginally gained and was led by notable strength in tech after WiseTech's CEO and founder stepped down due to a secret affairs and payments scandal, although the upside in the index was limited by weakness in consumer stocks.

- Nikkei 225 underperformed following recent yen strength and amid uncertainty ahead of Sunday's election.

- Hang Seng and Shanghai Comp rebounded from yesterday's selling with the help of strength in tech and automakers, while the PBoC conducted an MLF operation and kept the 1-year MLF rate unchanged at 2.00%, as expected.

- US equity futures traded sideways amid light catalysts and a lack of blockbuster after-market earnings.

- European equity futures are indicative of a lacklustre cash open with the Euro Stoxx 50 future -0.2% after the cash market closed higher by 0.3% on Thursday.

FX

- DXY traded little changed after paring some of the recent notable strength in a week devoid of tier-1 releases ahead of the major risk events in early November, while the latest data releases were encouraging including better-than-expected PMIs, New Home Sales and Initial Jobless Claims they failed to boost the dollar.

- EUR/USD held on to most of the prior day's spoils and sat above the 1.0800 level after benefitting from the softening of the dollar, while there was another deluge of ECB rhetoric including some pushback against larger rate cuts.

- GBP/USD traded sideways after mildly strengthening on the Reeves-induced jump in UK yields albeit with the upside capped as a return to the 1.3000 level remained elusive.

- USD/JPY attempted to recoup losses but was thwarted by resistance at the 152.00 level and following mixed Tokyo inflation.

- Antipodeans lacked demand alongside a quiet calendar and with headwinds from a slightly weaker yuan.

FIXED INCOME

- 10yr UST futures remained afloat in rangebound trade after yesterday's choppy performance and eventual bull flattening, despite the stronger-than-expected US data releases and a weaker 5yr TIPS auction.

- Bund futures took a breather following the recent resurgence to back above the 133.00 level.

- 10yr JGB futures edged mild gains after mixed Tokyo CPI data which printed below the central bank's 2% price target and is seen as a leading indicator for nationwide trends.

COMMODITIES

- Crude futures attempted to nurse some of the prior day's losses which were initially triggered by a report of Israel delaying the response to Iran following the US intelligence leak, although this was later denied by an Israeli security official, while the rebound was facilitated by support in Brent and WTI futures around the USD 74.00/bbl and USD 70.00/bbl levels, respectively.

- Spot gold trickled lower although remained above the USD 2,700/oz level amid an uneventful dollar.

- Copper futures were rangebound following recent whipsawing and amid a somewhat cautious risk tone.

CRYPTO

- Bitcoin lacked firm direction with price action choppy on both sides of the USD 68,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC conducted a CNY 700bln (CNY 789bln maturing) 1-year MLF operation with the rate kept at 2.00%.

- BoJ Governor Ueda said optimism over the US economic outlook seems to be broadening somewhat and need to scrutinise further whether optimism over the US outlook is sustained. Ueda said the BoJ still can afford to spend time scrutinising risks and recent yen falls are driven partly by optimism over the US economic outlook.

- Japanese Finance Minister Kato told the G20 that FX market volatility remains high, as well as noted they must be vigilant to spillovers from each member's macro-economic policy and excess volatility from speculative trading.

- It remains unclear whether Japan's ruling coalition can retain its majority in the lower house just days before the Sunday election with Nikkei polling showing a close race in nearly half of single-seat electoral districts.

DATA RECAP

- Tokyo CPI YY (Oct) 1.8% vs. Exp. 1.9% (Prev. 2.2%)

- Tokyo CPI Ex. Fresh Food YY (Oct) 1.8% vs. Exp. 1.7% (Prev. 2.0%)

- Tokyo CPI Ex. Fresh Food & Energy YY (Oct) 1.8% vs. Exp. 1.6% (Prev. 1.6%)

- Japanese Services PPI (Sep) 2.60% (Prev. 2.70%)

GEOPOLITICS

MIDDLE EAST

- Israeli senior security official quoted by army radio denied the report that Israel was forced to delay a potential retaliatory attack on Iran after details of the planning were leaked from the Pentagon, according to Times of Israel.

