US Market Open: US equity futures trade cautiously & DXY a little lower ahead of a slew of Fed speak & looming US-China talks

09 May 2025, 10:40 by Newsquawk Desk

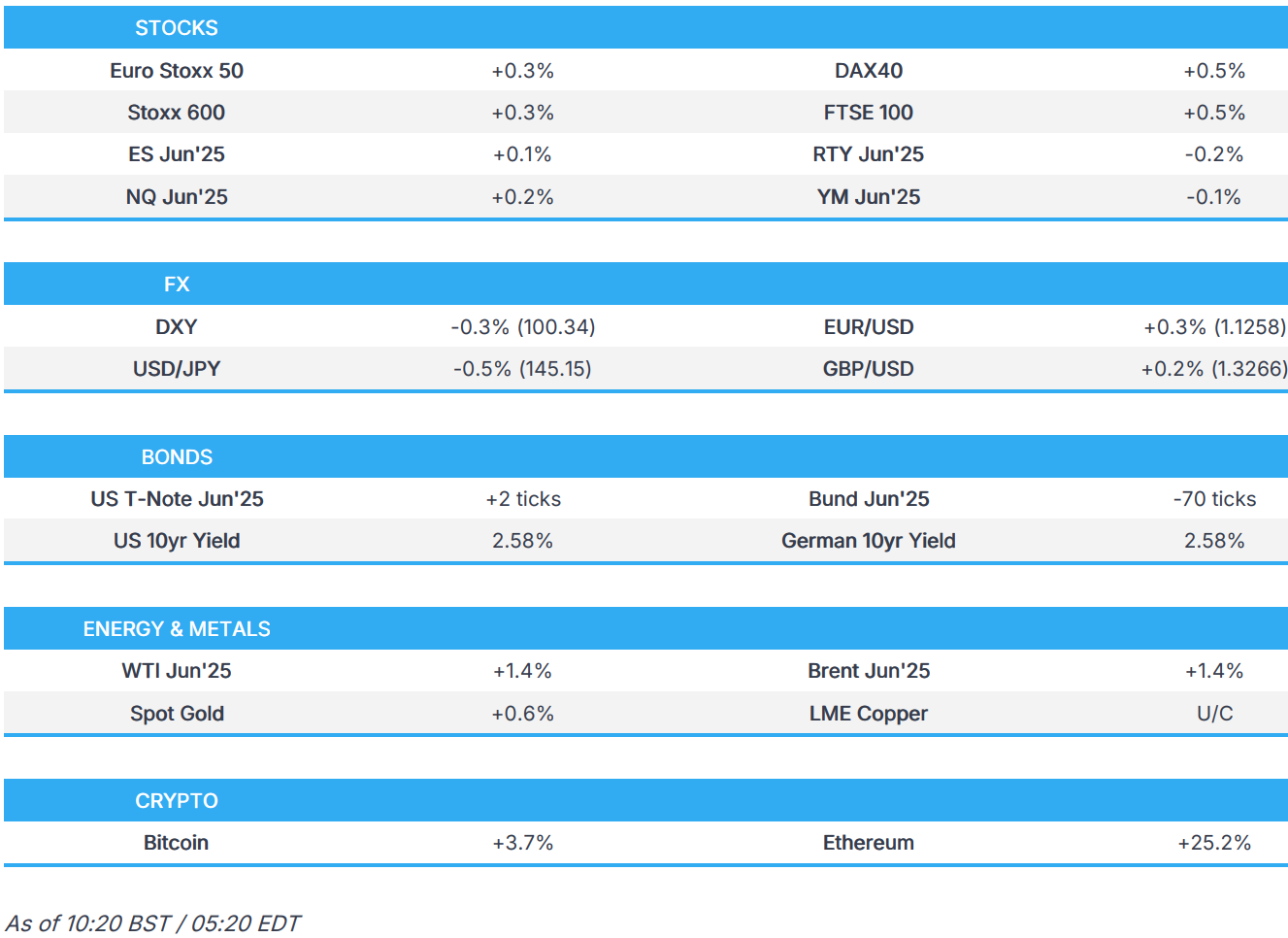

- European stocks are firmer across the board, whilst US equity futures trade cautiously ahead of US-China talks on the weekend.

- USD recovery pauses for breath, JPY outperforms whilst the Kiwi lags a touch.

