Europe Market Open: Fed's dot plot composition saw hawkish shift; US reportedly eyes Iran strike in the coming days

19 Jun 2025, 06:50 by Newsquawk Desk

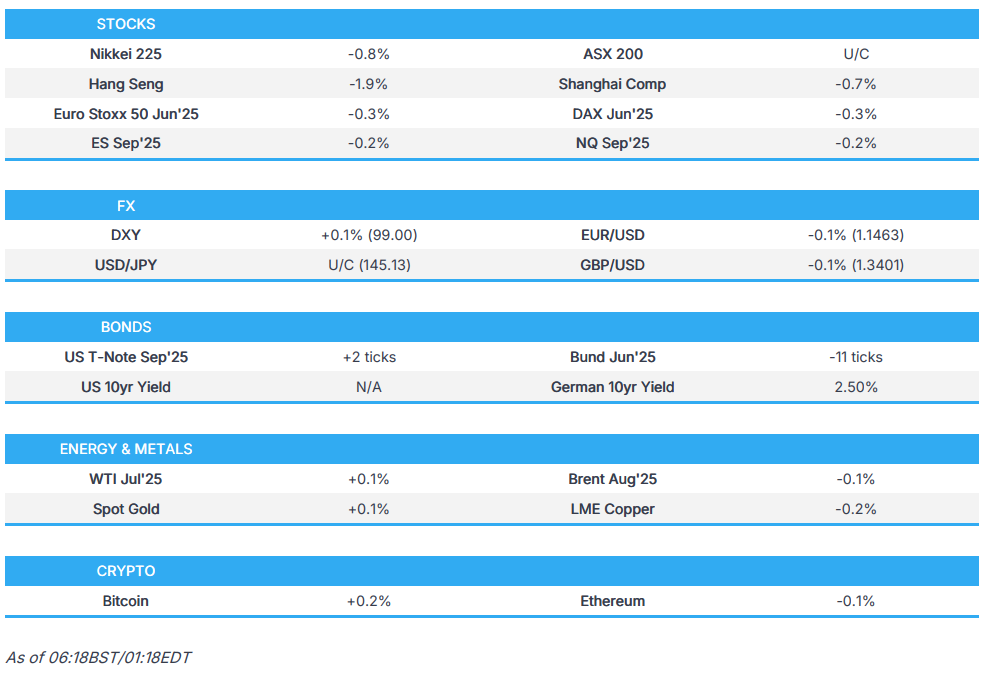

- APAC stocks traded subdued following the mixed close on Wall Street, where traders juggled the FOMC alongside geopolitics, with markets apprehensive as US President Trump keeps participants in the dark about his touted move on Iran.

- The Federal Reserve left rates unchanged at 4.25-4.5%, as was widely expected, with the 2025 dot plot left unchanged although the composition saw a hawkish shift; Fed Chair Powell pushed back on any dovish interpretation of policy in the short term.

- The US is reportedly eyeing this weekend as a possibility for an attack on Iran and is preparing for a possible strike in the coming days, according to Bloomberg.

- US President Trump is reportedly getting comfortable with the idea of taking out Iran's Fordow nuclear facility with multiple strikes. “There was now a movement to get ready for this,” ABC sources said.

- US President Trump is scheduled to be in the Situation Room for an intelligence briefing at 11:30 EDT on Thursday, according to CBS' Jacobs.

- European equity futures are indicative of a slightly softer open with the Euro Stoxx 50 -0.2% after cash closed down -0.4% on Wednesday.

- Looking ahead, highlights include BoE, SNB, Norges Bank, and CBRT, Speakers include ECB's Lagarde, Nagel, de Guindos, SNB's Jordan, Norges Bank's Bache, supply from Spain and France.

- Holiday: On Thursday 19th June, on account of the Juneteenth Holiday, the Desk will shut at 18:00BST/13:00EDT and re-open the same day for the beginning of Asia-Pac coverage at 22:00BST/17:00EDT.

US TRADE

EQUITIES

- US stocks ended the day with marginal gains, albeit with outperformance in the Russell, while geopolitics, Fed, and Trump dominated the tape.

- As a reminder, US cash markets will be closed on Thursday amid Juneteenth Holiday.

- SPX U/C at 5,981, NDX U/C at 21,720, DJI -0.10% at 42,172, RUT +0.52% at 2,113

- Click here for a detailed summary.

NOTABLE HEADLINES

- BoC Governor Macklem said the world had already been becoming more fragmented before Trump was elected, so businesses were still facing uncertainty, according to Reuters.

