Europe Market Open: Stocks pressured on US regional banking woes, White House said Trump-Putin call was productive

17 Oct 2025, 07:15 by Newsquawk Desk

- US stocks were pressured with risk-off trade seen amid a reignition of regional banking woes after Western Alliance (WAL) and Zion Bancorp (ZION) announced exposure to bad loans tied to fraud, adding to the concerns following the collapse of Tricolor and First Brands.

- US KRE (Regional Banking ETF) closed lower by over 6% and the financial sector saw a near 3% hit, while the broad risk sentiment was hit with equities sliding throughout the US session.

- APAC stocks were predominantly lower as the region followed suit to the losses on Wall Street, where risk sentiment took a hit as regional bank concerns were reignited following loan fraud disclosures by Western Alliance and Zion Bancorp.

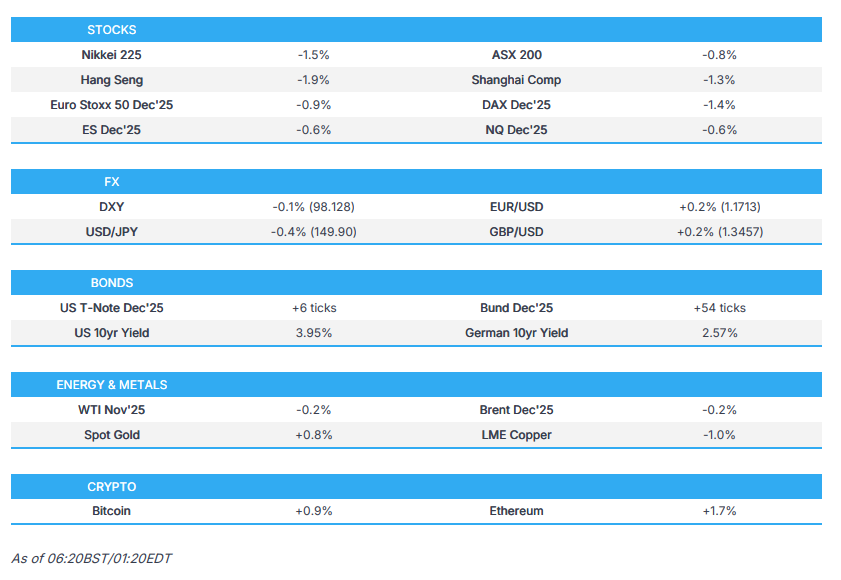

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.9% after the cash market closed with gains of 0.8% on Thursday.

- White House said regarding the Trump-Putin call that it was good and productive, while they have agreed to convene a meeting of high-level staff next week, which may then be followed by another Trump-Putin meeting.

- Looking ahead, highlights include EZ HICP Final (Sep), Atlanta Fed GDP, Suspended Releases: US Building Permits/Housing Starts (Sep), Industrial Production (Sep), Speakers including BoE’s Pill, Greene & Breeden, Fed’s Musalem, ECB's Nagel, Earnings from Ally Financial, SLB, American Express, State Street & Volvo AB.

SNAPSHOT

LOOKING AHEAD

- Highlights include EZ HICP Final (Sep), Atlanta Fed GDP, Suspended Releases: US Building Permits/Housing Starts (Sep), Industrial Production (Sep), Speakers including BoE’s Pill, Greene & Breeden, Fed’s Musalem, ECB's Nagel, Earnings from Ally Financial, SLB, American Express, State Street & Volvo AB.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks were pressured with risk-off trade seen amid a reignition of regional banking woes after Western Alliance (WAL) and Zion Bancorp (ZION) announced exposure to bad loans tied to fraud, adding to the concerns following the collapse of Tricolor and First Brands.

- The regional banking woes saw KRE (Regional Banking ETF) close lower by over 6% and the financial sector saw a near 3% hit, while the broad risk sentiment was hit with equities sliding throughout the US session, which spurred haven flows.

- SPX -0.63% at 6,629, NDX -0.36% at 24,657, DJI -0.65% at 45,952, RUT -2.09% at 2,467.

- Click here for a detailed summary.

TARIFFS/TRADE

- US State Department said Secretary of State Rubio and USTR Greer met with Brazil's Foreign Affairs Minister Vieira and had very positive talks regarding trade and ongoing bilateral issues, while they agreed to work together to schedule a meeting between President Trump and President Lula at the earliest possible occasion.

