Europe Market Open: Powell sends stocks lower despite "Big Progress" on US-Japan trade talks, ECB ahead

17 Apr 2025, 06:45 by Newsquawk Desk

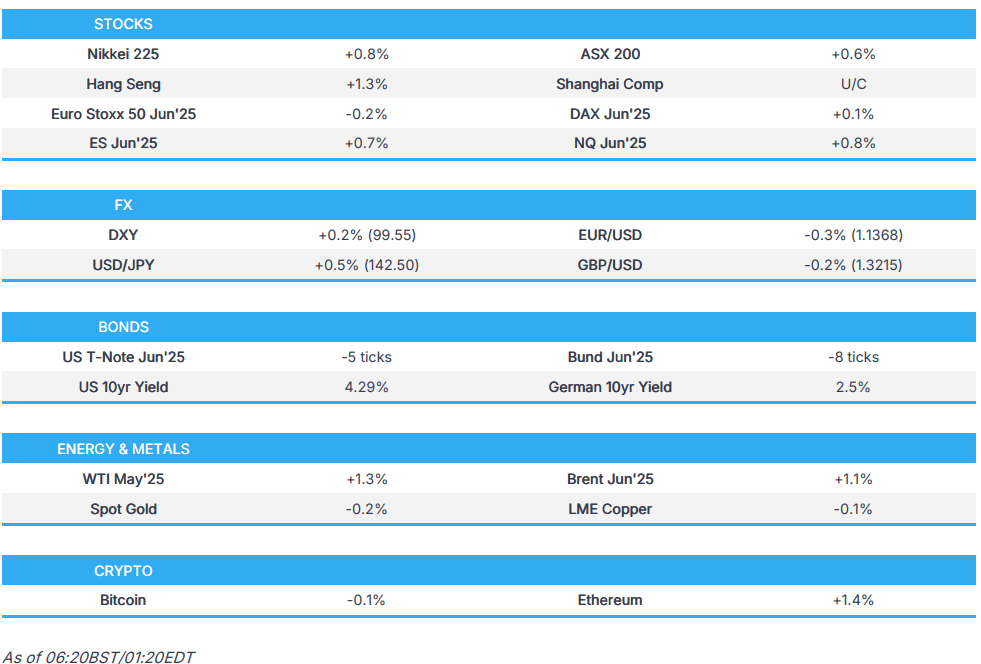

- Fed Chair Powell reaffirmed a wait-and-see approach and suggested incredibly high uncertainty

- US President Trump said "Big Progress!" was made with Japan on trade

- APAC shrugged off the negative Wall St. handover, but gains were capped with drivers limited

- DXY found reprieve from recent pressure but remains below 100.00, USD/JPY hit a seven-month low but has since rebounded back above 142.00

- USTs & JGBs soft while Bunds lacked firm direction; French supply ahead

- Crude extended on Wednesday's strength, XAU pulled back from fresh record highs, base metals choppy

- Looking ahead, highlights include German Producer Prices, US Jobless Claims, Philly Fed Index, ECB & CBRT Policy Announcements, Speakers including ECB President Lagarde, Fed’s Barr & Williams, Supply from France. Earnings from TSMC, UnitedHealth, American Express, DR Horton, Netflix, Sainsbury's, Rentokil & L'Oreal

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks declined and havens were bid as US-China trade tensions remained heightened with the tech sector the worst hit amid US export restrictions on certain NVIDIA and AMD chips to China, while nearly all sectors finished in the red aside from energy which benefitted from a rebound in oil prices. Nonetheless, equities were further pressured in late trade following comments from Fed Chair Powell who reaffirmed a wait-and-see approach and suggested incredibly high uncertainty.

- SPX -2.24% at 5,276, NDX -3.04% at 18,258, DJI -1.73% at 39,669, RUT -1.03% at 1,863.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump posted on Truth Social "A Great Honor to have just met with the Japanese Delegation on Trade. Big Progress!".

- Japanese Economy Minister Akazawa said he told US negotiation counterparts that Japan wants the best solution as soon as possible for both nations and strongly requested the revocation of tariffs on Japan. Akazawa said they agreed to hold a second meeting this month and he believes the US wants a deal within the 90-day window but added that he has no idea how talks will progress going forward.

