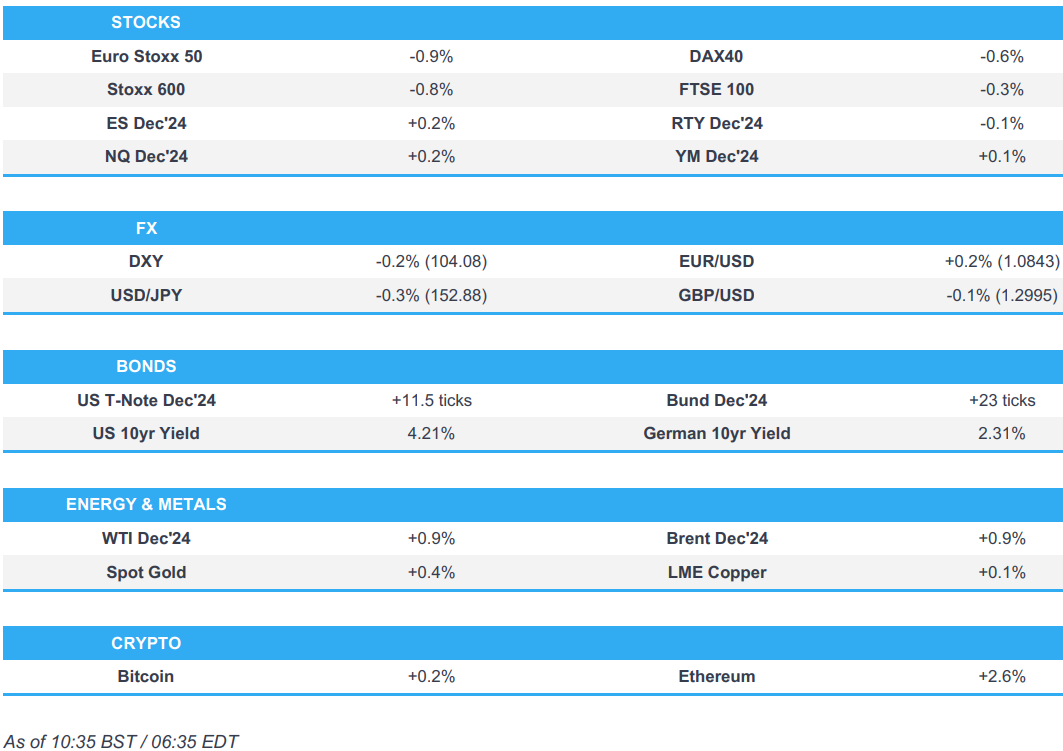

US Market Open: US futures mixed, GOOGL beats, DXY lower ahead of US ADP, PCE Prices/GDP Advance & GBP awaits Budget

30 Oct 2024, 11:14 by Newsquawk Desk

- European bourses opened in negative territory and continued to trundle lower as the morning progressed, Tech lags post-AMD

- Stateside, futures are firmer but only modestly so with Alphabet supporting as AI bolstered cloud performance

- DXY briefly dipped below the 104.00 mark, EUR aided by hawkish-data while GBP awaits the budget

- USTs continue to gain after Tuesday's 7yr into Refunding, Bunds weighed on by data

- Crude firmer after the surprise inventory draw with specifics otherwise somewhat light, XAU at another ATH

- Looking ahead, German Inflation, US ADP, PCE Prices/GDP Advance (Q3), Japanese Retail Sales, UK Budget, ECB’s Schnabel, BoC’s Macklem & Rogers and US Quarterly Refunding.

- Earnings from Eli Lilly, AbbVie, Caterpillar, ADP, Kraft Heinz, Hess, GE HealthCare, Humana, Garmin, Biogen, Bunge, Microsoft, Meta, Amgen, Booking Holdings, Starbucks, DoorDash, MetLife, Coinbase, MicroStrategy, Robinhood, Carvana, MGM Resorts, Roku.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.8%) began the session entirely in negative territory and continued to gradually trundle lower as the morning progressed.

- European sectors hold a strong negative bias. Retail just about holds afloat, lifted by post-earning strength in Next. Financial Services was initially propped up by gains in UBS, but has since edged towards the middle of the pile. Tech is found at the foot of the pile, with strong ASM International (+4.3%) results ultimately outmuscled by the dim mood across chip-names after AMD's Q4 outlook disappointed.

