US Market Open: DXY flat & US futures gain ahead of a slew of Fed speakers and TSLA earnings

22 Apr 2025, 11:00 by Newsquawk Desk

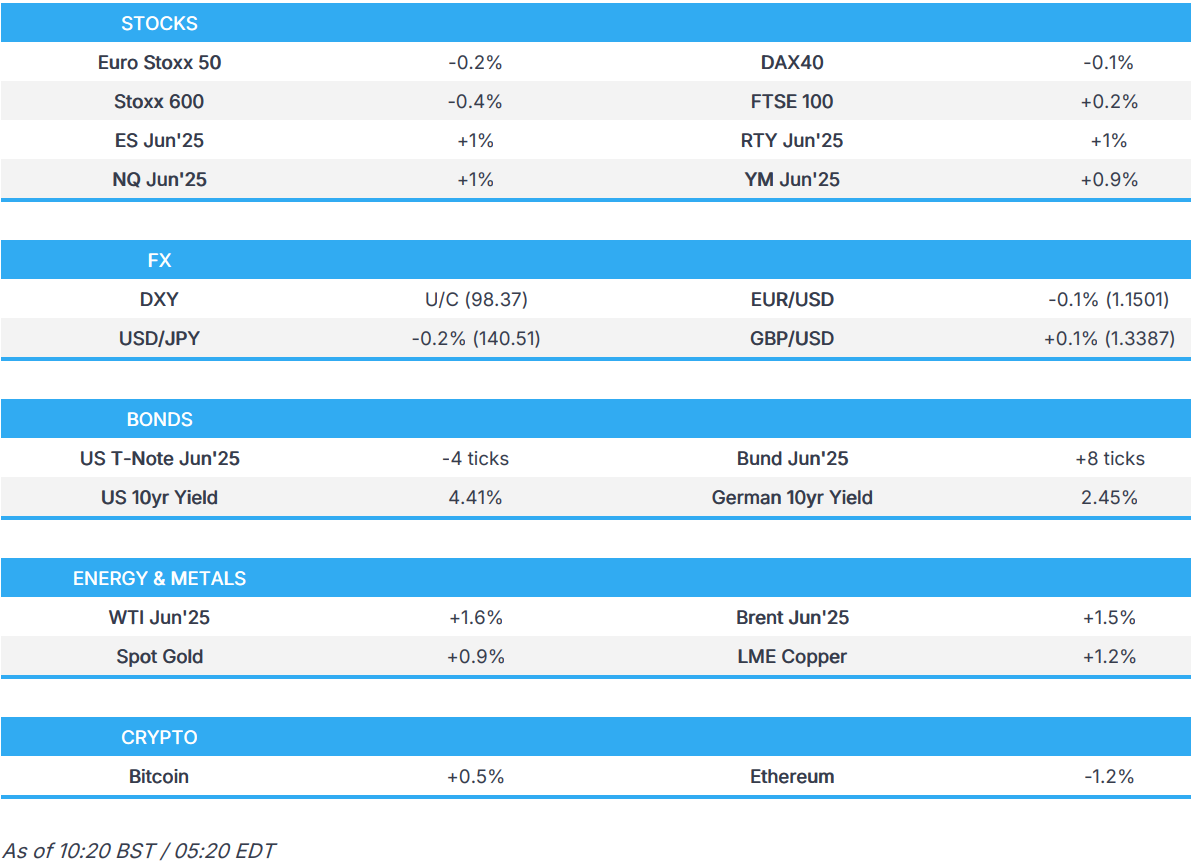

- European bourses modestly lower; US futures attempt to pare back Monday’s hefty losses.

- DXY flat, USD/JPY fails to sustain a move below 140, EUR/USD back on a 1.14 handle as USD bounces off lows.

- Modest UST & Bund divergence while Gilts lag and hit lows on BoE's Greene, who highlighted that wage growth remains "pretty high".

- Spot gold briefly tested USD 3,500/oz before waning; industrial commodities mostly firmer.

- Looking ahead, Canadian Producer Prices, US Richmond Fed Index, EZ Consumer Confidence. Speakers including ECB’s Knot, de Guindos, BoE’s Breeden, Fed’s Jefferson, Harker, Kashkari, Kugler & Barkin, Supply from the US, Earnings from Tesla, Verizon, GE Aerospace, Lockheed Martin, Danaher & Elevance.

TARIFFS/TRADE

- US Commerce Department finalised dumping duties ranging from 6.1% to 271.28% on solar cells imported from Cambodia, Malaysia, Thailand and Vietnam.

