US Market Open: JPY bid on hawkish BoJ sources, USTs pressured into supply & BLS NFP Prelim Revisions

09 Sep 2025, 11:27 by Newsquawk Desk

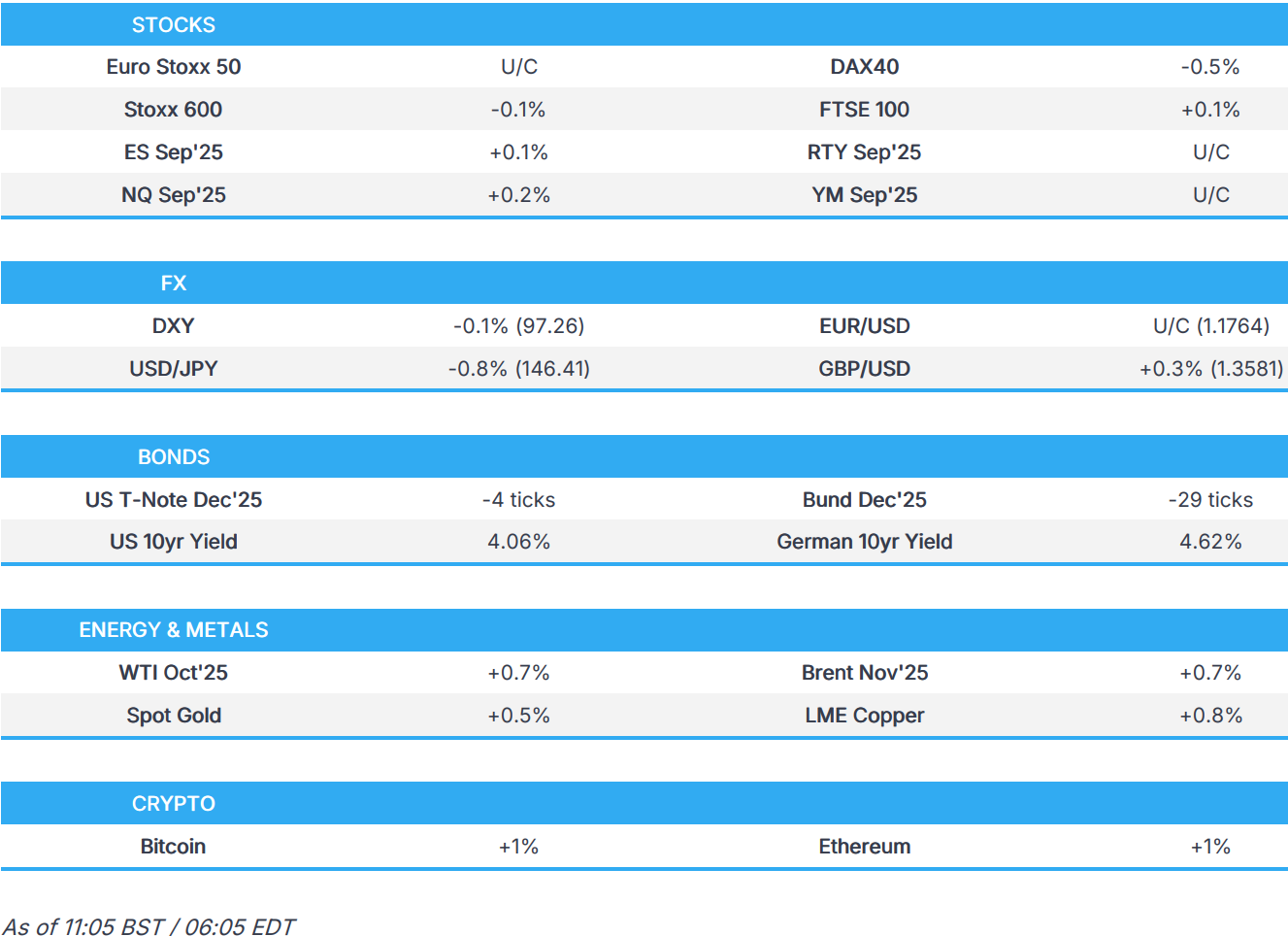

- Global equity futures are modestly mixed; Anglo American & Teck merge to create a USD 50bln mining giant.

