US Opening News: US gov't shuts down. DXY hit, Treasuries contained, awaiting ISM & shutdown update

01 Oct 2025, 11:49 by Newsquawk Desk

- US Government has officially gone into a shutdown. Weighing on the general risk tone in the early morning and the USD.

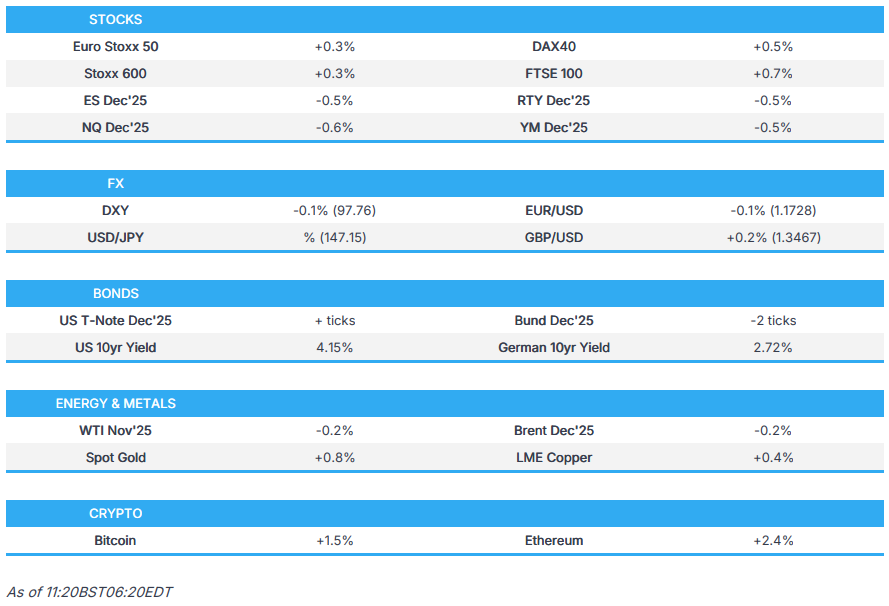

- European bourses have since bounce and extended to highs, Euro Stoxx 50 +0.3%; Healthcare leading. Stateside, futures remain lower awaiting data, ES -0.3%.

- DXY delved as low as 97.46 before recovering modestly, JPY tops the leaderboard, GBP & EUR both firmer though EUR losing some steam more recently.

- USTs contained awaiting data and shutdown updates, Bunds hit by soft supply, Gilts lag on Reeves.

- Crude initially steady but under increasing pressure this morning, XAU has resumed its ascent.

- Looking ahead, highlights include US ADP (Sep), ISM Manufacturing (Sep), Atlanta Fed GDP, BoC Minutes, Fedʼs Barkin, ECBʼs Elderson, de Guindos, Rehn, BoCʼs Rogers.

- Click for the Newsquawk Week Ahead.

US GOVERNMENT SHUTDOWN

- The US government officially went into shutdown, with a majority of operations halted after no funding deal was reached in the Senate, marking the first shutdown since 2018.

- House and Senate GOP leaders will hold a 10:00ET/15:00BST news conference Wednesday, according to Politico, citing sources.

TRADE/TARIFFS

- US Deputy Secretary of State encouraged investment from South Korea, with the US and South Korea holding a working group on visas for South Korean businesses investing in the US, according to a statement.

- South Korea and the US released a joint statement on a foreign exchange policy agreement, pledging to avoid manipulating exchange rates to gain an unfair competitive advantage. The statement did not mention a bilateral currency swap or South Korea’s state-run pension fund. Both sides agreed that FX market intervention should be reserved for combating excessive volatility and would be considered for both disorderly depreciation and appreciation. They also agreed to exchange FX intervention operations on a monthly basis and said any macroprudential or capital flow measures will not target exchange rates, according to Reuters.

- Taiwan rejected a US request to produce half of its chips locally, according to Bloomberg.

- Japanese Economy Minister Akazawa said they will operate a USD 550bln US-bound investment without causing FX impact, suggesting USD 550bln is the range where there is no FX impact, according to Reuters.

- European Commission is reportedly looking to sign the EU-Mercosur partnership agreement on December 5th, via Politico citing diplomats.

- European Commission reportedly plans to raise import tariffs on foreign steel to similar levels as US and Canada, via Reuters citing sources; expected to lift the steel import tariff level to 50%.

