Europe Market Open: Alphabet climbed post-earnings; more mega-caps, UK budget & US refunding ahead

30 Oct 2024, 06:55 by Newsquawk Desk

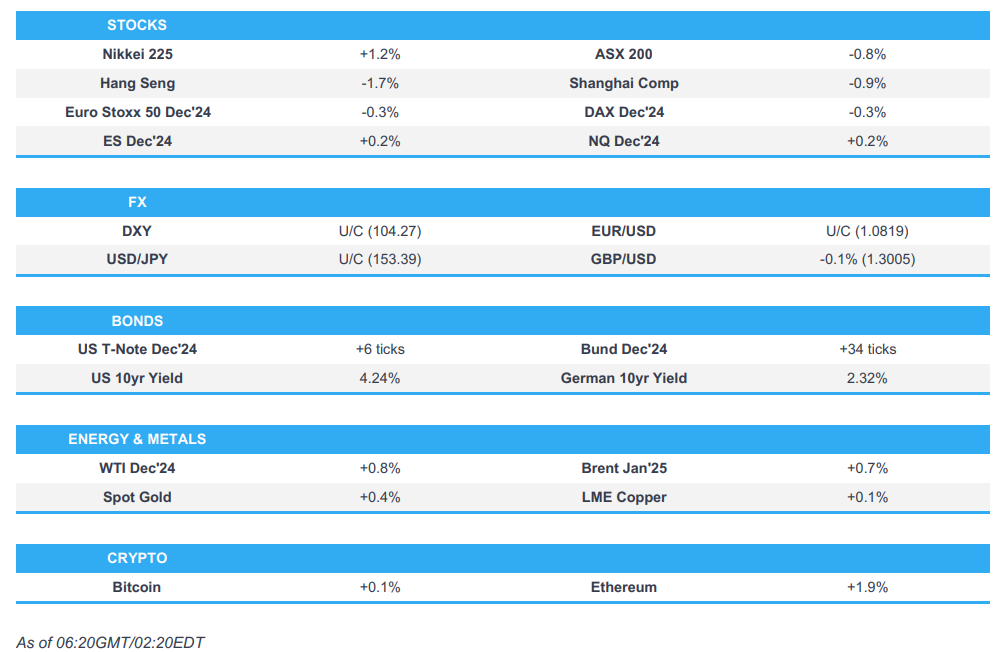

- APAC stocks were mostly lower after the mixed performance stateside and as participants braced for this week's key risk events.

- Alphabet Inc (GOOGL) Q3 2024 (USD): Adj. EPS 2.12 (exp. 1.84), Revenue 88.27bln (exp. 86.31bln). Co. shares were higher by 5.9% after-hours.

- European equity futures are indicative of a weaker cash open with the Euro Stoxx 50 future -0.4% after the cash market closed lower by 0.4% on Tuesday.

- DXY is steady on a 104 handle, EUR/USD maintains 1.08 status, Cable hovers around the 1.30 mark ahead of the UK budget.

- Looking ahead, highlights include French GDP, Spanish CPI, German Unemployment Rate, German GDP, German Inflation, US ADP, PCE Prices/GDP Advance (Q3), Japanese Retail Sales, UK Budget, ECB’s Schnabel, BoC’s Macklem & Rogers, Supply from Italy & US.

- Earnings from Eli Lilly, AbbVie, Caterpillar, ADP, Kraft Heinz, Hess, GE HealthCare, Humana, Garmin, Biogen, Bunge, Microsoft, Meta, Amgen, Booking Holdings, Starbucks, DoorDash, MetLife, Coinbase, MicroStrategy, Robinhood, Carvana, MGM Resorts, Roku, Next, Standard Chartered, GSK, Airbus, Schneider Electric, Biomerieux, Amundi, Nexans, Worldline, Capgemini, Endesa, Aena, Sandoz, UBS, Volkswagen, BASF.

SNAPSHOT

US TRADE

EQUITIES

- US stocks finished mixed as participants digested a deluge of data and earnings releases with notable outperformance in the Nasdaq heading into key earnings and as Communications and Technology did the heavy lifting, while all other sectors were in the red with Utilities, Energy and Consumer Staples the worst hit. The focus remains largely on earnings with many mega-cap stocks reporting this week and there are also key US data points ahead including GDP, PCE and NFP although the latest releases in the form of US Consumer Confidence and JOLTS Job Openings painted a mixed picture.