- US Equity Futures (ES +0.2% NQ +0.2% RTY -0.1%) are mixed and ultimately trading on either side of the unchanged mark ahead of a very busy docket, which includes; US ADP, PCE Prices/GDP Advance and a very busy data docket.

- In terms of pre-market movers; Alphabet (+5.5%) gains after it beat on Q3 and amid continued optimism surrounding AI which has boosted its cloud business. AMD (-8.5%) reported a mixed set of results, but its Q4 outlook was soft.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is marginally softer vs. most peers in what will be a session set to endure a raft of US data including GDP, quarterly core PCE and ADP with the latter (rightly or wrongly) set be used to gauge expectations for Friday's NFP print.

- EUR is firmer vs. the USD with some support garnered from better growth outturns in Germany and the Eurozone. This matters because the ECB is seemingly increasingly focused on growth dynamics. Albeit, markets are still awaiting inflation metrics tomorrow. The next upside target for EUR/USD comes via the 200DMA at 1.0868.

- GBP flat vs. the USD in the run up to today's UK budget. As mentioned in our commentary throughout the week, the budget is meant to be expansionary on a headline basis despite a potential squeeze on an individual basis. ING expects the event to not be a game-changer for the GBP, however, if there is to be a negative risk, it stems from the Gilt supply remit. For now, Cable is tucked within yesterday's 1.2959-1.3058 range and above its 100DMA at 1.2974.

- JPY is ever so slightly softer vs. the USD. Updates out of Japan have seen reports that opposition CDP leader Noda will submit a no-confidence motion against the Cabinet and asked the Japan Innovation Party to vote for him to become PM. USD/JPY is currently caged within yesterday's 152.75-153.86 range ahead of a busy session of US data.

- Despite a sluggish start to the session, both antipodes have managed to pick themselves up. AUD/USD printed another multi-month low overnight at 0.6538 before moving back into the green.

- SNB Chairman Schlegel says the CHF is a safe haven, which appreciates in times of uncertainty; ready to react to pressure and intervene in FX markets.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Bunds were initially firmer going into German GDP/State inflation metrics, but dipped into negative territory following stronger-than-expected Q3 GDP and hotter than the mainland implied state CPIs for October. Thereafter, EZ growth metrics also came in higher than expected but sparked no real reaction as this echoed the lead from Spain & Germany earlier in the session. Bunds currently trading around 132.70.

- Gilts outperform and hold near session highs at around 96.05. Focus for the complex is entirely on the upcoming UK budget, where the reaction will depend on just how much headroom Reeves gives herself and then, more pertinently, how much she utilises; for reference, the Reuters survey looks for the 2024/25 Gilt remit to increase by 17bln from 278bln to 295bln.

- USTs are modestly firmer but ultimately awaiting data and refunding. Q3 GDP is forecast at the 3.0% mark which would be in-fitting with the prior but above the final AtlantaFed GDP Nowcast of 2.8%. Thereafter, we turn to Quarterly Refunding which is largely expected to reiterate the last outing though attention is on any change to their guidance for no increase to coupon or FRN sizes for the next several quarters. Currently sitting at session highs at around 111-04+.

- Italy sells EUR 5.5bln vs exp. EUR 4.75-5.5bln 3.00% 2029 & 3.85% 2035 BTP & EUR 3.5bln vs exp. EUR 3-3.5bln 2033 CCTeu.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are in the green, deriving support from the firmer US tone though have faded from best amid the soft European start. Upside which came after a surprise draw in the headline inventory measures last night. Brent'Jan 25 currently sits around USD 71.30/bbl.

- Spot gold is a touch firmer benefitting from the softer yield environment and accompanying USD pressure; a narrative which could well change on upcoming key US data and the latest refunding announcement. Just off a USD 2789/oz peak, which marked yet another ATH.

- Base metals are largely contained, with specifics somewhat light after a busy session yesterday where reporting of Chinese stimulus drove upside in the European morning.

- Private Inventory Data (bbls): Crude -0.6mln (exp. +2.2mln), Cushing +0.3mln, Distillate -1.5mln (exp. -1.4mln), Gasoline -0.3mln (exp. +0.5mln).

- Kazakhstan is to cut its 2024 oil output target from the current 90.3mln tons, according to the Energy Minister.

- India's gold consumption rose 18% Y/Y in Q3, as investment and jewellery demand jumps, via World Gold Council.

- Click for a detailed summary

NOTABLE DATA RECAP

- German State CPIs: Hotter state CPIs than the mainland implied alongside stronger than expected Q3 growth metrics sparked a hawkish reaction.