- USD is a little lower whilst JPY soars amid hawkish BoJ reports.

- OAT-Bund 10yr spread a little wider in the aftermath of French PM Bayrou’s removal, JGBs hit by BoJ sources.

- BoJ reportedly sees some chance of hiking this year, despite the political situation, via Bloomberg citing sources; likely to keep rates unchanged on September 19th

- Crude rebounds and metals non-committal awaiting the next impetus.

- Looking ahead, US NFP Prelim. Benchmark Revisions, Apple Event, Comments from BoE's Breeden, Supply from the US.

TARIFFS/TRADE

- Japan's trade negotiator Akazawa said US tariffs on Japanese goods, including cars, will be lowered by September 16th, according to Reuters citing a post on X. However, Akazawa later commented that tariff discussions with the US are not fully resolved and that Japan must ensure the trade deal is carried out.

- South Korea and the US are to resume working-level talks regarding tariffs, according to Yonhap

- South Korea's presidential adviser said US trade negotiations are being delayed due to the issue of FX market impacts from the USD 350bln package and have asked the US to help find a solution to the capital market impact, while they told the US that they can't agree on terms similar to Japan's USD 550bln deal.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 U/C) opened modestly firmer across the board, but now display a mixed picture, though with nothing really behind the slip in sentiment.

- European sectors opened with a strong positive bias, but as sentiment slipped, sectors are now mixed. Basic Resources tops the pile, boosted by gains in Anglo American (+10%); the Co. and Teck Resources (+10.3% pre-market) have merged to create a USD 50bln mining giant; the merger is expected to yield USD 800mln in annual synergies. Elsewhere, Banks and Media complete the top three; for the latter, UMG (+2.2%) boosts the sector after receiving a broker upgrade.

- US equity futures (ES +0.1%, NQ +0.2%, RTY +0.1%) began marginally firmer but are now mixed but with outperformance in the NQ, continuing a similar theme seen in the prior session.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY edged higher through the European session shortly after printing session lows coming out of APAC hours, where for the most part DXY saw some relief from Monday's extension of post-NFP selling and as longer-dated US yields retreated. In terms of state-side news, the US Senate Banking panel is to vote on Miran's Fed nomination on September 10th, according to Bloomberg. Further, White House is preparing a report critical of the Bureau of Labor Statistics, according to WSJ. DXY resides in a 97.253-97.519 range.

- EUR moves at the whim of the buck following initial choppiness coming out of Asian hours. In France, PM Bayrou lost in a landslide as expected, while President Macron is to name a new PM in the coming days, which may come after the September 10th strikes. The OAT-Bund spreads pushed wider after Bayrou’s defeat, though EUR/USD held steady. EUR/USD trades in a 1.1744-1.1780 band.

- JPY firmed in European hours following source reports that the BoJ sees some chance of hiking this year, despite the political situation, via Bloomberg citing sources, but likely to keep rates unchanged on September 19th. Some officials are even of the view that a hike could be appropriate as early as October. Earlier sources via Reuters noted that while political uncertainty in Japan will not derail the BoJ's normalisation plan, it could impact the timing of the next hike: "BoJ does not need to hike in the midst of turbulence". USD/JPY fell under its 50 DMA (147.42) to a 146.56 trough from a 147.56 session high.

- GBP gained a firmer footing at the 1.3500 handle after G10 currencies generally took advantage of recent dollar selling, but with further upside limited amid light catalysts. Overnight, it was reported that UK Chancellor Reeves is to tell ministers to prioritise the fight against inflation in a Cabinet meeting today, according to FT, although this caused little immediate follow-through on exchange rates. GBP/USD resides in a 1.3544-1.3583 range, ahead of BoE's Breeden later.

- Antipodeans are holding the positive bias seen in APAC hours as the pairs are kept afloat after a firmer PBoC reference rate setting, but with gains capped following weaker Australian consumer sentiment and mixed business surveys.

- Norway's Labour Party government won re-election backed by four smaller parties, according to official results.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A slightly softer start to the session for USTs, but only modestly so. Specifics light as we look to the BLS NFP benchmark revision report, an Apple event and then 3yr supply. Into this and mentioned supply USTs find themselves a little heavy, towards the lower end of a 113-11 to 113-19 band.

