Europe Market Open: Fed cut by 25bps, though Powell struck a hawkish tone for December; European equity futures positive

30 Oct 2025, 07:14 by Newsquawk Desk

- Fed cut by 25bps as expected, subject to 50bps and U/C dissent, announced it will end the balance sheet drawdown.

- Chair Powell struck a hawkish tone around December, weighing on stocks, USTs & XAU while the USD benefited.

- Trump said the meeting with Xi was amazing & lots of decisions were made, he rated the meeting a 12/10.

- BoJ held rates, Takata & Tamura dissented, favouring a hike; support seen in JGBs afterwards as the statement avoided any overtly hawkish signal.

- European futures point to a positive cash open, US futures are gradually rebounding following Powell and the first Mag 7 numbers; GOOGL +7% after-hours, MSFT -3%, META -6%

- Crude benchmarks faded some of the gains seen after the EIA report, XAU hit by Powell but off lows, base metals followed the risk tone.

- Looking ahead, highlights include Spanish Flash HICP (Oct), German Unemployment (Sep), Flash GDP (Q3), Prelim. CPI (Oct), EZ Final Consumer Confidence (Oct), Japanese Tokyo CPI (Oct) & Unemployment Rate (Sep), (Suspended Releases: US GDP & PCE (Q3), Weekly Claims), Events: ECB Policy Announcement, Comments from BoJ Governor Ueda, ECB President Lagarde, Fed’s Logan & Bowman, Supply from Italy.

- Earnings from Amazon, Apple, Coinbase, Reddit, MicroStrategy, Cloudflare, Riot Platforms, Eli Lilly, Merck, Comcast, Roblox, Mastercard, Standard Chartered, Shell, Kion, Lufthansa, Volkswagen, Puma & ING.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks, Treasuries, and Gold saw notable selling, while the Dollar soared in the wake of a very hawkish Powell at the Fed press conference. In the decision beforehand, it cut rates by 25bps, as expected, to 3.75-4%, albeit in a 10-2 decision. Governor Miran dissented for a 50bps reduction, as he said he would, while Schmid opted to leave rates unchanged. It also announced it will end the balance sheet contraction from December 1st; two-way action was seen in markets. However, Powell started his presser by noting there are strongly differing views on how to proceed in December, with another cut far from assured. He added that today's cut was another risk management move, but going ahead, it is different. Continuing to add to the hawkish rhetoric, the Chair noted there is a growing chorus of feeling they should maybe wait a cycle [regarding another cut]. As such, a hawkish reaction was seen with T-Notes tumbling, ES falling beneath 6.9k, and spot gold testing USD 3.9k/oz to the downside.

- SPX +0.00% at 6,891, NDX +0.41% at 26,120, DJI -0.16% at 47,632, RUT -0.87% at 2,485.

- Click here for a detailed summary.

FOMC

- Overall, a hawkish reaction was seen following Chair Powell with T-Notes tumbling, ES falling beneath 6.9k, and spot gold testing USD 3.9k/oz to the downside.

- Fed cut rates by 25bps as expected to 3.75-4.00%, with two dissenters as Miran voted for a 50bps cut and Schmid voted for unchanged. Fed said it is ending the drawdown of its balance sheet and is to reinvest MBS proceeds into Treasury bills from December 1st and said available indicators suggest that economic activity has been expanding at a moderate pace, while job gains have slowed this year, and the unemployment rate has edged up but remained low through August. Fed noted that more recent indicators are consistent with these developments and stated that inflation has moved up since earlier in the year and remains somewhat elevated. Fed also said the Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment rose in recent months. Furthermore, it maintained guidance that in considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.

- Fed Chair Powell reiterated that data available suggests the outlook for employment and inflation has not changed much since the September meeting, while he noted there are different views on how to proceed in December and that another cut in December is far from assured.

- Fed Chair Powell reiterated in the Q&A that a reduction in December is not a foregone conclusion, far from it, and that there is tension between two goals, while no decision has been made for December, and they had strongly differing views. Fed Chair Powell said the latest cut was risk management, but going forward, it is a different thing, as well as noted that the Fed cannot address both employment and inflation risks with its one tool, and that policymakers have different forecasts and have different risk tolerances.

- Fed Chair Powell said for the latest rate cut, it was a strong, solid vote, and the different views at the FOMC were about the future. Powell also stated that at a certain point, they will want reserves to gradually start growing, and will be adding some reserves at a certain point, but want to move the balance sheet to shorter-duration and have not decided on an endpoint. Fed Chair Powell, when asked about why they wouldn't cut in December aside from the lack of data, replied that there are many estimates on the neutral rate level on the committee, and some think it is time to take a step back, while he added they have moved 150bps already. Furthermore, he said there is a sense from some to pause, but a sense from others to go ahead with rate cuts.