- Japanese PM Ishiba said the Economy Minister reported to him that constructive talks were held with the US, while Ishiba added that of course talks will not be easy going forward and he will visit the US at an appropriate time to meet with US President Trump.

- China is said to move from the US to Canada for more oil amid trade tensions, according to Bloomberg.

- Intel (INTC) told Chinese clients last week that chips would require a licence for exporting to China if the chips met certain requirements, according to FT.

- UK officials are said to be tightening security when handling sensitive trade documents to shield them from the US amid the tariff war, according to Guardian sources.

- White House officials believe a trade deal with Britain can be finalised within three weeks, according to Telegraph sources.

NOTABLE HEADLINES

- Fed Chair Powell said the Fed is well-positioned to wait for greater clarity before considering any change to its policy stance, while they may find themselves in the challenging scenario in which dual-mandate goals are in tension, and if that occurs, the Fed would consider how far the economy is from each goal and potential time horizons for those gaps to close. Powell said the effects of policy will likely move the Fed away from its goals and they will be moving away from goals for the balance of this year but perhaps can resume next year. Furthermore, he said changes in policies are fundamental and there is no real experience in how to analyse it with such incredibly high uncertainty, as well as noted that high uncertainty leads to households and businesses stepping back from decisions. On tariffs specifically, said tariffs are even larger than in the Fed's upside estimates.

- Fed's Schmid (2025 voter) said there is a lot of nervousness in the agricultural sector from tariffs but noted he's an optimist and they need to be patient to see how it plays out, while he said they will react to disruptions that might affect mandates.

- Fed's Hammack (2026 voter) said she sees a strong case to hold policy steady for now and policy patience will allow the Fed to gather more data on the economy. Hammack noted it is not appropriate to respond to every twist and turn of markets, while the focus is on how markets impact the economy and not focused on asset prices per se. Furthermore, Hammack said it is going to take time to see how trade policy is impacting the economy and the right thing may be to stay on hold for now, noting steady policy is an "active choice".

- White House seeks to cut USD 40bln in funding for the Department of Health and Human Services, according to The Washington Post.

APAC TRADE

EQUITIES

- APAC stocks shrugged off the negative handover from Wall St. but with gains capped amid a lack of bullish drivers and as trade uncertainty lingered.

- ASX 200 was led higher by strength in energy and mining stocks following recent gains in underlying commodity prices and as participants digest quarterly updates from the likes of BHP, South32 and Santos.

- Nikkei 225 reclaimed the 34,000 status amid favourable currency moves and with US President Trump suggesting big progress was made in US-Japan trade talks.

- Hang Seng and Shanghai Comp conformed to the positive mood but with the gains in the mainland limited by the ongoing US-China trade frictions, while officials from MOFCOM, MIIT and the PBoC are set to hold a briefing on Monday where China will announce an expansion plan for its service sector.

- US equity futures nursed some of its recent losses after declining on Fed Chair Powell's comments which continued to suggest a lack of a 'Fed put'.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.4% after the cash market closed with losses of 0.1% on Wednesday.

FX

- DXY found reprieve from the recent selling pressure but languished beneath the 100.00 level after retreating yesterday amid the ongoing trade uncertainty and US-China frictions.

- EUR/USD gave back some of its recent spoils and reverted to beneath the 1.1400 handle amid the rebound in the greenback, while attention now turns to the looming ECB policy meeting where the central bank is expected to lower its rates by 25bps.

- GBP/USD remained lacklustre after the mid-week pullback from resistance just shy of the 1.3300 territory following softer UK inflation readings although the downside was stemmed by an intraday floor around the 1.3200 level.

- USD/JPY re-emerged from beneath the 142.00 level after dipping to fresh seven-month lows with the rebound supported by the positive risk appetite and after weaker-than-expected Japanese exports and imports data.

- Antipodeans were rangebound with muted reactions seen following firmer-than-expected New Zealand CPI figures and mixed Australian employment data.

- PBoC set USD/CNY mid-point at 7.2085 vs exp. 7.3083 (Prev. 7.2133).

FIXED INCOME

- 10yr UST futures retreated following the prior day's rally amid the risk-off trade on Wall St and after Fed Chair Powell maintained his call for patience, while participants now await more Fed commentary and US supply.

- Bund futures lacked firm direction after the recent choppy mood and heading into the ECB policy decision with money markets fully pricing in a rate cut.