- JGBs were on a gradual descent across the APAC session and into the European morning, initially in-fitting with the modest pullback seen in peers but then accelerating on fresh BoJ sources. Firstly, Reuters reported that political uncertainty will not derail the BoJ’s normalisation plan, but could impact the timing. However, this was followed by a Bloomberg source that the BoJ still sees some chance of hiking this year (markets imply 15bps of tightening by end-2025). Even more hawkishly, the source stated some officials are of the view that an October hike could be appropriate (+8bps implied by markets). The hawkish elements sent JGBs to a 136.73 trough, lower by near enough 50 ticks at worst.

- OATs kicked off the day near enough unchanged to Monday’s close. With a small bout of pressure seen into the close as the French confidence vote hit just minutes before. However, as expected, the price reaction for OATs themselves has been fairly muted, due to the fall of Bayrou being very much priced in. One nuance on the reaction, but only really evident in the spread, was the slightly worse than expected vote split for him, as not all of the central alliance voted ‘for’ Bayrou. A nuance that perhaps explained the modest jump up in the OAT-Bund 10yr spread to 83.38bps this morning, eclipsing the 82.19bps peak that printed when Bayrou announced the vote. If the move continues, we look to the YTD peak at 88bps and then the 2024 peak of 90bps.

- Bunds are softer, with the pressure of a comparable scale to that outlined in USTs above; pressure which came ahead of a double green line outing. The auction was fairly in-line and had limited impact on Bunds. At a 128.97 low, above Monday’s 128.91 base and towards the upper-end of Friday’s 128.51 to 129.20 band; i.e. similar price action to USTs, as outlined above.

- Gilts echo the above. Down to 91.31 at worst but well clear of Monday’s 91.09 base and, like with Bunds and USTs, towards the upper end of a 90.65 to 91.31 range. Specifics for the UK a little light, supply was well received and lifted Gilts off worst levels and to a marginal new high at 91.48; though, the benchmark still languishes in the red by just under 10 ticks. That aside, we await a speech from Chancellor Reeves in the later part of the morning.

- UK sells GBP 1.75bln 4.75% 2043 Gilt: b/c 3.50x (prev. 3.38x), average yield 5.291% (prev. 5.155%) & tail 0.2bps (prev. 0.3bps).

- Germany sells EUR 0.49bln vs exp. 0.5bln 0.00% 2031 Green & EUR 0.85bln vs exp. EUR 1.0bln 2.50% 2035 Green Bund.

- Click for a detailed summary

COMMODITIES

- Crude edges higher in rangebound trade after the prior day's fluctuations, whereby early gains due to OPEC+ and geopolitics were trimmed after Saudi Arabia lowered premiums for OSPs to Asia and North-West Europe. WTI currently resides in a 62.37-63.16/bbl range while Brent sits in a USD 66.12-66.94/bbl range.

- Precious metals are relatively rangebound trade amid light catalysts and head of risk events, with attention now on data releases, including the BLS prelim. benchmark revisions are scheduled today, followed by PPI on Wednesday and CPI on Thursday. Spot gold currently resides in a USD 3,628.48-3,659.43/oz after printing fresh record highs yet again.

- Base metals lack firm direction with the price action contained within a tight range after the indecisive performance on Monday, and with newsflow light today. 3M LME copper resides in a USD 9,894.20-9,963.70 /t range at the time of writing.

- Iraq sets October Basra medium crude official selling price to Asia at USD 1.35/bbl premium to Dubai average; Selling price for Europe set at -USD 2/bbl versus Dated Brent; Selling price to North and South America at -USD 1/bbl versus ASCI.

- US Interior Secretary says they have the capacity to replace all Russian gas to Europe.

- HSBC expects "OPEC+ to start unwinding 1.65mbd voluntary cuts from October"; HSBC maintains USD 65/bbl Brent forecast from Q4, with rising downside risks from rising market surplus.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK BRC Retail Sales YY (Aug) 2.9% (Prev. 1.8%); Total Sales YY (Aug) 3.1% (Prev. 2.5%)

- French Industrial Output MM (Jul) -1.1% vs. Exp. -1.5% (Prev. 3.8%, Rev. 3.7%).

NOTABLE EUROPEAN HEADLINES

- Barclays UK August Consumer Spending rose 0.5% Y/Y vs prev. 1.4% Y/Y increase in July.