- SPX +0.16% at 5,833, NDX +0.98% at 20,551, DJI -0.36% at 42,233, RUT -0.27% at 2,238.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US Treasury Secretary Yellen said she has been hearing from banks that burdens of regulatory compliance have become quite extraordinary.

- Alphabet Inc (GOOGL) Q3 2024 (USD): Adj. EPS 2.12 (exp. 1.84), Revenue 88.27bln (exp. 86.31bln). Google advertising revenue: 65.85bln (exp. 65.5bln), Google Search & Other revenue: 49.39bln (exp. 49.08bln), Google Cloud revenue: 11.35bln (exp. 10.79bln), YouTube ads revenue: 8.92bln (exp. 8.89bln) Co. shares were higher by 5.9% after-hours

- Advanced Micro Devices (AMD) Q3 2024 (USD): adj. EPS 0.92 (exp. 0.92), Revenue 6.82bln (exp. 6.71bln) Co. shares were lower by 7.6% after-hours

- Snap Inc (SNAP) Q3 2024 (USD): EPS 0.08 (exp. 0.05), Revenue 1.37bln (exp. 1.36bln). Co. shares were higher by 10.6% after-hours

- Visa (V) Q4 2024 (USD): Adj. EPS 2.71 (exp. 2.58), Revenue 9.6bln (exp. 9.49bln). Co. shares were higher by 1.8% after-hours

APAC TRADE

EQUITIES

- APAC stocks were mostly lower after the mixed performance stateside and as participants braced for this week's key risk events including mega-cap earnings in the US and a deluge of data releases.

- ASX 200 was pressured by notable weakness in the consumer sectors after Woolworths flagged a challenging fiscal year.

- Nikkei 225 bucked the trend and extended above the 39,000 status with the BoJ widely expected to refrain from further policy normalisation when it concludes its 2-day policy meeting tomorrow.

- Hang Seng and Shanghai Comp declined with the former dragged lower by weakness in tech and automakers owing to trade-related headwinds from the threat of higher US tariffs in the event of a Trump election victory next week and after the EU imposed duties on subsidised EVs from China, while the losses in the mainland were initially cushioned following prior reports of a potential fresh fiscal package before eventually succumbing to the broad risk aversion.

- US equity futures (ES +0.1%%, NQ +0.1%) were rangebound with mild support from after-market earnings including strong Alphabet results.

- European equity futures are indicative of a weaker cash open with the Euro Stoxx 50 future -0.4% after the cash market closed lower by 0.4% on Tuesday.

FX

- DXY traded within a tight range after the recent indecisive performance and mixed data in which JOLTS came in beneath all analyst expectations and Consumer Confidence surpassed the top end, while participants are awaiting upcoming key releases and risk events this week including GDP, PCE, NFP, ISM Mfg and corporate earnings, followed by the US election and FOMC next week.

- EUR/USD took a breather after recovering from a brief dip beneath the 1.0800 level and ahead of a slew of EU data.

- GBP/USD pulled back beneath 1.3000 after yesterday's mild outperformance with the focus now on the looming Budget.

- USD/JPY lacked direction ahead of tomorrow's BoJ policy announcement with no major fireworks anticipated.

- Antipodeans eventually weakened in the aftermath of the mixed CPI data in which the monthly and quarterly headline inflation printed softer than expected but the Trimmed Mean and Weighted Median figures mostly topped forecasts.

- SNB Chair Schlegel said the SNB now focuses on normalising of monetary policy and must ensure policy does not become too restrictive, while they remain willing to be active in foreign currency markets as necessary. Schlegel added that further rate reductions could be necessary in the coming quarters to maintain price stability.

- BoC Governor Macklem said if the economy evolves broadly in line with their forecast, they anticipate cutting the policy rate further to support demand and keep inflation on target.

FIXED INCOME

- 10yr UST futures retested the 111.00 level after the prior day's intraday rebound which was helped by a strong 7yr auction.

- Bund futures recouped some of the recent losses but with gains limited ahead of German GDP and CPI data.

- 10yr JGB futures tracked the recovery in global peers as the BoJ kick-started its 2-day policy meeting.

COMMODITIES

- Crude futures mildly gained following the surprise headline crude draw in the latest private sector inventory data but with the upside capped after the prior day's choppy performance and with risk appetite mostly subdued, while reports suggested some optimism regarding ending the fighting in Lebanon but coincided with Hezbollah launching a new wave of offensive against Israel.

- Private Inventory Data (bbls): Crude -0.6mln (exp. +2.2mln), Cushing +0.3mln, Distillate -1.5mln (exp. -1.4mln), Gasoline -0.3mln (exp. +0.5mln).