- US State Department said China's sanctions against Hanwha Ocean's (042660 KS) US-linked units are attempts to undermine US-South Korea cooperation and coerce South Korea.

- South Korean Finance Minister said it's 'uncertain' whether US President Trump will accept Korea's position against an 'upfront' USD 350bln payment related to their tariff/trade agreement, according to Yonhap.

NOTABLE HEADLINES

- Fed Governor Miran said the downside of tariffs has been nowhere near what people predicted and that tariffs have had no material signs of growth drag or inflation spike, while he doesn't think the cost of tariffs will be passed onto consumers.

- Fed's Kashkari (2026 voter) said it is too soon to know the effect of tariffs on inflation and the impact of tariffs is taking longer to be felt than had guessed, while he expects services inflation to trend down and it is possible that goods inflation could spill over. Furthermore, he said the job market is slowing down and it is challenging to read signals without core government data because of the shutdown, as well as noted that most folks say they are still concerned about inflation.

- US President Trump said they will dramatically slash the cost of IVF and that prices of fertility drugs are going way down, while Trump also said he thinks they have a deal on beef to bring down prices.

- The Trump administration's slashing of the federal workforce amid the government shutdown is threatening AI work at the Commerce Department, according to Axios, citing sources close to the agency.

- US Senator Majority Leader Thune said the Senate is expected to vote next week on a bill to pay federal workers who have been forced to work without pay which would include the military, according to Punchbowl. It was separately reported that Thune is quietly pressing President Trump to reopen key farm loans during the shutdown, according to Politico.

- US nears tariff relief for auto industry after lobbying push and is to make an announcement as soon as Friday, according to Bloomberg.

APAC TRADE

EQUITIES

- APAC stocks were predominantly lower as the region followed suit to the losses on Wall Street, where risk sentiment took a hit as regional bank concerns were reignited following loan fraud disclosures by Western Alliance and Zion Bancorp.

- ASX 200 was led lower by underperformance in financials, energy and tech, while gold miners were boosted by the record highs in the precious metal.

- Nikkei 225 retreated amid a firmer currency and as banking stocks suffered in sympathy with US counterparts, while uncertainty lingered ahead of next Tuesday's PM vote with the Japanese Innovation Party noting a 50-50 chance of a coalition with the LDP.

- Hang Seng and Shanghai Comp conformed to the downbeat mood amid US-China frictions, with both sides blaming each other for the tensions.

- US equity futures (ES -0.5%) languished near the prior day's lows after regional bank concerns triggered a broad risk-off mood.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.9% after the cash market closed with gains of 0.8% on Thursday.

FX

- DXY traded rangebound, which provided some respite from this week's selling pressure that had been triggered by US-China trade frictions and regional bank woes after Western Alliance and Zion Bancorp announced exposure to bad loans tied to fraud.

- EUR/USD extended on advances to reclaim the 1.1700 status after benefitting from recent dollar weakness, while there were recent comments from ECB speakers, including Lagarde, who noted they are well-positioned to face future shocks, and Dolenc stated that the next ECB move could be a hike or a cut.

- GBP/USD remained afloat after mildly gaining in the aftermath of the monthly GDP and output data, although the upside was limited and there was little reaction seen to comments from BoE's Mann that the UK labour market is loosening

- USD/JPY tested the 150.00 level to the downside amid the risk-off mood and recent unwinding of the Takaichi trade.

- Antipodeans were somewhat mixed in rangebound trade with headwinds in AUD/USD from the downbeat risk tone.

- PBoC set USD/CNY mid-point at 7.0949 vs exp. 7.1154 (Prev. 7.0968)

FIXED INCOME

- 10yr UST futures extended on gains after rallying yesterday as regional bank concerns spurred a flight to quality.

- Bund futures lingered around a four-month high above the 130.00 level following the recent haven flows.

- 10yr JGB futures tracked the upside in global counterparts owing to a haven bid and with firmer demand at the enhanced liquidity auction.

COMMODITIES

- Crude futures were indecisive after declining yesterday amid the global risk-off sentiment on potential regional banking woes, while the latest weekly EIA inventory report also showed a larger-than-expected build in headline crude stockpiles.

- US EIA Weekly Crude Stocks: 3.524M vs. Exp. 0.288M (Prev. 3.715M).

- White House official said the US and India have had productive discussions that have led India to already cut Russian oil imports by 50%.