- German Unemployment Chg SA (Oct) 27.0k vs. Exp. 15.0k (Prev. 17.0k); Unemployment Rate SA (Oct) 6.1% vs. Exp. 6.1% (Prev. 6.0%); Unemployment Total SA (Oct) 2.856M (Prev. 2.823M); Unemployment Total NSA (Oct) 2.791M (Prev. 2.806M)

- German GDP Flash QQ SA (Q3) 0.2% vs. Exp. -0.1% (Prev. -0.1%); GDP Flash YY NSA (Q3) 0.2% vs. Exp. 0.1% (Prev. 0.3%)

- Spanish CPI YY Flash NSA (Oct) 1.8% vs. Exp. 1.80% (Prev. 1.50%); Core 2.5% (prev. 2.4%); HICP Flash YY (Oct) 1.8% vs. Exp. 1.8% (Prev. 1.7%)

- Spanish Estimated GDP QQ (Q3) 0.8% vs. Exp. 0.6% (Prev. 0.8%); YY (Q3) 3.4% vs. Exp. 3.00% (Prev. 3.10%, Rev. 3.2%)

- Italian GDP Prelim QQ (Q3) 0.0% vs. Exp. 0.2% (Prev. 0.2%); GDP Prelim YY (Q3) 0.4% vs. Exp. 0.7% (Prev. 0.9%, Rev. 0.6%)

- Italian Producer Prices YY (Sep) -2.0% (Prev. -0.8%); Producer Prices MM (Sep) -0.6% (Prev. 0.7%)

- EU Economic Sentiment (Oct) 95.6 vs. Exp. 96.3 (Prev. 96.2, Rev. 96.3); Services Sentiment (Oct) 7.1 vs. Exp. 6.6 (Prev. 6.7, Rev. 7.1); Consumer Confid. Final (Oct) -12.5 vs. Exp. -12.5 (Prev. -12.5); Industrial Sentiment (Oct) -13.0 vs. Exp. -10.5 (Prev. -10.9, Rev. -11.0); Selling Price Expec (Oct) 6.5 (Prev. 6.2, Rev. 6.3); Cons Infl Expec (Oct) 13.3 (Prev. 10.9, Rev. 11.0); Business Climate (Oct) -0.96 (Prev. -0.76)

- EU GDP Flash Prelim YY (Q3) 0.9% vs. Exp. 0.8% (Prev. 0.6%); GDP Flash Prelim QQ (Q3) 0.4% vs. Exp. 0.2% (Prev. 0.2%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is to provide armed forces a boost of nearly GBP 3bln in the Budget, according to The Telegraph.

NOTABLE US HEADLINES

- Alphabet Inc (GOOGL) Q3 2024 (USD): Adj. EPS 2.12 (exp. 1.84), Revenue 88.27bln (exp. 86.31bln). Google advertising revenue: 65.85bln (exp. 65.5bln), Google Search & Other revenue: 49.39bln (exp. 49.08bln), Google Cloud revenue: 11.35bln (exp. 10.79bln), YouTube ads revenue: 8.92bln (exp. 8.89bln) Co. shares were higher by 5.9% after-hours

- Advanced Micro Devices (AMD) Q3 2024 (USD): adj. EPS 0.92 (exp. 0.92), Revenue 6.82bln (exp. 6.71bln) Co. shares were lower by 7.6% after-hours

- Snap Inc (SNAP) Q3 2024 (USD): EPS 0.08 (exp. 0.05), Revenue 1.37bln (exp. 1.36bln). Co. shares were higher by 10.6% after-hours

- Visa (V) Q4 2024 (USD): Adj. EPS 2.71 (exp. 2.58), Revenue 9.6bln (exp. 9.49bln). Co. shares were higher by 1.8% after-hours

- Caterpillar Inc (CAT) Q3 2024 (USD): Adj. EPS 5.17 (exp. 5.34), Revenue 16.11bln (exp. 16.08bln).

GEOPOLITICS

MIDDLE EAST

- Iran's Defense Minister says "there has been no disruption to missile production since the Israeli attack".

- Israeli army issues bombing notice to the entire eastern city of Baalbeck and surrounding areas, according to Reuters citing IDF spokesperson.