- 10yr JGB futures declined as the improvement in risk sentiment spurred haven outflows and with demand also not helped by weaker results from the enhanced liquidity auction for longer-dated JGBs.

COMMODITIES

- Crude futures extended on yesterday's gains after the US issued fresh Iran-related sanctions targeting oil tankers, while Treasury Secretary Bessent noted that the Trump administration has made it clear that they will apply maximum pressure on Iran and disrupt the regime’s oil supply chain and exports.

- Spot gold mildly pulled back after recently printing a fresh record high with the precious metal above the USD 3,300/oz level.

- Copper futures were choppy but ultimately faded some of the recent gains as risk sentiment in its largest buyer lagged.

CRYPTO

- Bitcoin Marginally softened overnight and tested the USD 84,000 level to the downside.

NOTABLE ASIA-PAC HEADLINES

- China is to announce an expansion plan for its service sector at a briefing on Monday with officials from MOFCOM, MIIT and the PBoC to attend the briefing, while the Finance Ministry held a meeting with experts on international economic conditions.

- US is debating barring Americans' access to DeepSeek services and weighing penalties to block DeepSeek from US tech buys, according to NYT. It was also reported that a US House panel is probing whether DeepSeek used restricted NVIDIA (NVDA) chips, according to FT

- BoJ Governor Ueda said Japan's economy is recovering moderately albeit with some weak signs, while he added that Japan's economy and prices moving roughly in line with their forecasts but they must be vigilant to heightening uncertainty including from each country's trade policy. Ueda also stated that Japan's real interest rates remain very low and the BoJ is expected to keep raising interest rates if the economy and prices move in line with projections made in the quarterly report. Furthermore, he said when the BoJ raised rates in January, the US economy was in solid shape and markets had been stable but added that uncertainty surrounding US policy, particularly on tariffs, has heightened sharply recently, as well as noted that US tariffs could exert downward pressure on the economy and reiterated that keeping low rates even when underlying inflation is accelerating could result in a situation where we would be forced to hike rapidly.

- BoJ's Nakagawa said US tariff policy, as well as overseas economic and market developments, are among risks to Japan's economic outlook, while uncertainty over US tariffs could affect household and corporate sentiment, and Japan's economy and prices.

- Bank of Korea kept its base rate unchanged at 2.75%, as expected, with the rate decision not unanimous as board member Shin Sung-Hwan dissented and saw a need to respond to the worsening economic outlook. BoK said uncertainties to the growth path are higher and headwinds to economic growth are seen bigger than previously expected, while it will determine the timing and pace of any further base rate cuts and noted that monetary easing policy stance is to continue. BoK Governor Rhee said most board members saw lower interest rates in the three months ahead and they will factor in the interest rate differential with the US for the next rate decision. Furthermore, Rhee said they will assess in May whether the policy rate needs to go below 2.25% by year-end.

DATA RECAP

- Japanese Trade Balance (JPY)(Mar) 544.1B vs. Exp. 485.3B (Prev. 584.5B, Rev. 590.5B)

- Japanese Exports YY (Mar) 3.9% vs. Exp. 4.5% (Prev. 11.4%)

- Japanese Imports YY (Mar) 2.0% vs. Exp. 3.1% (Prev. -0.7%)

- Australian Employment (Mar) 32.2k vs. Exp. 40.0k (Prev. -52.8k)

- Australian Unemployment Rate (Mar) 4.1% vs. Exp. 4.2% (Prev. 4.1%)

- New Zealand CPI QQ (Q1) 0.9% vs. Exp. 0.7% (Prev. 0.5%)

- New Zealand CPI YY (Q1) 2.5% vs. Exp. 2.3% (Prev. 2.2%)

- New Zealand RBNZ Sectoral Factor Model Inflation Index YY (Q1) 2.9% (Prev. 3.1%)

GEOPOLITICS

MIDDLE EAST

- US President Trump waved off a planned Israeli strike on Iranian nuclear sites in favour of negotiating a deal with Iran to limit its nuclear program, according to the New York Times

- US Treasury Secretary Bessent said the Trump administration has made it clear that they will apply maximum pressure on Iran and disrupt the regime’s oil supply chain and exports, which support terrorist proxies and partners, while he added they are prepared to take all actions available to get Iran’s energy exports down to zero.