- Spot gold swung between gains and losses in which the precious metal initially rallied to a fresh all-time high of around USD 4,380/oz but then wiped out its gains and then some, in tandem with a pullback in silver from record levels, before returning to near its peak.

- Copper futures retreated alongside the intraday declines across the commodities complex in risk-off trade.

CRYPTO

- Bitcoin gained overnight, albeit in a choppy fashion with prices back above the USD 109k level.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said the global economy is resilient, but uncertainty is high and faces complex challenges that could weigh on medium- and long-term growth outlook, while his view on the global economy and outlook has not changed much from before he visited the US. Ueda said the impact of tariffs on the global and US economy is being delayed, which is keeping growth resilient, while he stated that they will adjust the degree of monetary support in accordance with the likelihood of their growth and inflation forecasts materialising.

- BoJ Assistant Governor Shimizu said every country is facing a number of uncertainties, particularly from trade policy, which could have an adverse impact on corporate and household sentiment. Shimizu said inflation expectations in Japan are still below 2%, so they have to lift expectations and continue to support economic activity. Furthermore, he said it is not known exactly how Japan's economy will react to the new environment on interest rates, which is why the BoJ has to be very careful in proceeding with policy normalisation.

- Japan's LDP and CDP agreed to hold a vote to decide Japan's next PM on October 21st, while it was also reported that Japan Innovation Party co-leader Yoshimura said the chance of a coalition with the LDP is 50-50.

DATA RECAP

- Singapore Non-Oil Exports MM (Sep) 13.0% vs Exp. 9.0% (Prev. -8.9%)

- Singapore Non-Oil Exports YY (Sep) 6.9% vs Exp. -2.1% (Prev. -11.3%)

GEOPOLITICS

MIDDLE EAST

- US President Trump warned that "If Hamas continues to kill people in Gaza, which was not the Deal, we will have no choice but to go in and kill them".

- Hamas said the return of Israeli hostages' bodies may take time as some were buried in tunnels destroyed by Israel and others remain under rubble, while the retrieval requires equipment to remove rubble, which is currently unavailable due to Israel's entry ban on such tools. Furthermore, it stated that it remains committed to the Gaza agreement and is keen to hand over all remaining hostages' bodies.

- A meeting is expected in the coming days in Egypt where senior officials from the US, Europe, and Arab countries will participate to address the second phase of President Trump’s peace plan, according to the Jerusalem Post.

RUSSIA-UKRAINE

- US President Trump said regarding Russian President Putin and Ukrainian President Zelensky, that they might do separate meetings, while he will probably meet Putin over the next two weeks. Trump commented that Tomahawks are also needed for the US, and he responded that he will speak to Senate Majority Leader Thune after House Speaker Johnson, about the Putin call and make the right determination, when asked about Russian sanctions.

- US President Trump held a call with Russian President Putin, which he said was very productive, and believes that the success in the Middle East will help in the negotiation to attain an end to the war with Russia/Ukraine. Trump said they "agreed that there will be a meeting of our High Level Advisors, next week", while he added that "President Putin and I will then meet in an agreed upon location, Budapest, Hungary, to see if we can bring this “inglorious” War, between Russia and Ukraine, to an end".

- White House said regarding the Trump-Putin call that it was good and productive, while they have agreed to convene a meeting of high-level staff next week, which may then be followed by another Trump-Putin meeting.

- Russian President Putin’s Special Envoy said the Trump-Putin call was positive and productive, and sets out the next steps clearly, while a Kremlin aide said two countries (US & Russia) will quickly prepare for a summit and that the Putin-Trump call took place at Russia's initiative.

- Ukrainian President Zelensky said they can see that Russia is in a rush to resume dialogue once it hears talk of Tomahawk missiles, while he added that they are counting on the momentum that worked in ending the war in the Middle East, to help end the war with Russia.

EU/UK

NOTABLE HEADLINES

- BoE's Mann said the UK labour market is loosening but not falling off a cliff, while she added that the UK yield curve now provides a more appropriate financial condition for the UK economy.

- ECB President Lagarde said growth and inflation risks have become more balanced, while she added the ECB is well-positioned to face future shocks.

- ECB's Kocher said policy uncertainty is high at the moment and no need to be overactive, while he also commented that inflation at 1.7-1.8% is close to the target, and should not overreact. Kocher also said there is no reason to hike at the moment.

- ECB's Scicluna said the ECB must not rush further interest rate action, because the effects of higher US tariffs on prices aren't yet clear, according to Bloomberg.