- Marked divergence as EGBs & Gilts react in full to trade updates. USTs await a barrage of Fed speak.

- Softer intraday Dollar keeps commodities afloat for now.

- Looking ahead, Canadian Jobs, Speakers including BoE’s Pill, Fed’s Barr, Kugler, Perli, Williams, Goolsbee & Waller.

TARIFFS/TRADE

- US Commerce Secretary Lutnick said deals will be used as templates for other deals and that they will have dozens of deals announced by July 8th. Lutnick stated that as you get to bigger economies and more work, it takes time and economies such as India, Japan and South Korea are huge and take a lot of work, while he added that de-escalation with China is US Treasury Secretary Bessent's goal in talks and that as countries open their markets, the best any country can do is a 10% tariff.

- Detroit Three trade group said the Trump trade deal with the UK "hurts American automakers, suppliers and auto workers".

- China's Vice Foreign Minister Hua said the US cannot sustain what it is doing in trade policy and that China has full confidence in its ability to manage US trade issues. Hua added that China does not want a war of any kind with any other country and has full capability to overcome difficulties amid the trade war, as well as noted that ordinary people in China do not want a trade war but are confident and said they have no fear if they have to face up to reality regarding trade talks.

- China signed a letter of intent with exporters in Argentina to buy about USD 900mln of soybeans, corn and vegetable oil - in turn shifting from the US, according to Bloomberg.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.4%) opened modestly firmer across the board, and have traded sideways throughout the morning thus far.

- European sectors hold a positive bias; there is some clear outperformance in Energy, while other sectoral gainers are relatively similar in magnitude. Travel & Leisure and Media sit at the foot of the pile – holding modest losses.

- US equity futures are mixed (ES +0.1% NQ +0.2% RTY -0.2%), with the ES and NQ attempting to hold onto some of the strength seen on Thursday, whilst the RTY dips lower. Traders will keep a keen eye out for a slew of Fed speakers

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- The recent recovery in the USD has paused for breath with the greenback having gained in the past two sessions on account of the post-FOMC reaction and ongoing trade optimism. On the latter, Thursday saw the unveiling of a UK-US trade agreement. However, of greater importance was Thursday's remarks from US President Trump that tariffs on China can't get any higher than 145% and knows they will be coming down. This was followed up by a report in the New York Post that the US is weighing a plan to slash China tariffs to as low as 50% as soon as next week. Today sees a busy Fed speaker slate with Barr, Kugler, Perli, Williams, Goolsbee & Waller all due on deck. DXY currently trading around 100.40.

- EUR/USD is a touch firmer after being weighed on in the past two sessions amid ongoing trade optimism. This is a reversal of the pattern we saw in April as trade tensions ratcheted higher and the EUR benefitted as a liquid alternative to the Greenback. EZ docket is lacking and ECB speak thus far has proved non-incremental with ECB's Simkus noting ECB June projections may be a little bit worse and a cut next month is needed. EUR/USD briefly slipped onto a 1.11 handle overnight with a low at 1.1197.

- JPY is attempting to claw back some of its recent losses vs. the USD which has seen USD/JPY pick up from a WTD low on Tuesday at 142.35 to a 146.18 peak. Japanese-specific newsflow remains on the light side as market participants await progress on the trade front between Japan and the US. USD/JPY has returned to a 145 handle with a session low at 145.08.

- GBP was unable to benefit vs. the USD and only marginally gained vs. the EUR despite a "hawkish cut from the BoE and news of a UK-US trade agreement. Overnight, Cable hit a new low for the week at 1.3213, whilst EUR/GBP is contained within Thursday's 0.8457-0.8523 range; lower bound of which coincides with the 50DMA. Commentary from BoE's Bailey today proved to be a non-event; the Governor highlighted the unwavering commitment to the 2% target.

- Antipodeans have been choppy after the recent dollar strength and as participants digested the latest Chinese trade data, while Westpac adjusted its RBNZ call and now sees two 25bps rate cuts by July instead of its prior view for just one cut.