- EU antitrust regulators were set to open a full-scale investigation into the USD 36bln Mars bid for Kellanova (K), according to Reuters sources, as regulators were concerned about Mars' high market share in certain products in some EU countries.

- Microsoft (MSFT) is planning thousands more job cuts aimed at salespeople, Bloomberg reported.

- Meta (META) is reportedly in talks to hire a former GitHub CEO to join AI efforts, according to The Information.

TRADE/TARIFFS

- The Chinese Ambassador to the US called for US tariffs on China to be removed completely, according to Bloomberg.

- German Chancellor Merz expressed hope for an agreement in the US-EU tariff row in the coming days, according to Reuters.

FOMC

STATEMENT AND SEP

- The Federal Reserve left rates unchanged at 4.25-4.5%, as was widely expected, with the 2025 dot plot left unchanged at 3.9%, which signals 50bps of cuts this year, although the 2026 dot plot was revised higher to 3.6% from 3.4% and 2027 was revised up to 3.4% from 3.1%. However, there was some discourse over the number of cuts seen this year. Seven members see no cuts this year, vs. four in March, while two see worth 25bps of cuts, down from four in March, eight see 50bps (prev. nine), and two see 75bps of easing (unchanged from March).

- Highlighting the close proximity for the median dot, 9 members see FFR above the median, and 10 members see FFR at the median or below. GDP forecasts were cut for both 2025 and 2026 to 1.4% (prev. 1.7%) and 1.6% (exp. 1.8%), respectively, while unemployment rate forecasts ticked higher across all time horizons ex. long-run. Headline and Core PCE inflation dots were also notably lifted with the 2025-end headline rate seen at 3.0% (prev. 2.7%) and 2026 at 2.4% (prev. 2.2%).

- Regarding the statement, the Committee said the uncertainty about the outlook has "diminished further but remains elevated", a change from the prior "increased further", and it also removed the stagflation warning line that "risks of higher unemployment and higher inflation have risen".

PRESS CONFERENCE

- Fed Chair Powell largely echoed familiar remarks in that a patient and wait-and-see approach is appropriate. He also toed the usual line post SEPs that projections are subject to uncertainty, and are not a set plan.

- He recommended focusing on the near-term projections due to the difficulty of providing longer-term forecasts. Looking ahead, Fed Chair Powell said the time will come when they have more confidence, but he cannot say exactly when that will be.

- He stressed that as long as they have the kind of labour market they have, and inflation is coming down, the right thing to do is hold rates. Powell expects to learn a great deal more over the summer, adding they will make smarter decisions if they wait a "couple of months".

- Powell noted inflation has been favourable over the last three months, but he expects to see more tariff impacts in the coming months and expects businesses to pass on costs to consumers, again stressing this is why the Fed need to be patient. Powell said they have to keep rates high to get inflation all the way down, and he described policy as "modestly restrictive", noting it is not very restrictive. Powell in May said, "Policy is sort of modestly or moderately restrictive".

REACTION

- The unchanged 2025 dot plot initially resulted in gains in stocks and Treasuries, alongside a Dollar sell-off. However, moves had started to pare as the hawkish composition of the 2025 dot plot was digested, while the 2026 and 2027 dots were revised up. Meanwhile, inflation projections were revised up, growth forecasts were revised down and unemployment forecasts were revised higher, likely to incorporate the expected impact of tariffs.

- In Powell's presser, he largely echoed familiar remarks in that a patient and wait-and-see approach is appropriate, and that they would learn more over the summer to make smarter decisions, weighing on T-notes, stocks and supporting the Dollar. However, Trump managed to steal the limelight through the Fed and markets saw pronounced downside in the crude complex and an upside in indices as he said he may meet with Iran.

- US President Trump posted critical language of Fed Chair Powell; "Too Late—Powell is the WORST. A real dummy, who’s costing America $Billions!"

APAC TRADE

EQUITIES

- APAC stocks traded subdued following the mixed close on Wall Street, where traders juggled the FOMC alongside geopolitics, with markets apprehensive as US President Trump keeps participants in the dark about his touted move on Iran.

- ASX 200 saw its losses cushioned by a recovery in gold miners. The index came off highs after employment surprisingly contracted.

- Nikkei 225 marginally underperformed with USD/JPY briefly dipping under 145.00 and a trade deal with the US proving elusive.

- Hang Seng and Shanghai Comp were subdued in tandem with the broader risk tone, with China-specific newsflow once again taking a back seat to geopolitics.