- Israeli military plans for an attack on Iran have passed the approval of the Chief of Staff and the Minister of Defence and are waiting for a "green light" from the political level, according to Kann News citing a security source. Israel's Channel 12 also reported that Israel seems to have reached its peak in preparing for the attack on Iran.

- Iran's Supreme Leader Khamenei ordered plans to respond to a possible Israeli attack but stressed that Iran will not act if the Israeli attack is limited, according to The New York Times. Iranian officials said Khamenei ordered the military to devise multiple military plans for responding to an Israeli attack in which the scope of any Iranian retaliation will largely depend on the severity of Israel’s attacks with Iran to retaliate if Israeli strikes inflict widespread damage and high casualties, but if Israel limits its attack to a few military bases and warehouses storing missiles and drones, Iran may do nothing. Furthermore, Khamenei directed that a response would be certain if Israel strikes oil and energy infrastructure or nuclear facilities, or if it assassinates senior officials.

- Israel conducted raids on the area of Choueifat Amrousiya, Haret Hreik and the Hadath area in the southern suburbs of Beirut, according to Sky News Arabia. Israel also conducted a raid on the Masnaa border crossing between Lebanon and Syria, as well as on the residence of press teams in the southern town of Hasbaya, Lebanon.

- Israeli Chief of Staff said a "definitive end" of the war in Lebanon is likely, according to Al Arabiya.

- Israel said its spy chief will attend Gaza ceasefire talks, while Hamas vows to stop fighting if a truce is reached, as long-stalled efforts to end the war appeared to gain momentum, according to Arab News via X.

- Egyptian media reported that an Egyptian security and military delegation met with the head of the Mossad and a delegation from the Shin Bet. It was separately reported that a Hamas delegation went to Cairo to listen to proposed ceasefire deal ideas but there is no change in the group's position, according to a Hamas senior official.US and Israel are to hold Gaza peace talks in Doha with Washington to push for a ceasefire ahead of the Presidential Election, according to FT.

- Secretary General of the Gulf Cooperation Council said their recent meetings with Iran focused on the future of relations and ensuring calm, while their main goal is to end military operations in the Gaza Strip and Lebanon.

OTHER

- Russian President Putin said the cross-border payments issue is important and will develop cooperation within BRICS, while he added that BRICS does not pursue a separate common payment system and if the US is open to normal relations with Russia, they will do the same. Putin earlier said they will discuss peaceful settlements of conflict in the Middle East and that Ukraine is being used to create strategic threats to Russia.

- Elon Musk has reportedly been in regular contact with Russian President Putin since late 2022 and at one point, Putin asked him to avoid activating his Starlink internet service over Taiwan as a favour to Chinese President Xi, according to WSJ.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer said Britons who receive additional income from stock holdings don’t count as ‘working people,’ which suggests he is willing to raise taxes on investors, according to Bloomberg.

- ECB’s Lane said analysis of underlying inflation also indicates that the disinflation process is well on track and inflation is set to return to target in the course of 2025. Lane said interest rate decisions are based on their assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission. Furthermore, he said each of the underlying inflation indicators tracked by the ECB has declined significantly since the post-pandemic inflation surges, with the range narrowing towards its historical average, as well as noted that most other measures of underlying inflation that the ECB regularly monitor have also come down over the past year and showed signs of continued easing in September.

- ECB's Kazaks said they must avoid doing undue damage to the economy and should not hold rates at high levels for too long, while he also stated the economy is the single biggest concern and it makes sense to go step-by-step on ECB rates.

- ECB's Makhlouf said policy should remain prudent and cautious, while he added monetary policy cannot solve all economic issues and the ECB would need powerful data for large rate cuts.

- ECB's Muller said he is still confident they'll see a gradual recovery and is not worried about falling behind the curve, while the best policy choice is measured rate cuts.

- ECB's Wunsch said they do not need a discussion on 50bps at this stage but noted Europe's economy is weaker than they thought and they are data-dependent. Wunsch added that risks are still relatively balanced and a few changes could impact inflation in both directions.

DATA RECAP

- UK GfK Consumer Confidence (Oct) -21.0 vs. Exp. -21.0 (Prev. -20.0)