- US Trade Representative's statement confirmed that USTR Greer and India's Ministry of Commerce and Industry have finalised terms of reference to lay down a roadmap for negotiations on reciprocal trade and stated that India's constructive engagement so far has been welcomed.

- South Korea's Acting President Han said he expects South Korea-US trade talks this week to pave the way towards a mutually beneficial solution.

- Reuters reports that "Japan sees little scope for grand deal on yen in talks with US" at this week's Washington meeting of Finance Ministers. Sources report that Japan will push back against any request to boost its currency. Japan reportedly sees little scope for direct action i.e. FX intervention or an immediate BoJ hike, via Reuters citing sources. The meeting is likely to focus, from a Japanese perspective, on getting further insight into Washington's intentions.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.6%) opened mostly and modestly lower and have traded sideways throughout the morning thus far. Sentiment in Europe today is fairly gloomy, playing catch-up to the hefty losses seen in the US on Monday (reminder: Europe was shut on account of Easter Monday).

- European sectors hold a negative bias, in-fitting with the risk tone. Real Estate takes the top spot, benefiting from the relatively lower yield environment (in Europe). Insurance follows closely behind, with both Helvetia and Baloise jumping around 4% after the pair announced a merger of equals to form a leading European insurance group. Healthcare has been weighed on today by significant pressure in Novo Nordisk (-8%), hit as traders digest the latest obesity-pill updates from rival Eli Lilly.

- US equity futures (ES +1% NQ +1% RTY +1%) are entirely in the green, attempting to pare back some of the hefty losses seen in the prior session. Docket today sees US Richmond Fed Index and a slew of Fed speakers alongside numerous heavyweight earnings including Tesla.

- Chinese tech names are reportedly considering US listings despite "market ructions", via Bloomberg citing sources; Walnut Coding, CloudSky, Zaihui & Zhonghe said to be considering IPOs in the US.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is flat with the USD showing a differing performance vs. peers (stronger vs. EUR and CHF, weaker vs. JPY). Monday was a notable down day for the USD after another outburst from US President Trump, attempting to strong arm Fed Chair Powell into lowering rates and speculation over whether he will attempt to remove him before his term expires next year. Today's calendar is lacking in US data but heavy in speakers with Fed’s Jefferson, Harker, Kashkari, Kugler & Barkin all due on deck.

- EUR/USD is a touch lower but holding above 1.15 after early USD buying knocked the pair from its overnight peak at 1.1547. This comes after the pair hit a multi-year high on Monday at 1.1574. On the trade front, there has been little in the way of updates since last week's reporting that the EU expects tariffs to remain given a lack of progress in trade discussions. As it stands, despite today's reprieve for the USD, the EUR still remains a liquid alternative to the USD should investors continue to shun US assets.

- JPY is top of the G10 leaderboard as the currency continues to benefit from its safe-haven appeal with USD/JPY briefly slipping below the 140 mark earlier in the session for the first time since September 2024. JPY is also underpinned by hopes over upcoming talks between the US and Japanese administrations. That being said, a Reuters sources piece noted that Japan will push back against any request to boost its currency. This prompted a slight pick up in USD/JPY after failing to sustain a move below 140. From a policy perspective in Japan, source reporting suggests that the BoJ is likely to keep its rate-hike signal intact at its meeting next week despite Trump tariff risks.

- GBP is flat vs. the USD with UK-specific newsflow on the light side. In an interview on Bloomberg TV, MPC member Greene remarked that the main issue from the trade war is whether the main impact will be on demand or the supply side; whether the main factors will be on demand or the supply side. Greene added that wage growth remains "pretty high", however, the labour force survey has been volatile and has its own collection issues. BoE's Breeden is due later in the day.

- Antipodeans are both now steady vs. the USD after initially kicking the session off on the front foot. Upside was trimmed alongside a pick up in the USD in quiet newsflow. Overnight, AUD/USD hit a fresh YTD peak at 0.6439 before returning back to within Monday's 0.6369-0.6437 range.

- PBoC set USD/CNY mid-point at 7.2074 vs exp. 7.2925 (Prev. 7.2055).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are still digesting the remarks from Trump on Fed Chair Powell and interest rates. Commentary which sparked marked steepening on Monday as short-end yields were weighed on by the prospect of cuts while the long-end picked up on the prospect of this sparking more inflation down the line. As it stands, the curve is unwinding that action a little and is slightly flatter today but still in close proximity to the steepest points seen on Monday i.e. 2s10s around 63bps vs Monday’s 55-66bps range. USTs are softer on the session, at the low-end of a 110-18 to 110-27+ band. A 2-year auction is due later, with focus also on a slew of Fed speakers.