- Kazakhstan is to cut its 2024 oil output target from the current 90.3mln tons, according to the Energy Minister.

- Spot gold extended on recent advances to print fresh record highs with USD 2800/oz as the next key target level.

- Copper futures were restrained after recent whipsawing and amid the cautious sentiment in the region.

CRYPTO

- Bitcoin was choppy with price action indecisive following its recent surge to above the USD 72,000 level.

NOTABLE ASIA-PAC HEADLINES

- China responded to US finalised restrictions on Chinese technology in which it called on the US to end the politicisation of economic affairs and hopes the US respects market economy rules, while it sees the US action as damaging to Chinese and American business collaboration.

- MOFCOM said China does not agree with or accept the ruling regarding EU tariffs on Chinese EVs and opened proceedings at the WTO, while it noted the EU's indication it will continue to consult with China on a price commitment plan.

- EU imposed duties on unfairly subsidised EVs from China while discussions on price undertakings continue with duties of 17% imposed on BYD, 18.8% on Geely and 35.3% on SAIC. Furthermore, Tesla will be assigned a duty of 7.8% and all other non-cooperating companies will have a duty of 35.3%.

- German Economy Ministry said the negotiations with China are complex and have not yet led to a result.

- Japanese opposition CDP leader Noda will submit a no-confidence motion against the Cabinet and asked the Japan Innovation Party to vote for him to become PM, although Noda reportedly declined to respond to a request by the Japan Innovation Party.

- Japan Exchange Group announced the Tokyo Stock Exchange will extend trading hours by 30 minutes from November 5th with the new close to be at 15:30 local time (06:30GMT/02:30EDT).

DATA RECAP

- Australian CPI QQ (Q3) 0.2% vs. Exp. 0.3% (Prev. 1.0%)

- Australian CPI YY (Q3) 2.8% vs. Exp. 2.9% (Prev. 3.8%)

- Australian RBA Trimmed Mean CPI QQ (Q3) 0.8% vs. Exp. 0.7% (Prev. 0.8%)

- Australian RBA Trimmed Mean CPI YY (Q3) 3.5% vs. Exp. 3.5% (Prev. 3.9%)

- Australian RBA Weighted Median CPI QQ (Q3) 0.9% vs. Exp. 0.8% (Prev. 0.8%)

- Australian RBA Weighted Median CPI YY (Q3) 3.8% vs. Exp. 3.6% (Prev. 4.1%)

- Australian Weighted CPI YY (Sep) 2.10% vs. Exp. 2.40% (Prev. 2.70%)

GEOPOLITICS

MIDDLE EAST

- Israeli Chief of Staff said if Iran makes a mistake and launches missiles towards Israel, they will hit strongly the capabilities and places they excluded during the previous strike, according to Sky News Arabia. A separate report also noted that the IDF warned that if Iran attacks again, they will strike back very, very hard.

- Israeli minister said the war with Hezbollah will be over by year-end.

- Israeli officials cited by Axios noted that Hezbollah is ready to distance itself from Hamas in Gaza and the IDF is close to ending the ground operation in villages in Lebanon that border with Israel, while the army reportedly recommended to PM Netanyahu that the time is right to end the fighting in Lebanon. Furthermore, Haaretz reported the security establishment is unanimous regarding exploiting military achievements in southern Lebanon and Gaza to reach agreements to end the war

- US President Biden's advisers are to visit Israel to try to seal a deal to end the war in Lebanon, according to Axios.

- Hezbollah launched a new wave of its offensive against Israel with 19 operations, according to IRNA.

- Sirens sounded in several areas of Israel after the launch of surface-to-surface missiles from Lebanon, according to Al Arabiya.

OTHER

- Ukraine and Russia are in talks about halting strikes on energy plants, according to FT.

- US confirmed a small number of North Korean troops are already in Russia’s Kursk region, according to Yonhap. It was also reported that South Korea's defence intelligence agency said it is possible some North Korean troops have been deployed on the battlefield in the Ukraine-Russia war and stated that North Korean troops are not ready for drone warfare in the Ukraine-Russia war.

EU/UK

NOTABLE HEADLINES

- UK Treasury confirmed the national minimum wage will increase in April to GBP 12.21/hr from GBP 11.44/hr.

- UK Chancellor Reeves is to provide armed forces a boost of nearly GBP 3bln in the Budget, according to The Telegraph.

- Banks reportedly seek a meeting with the UK Treasury over car finance ruling with executives anxious about risks following a court decision on secret commissions on auto loans, according to FT.