TARIFFS/TRADE

- US President Trump said the meeting with Chinese President Xi was amazing and a lot of decisions were made, while they will be providing conclusions on very important things and agreed that Xi will work very hard to stop fentanyl. Trump confirmed that China soybean purchases will start immediately and they agreed to reduce China fentanyl tariffs to 10%, as well as noted that they did discuss chips and will be talking to NVIDIA and others about taking chips, but are not talking about Blackwell chips. Trump said the rare earth issue has been settled and there are no more roadblocks on rare earths, while he said it's a one-year agreement that will be extended and tariffs on China will be 47%, down from 57%. Furthermore, he is going to China in April and Xi will be coming to the US sometime after that, while he rated the meeting a 12 out of 10.

- Chinese President Xi told US President Trump at the start of the meeting that it is a pleasure to meet him and they do not always see eye to eye, but this is normal and it is normal for economies to have frictions, while he added that China’s development goes hand in hand with the vision to make America great again. Xi also stated that China and the US should be partners and friends, as well as noted that trade teams have reached a basic consensus and they are ready to continue working to build a solid foundation for two-way ties.

- US Treasury Secretary Bessent said the announcement after the Trump-Xi meeting will be a resounding victory for our farmers.

- US Senate Minority Leader Schumer and other democratic Senators urge US President Trump not to lift restrictions on AI chips and American tech in pursuit of a China trade deal.

- US President Trump posted that "South Korea has agreed to pay the USA 350 Billion Dollars for a lowering of the Tariffs charged against them by the United States. Additionally, they have agreed to buy our Oil and Gas in vast quantities, and investments into our Country by wealthy South Korean Companies and Businessmen will exceed 600 Billion Dollars. Our Military Alliance is stronger than ever before and, based on that, I have given them approval to build a Nuclear Powered Submarine, rather than the old fashioned, and far less nimble, diesel powered Submarines that they have now. A great trip, with a great Prime Minister!"

NOTABLE HEADLINES

- US President Trump's administration taps three different funds to pay US troops this Friday, according to Axios.

- Alphabet Inc (GOOGL) Q3 2025 (USD): EPS 2.87 (exp. 2.30), Rev. 102.3bln (exp. 99.73bln); shares rose 7% after-market.

- Microsoft Corp (MSFT) Q1 2026 (USD): Adj. EPS 4.13 (exp. 3.67), Rev. 77.7bln (exp. 75.40bln); shares fell 3% after-market

- Meta Platforms Inc (META) Q3 (USD) EPS 1.05 (exp. 6.76), Rev. 51.2bln (exp. 49.35bln), includes one-time non-cash income tax charge of USD 15.93bln; shares fell 6% after-market.

APAC TRADE

EQUITIES

- APAC stocks were mixed after the Fed rate cut and Powell's hawkish presser, while participants also digested the BoJ decision and Trump-Xi meeting.

- ASX 200 lacked demand in the absence of tier-1 data and as markets reflected on the recent deluge of risk events.

- Nikkei 225 swung between gains and losses with price action indecisive amid the BoJ policy decision in which the central bank maintained rates, as widely expected and refrained from any major clues for when it will resume its rate normalisation.

- Hang Seng and Shanghai Comp were indecisive as the attention was on the Trump-Xi meeting, where the leaders exchanged pleasantries at the start, but were then quiet with no statements provided upon the conclusion of the meeting. However, Trump later commented that the meeting was amazing and confirmed a reduction in fentanyl-related tariffs, while he also said the rare earths issue was resolved and rated the meeting a 12 out of 10.

- US equity futures gradually rebounded from the prior day's trough following the FOMC, Powell presser and the first batch of Mag 7 earnings, while there was a bout of selling seen after the initial silence from both sides following the Trump-Xi meeting.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed flat on Wednesday.