- Modest two-way action in Bunds today, with catalysts light thus far. No reaction to the latest ECB SPF that featured an increase to the inflation and cut to the growth views of respondents; a point which may well be reflected in the IMF forecasts this afternoon. Holding at the top-end of a 131.46-83 band on return from the long weekend and while Bunds are outperforming USTs, it is only modest with the German benchmark essentially unchanged. Ahead, a 2027 Schatz auction with appearances from ECB's Lagarde and Knot also scheduled.

- Gilts opened lower by just under 30 ticks before paring essentially all of the move to print a 92.40 high, just five ticks shy of Friday’s close. However, this proved short lived with the benchmark coming under gradual but notable pressure and entered the appearance from BoE’s Greene at a 92.02 base. Greene highlighted two-way risks to inflation being present though some modest pressure in Gilts, to a 91.96 trough, came as she highlighted wage growth remains “pretty high” and she is keeping an eye on the rise in inflation expectations.

- Click for a detailed summary

COMMODITIES

- Crude futures extend on the rebound from the prior day's trough despite the European rebound in the Dollar and overall quiet news flow thus far. Desks pin the recent losses in the complex to US tariff uncertainty, risk aversion from Trump pressuring the Fed Chair, and telegraphed progress regarding US-Iran nuclear talks. WTI resides in a USD 62.72-63.43/bbl range with its Brent counterpart in a USD 66.54-67.25/bbl parameter.

- Spot gold extended on its rally and printed a fresh record high at USD 3,500/oz at the time of writing, with gains in the yellow metal facilitated by the recent fall in the Dollar coupled with ongoing uncertainty on the US tariff policy and geopolitics. Add to that, the issue of US central bank independence after US President Trump upped the pressure on Fed Chair Powell to ease monetary policy. Spot gold currently resides in a USD 3,3412.34-3,500.20/oz range.

- Mostly firmer trade across base metals amid the recent fall in the Dollar and resilience in the red metal's largest buyer. 3M LME copper resides in a USD 9,254.03-9,333.05/t.

- Click for a detailed summary

NOTABLE EUROPEAN HEADLINES

- BoE's Greene says market pricing for BoE rate cuts has been moving around a lot but not all of it is to do with the UK. Aware of rise in inflation expectations, but risks are to both sides. US tariffs represent more of a disinflationary risk than an inflationary one for the UK. Wage growth remains "pretty high", the labour force survey has been volatile and has its own collection issues.

- ECB Survey of Professional Forecasters; 2025 and 2026 inflation forecasts raised, growth lowered.

- German government lowers growth forecasts to 0.0% for 2025 and ~1% for 2026 (Including the US base tariff of ten percent as well as on steel, aluminium and cars), according to Handelsblatt's Olk.

NOTABLE US HEADLINES

- WSJ's Timiraos wrote "Trump Is Laying the Groundwork to Blame Powell for Any Downturn" and is signalling he will blame the Fed for any economic weakness resulting from his trade war if it doesn't cut rates soon.

- US Securities and Exchange Commission announced Paul Atkins was sworn in as chairman.

GEOPOLITICS

- Kremlin spokesman Peskov said Russian President Putin's comments on Monday that it was possible to discuss the issue of not striking the civilian targets, including bilaterally, he had negotiations and discussions with the Ukrainian side in mind.

- Iranian Foreign Minister will visit China on April 23rd, according to the Chinese Foreign Ministry.

CRYPTO

- Bitcoin is on a firmer footing and trades around USD 88.3k; Ethereum edges lower but manages to hold above USD 1.6k.

APAC TRADE

- APAC stocks traded mixed with most indices rangebound despite the sell-off on Wall St where stocks and the dollar were pressured after President Trump renewed his criticism against Fed Chair Powell.

- ASX 200 was little changed as strength in mining stocks and gold producers were offset by losses in tech, energy and healthcare, while price action was also hampered by the absence of any key data.

- Nikkei 225 struggled for direction and swung between gains and losses in relatively contained parameters amid a choppy currency and slightly higher Japanese yields.

- Hang Seng and Shanghai Comp conformed to the mixed picture with the Hong Kong benchmark marginally pressured on return from the Easter weekend, while the mainland was kept afloat amid earnings and positive EV-related updates.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Kato said finance authorities are to ask banks to help support financing at small companies affected by US tariffs, while he is arranging to hold a meeting with US Treasury Secretary Bessent and plans to discuss forex issues.

- Japan Keidanren Business Federation Chief Tokura says wants FX to stabilise as much as possible; rapid FX fluctuations are not desirable for the economy, in response to a question on USD/JPY moving below 140.00.