EUROPEAN TRADE

EQUITIES

- European bourses largely firmer, Euro Stoxx 50 +0.3%. Regional outperformance seen in the FTSE 100 +0.7% and SMI +1.5% on account of gains for Healthcare names after Pfizer's pricing deal.

- More broadly, sectors are mixed. Energy initially firmer but has succumbed to fresh pressure in the underlying benchmarks, Tech lags and drags on the DAX 40 +0.4%.

- Numerous individual movers of note, but not changing the macro picture: Puma & Adidas firmer after Nike (+3.2% pre-market); BNP Paribas hit by Bloomberg reports of changes to Basel rules - see European updates for more.

- Stateside, futures are lower across the board as selling pressure picked up early doors when the US government shutdown formally occurred. ES -0.6%, NQ -0.7%; given the shutdown, today's ADP and ISM data draws even greater focus.

- In terms of stocks to watch: Nike (+3.2%) post-earnings; Occidental (+1.3%) as Berkshire Hathaway is looking at the petrochemical unit; Morgan Stanley (+0.5%) after the Fed lowered the names stress capital buffer.

- Samsung (SSNLF/ 005930 KS) and SK Hynix (HXSCL) to supply memory chips to OpenAI's Stargate project, via Yonhap & Reuters.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD falters on shutdown concerns. Given the shutdown, alternative labour reports to Friday's currently-cancelled Payrolls will draw greater importance. DXY delved as low as 97.46 (lowest since 24th Sept) before recovering modestly across the European morning.

- JPY tops the G10 leaderboard, USD/JPY briefly slipped below 147.00. Support for the Yen is partially a by-product of its safe-haven appeal as the US government enters into shutdown. Additionally, the Yen is also being bolstered by the Japanese Tankan survey, which was mixed/in-line, but ultimately viewed by markets as not being enough to derail expectations of a BoJ rate hike next month.

- Sterling and Euro both firmer vs the USD. Sterling unaffected by BoE's Mann or the regions PMIs, no move in the EU on its data either including Flash HICP. GBP/USD surpassed its 50DMA @ 1.3463 with focus on a test of 1.35 to the upside while EUR/USD got as high as 1.1778 before fading as the USD came off worst.

- Antipodeans diverge with AUD unable to capitalise on the softer USD with the risk tone capping and with attention on the regions PMIs (revised lower) and Tuesday's reporting around iron ore cargoes. Kiwi unaffected by the latter points and as such is a touch firmer NZD/USD looking to the 200-DMA at 0.5844.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Treasuries are currently holding around the unchanged mark, though the benchmark has posted losses of a handful of ticks at worst this morning. Unable to materially benefit from the deteriorating risk tone, though the complex is off worst in a narrow 112-12 to 112-16+ band.

- As a reminder, in 2018 Fitch warned that an extended shutdown could spark a downgrade to the US’ AAA rating (currently AA+). Since, we have seen the major agencies all warn about increasing US budgetary and general fiscal risks, a point that becomes more acute during a shutdown.

- Narrative similar for Bunds, hit a 128.24 low early doors but lifted off this as the European morning progressed. However, the benchmark was sent back to lows after a particularly weak 2035 auction, continuing the deteriorated trend of such outings.

- Gilts lag, hit by the FTSE 100 extending to highs given pharmaceutical outperformance and reports in the Guardian that Chancellor Reeves will be lifting the two-child benefit cap. Removing the cap would cost the exchequer around GBP 3.5bln/yr. Benchmark lower by 30 ticks at worst, but is off its 90.54 trough.

- Click for a detailed summary

COMMODITIES

- Crude was initially contained after the OPEC Secretariat's pushback to reports around a 500k BPD production adjustment by the OPEC 8. Since, a bout of pronounced selling pressure has emerged. No clear or overt fresh fundamental driver behind the move, though it is potentially a function of increased attention on Saudi Arabian Oil Co. cutting benchmark prices of LPG by more than forecast.

- As it stands, WTI and Brent are currently holding modestly in the red but off lows in respective USD 61.62-62.89/bbl and USD 65.32-66.57/bbl parameters.

- Spot gold has rebounded from the profit taking seen on Tuesday, climbing across the European morning as the risk tone got hit by the government shutdown. While the general risk tone is off worst, XAU is yet to lose its allure and remains near its latest ATH of USD 3895/oz.