- Israeli officials cited by Axios noted that Hezbollah is ready to distance itself from Hamas in Gaza and the IDF is close to ending the ground operation in villages in Lebanon that border with Israel, while the army reportedly recommended to PM Netanyahu that the time is right to end the fighting in Lebanon. Furthermore, Haaretz reported the security establishment is unanimous regarding exploiting military achievements in southern Lebanon and Gaza to reach agreements to end the war

- US President Biden's advisers are to visit Israel to try to seal a deal to end the war in Lebanon, according to Axios.

- Sirens sounded in several areas of Israel after the launch of surface-to-surface missiles from Lebanon, according to Al Arabiya.

OTHER

- Russia's Kremlin dismisses FT report that Russia and Ukraine "are in early talks about stopping striking energy infrastructure".

- Ukraine and Russia are in talks about halting strikes on energy plants, according to FT.

- US confirmed a small number of North Korean troops are already in Russia’s Kursk region, according to Yonhap. It was also reported that South Korea's defence intelligence agency said it is possible some North Korean troops have been deployed on the battlefield in the Ukraine-Russia war and stated that North Korean troops are not ready for drone warfare in the Ukraine-Russia war.

CRYPTO

- Bitcoin takes a breather after advancing past USD 72k and after failing to breach USD 73k.

APAC TRADE

- APAC stocks were mostly lower after the mixed performance stateside and as participants braced for this week's key risk events including mega-cap earnings in the US and a deluge of data releases.

- ASX 200 was pressured by notable weakness in the consumer sectors after Woolworths flagged a challenging fiscal year.

- Nikkei 225 bucked the trend and extended above the 39,000 status with the BoJ widely expected to refrain from further policy normalisation when it concludes its 2-day policy meeting tomorrow.

- Hang Seng and Shanghai Comp declined with the former dragged lower by weakness in tech and automakers owing to trade-related headwinds from the threat of higher US tariffs in the event of a Trump election victory next week and after the EU imposed duties on subsidised EVs from China, while the losses in the mainland were initially cushioned following prior reports of a potential fresh fiscal package before eventually succumbing to the broad risk aversion.

NOTABLE ASIA-PAC HEADLINES

- China responded to US finalised restrictions on Chinese technology in which it called on the US to end the politicisation of economic affairs and hopes the US respects market economy rules, while it sees the US action as damaging to Chinese and American business collaboration.

- MOFCOM said China does not agree with or accept the ruling regarding EU tariffs on Chinese EVs and opened proceedings at the WTO, while it noted the EU's indication it will continue to consult with China on a price commitment plan.

- EU imposed duties on unfairly subsidised EVs from China while discussions on price undertakings continue with duties of 17% imposed on BYD, 18.8% on Geely and 35.3% on SAIC. Furthermore, Tesla will be assigned a duty of 7.8% and all other non-cooperating companies will have a duty of 35.3%.

- Japanese opposition CDP leader Noda will submit a no-confidence motion against the Cabinet and asked the Japan Innovation Party to vote for him to become PM, although Noda reportedly declined to respond to a request by the Japan Innovation Party.

- Japan Exchange Group announced the Tokyo Stock Exchange will extend trading hours by 30 minutes from November 5th with the new close to be at 15:30 local time (06:30GMT/02:30EDT).

- Agricultural Bank of China (1288 HK) Q3 (CNY): Net income 78.48bln, +5.9% Y/Y.

- Bank of China (3988 HK) Q3 (CNY): Profit attributable 57.162bln (+4.4% Y/Y); 9M NIM +1.41%.

- China Construction Bank (939 HK) Q3 (CNY) Net Income 91.5bln, +3.8% Y/Y, Op. Revenue 177.5bln, -2.7% Y/Y.

- MediaTek (2454 TW) Q3 (TWD): Sales 131.8bln, +19.7% Y/Y; sees Q4 sales in 126.5-134.5bln range (exp. 126bln).

DATA RECAP

- Australian CPI QQ (Q3) 0.2% vs. Exp. 0.3% (Prev. 1.0%); YY 2.8% vs. Exp. 2.9% (Prev. 3.8%)

- Australian RBA Trimmed Mean CPI QQ (Q3) 0.8% vs. Exp. 0.7% (Prev. 0.8%); YY 3.5% vs. Exp. 3.5% (Prev. 3.9%)

- Australian RBA Weighted Median CPI QQ (Q3) 0.9% vs. Exp. 0.8% (Prev. 0.8%); YY 3.8% vs. Exp. 3.6% (Prev. 4.1%)

- Australian Weighted CPI YY (Sep) 2.10% vs. Exp. 2.40% (Prev. 2.70%)