- US equity futures were subdued following the choppiness seen during the Fed, with attention overnight on geopolitics. Futures saw some weakness on reports via ABC that US President Trump was getting comfortable with the idea of taking out Iran's Fordow nuclear facility with multiple strikes. Another leg lower was seen as Bloomberg reported that the US was reportedly eyeing this weekend as a possibility for an Iran attack and was preparing for a possible strike in the coming days.

- European equity futures are indicative of a slightly softer open with the Euro Stoxx 50 -0.2% after cash closed down -0.4% on Wednesday.

FX

- DXY was modestly firmer, holding the bias seen post-FOMC, which initially resulted in a dovish reaction amid the 2025 dot plot being maintained, albeit with a hawkish shift in the composition. Afterwards, Fed Chair Powell pushed back on any dovish interpretation of policy in the short term, noting they would have to keep rates high to bring inflation all the way down, and said they would learn more over the summer when they could make smarter decisions. Overnight, the index saw some upticks and eventually climbed above 99.00 following reports that the US was reportedly eyeing this weekend as a possibility for an Iran attack, and was preparing for a possible strike in the coming days.

- EUR/USD saw slight weakness, but more so amid the upward bias in the Dollar, with the pair dipping back under the 1.1500 level in late US trade before breaching Wednesday's low and finding support at 1.1450.

- GBP/USD hovered around the 1.3400 mark as traders gear up for the latest BoE policy announcement, in which the MPC was widely expected to keep policy steady with dovish dissent from Dhingra and Taylor.

- USD/JPY oscillated on either side of 145.00, with broader market sentiment cautious amid the fluid geopolitical landscape. USD/JPY saw its 21 DMA at 144.10 and 50 DMA at 144.01.

- Antipodeans were both softer, as their high-beta properties kept the pairs subdued amid the broader cautious mood. AUD/USD was also hampered by jobs data showing a surprise shed of jobs, driven by part-time roles. NZD saw deeper losses despite Q1 New Zealand GDP largely printing above forecasts, with downside momentum accelerating on a breach of 0.6000.

- PBoC set USD/CNY mid-point at 7.1729 vs exp. 7.1916 (prev. 7.1761)

- Brazilian Selic Interest Rate 15.0% vs. Exp. 14.75% (Prev. 14.75%); BCB sees the end of a tightening cycle, and will not hesitate to raise rates if appropriate.

FIXED INCOME

- 10yr UST futures saw losses as Fed Chair Powell pushed back on near-term rate cuts, but were underpinned overnight by the aforementioned geopolitics, with upticks seen amid reports that the US was preparing for a strike on Iran in the coming days.

- Bund futures caught up to some of the Fed-induced losses, but the downside was limited as markets remained anxious with the US reportedly preparing to strike Iran.

- 10yr JGB futures edged higher, with desks citing haven demand amid the Middle Eastern tensions, while Japan’s MoF was gearing up to hold a JGB primary dealers’ meeting on 20th June. Downticks in contracts were seen as Tokyo trade resumed and traders reacted to Reuters sources suggesting Japan plans to cut super‑long bond sales by 10 % to ease market concerns. A knee-jerk higher was then seen on the 5-year JGB auction which saw the highest cover since 2023.

- US Treasury Holdings (April, USD): China 757bln (prev. 765bln), Japan 1.135tln (prev. 1.131tln), UK 808bln (prev. 779bln).

- Japan sold JPY 2.4tln 5yr JGBs; b/c 4.58x (prev. 3.19x), average yield 0.9820% (prev. 0.9800%).

- Japan said to plan to cut super‑long bond sales by 10% to ease market concerns; Japan is set to cut scheduled JGB sales to the market by JPY 500bln from the initial plan to JPY 171.8tln in FY2025/2026, according to a draft revised plan cited by Reuters. It plans to cut sales of 20- and 30-year bonds by JPY 900bln each, to JPY 11.1tln and JPY 8.7tln, respectively, in FY2025/2026. The government also aimed to increase JGB sales to households by JPY 500bln to JPY 5.1tln, and to raise sales of 2-year JGBs, as well as one-year and six-month treasury discount bills, by JPY 600bln each, according to Reuters.

COMMODITIES

- Crude futures were subdued following a choppy Wednesday and amid Dollar strength, with some upside overnight seen on reports via ABC that US President Trump was getting comfortable with the idea of taking out Iran's Fordo nuclear facility with multiple strikes: "There is now a movement to get ready for this." Another leg higher was seen as Bloomberg reported that the US was said to be eyeing this weekend as a possibility for an Iran attack and was preparing for a possible strike in the coming days.