- Newsquawk Analysis: French PM Bayrou lost, as expected. What next?

NOTABLE US HEADLINES

- US Senate Banking panel to vote on Miran's Fed nomination on September 10th, according to Bloomberg.

- White House is preparing a report critical on the Bureau of Labor Statistics, according to WSJ

GEOPOLITICS

MIDDLE EAST

- Israel conducted strikes in the vicinity of Syria's Homs, Palmyra and Latakia cities.

- Downing Street spokesperson said Palestinian President Abbas welcomed UK PM Starmer's pledge to recognise a Palestinian state ahead of the UN General Assembly meeting later this month.

- "Iranian government: The regime's leadership will decide to withdraw from the Nuclear Non-Proliferation Treaty", via Al Arabiya.

- Iran-IAEA agreement likely at Cairo talks, according to Tasnim News.

RUSSIA-UKRAINE

- Ukraine is at risk of a shortage of air defence weapons after a US DoD review of military aid resulted in slower deliveries, according to officials cited by FT.

OTHER

- North Korea's leader Kim observed solid fuel engine tests and said it marks an important change to the nuclear force.

- Chinese President Xi sent congratulations to North Korea's Kim on the founding anniversary, while it was separately reported that President Xi said China is ready to enhance strategic communication and maintain close cooperation with North Korea for regional and world peace, and development, according to Xinhua.

CRYPTO

- Bitcoin is a little firmer and trades just under USD 113k, with Ethereum also moving higher towards USD 4.4k.

APAC TRADE

- APAC stocks traded mixed as the region failed to fully sustain the mildly positive handover from Wall St, with price action contained amid light fresh catalysts and as participants looked ahead to upcoming events, including inflation data scheduled in the next couple of days.

- ASX 200 was dragged lower with notable weakness in Energy, Industrials, Real Estate and Financials, with sentiment also not helped by a deterioration in consumer confidence and mixed business surveys.

- Nikkei 225 initially rallied above the 44,000 levels to print a fresh record high, but then gradually faded its gains as political uncertainty lingered.

- Hang Seng and Shanghai Comp were mixed with the Hong Kong benchmark led higher by outperformance in real estate and tech, with the former helped as China's MIIT pledged to accelerate breakthroughs in high-performance chip technology. Conversely, the mainland lagged amid lingering global frictions with EU officials reportedly discussing potential sanctions on China and other parties for the purchase of Russian energy, while Chinese President Xi recently took aim at a 'certain country' increasing trade war risks.

NOTABLE ASIA-PAC HEADLINES

- BoJ reportedly sees some chance of hiking this year, despite the political situation, via Bloomberg citing sources; likely to keep rates unchanged on September 19th. Sees steady progress towards the BoJ price target. Sees the US trade deal as removing some risks to growth. Some officials are even of the view that a hike could be appropriate as early as October.

- Reuters sources report that while political uncertainty in Japan will not derail the BoJ's normalisation plan, it could impact the timing of the next hike; add, "BoJ does not need to hike in the midst of turbulence". "no rush...as long as it gets another rate hike done possibly by early next year".

- Bank of Japan likely to slightly reduce purchases of super-long Japanese government bonds in Q4 2025, according to Reuters sources. BoJ to make final decision on 30 September, influenced by 20-year government bond auction on 17 September and market volatility in super-long JGB yields.

- China's Ministry of Industry and Information Technology said in a briefing that China is to accelerate breakthroughs in high-performance chip technology and will guide 10-gigabit optical networks from pilot testing to deployment.

- Japanese Finance Minister Kato said he will carefully consider the possibility when asked about entering the LDP leadership race, while he noted that Japan's economy is showing bright signs, but there is a need to support those suffering from rising prices, including food prices.

- Japanese LDP politician Kono reiterated that if the BoJ delays rate hikes, it would boost inflation, and noted they need to fix a weak yen, so the BoJ needs to hike rates, while he added that a sales tax cut would increase the deficit, and said he is 'sleeping on' whether to run for LDP leadership.

DATA RECAP

- Australian Consumer Sentiment (Sep) -3.1% (Prev. 5.7%)

- Australian NAB Business Confidence (Aug) 4.0 (Prev. 7.0, Rev. 8); Conditions (Aug) 7.0 (Prev. 5.0)