- 3M LME Copper is marginally firmer but veering towards the lower end of the day’s current USD 10.26-10.36k band. Focus primarily on the overarching macro narrative as outlined above. While only modest, the fact the space is firmer during the broader market pressure we are seeing and with China away for Golden Week is notable.

- Private inventory data (bbls): Crude -3.7mln (exp. +1.0mln, prev. -3.8mln), Distillate +3.0mln (exp. -1.1mln, prev. +0.5mln), Gasoline +1.3mln (exp. +0.7mln, prev. +1.1mln), Cushing -0.7mln (prev. +0.072mln)

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HCOB Manufacturing Final PMI (Sep) 49.8 vs. Exp. 49.5 (Prev. 49.5)

- German HCOB Manufacturing PMI (Sep) 49.5 vs. Exp. 48.5 (Prev. 48.5)

- French HCOB Manufacturing PMI (Sep) 48.2 vs. Exp. 48.1 (Prev. 48.1)

- Italian HCOB Manufacturing PMI (Sep) 49.0 vs. Exp. 50 (Prev. 50.4)

- UK S&P Global Manufacturing PMI (Sep) 46.2 (Prev. 46.2)

- EU HICP Flash YY (Sep) 2.2% vs. Exp. 2.2% (Prev. 2.0%); X F&E Flash YY (Sep) 2.4% vs. Exp. 2.3% (Prev. 2.3%); Services 3.2% (prev. 3.1%

NOTABLE EUROPEAN HEADLINES

- BoE's Mann says that UK monetary policy is relatively loose, via Bloomberg TV. Adds that tighter interest rates would not currently be appropriate.

NOTABLE US HEADLINES

- Fed’s Logan (2026 voter) said the Fed will be cautious in any further reductions and that the US may need additional labour market slack to reach the 2% inflation target. She noted resilient consumption and business investment show policy is only modestly restrictive, adding that inflation expectations cannot be taken for granted and that financial conditions are now a tailwind, further evidence that policy is modestly restrictive. Logan said it is unclear how much further the Fed can cut before hitting neutral and warned that even excluding tariff impacts, inflation may be as high as 2.4%, driven by non-housing services, according to Reuters.

- Nike Inc (NKE) Q1 2026 (USD): EPS 0.49 (exp. 0.27), Revenue 11.72bln (exp. 11.00bln). Gross margin decreased 320bps to 42.2%, primarily due to lower average selling price, reflecting higher discounts and channel mix, as well as higher tariffs in North America. CFO said tariffs will cost approximately USD 1.5bln, higher than the prior estimate of around USD 1bln, and expects Q2 revenue to fall by low single digits versus estimates of a 3.1% decline, according to Reuters. Shares rose 4.5% after hours.

- Fed to ease Morgan Stanley's (MS) capital requirements following a review, according to Bloomberg.

- US Energy Secretary said the US government is taking an equity stake in Lithium Americas (LAC), via Bloomberg TV; US DoE to take a 5% stake in Lithium Americas (LAC), according to Reuters sources.

- BlackRock’s (BLK) GIP is said to be nearing USD 38bln takeover of utility AES (AES), according to FT sources

GEOPOLITICS

MIDDLE EAST

- Yemen’s Houthis said they attacked the Dutch-flagged ship Minervagracht with a cruise missile, according to Reuters.

- IRGC says "The range of missiles will be increased to any point Tehran deems necessary in response to European demands to restrict Iran's missile capabilities", via Sky News Arabia.

- Hamas has informed mediators of the need to provide international guarantees for a complete Israeli withdrawal and ensure that the ceasefire is not violated, Sky News Arabia citing sources.

RUSSIA-UKRAINE

- Ukrainian President Zelensky warned the situation at the Zaporizhzhia nuclear power plant is critical, noting that Russian shelling is obstructing efforts to restore external power supply and that one backup diesel generator has stopped working, according to Reuters.

- The IAEA said it is engaging with both sides of the military conflict to restore off-site power at Ukraine’s Zaporizhzhia nuclear power plant, according to Reuters.

- Finnish President Stubb said, on potential US sanctions on Russia, that US President Trump is moving from the "carrot" to the "stick", via Politico; when asked what the "stick" would be, he said a "driver".