- Spot gold was buoyed overnight by the aforementioned geopolitics following post-Fed weakness.

- Copper futures were subdued in lockstep with the broader risk tone across markets.

- US EIA- Nat Gas, Change Bcf w/e 95.0bcf vs. Exp. 98.0bcf (Prev. 109.0bcf)

- Goldman Sachs said that following the rise in Brent to USD 76–77/bbl, it estimated a geopolitical risk premium of around USD 10/bbl. While its base case remained that Brent would decline to around USD 60/bbl in Q4, assuming no supply disruptions, the USD 10/bbl premium appeared justified in light of its lower Iran supply scenario—where Brent spiked just above USD 90/bbl—and in tail scenarios where broader regional oil production or shipping was negatively affected, according to Reuters.

CRYPTO

- Bitcoin traded within a narrow range of around USD 105k.

- White House crypto czar Sacks said the crypto bill was 'very close' and that the stablecoin bill would create demand for US dollars, according to Reuters.

- US President Trump posted "The Senate just passed an incredible Bill that is going to make America the UNDISPUTED Leader in Digital Assets...The House will hopefully move LIGHTNING FAST, and pass a “clean” GENIUS Act. Get it to my desk, ASAP".

NOTABLE ASIA-PAC HEADLINES

- HKMA maintains its base rate at 4.75%, as expected (in lockstep with the Fed).

- Magnitude 6 earthquake strikes off coast of Hokkaido, Japan region according to GFZ.

- PBoC injected CNY 203.5bln via 7-day reverse repos with the rate maintained at 1.40%.

DATA RECAP

- New Zealand GDP Exp Based QQ, SA (Q1) 0.9% vs. Exp. 0.7% (Prev. 0.8%, Rev. 0.6%)

- New Zealand GDP Prod Based QQ, SA (Q1) 0.8% vs. Exp. 0.7% (Prev. 0.7%, Rev. 0.5%)

- New Zealand GDP Prod Based YY, SA (Q1) -0.7% vs. Exp. -0.8% (Prev. -1.1%, Rev. -1.3%)

- New Zealand GDP Prod Based, Ann Avg (Q1) -1.1% vs. Exp. -1.0% (Prev. -0.5%, Rev. -0.6%)

- Australian Employment (May) -2.5k vs. Exp. 22.5k (Prev. 89.0k)

- Australian Unemployment Rate (May) 4.1% vs. Exp. 4.1% (Prev. 4.1%)

- Australian Participation Rate (May) 67.0% vs. Exp. 67.1% (Prev. 67.1%)

- Australian Full Time Employment (May) 38.7k (Prev. 59.5k)

GEOPOLITICS

Strikes Headlines

- Heavy explosions had rocked Isfahan, Shiraz, and Kermanshah early on Thursday, eyewitnesses told Iran International, shortly after Iran had launched a new missile barrage against Israel.

- Israel’s airstrikes on Iran had likely set back the country’s nuclear programme by a few months, according to NBC sources.

- The Israeli military issued a warning on social media early on Thursday, in Persian, calling for people to leave Iran’s Arak nuclear complex and the surrounding area, stating it was conducting an operation there, according to Reuters.

- An IDF spokesman said they would continue to strike nuclear reactors in Iran, Al Jazeera reported.

- Iran reportedly thwarted a large-scale attack on its banking network, according to Fars.

- Israel is ready to continue attacking Iran, even without US participation, according to Al Arabiya.

- Israeli military official said several Iranian missiles hit civilian population centres, including a hospital in southern Israel, after dozens of missiles launched at Israel, according to Reuters.

US Involvement Headlines

- US President Trump is scheduled to be in the Situation Room for an intelligence briefing at 11:30 EDT on Thursday, according to CBS' Jacobs.

- The US is reportedly eyeing this weekend as a possibility for an attack on Iran and is preparing for a possible strike in the coming days, according to Bloomberg.

- US President Trump is reportedly getting comfortable with the idea of taking out Iran's Fordow nuclear facility with multiple strikes. “There was now a movement to get ready for this,” ABC sources said. “There had been no response from the Iranians regarding ongoing nuclear talks, likely because of the way Trump had demanded an unconditional surrender,” they added.

- US President Trump had reviewed attack plans for Iran but was holding off to see if Tehran stepped back from its nuclear programme, a person familiar with the matter told CNN.