- PBoC injected CNY 77bln via 7-day reverse repos with the rate at 1.40% for a net weekly drain of CNY 781.7bln, which was the most in two months.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are essentially unchanged as newsflow since Thursday’s flurry of trade updates, which weighed on the benchmark into/after settlement, has been a little lighter. USTs at the bottom-end of a 110-25 to 110-30 band and by extension towards Thursday’s 110-24 base. We await anything fresh on the trade front and confirmation/rebuttal from the administration on the piece in the NY Post (and other vendors since) that China tariffs could be cut to as low as 50% next week. Today's docket is light on the data front but will see a slew of Fed speakers throughout the day.

- Lower by 70 ticks at worst as Bunds, and EGBs broadly, react in full to Thursday’s trade developments, developments that are providing some modest support to the European risk tone this morning. European-specific tariff/trade updates have been light aside from commentary from German Chancellor Merz who said that Trump agreed with him in a phone call on the need to resolve the trade situation quickly. Currently holding just off today’s 130.38 WTD low.

- Gilts are in-fitting with Bunds but with the pressure of an even greater magnitude as the UK benchmark had more of the trade developments to catch up on. Lower by 78 ticks at most to a 92.07 base; support at the figure and then 91.96 from late April and 91.59 from early April. Bailey this morning didn’t add much for specific policy, discussing scenario analysis and similar points in the context of the BoE’s forecasting process. Potentially more pertinently, Chief Economist Pill is due and will hopefully provide insight into his dissent.

- UK DMO intends to sell by programmatic Gilt tender up to GBP 2bln of 0.125% 2028 Gilt on May 15th.

- Click for a detailed summary

COMMODITIES

- Crude futures edge higher in early European morning amid the ongoing trade optimism heading into this weekend's US-Sino trade talks in Switzerland. Elsewhere, US President Trump said they are trying to work on Iran without getting into bombing, while it was separately reported that US President Trump had a private meeting with Israeli PM Netanyahu's advisor ahead of his Middle East trip, according to Axios. WTI Jun trades near session highs between USD 59.89-60.74/bbl while Brent Jul resides in a USD 62.84-63.65/bbl parameter.

- Modest gains across the precious metals complex, underpinned by the current intraday weakness of the Dollar. Spot gold initially dipped beneath the prior day's lows before recovering to above the USD 3,300/oz level. Currently in a USD 3,274.81-3,332.35/oz range at the time of writing.

- Copper futures, in APAC hours, extended on mid-week pullback with selling exacerbated as Chinese markets got underway and with the PBoC's open market operations resulting in the largest weekly net drain in two months, while participants also reflected on the latest Chinese trade data. Copper futures saw a brief spike higher in European trade, albeit in the absence of pertinent newsflow. The move swiftly pared back shortly after. 3M LME copper resides in a USD 9,342.00-9,465.55/t range.

- Iran's oil minister has ordered resumption of exploratory drilling in the Caspian Sea, via Shana.

- China's MOFCOM is to tighten export controls on Gallium, to prevent the smuggling and export of strategic minerals.

- Russia's Deputy Foreign Minister says cannot confirm whether Russia and US are discussing the resumption of gas supplies to Europe, via Ifax.

- Click for a detailed summary

NOTABLE DATA RECAP

- Norwegian Consumer Price Index YY (Apr) 2.5% vs. Exp. 2.5% (Prev. 2.6%); Core 3.0% vs. Exp. 3.2% (Prev. 3.4%)

- Norwegian Consumer Price Index MM (Apr) 0.7% vs. Exp. 0.6% (Prev. -0.7%); Core 0.5% vs. Exp. 0.5% (Prev. 0.2%)

- Italian Industrial Output MM SA (Mar) 0.1% vs. Exp. 0.5% (Prev. -0.9%); Industrial Output YY WDA (Mar) -1.8% (Prev. -2.7%, Rev. -2.6%)

NOTABLE EUROPEAN HEADLINES

- Morgan Stanley now expect the BoE to hold rates in June (prev. forecast 25bps cut); now expects rate cut in December, maintains year-end Bank Rate forecast at 3.25%.

- BoE's Bailey says commitment to the 2% inflation target is unwavering. Scenarios have helped us not only to explore what would happen in case a particular shock, or constellation of shocks, should hit the economy, but also how any given set of shocks could affect the economy and inflation depending on the strengths of different economic mechanisms. Good there is a diversity of view on the MPC. UK-US trade deal will leave effective tariff rate higher than they were when they started.