- European leaders will not agree on the latest Russian sanctions today, via Radio Free Europe's Jozwiak; hopes that European ambassadors can get a green light on Friday.

- Italy's Energy Minister Fratin says the EU has not reached a deal to ban Russian LNG before 2028 due to some countries not having alternative suppliers.

APAC TRADE

- APAC stocks traded mixed following modest gains on Wall Street, with focus on the length of the US government shutdown after the Senate rejected the House-passed CR, whilst Chinese participants were away for Golden Week.

- ASX 200 fluctuated between small gains and losses, supported by gold miners at the top of the index, while Energy and Tech lagged. BHP came under pressure after China banned its iron ore cargoes amid a pricing dispute.

- Nikkei 225 underperformed as the regional laggard despite a relatively mixed BoJ Tankan Survey.

- KOSPI was modestly firmer after above-forecast trade data, whilst reports suggested the US and South Korea agreed to establish a visa desk for Korean firms investing in the US. The two sides also issued a joint statement on foreign exchange policy, though it did not mention a bilateral currency swap or South Korea’s state-run pension fund.

- Nifty 50 traded flat and was little changed as the RBI kept its repo rate unchanged at 5.50% as expected in a unanimous decision, maintaining a neutral policy stance.

- Hang Seng and Shanghai Comp were shut for Golden Week and will return next Thursday.

NOTABLE ASIA-PAC HEADLINES

- A BoJ official, following the Tankan Survey, said firms were divided on how they viewed the impact of US tariffs. Some suggested the US-Japan deal has reduced uncertainty and improved the business outlook, while others saw a worsening outlook, according to Reuters.

- RBI kept its repo rate unchanged at 5.50%, as expected, in a unanimous decision, maintaining a neutral policy stance, with 2026 CPI now seen at 2.6% (prev. 3.1%). RBI Governor noted the Indian economy shows strength and headline inflation has significantly moderated. He said rationalisation of GST will have a sobering impact on inflation while stimulating consumption and growth, and added that tariffs will moderate exports. He highlighted the global economy is proving more resilient than anticipated but the outlook remains clouded amid elevated policy uncertainty, according to Reuters.

DATA RECAP

- Japanese Tankan All Big Capex Est (Q3) 12.5% vs. Exp. 11.3% (Prev. 11.5%)

- Japanese Tankan Big Mf Idx (Q3) 14.0 vs. Exp. 15.0 (Prev. 13.0)

- Japanese Tankan big non-mf outlook DI (Q3) 28.0 vs. Exp. 29.0 (Prev. 27.0)

- Japanese Tankan Big Mf Outlook DI (Q3) 12.0 vs. Exp. 13.0 (Prev. 12.0)

- Japanese Tankan Big Non-Mf Idx (Q3) 34.0 vs. Exp. 34.0 (Prev. 34.0)

- Japanese Tankan Sm Non-Mf Outlook DI (Q3) 10.0 vs. Exp. 9.0 (Prev. 9.0)

- Japanese Tankan All Sm Capex Est (Q3) -2.3% vs. Exp. -2.2% (Prev. -5.6%)

- Japanese Tankan Sm Mf Outlook DI (Q3) -1.0 vs. Exp. -1.0 (Prev. -2.0)

- Japanese Tankan Small Mf Idx (Q3) 1.0 vs. Exp. 2.0 (Prev. 1.0)

- Japanese Tankan Small Non-Mf Idx (Q3) 14.0 vs. Exp. 14.0 (Prev. 15.0)

- Japanese S&P Global Manufacturing PMI Final SA (Sep) 48.5 (Prev. 48.4)

- South Korean Import Growth Prelim (Sep) 8.2% vs. Exp. 5.6% (Prev. -4.1%)

- South Korean Export Growth Prelim (Sep) 12.7% vs. Exp. 7.2% (Prev. 1.2%)

- South Korean Trade Balance Prelim (Sep) 9.56B vs. Exp. 7.81B

- New Zealand Building Consents (Aug) 5.8% (Prev. 5.4%, Rev. 5.3%)

- Australian S&P Global Manufacturing PMI Final (Sep) 51.4 (Prev. 51.6)

- Australian AIG Manufacturing Index (Sep) -13.2 (Prev. -20.9)

- Australian AIG Construction Index (Sep) 12.3 (Prev. 1.0)