- Following the Situation Room meeting, President Trump told top advisers that he had approved attack plans for Iran that were presented to him, but said he was waiting to see if Iran would be willing to discuss ending its nuclear programme, according to ABC sources.

- US President Trump had reportedly privately approved attack plans for Iran on Tuesday but withheld the final order, according to WSJ sources. “President Trump told senior aides late Tuesday that he approved of attack plans for Iran, but was holding off on giving the military the final order to see if Tehran would abandon its nuclear programme,” three people familiar with the deliberations said, via a WSJ reporter.

- US President Trump reportedly wanted to ensure that any attack on Iran was truly necessary, would not drag the US into a prolonged war in the Middle East, and—most importantly—would actually achieve the objective of destroying Iran’s nuclear programme, according to Axios. One option under consideration was a risky commando raid. Israeli special forces had carried out such an operation last September, albeit on a smaller scale, when they destroyed an underground missile factory in Syria by planting and detonating explosives. A US official said the Israelis had told the Trump administration that while they might not be able to reach deep enough into the mountain with bombs, they might “do it with humans.”

- CENTCOM Commander Kurilla met with President Trump and briefed him on the military option, Jerusalem Post reported.

- A US official told Al Jazeera that US forces in the Middle East had taken maximum security measures and that none of the B-2 bombers had yet headed to the region.

- Israel estimated that the US would join the attack on Iran and the Fordow nuclear facility, according to Sky News Arabia citing the Israeli Broadcasting Authority.

- The army is at the peak of its preparations for the US to enter the war on Iran, according to Al Hadath citing Israeli broadcasting.

- Israel's Channel 12, citing a source, reported that US air defence systems had intercepted the latest batch of Iranian missiles, according to Al Jazeera.

- People with ties to the White House continued to believe — barring a 180 from the Iranians — that a US strike was possibly coming by the weekend, according to FBN’s Gasparino.

- A senior Iranian official said any direct US entry onto the front line would be met with an unprecedented threat to enemy ships, via Al Jazeera.

Diplomacy Headlines

- An Iranian official from the Foreign Ministry, who asked not to be named, said that Iran would accept President Trump’s offer to meet soon, according to The New York Times.

- The Iranians had conveyed a message to the Qataris, who, together with the Omanis, were trying to mediate for a ceasefire, saying they were willing to talk in order to reach an agreement with the US, but that Israel needed to "calm things down", via Jerusalem Post.

- The Iranian Foreign Ministry denied the arrival of an Iranian negotiating delegation to the Omani capital, Muscat, according to Sky News Arabia.

- The EU, France, Germany, and Britain will reportedly hold talks with the Iranian foreign minister on Friday in Geneva, according to Reuters sources.

- US President Trump said he would hold a meeting to discuss the Iran-Israel situation. He stated that Iran wanted to meet and that “anything could happen,” but he had not made a final decision yet. He remarked that Israel was doing “pretty well” and had discussed Iran with a Pakistani army official. He said he had told Israeli PM Netanyahu to continue and that they would meet shortly in the operating room, where he had ideas on what they were going to do. “I make my decisions at the last minute,” he added. Trump said he believed Iran was only a few weeks away from having a nuclear weapon. When asked about the Middle East, he said, “I don’t want to get involved.” He also stated that he believed Iran would use a nuclear weapon if it had one. On acting against Fordow, he said he had not made a decision. He noted that a deal could still happen and that he had not closed the door on meeting with Iran. He added that his supporters did not want to see Iran acquire a nuclear weapon. He suggested that fighting might be necessary to block Iran’s nuclear ambitions and that they were aiming for total victory — meaning no nuclear weapon. He concluded that if Israel did a good job, they would not need to fight, according to Reuters.

RUSSIA-UKRAINE

- Russian President Putin said Russia is open to talks with Europe as a whole. He stated, “We considered Germany and other European states not as neutral states, but as those who supported Ukraine and were participants in military actions,” according to Reuters.

- Russian President Putin said he was ready to meet anyone in Ukraine, including Ukrainian President Zelensky. He added that he was prepared to meet the head of Ukraine at the final stage of negotiations, according to Reuters.

- Russian President Putin said they are ready for substantive talks with Ukraine on the principles of a peaceful settlement. He noted that the negotiating teams were in contact and that the next meeting was possible after 22 June, according to Reuters.

EUROPE

NOTABLE HEADLINES

- ECB's Nagel said the ECB's mission was more or less accomplished, according to Reuters.

- SNB Financial Stability Report: Economic and financial conditions relevant for the Swiss financial sector have deteriorated over the past 12 months.