- ECB's Simkus says geopolitics since the start of the year is bad news for the economy, via Bloomberg TV; there is downward pressure on inflation Euro-area inflation depends on EU retaliation to the US. ECB June projections may be a little bit worse. June ECB rate cut is needed. It is unclear if a post-June rate cut will be in July or September. "We are more or less there on inflation". There is no central scenario for ECB rates. "Quite high chances we'll be undershooting on inflation".

- ECB's Rehn says disinflation is on track, and the growth outlook is weakening.

- New German Economy Minister Reiche says "we need a combination of renewable energies and gas, we tended to focus almost too much in climate protection".

- German Chancellor Merz says will not change previous German government's position of joint EU debt. Mutual debt "must remain exceptional", cannot be used for every crisis.

NOTABLE US HEADLINES

- US President Trump posted on Truth that he spoke with Commerce Secretary Lutnick and agreed the “Digital Equity Act” is unconstitutional, which he is ending immediately and there will be no more woke handouts based on race, saving taxpayers billions of dollars.

GEOPOLITICS

RUSSIA-UKRAINE

- US President Trump posted on Truth that talks with Russia and Ukraine continue, while he called for a 30-day unconditional ceasefire and said that hopefully, an acceptable ceasefire will be observed, and both countries will be held accountable for respecting the sanctity of these direct negotiations. Furthermore, he warned if a ceasefire is not respected, the US and its partners will impose further sanctions.

- Ukrainian President Zelensky said Ukraine is ready for an immediate 30-day ceasefire and that a 30-day ceasefire will be a real indicator of movement towards peace.

- Ukrainian official said Russia struck eight settlements in the Zaporizhzhia region with drones and artillery 220 times during the ceasefire.

- UK PM Starmer is to announce the largest ever sanctions package targeting shadow fleet as UK ramps up pressure on Russia, according to the UK government.

OTHER

- North Korea said it tested a Hwasong-11 missile and multiple launch rockets on Thursday and the test was conducted under the nuclear weapons defence system, while North Korean leader Kim stressed the combat readiness of nuclear forces, according to KCNA.

- China and Russia's joint statement vowed to strengthen cooperation to safeguard the authority of international law and they both strongly opposed unilateral sanctions and long-arm jurisdiction, while they also opposed the practice of double standards or imposition by some states of their will on other states.

CRYPTO

- Bitcoin is on a stronger footing and has topped USD 103k; Ethereum is soaring and now looks to test USD 2.5k to the upside.

APAC TRADE

- APAC stocks traded with a positive bias as the region took impetus from the gains stateside, where sentiment was underpinned by trade optimism following the announcement of a UK-US trade agreement framework and President Trump's rhetoric regarding China tariffs.

- ASX 200 gained as outperformance in tech, financials and energy more than atoned for the slack in mining stocks, while earnings also provided a tailwind after an increase in profits for Macquarie Group.

- Nikkei 225 returned to above the USD 37,000 level for the first time since late March with the index propelled by recent currency weakness, while the data was mixed as Household Spending topped forecasts but Labour Cash earnings softened.

- Hang Seng and Shanghai Comp were cautious amid the latest Chinese trade data which topped forecast but showed a slowdown in export growth, although downside was limited ahead of US-China talks on Saturday and after recent comments from President Trump who expects tariffs to go down, while the US was also reportedly weighing a plan to slash China tariffs to as low as 50% as soon as next week.

DATA RECAP

- Chinese Trade Balance USD (Apr) 96.18B vs. Exp. 89.0B (Prev. 102.64B).

- Chinese Exports YY (USD)(Apr) 8.1% vs. Exp. 1.9% (Prev. 12.4%); Imports YY (USD)(Apr) -0.2% vs. Exp. -5.9% (Prev. -4.3%)

- Chinese Trade Balance (CNY)(Apr) 690.0B (Prev. 736.7B)

- Chinese Exports (CNY)(Apr) 9.3% (Prev. 13.5%); Imports (CNY)(Apr) 0.8% (Prev. -3.5%)

- Japanese Overall Labour Cash Earnings (Mar) 2.10% vs. Exp. 2.40% (Prev. 3.10%, Rev. 2.70%)

- Japanese All Household Spending MM (Mar) 0.4% vs. Exp. -0.5% (Prev. 3.5%); YY (Mar) 2.1% vs. Exp. 0.2% (Prev. -0.5%)