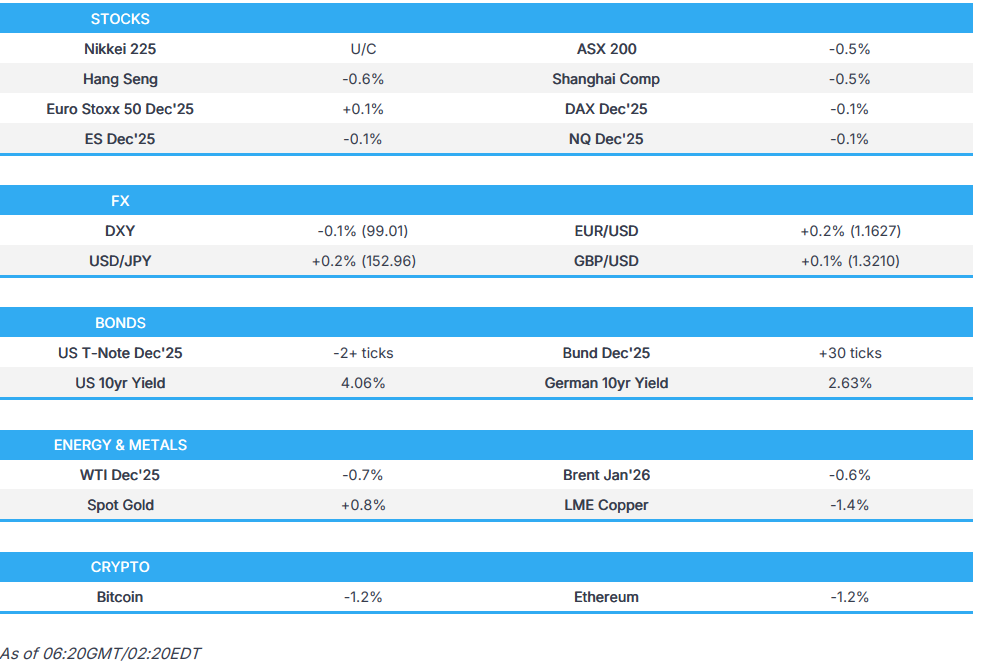

FX

- DXY took a breather overnight and held on to most of the spoils seen in the aftermath of the FOMC where the Fed cut rates by 25bps as expected and announced it will end the balance sheet contraction from December 1st, while there were hawkish comments from Fed Chair Powell at the post-meeting presser in which he downplayed market expectations of another cut in December which he said was far from assured.

- EUR/USD nursed some of its recent losses after recovering from a brief dip beneath the 1.1600 handle, while participants also look ahead to today's ECB meeting and a slew of data releases from the bloc, including Q3 GDP.

- GBP/USD just about reclaimed the 1.32 status after retreating yesterday amid the dollar strength while it was reported that UK PM Starmer left the door open for potential tax hikes in November's budget, as he refused to rule out increases to income tax, national insurance or VAT.

- USD/JPY traded indecisively with markets tentative throughout the day amid the BoJ policy meeting and Trump-Xi talks.

- Antipodeans nursed some of the Powell-triggered losses against the dollar as the focus turned to the US-China summit.

- PBoC set USD/CNY mid-point at 7.0864 vs exp. 7.1056 (Prev. 7.0843).

FIXED INCOME

- 10yr UST futures languished around the prior day's lows after bear flattening yesterday in reaction to Fed Chair Powell's push-back against a December rate cut, while the US also sold USD 30bln of 2-year FRNs at a high discount margin of 0.190% on Wednesday.

- Bund futures retreated in sympathy with US counterparts, while participants await German GDP, unemployment and inflation.

- 10yr JGB futures rebounded from early losses and reclaimed the 136.00 level with support seen in the aftermath of the BoJ policy decision where the central bank kept rates unchanged and refrained from any overtly hawkish signals.

COMMODITIES

- Crude futures were lacklustre after fading the gains seen from yesterday's bullish inventory data.

- Spot gold nursed some of the post-FOMC losses after declining amid a firmer buck and a hawkish Powell.

- Copper futures declined in choppy trade amid the recent deluge of key risk events.

CRYPTO

- Bitcoin wiped out early gains and dipped beneath USD 109k as markets were briefly rattled by the initial silence following the Trump-Xi meeting.

NOTABLE ASIA-PAC HEADLINES

- BoJ maintained its short-term interest rate target at 0.5%, as expected, with board members Takata and Tamura the dissenters who proposed raising short-term rates by 25bps. BoJ said real interest rates are at significantly low levels and it will continue to raise the policy rate if the economy and prices move in line with its forecast, in accordance with improvements in the economy and prices, while it will conduct monetary policy as appropriate from the perspective of sustainably and stably achieving the 2% inflation target and noted that it is important to scrutinise without any pre-set idea whether the BoJ’s projection will be met, given high uncertainty on trade policy and its impact on the economy. Furthermore, the BoJ stated that underlying consumer inflation is likely to stagnate on slowing growth, but increase gradually thereafter, and is likely to be at a level generally consistent with the 2% target in the second half of the projection period from fiscal 2025 through 2027, while board members' median projections for Real GDP and Core CPI were mostly kept unchanged from the previous aside from the slight upgrade to FY2025 Real GDP to 0.7% from 0.6%.

- Chinese Premier Li said it is necessary to implement requirements of high-quality development in all fields and aspects of economic and social development, while he added it is necessary to promote high-quality development as the theme, reform and innovation as the fundamental driving force, and meet the people's growing needs for a better life. Furthermore, he stated it is necessary to focus more on strengthening the domestic cycle, coordinate the implementation of the strategy of expanding domestic demand, and deepen supply-side structural reforms.

- HKMA cut its base rate by 25bps to 4.25%, as expected.

GEOPOLITICS

OTHER

- US President Trump posted that the US has more nuclear weapons than any other country, which was accomplished during his first term in office, while he stated that because of other countries testing programs, he has instructed the Department of War to start testing US nuclear weapons on an equal basis, and that process will begin immediately.

- US President Trump said he wasn't able to talk with North Korea leader Kim because he was so busy, but would come back to talk with Kim.

- US Defense Secretary Hegseth said they carried out a lethal kinetic strike earlier today on another narco-trafficking vessel operated by a designated terrorist organisation in the Eastern Pacific.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves is looking at an early scrapping of windfall tax on the UK oil and gas sector, according to FT.

- UK Chancellor Reeves has admitted she breached housing rules when renting out her family home, via BBC; PM Starmer has dismissed calls for an investigation into the incident.